Free Credit Card Processing: Myth or Reality for Small Businesses?

The Truth About Free Credit Card Processing

Free credit card processing for small business sounds too good to be true, but it's not entirely a myth. While there's no magic solution that eliminates all costs, there are legitimate ways small businesses can effectively achieve zero-cost credit card processing through fee-shifting models.

Quick Answer: Is Free Credit Card Processing Real?

What It Really Means How It Works Is It Actually Free? Zero-cost to the merchant Fees are passed to customers who choose to pay with credit cards Yes for merchants, no for customers Legal in 46 states (restrictions in CA, CT, ME, MA) Implemented via surcharges (3-4%) or cash discounts Equipment and setup costs may still apply Automated systems handle the fee calculations Customers can avoid fees by using cash, debit, or ACH Alternative payment methods still incur minimal fees

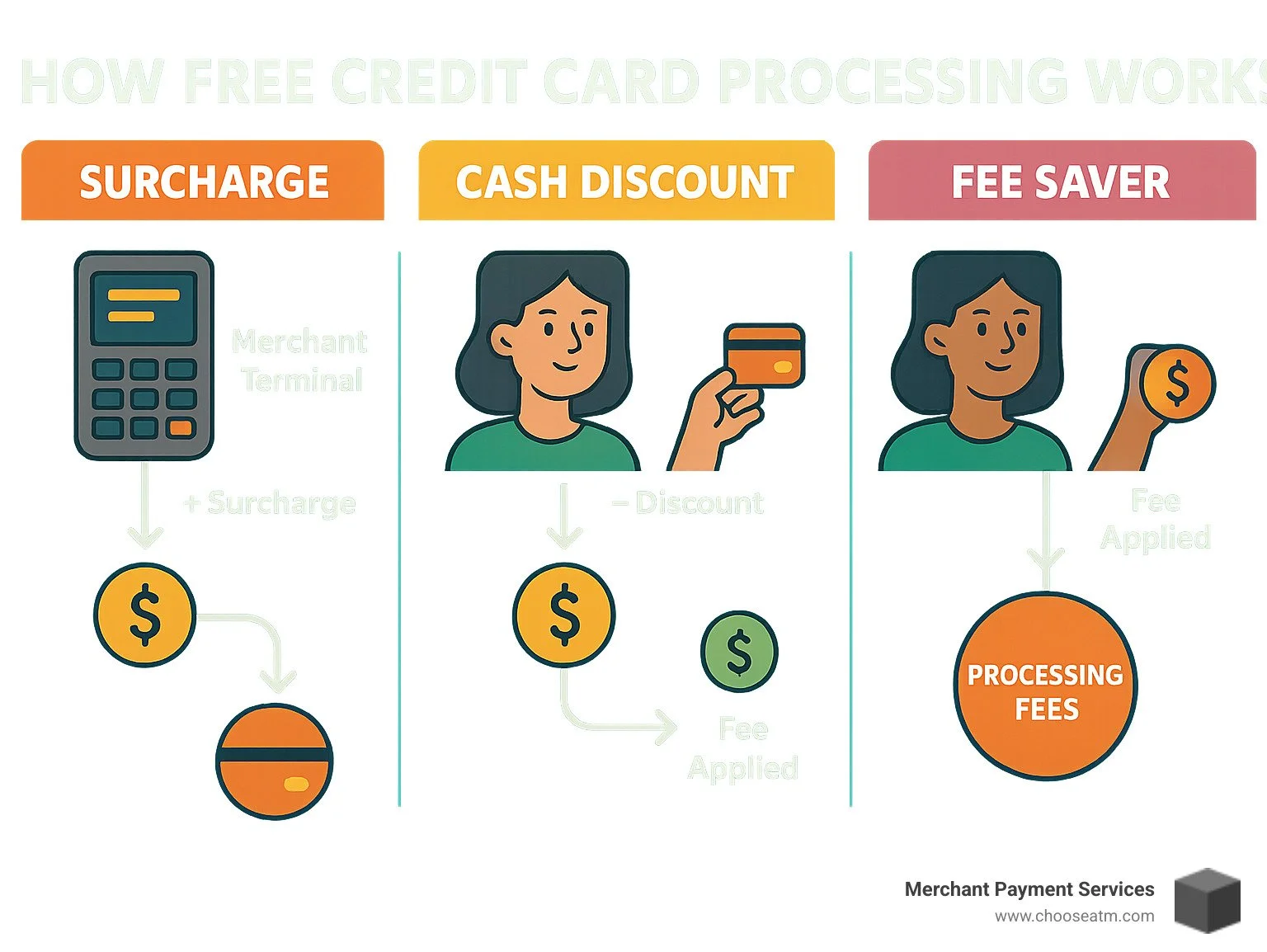

The reality is that processing fees don't disappear – they just change hands. When merchants advertise "free credit card processing," they're typically using one of these approaches:

