Your ATM's Secret Weapon: Second Line Maintenance Service

Why Your ATM Needs Professional Second Line Care

ATM second line maintenance service provides advanced hardware repairs, software updates, and complex troubleshooting that goes beyond basic first-line fixes. While first-line maintenance handles simple tasks like clearing paper jams or refilling receipt paper, second-line service tackles serious issues requiring specialized tools, replacement parts, and expert technicians.

Think of it this way: if first-line maintenance is like changing a light bulb, second-line maintenance is like rewiring your entire electrical system. The complexity, expertise, and tools required are completely different, and the impact on your business operations is far more significant.

Key differences between first and second-line ATM maintenance:

• First Line: Tool-free fixes, consumable refills, basic error clearing (under 2-hour response)

• Second Line: Hardware repairs, parts replacement, software patches, diagnostic testing

• Scope: Component-level troubleshooting, preventive maintenance, security updates

• Technicians: Certified specialists with advanced training and repair tools

• Timeline: Scheduled maintenance visits plus emergency on-site response

• Cost Impact: First-line fixes cost hundreds; second-line repairs can save thousands

• Business Impact: First-line keeps you running; second-line keeps you profitable

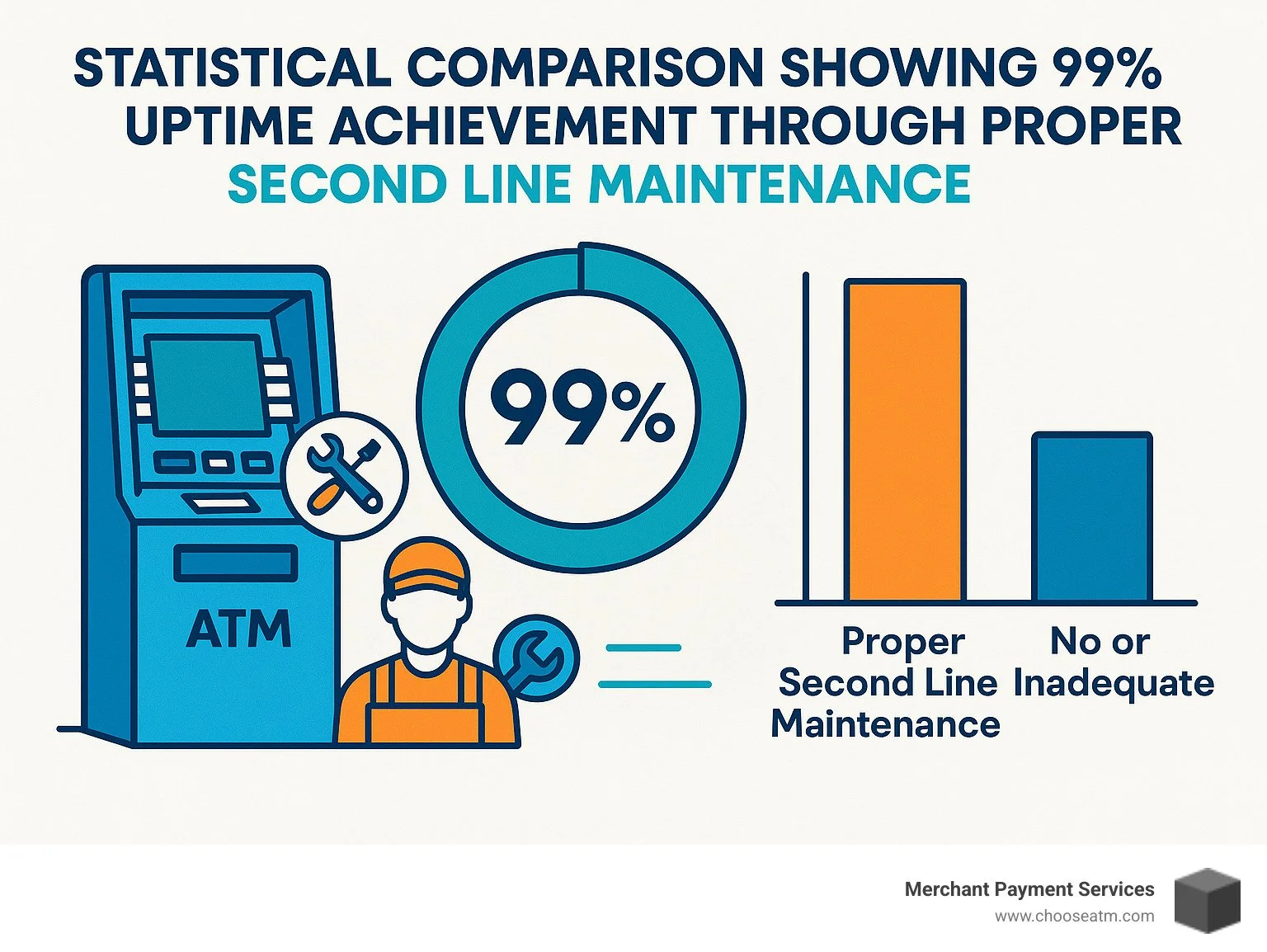

When your ATM breaks down, 99% uptime isn't just a nice number—it directly impacts your bottom line. Every hour of downtime means lost surcharge revenue and frustrated customers who might not return. Consider this: a busy ATM processing 150 transactions daily at $3.50 per transaction generates $525 in daily surcharge revenue. Just one day of downtime wipes out that entire amount, and the ripple effects extend far beyond immediate lost revenue.

Proactive second-line maintenance can increase ATM uptime significantly, translating to increased customer satisfaction and revenue. The difference between reactive and proactive maintenance approaches often determines whether your ATM becomes a profit center or a constant source of stress and unexpected expenses.

Second-line maintenance covers everything from diagnosing complex cash dispenser jams and replacing faulty motor components to applying remote software patches for security vulnerabilities. It's the difference between a quick band-aid fix and a comprehensive solution that prevents recurring problems. This level of service requires technicians who understand not just how to fix immediate problems, but how to identify underlying issues that could cause future failures.

The financial implications extend beyond simple repair costs. Poor maintenance practices can lead to compliance violations, security vulnerabilities, and reputation damage that affects your entire business. In today's competitive marketplace, customers have choices about where to conduct their banking transactions, and a consistently unreliable ATM can drive them to competitors.

I'm Lydia Valberg from Merchant Payment Services, where our family has delivered reliable ATM second line maintenance service solutions for over 35 years across the United States. Our experience has shown that businesses with proper second-line maintenance strategies see dramatically fewer emergency calls and higher customer satisfaction rates. We've tracked these metrics across thousands of installations, and the patterns are clear: investment in quality second-line maintenance pays for itself through reduced downtime, lower emergency repair costs, and increased customer loyalty.

Decoding Maintenance Tiers: First Line vs. Second Line

Picture this: your ATM glitches on a busy Friday. Knowing whether you need a quick reset or a certified tech can save serious cash and customer anger.

First line maintenance is the two-hour, tool-free fixthink clearing a receipt jam, topping up paper, or rebooting software. Training is short, the work is simple, and the goal is speed.

Second line maintenance is the deep dive. Certified specialists arrive with diagnostic laptops, OEM parts, and the clearance to open secure areas. They swap bad motors, apply security patches, and run full validation tests so problems dont come back.

For a refresher on basic upkeep, see our ATM First Line Maintenance primer and step-by-step ATM Troubleshooting Guide.

Why the Distinction Matters

Downtime isnt abstractits lost revenue. At $3.50 per transaction, 100 missed withdrawals equal $350 gone in a single day. Worse, a broken ATM erodes customer trust that cost hundreds of dollars to earn.

Different skills, response times, and compliance rules separate the two tiers:

First line: basic resets and consumables; basic certification and phone support. Second line: hardware repair, encryption management, and PCI-compliant access by bonded techs.

Get the tier wrong and you pay twiceonce for the wrong call-out, then again for the real fix. Merchant Payment Services has spent 35 years helping U.S. businesses avoid that trap.

ATM Second Line Maintenance Service Essentials

Second-line care is more than swapping partsits a preventive strategy that protects revenue and reputation.

Key deliverables

Hardware repair: cash‐dispenser motors, card readers, displays, PC coresall replaced with OEM-grade parts. Software upkeep: EMV firmware, Windows patches, and security certificates applied on-site or remotely. Validation testing: test transactions run before the tech leaves, guaranteeing first-time fix. Root-cause analysis: logs reviewed to stop repeat failures, not just clear todays error. Scheduled preventive visits: quarterly cleanings, calibrations, and full diagnostics that spot issues weeks early. Our ATM Maintenance Services Handbook outlines the checklist.