Surcharge model: Adding a fee (usually 3-4%) to credit card transactions

Cash discount program: Setting prices to include the fee, then discounting for cash payments

Fee Saver automation: Systems that apply the legally appropriate fee based on location and card type

Small businesses processing $30,000 monthly in credit card sales can save approximately $900-1,200 per month with these programs – a significant boost to your bottom line.

I'm Lydia Valberg, co-owner of Merchant Payment Services, where I've helped hundreds of small businesses implement free credit card processing for small business solutions that eliminate processing fees while maintaining customer satisfaction. My family's 35-year history in payment processing gives me unique insight into balancing cost savings with customer experience.

Why "Free" Matters in 2024

In today's increasingly cashless economy, the ability to process credit cards without incurring fees has become critical for small business profitability. According to Worldpay Global, cards and digital wallets are projected to account for 80% of online payments by 2026, making credit card processing an unavoidable business expense.

The COVID-19 pandemic accelerated this shift, with many consumers avoiding cash transactions entirely. For small businesses operating on thin margins (often 3-7%), traditional credit card processing fees of 2-4% can consume a significant portion of profits. When every percentage point matters, eliminating these fees can mean the difference between struggling and thriving.

Free Credit Card Processing for Small Business: How It Works

Let's be honest - when you hear "free credit card processing for small business," your first thought might be "what's the catch?" The truth is refreshingly simple: the fees don't vanish into thin air, they just shift from your business to customers who choose to pay with credit cards.

Traditional credit card processing feels like death by a thousand paper cuts:

Interchange fees (the banks and card networks like Visa take these)

Assessment fees (more money for the card networks)

Payment processor markup (your processor needs to eat too)

All together, these fees typically gobble up 2-4% of each transaction. But with zero-fee processing, your customers who choose credit cards absorb these costs, while you keep every penny of the sale amount.

Here's how it works in practice:

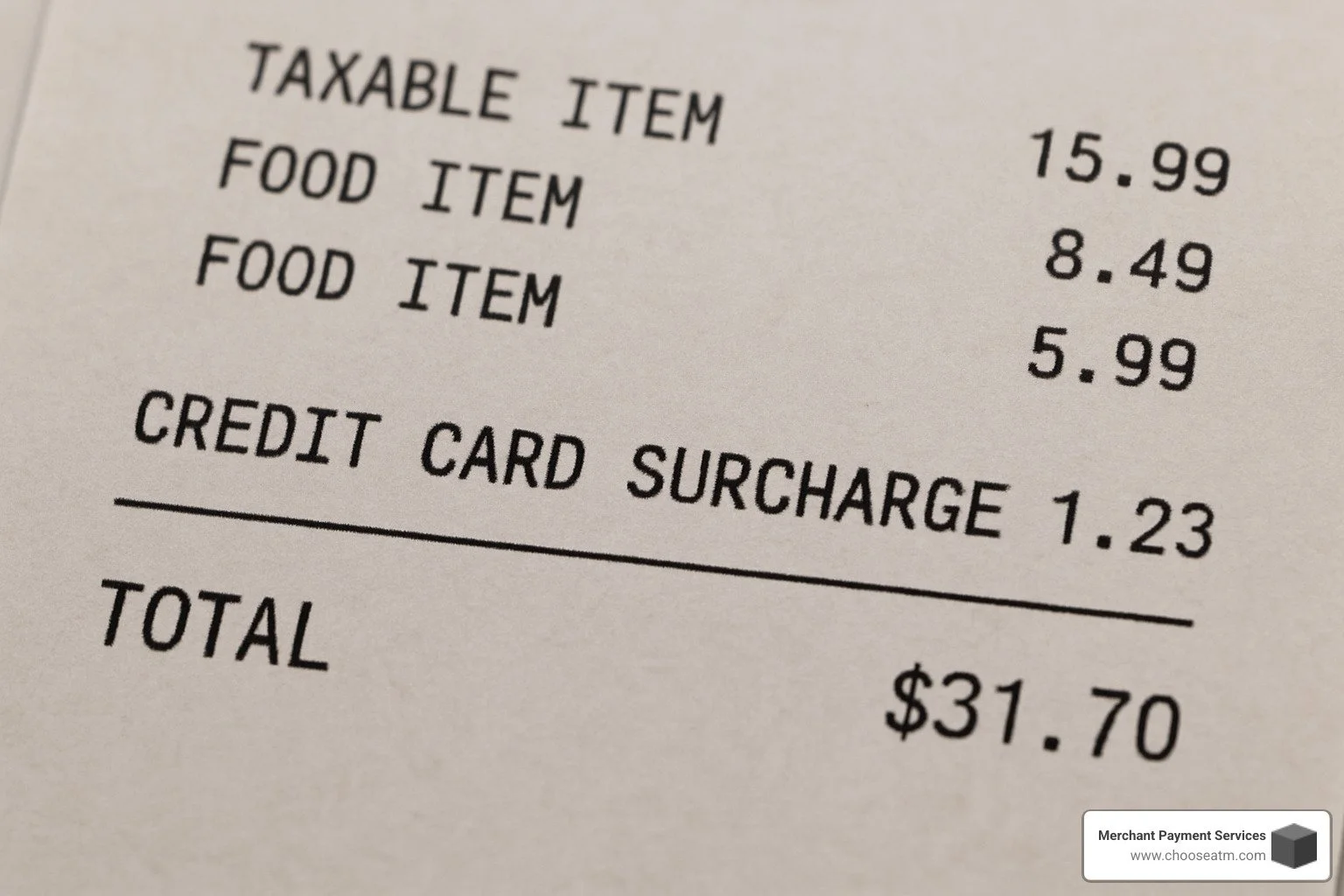

Your customer picks out that perfect item and decides to pay with credit. Your terminal automatically adds the appropriate fee (usually 3-4%), they see and approve this fee right on the screen, and you receive the full pre-fee amount in your bank account. The processor collects and keeps just the fee portion to cover the costs. It's that straightforward!

Worth noting: debit card transactions typically aren't included in these programs. They still process at the regular rate (usually 1-1.5% plus a small transaction fee), but since these rates are much lower anyway, it's less painful.

"Free Credit Card Processing for Small Business" Defined

When we talk about free credit card processing for small business, we're describing a beautiful arrangement where:

You, the merchant, pay absolutely nothing on credit card transactions. Your customer pays a small surcharge (typically 3-4%) when they choose to use their credit card. The full purchase amount lands in your bank account, and the processor collects just the surcharge to cover interchange and other fees.

As one thrilled business owner told me after implementing this system: "Our savings over the year will be close to $12k." Imagine what you could do with an extra $12,000 - hire help, upgrade equipment, expand inventory, or maybe even take that vacation you've been postponing for years!

The key point is that while someone still pays the processing fees (nothing in life is truly free), it isn't you. Businesses using these programs typically see their monthly credit card processing statements show a beautiful zero in the fees column for credit transactions.

Is It Really Free, or Are There Hidden Costs?

While zero-fee processing eliminates transaction fees, there are still some potential costs to keep your eyes open for:

Equipment costs might sneak up on you. Some providers offer free terminals, while others charge for hardware or have monthly equipment fees. I've seen providers advertising terminals at $49-99 per month, which can eat into your savings.

PCI compliance fees don't disappear. Payment Card Industry compliance may still incur annual or monthly fees, though good providers include this in their service package.

Chargeback fees remain a reality. When customers dispute charges, you'll typically still pay a fee (often $15-25 per chargeback), so maintaining good customer service remains important.

Statement or monthly fees might still appear. Some providers charge monthly service fees despite offering "free" processing, so read the fine print carefully.

Customer perception costs are harder to measure but very real. According to a study by PYMNTS.com, almost half of U.S. credit card users would consider switching merchants to avoid paying a surcharge. That's potentially lost business if not handled thoughtfully.

The most honest providers will be upfront about these additional costs. When you're shopping around, don't be shy - ask specifically about all potential fees beyond the transaction rates. A good partner will gladly walk you through the complete picture, not just the highlight reel.

Types of Zero-Fee Programs Explained

There are several ways to implement free credit card processing for small business, and each creates a slightly different experience for you and your customers. Think of these as different flavors of the same ice cream – they're all sweet for your bottom line, but the taste varies!

Surcharge vs. Cash Discount

Surcharge Model is straightforward – your customer pays a little extra when they choose credit. Your $10 sandwich becomes $10.40 with a 4% surcharge. The base price stays the same, but the fee appears at checkout and on receipts. It's crystal clear what's happening, but some customers might wrinkle their nose at the extra charge. This model works well in 46 states, though you'll need a different approach in California, Connecticut, Maine, and Massachusetts where restrictions apply. And if you're in Colorado, remember they cap surcharges at 2%.