Typical Issues Resolved

Cash dispenser jams from worn pick wheels or misaligned transports.

Card reader faultsmag-stripe heads, EMV contacts, or contactless antennas.

PC core crashes caused by failed drives or corrupt OS images.

Firmware bugs that surface only under certain loads.

Safe door malfunctions requiring bonded access.

Why It Pays Off

A single emergency visit during peak hours can cost more than a year of preventive checks. Second-line service shifts you from firefighting to consistent 99 % uptimeand that keeps surcharge revenue flowing.

Why SLM Is Critical for Uptime, Cost Efficiency & Customer Experience

When your ATM works reliably, everyone wins. Your customers get the cash they need without frustration, and you earn consistent surcharge revenue without interruption. That's why ATM second line maintenance service isn't just about fixing problems—it's about protecting your investment and keeping money flowing.

Let's talk real numbers. If your ATM processes 100 transactions daily at $3.50 each, you're looking at $350 in daily surcharge revenue. One day of downtime wipes out that entire amount. But the real cost goes deeper than lost revenue.

Brand trust takes a hit every time customers encounter a broken ATM. We've seen this pattern repeatedly across the United States: locations with reliable ATMs build customer loyalty and see transaction volumes grow over time. Meanwhile, businesses with frequent ATM problems watch customers walk away—sometimes permanently.

99% availability isn't just a nice goal; it's what separates profitable ATM operations from headaches. Our experience managing ATMs for over 35 years has shown us that businesses achieving this level of uptime see dramatically better returns on their ATM investments.

The cost avoidance through proactive maintenance often surprises business owners. Catching a worn cash dispenser motor during routine maintenance costs far less than dealing with an emergency breakdown during peak hours. We've tracked these numbers across thousands of ATMs, and the pattern is clear: prevention beats reaction every time.

Maintenance Approach Annual Cost Downtime Hours Lost Revenue Total Cost Reactive Only $3,500 120 hours $15,000 $18,500 Proactive SLM $6,000 24 hours $3,000 $9,000 Savings $9,500

The ROI metrics consistently favor proactive second-line maintenance. That $9,500 annual savings in the table above represents real money that stays in your pocket instead of going to emergency repairs and lost opportunities.

KPIs Every Bank Should Track

Smart ATM operators measure what matters. Mean Time to Repair (MTTR) tells you how quickly problems get resolved once help arrives. Industry leaders target under two hours for most second-line issues, and that's what you should expect from your maintenance provider.

First-time fix rate reveals whether your technicians come prepared with the right tools and parts. Rates above 85% indicate a maintenance provider who understands your equipment and stocks appropriate inventory. Lower rates often mean multiple service calls for the same problem—frustrating and expensive.

Repeat call rate within 30 days shows whether repairs actually solve underlying issues or just patch symptoms. High repeat rates suggest inadequate root cause analysis or quality problems with replacement parts.

Parts consumption trends help predict when equipment might need replacement rather than continued repairs. Sudden spikes in parts usage often signal it's time for equipment upgrade planning.

Customer abandonment rates at specific locations can reveal performance issues that affect user experience, even when the ATM technically works. Sometimes an ATM that's slow or difficult to use drives away customers just as effectively as one that's completely broken.

Risks of Poor or Delayed Second Line Care

Cutting corners on second-line maintenance creates risks that extend far beyond simple inconvenience. Lost revenue from downtime represents just the tip of the iceberg.

Fraud exposure increases dramatically when ATMs operate with outdated software or malfunctioning security features. Criminals specifically target poorly maintained ATMs with known vulnerabilities. We've seen cases where delayed security updates led to significant losses that could have been prevented with proper maintenance.

Compliance fines can result from failing to maintain required security standards or accessibility features. Regulatory requirements continue evolving, and your ATM second line maintenance service must keep pace with these changes to protect your business.

Reputation damage spreads quickly in today's connected world. Customers share negative experiences through social media and online reviews, potentially affecting your business far beyond the immediate ATM transaction. We've worked with businesses that had to rebuild their reputation after periods of poor ATM reliability damaged customer trust.

The good news? These risks are completely preventable with the right maintenance approach. Proper second-line maintenance protects your investment, your customers, and your reputation—all while maximizing the profit potential of your ATM program.

Technology Powering Modern Second Line Maintenance

Yesterday: wait for the ATM to die. Today: know its failing weeks in advance.

Remote monitoring streams health data 24/7 so techs see motor stress or sensor errors long before customers do.