Cash Discount Programs flip the script. Here, your prices already include the processing fee, and customers who pay with cash or debit get a nice discount (typically 3-4%). That $10.40 sandwich is advertised at that price, but cash customers pay just $10. The beauty? This approach is legal everywhere in the US and complies with the Durbin Amendment of the Dodd-Frank Act.

The difference is all about psychology. As one of our merchants put it: "We've been using the cash discount model for six months, and customers actually appreciate the transparency and option to save money." People love feeling like they're getting a deal rather than being charged extra.

Convenience & Service Fees for Online/Phone Sales

If you sell online or take orders by phone, you have specialized options:

Convenience Fees work well for web transactions. Instead of percentages, you charge a flat fee for using an alternative payment channel. The amount stays the same regardless of purchase size or card type. This approach shines for invoices, online checkouts, and subscription billing.

Service Fees are percentage-based and work particularly well for specific service categories like government, education, and utilities. The fee applies to the total transaction and must be clearly disclosed during checkout.

For online businesses, don't overlook ACH payments (direct bank transfers). They typically cost just 0.5% + $0.25 per transaction with a $6 cap – a bargain for higher-ticket items or B2B transactions. One online retailer told us they saved over $1,500 monthly by steering customers toward ACH for purchases over $300.

Each approach has its sweet spot depending on your business type, customer base, and location. The right model can transform those processing fees from a profit-killer into a non-issue while keeping your customers happy.

Legal & Compliance Checklist in the U.S.

Navigating the legal landscape for free credit card processing for small business doesn't have to give you a headache. Let's break down what you need to know to stay on the right side of the law while eliminating those processing fees.

Required Disclosures & Signage

Think of proper signage as your legal shield. Card networks and state laws require you to be completely transparent with your customers about any fees or discounts.

You'll need clear notices posted at your store entrance and checkout counter. These signs should explain your surcharge or cash discount policy in simple terms that any customer can understand. Nobody likes surprises at the register!

Your receipts need to show the surcharge as its own line item – not hidden within the product price. This transparency builds trust with your customers while keeping you compliant.

Timing matters too. Customers must know about any surcharges before they hand over their card, not after. As one coffee shop owner told me, "We have signs at the door and register, plus our staff gives a friendly reminder before processing. Most customers appreciate the heads-up."

Don't forget to register with Visa, Mastercard and other card networks at least 30 days before starting your program. This registration isn't optional – it's required.

Finally, keep your surcharges reasonable. They cannot exceed your actual cost of acceptance or 4% of the transaction – whichever is lower. Pushing beyond these limits isn't just bad for customer relations; it's against the rules.

States Where Surcharging Is Restricted

While most states allow surcharging, a few have specific restrictions you'll need to steer:

California has a complicated relationship with surcharging. Their ban was ruled unconstitutional, but new restrictions take effect July 1, 2024. If you're in the Golden State, you'll want to stay updated on these changes.

Connecticut, Maine, and Massachusetts currently prohibit surcharging altogether. If your business operates in these states, you'll need to use a cash discount program instead.

Colorado takes a middle path – surcharging is allowed, but capped at 2% (compared to the standard 3-4% elsewhere).

A bakery owner in Massachusetts shared her experience: "We implemented a cash discount program instead of surcharging. Our customers actually love it – they feel like they're getting a special deal when they pay with cash, and we still save on processing fees. Win-win!"

Cash discount programs remain legal nationwide, making them a safe harbor if you operate in multiple states or in areas with surcharging restrictions.

Equipment & Software Requirements

Having the right tools makes implementing your zero-fee program much simpler. You'll need:

EMV-enabled terminals that automatically apply and clearly disclose surcharges or cash discounts. These smart terminals take the guesswork out of compliance by handling the calculations and disclosures for you.

Your point-of-sale system must be able to tell the difference between credit and debit cards, applying fees only where appropriate. Many modern POS systems can be configured for this, but older systems might need updates.

For online stores or phone orders, your virtual terminal needs proper setup to apply and disclose fees correctly. E-commerce businesses have specific requirements that differ slightly from brick-and-mortar stores.

Receipt capabilities are non-negotiable – your system must clearly itemize any surcharge or discount. Clear receipts prevent customer confusion and demonstrate compliance if questions arise.

Most reputable providers include compatible equipment as part of their service package, though some charge monthly equipment fees ranging from $49-99. As one restaurant owner noted, "The terminal our processor provided handles everything automatically – it was truly plug-and-play."