IoT sensors track heat, voltage, and vibrationthe ATMs version of a fitness watch.

Predictive analytics crunch data from thousands of U.S. machines, flagging patterns that indicate an impending fault.

Vendor-neutral dashboards combine mixed brands in one view, cutting management costs by up to 30 %.

Cloud-based patching keeps operating systems and encryption modules current against emerging cyber threats.

For a deeper look at data-driven upkeep, watch our latest research on predictive ATM maintenance.

Multi-Vendor & Software Management

Open standards and universal drivers let one team manage Diebold, Hyosung, NCRyou name itwithout juggling multiple contracts. That means faster fixes and fewer surprises. For details, visit our ATM Maintenance center.

Choosing & Outsourcing Your Second Line Partner

Selecting a provider is less about price and more about proof.

SLA tiers: look for iron-clad promises<2-hour arrival for down machines and clear penalties if they miss. U.S. coverage: techs must be local to every site you run today and where youll grow tomorrow. Parts logistics: regional depots stocked with high-fail components end the three-day wait. Certified techs: manufacturer credentials for your specific models, updated annually. Flexible contracts: scale visits up or down seasonally, bundle cash loading with maintenance, and avoid early-termination traps.

Need a checklist? Our ATM Service guide walks you through scoring vendors against these metrics.

Combining Visits Saves Money

Merchant Payment Services coordinates second-line work with first-line tasks and cash replenishment. One truck roll, one invoice, 20-30 % lower maintenance spendand your ATM stays online.

Frequently Asked Questions about ATM Second Line Maintenance Service

Let's address the most common questions we hear from business owners considering ATM second line maintenance service. After 35 years in the industry, we've learned that clear answers help you make better decisions for your business.

How fast should an SLM provider arrive on-site?

When your ATM goes down, every minute counts. Industry best practice calls for response times under 2 hours for emergency second-line maintenance calls, and that's exactly what we deliver at Merchant Payment Services.

Some premium providers even guarantee response times under 90 minutes for critical locations like busy retail stores or high-traffic areas where downtime hits hardest. The key is understanding how response time gets measured—it should start from the moment you log the service call until a qualified technician arrives on-site with the right tools and parts.

Here's what matters most: your provider should have enough technicians strategically located across the United States to meet these response commitments consistently. Empty promises about fast response don't help when you're dealing with frustrated customers at a broken ATM.

Does SLM include software security patches and upgrades?

Yes, comprehensive ATM second line maintenance service absolutely includes software maintenance, security patches, and compliance updates. This isn't optional—it's essential for keeping your ATM secure and compliant.

Your second-line provider should handle EMV updates, encryption key management, and patches for security vulnerabilities as part of their standard service. Think of it like keeping your smartphone updated, except the stakes are much higher when dealing with financial transactions.

However, major software upgrades or operating system changes often require separate coordination and testing. These bigger changes need careful planning to avoid disrupting your ATM's operation during busy periods.

The bottom line: your maintenance provider should proactively manage routine security updates while coordinating with you on major system changes that might affect your business operations.

Can one SLM contract cover multiple ATM brands?

Absolutely, and this is actually one of the smartest approaches for most businesses. The best second-line maintenance providers support multi-vendor environments and can service ATMs from all major manufacturers across the United States.

Vendor-neutral service approaches often provide better cost efficiency and simplified vendor management compared to juggling separate providers for different ATM brands. Instead of managing multiple contracts, phone numbers, and service standards, you get one reliable partner who handles everything.

At Merchant Payment Services, we've seen businesses reduce their maintenance costs by 20-30% when they consolidate their second-line maintenance under a single provider. Plus, you get consistent service standards and simplified reporting across your entire ATM fleet.

The key is choosing a provider with deep experience across multiple ATM manufacturers and the technical expertise to handle the unique requirements of each brand. This approach gives you flexibility as your business grows and simplifies your vendor relationships.

Conclusion

Your ATM is a profit centerunless its down. Proactive second-line maintenance from Merchant Payment Services lifts availability from 85 % to 99 %, adding more than $20,000 in annual surcharge revenue to a single busy machine.

With 35 years of U.S. experience, we combine predictive monitoring, certified technicians, and nationwide parts depots so you can focus on your core business.

Ready to lock in worry-free uptime? Explore our full program at chooseatm.com or call +1 (800)454-3158 to schedule a free ROI analysis today.