According to research from Worldpay's Global Payments Report, consumers are increasingly accepting of surcharges when they're clearly disclosed and reasonable. Their studies show that transparency is the key factor in customer acceptance of these programs.

With the right preparation and tools, navigating the legal requirements of free credit card processing for small business becomes much more manageable. The savings are well worth the initial setup effort!

Implementation, Customer Communication & Savings

Successfully implementing free credit card processing for small business doesn't have to be complicated. With some thoughtful planning and clear communication, you can start saving on processing fees while keeping your customers happy.

Step-by-Step Setup Guide

Getting started with zero-fee processing is simpler than you might think. First, you'll need to decide which program fits your business best – surcharge, cash discount, or convenience fee. Your choice should reflect both your business style and what's legal in your state.

Once you've made that decision, it's time to partner with a provider who specializes in these programs. They'll handle the paperwork, including the required registration with Visa, Mastercard and other networks (which needs to happen at least 30 days before you launch).

"The setup was much easier than I expected," shares Marie, a boutique owner in Ohio. "My provider handled all the card network registrations, and the terminals came pre-programmed to automatically apply the right fees."

Your provider should equip you with terminals that automatically handle the fee calculations and required disclosures. They'll also provide the signage you need to post at your entrances and checkout areas – a critical compliance requirement.

Don't forget to thoroughly train your staff. They need to understand how the program works so they can confidently explain it to curious customers. If you sell online, you'll also need to update your checkout process to properly disclose and apply the appropriate fees.

The whole process typically takes about 30-45 days from start to finish – not bad for a change that could save you thousands of dollars annually!

How to Communicate the Change Without Losing Sales

The way you talk about your new program can make all the difference in how customers receive it. Clear, positive communication is your best tool for preventing pushback.

When explaining in person, focus on the choices available rather than the fees. For example: "We've implemented a cash discount program to keep our prices low. You'll receive a 4% discount when paying with cash or debit card. If you prefer to use a credit card, that's fine too – the regular price will apply."

For loyal customers, consider sending an email announcement before the change takes effect. Keep it warm and appreciative: "Dear Valued Customers, To continue offering competitive pricing, we're implementing a cash discount program starting [date]. Customers paying with cash or debit will receive a 4% discount on all purchases. Credit cards will be accepted at our regular prices. This change allows us to maintain our quality and service without raising prices across the board. Thank you for your understanding and continued support."

Tom, a hardware store owner in Arizona, found that honesty worked best: "We were upfront about why we made the change. Most customers understand that processing fees eat into small business profits, and they appreciated having options to save money themselves."

Some smart communication strategies include:

Emphasizing choice rather than restrictions

Training staff to explain the program with confidence and positivity

Reassuring customers that credit cards are still welcome

Offering a special promotion during the transition period to create goodwill

Estimate Your Savings & Alternative Options

The potential savings from free credit card processing for small business can be substantial. To get a realistic picture of what you might save, take a look at your current monthly processing statements.

Identify the total fees you're currently paying for credit card transactions, then multiply your monthly credit card volume by your effective processing rate. For a business processing $30,000 monthly in credit cards at a 3.2% rate, that's $960 in monthly savings – or $11,520 over a year!

That's money you could reinvest in inventory, marketing, staff bonuses, or simply keeping your prices competitive in challenging economic times.

If surcharging or cash discounts don't work for your business model, you still have options to reduce processing costs. ACH payments (bank transfers) typically cost just 0.5% + $0.25 per transaction, with a cap of $6, making them especially attractive for larger transactions.

You might also consider setting a $10 minimum for credit card purchases (perfectly legal under card network rules) to reduce the impact of fees on small sales. With sufficient processing history, you can often negotiate better rates with your processor, especially if you're willing to shop around.

"We saved almost $15,000 last year after implementing our cash discount program," shares Jennifer, a café owner. "That covered the cost of a much-needed equipment upgrade that we'd been putting off for years."

Frequently Asked Questions About Free Credit Card Processing

What happens with debit cards? Debit cards follow different rules – they typically cannot be surcharged and process at regular rates (usually 1-1.5% plus a transaction fee). The good news? In cash discount programs, debit cards often qualify for the discount, making them a win-win for both you and your customers.

Is it legal in my state? Cash discount programs are legal everywhere in the U.S. Surcharging is legal in 46 states, with restrictions in California, Connecticut, Maine, and Massachusetts. Colorado allows surcharging but caps it at 2%. Your processor should help ensure you're compliant with local regulations.

How much can I really save? Most businesses save their entire credit card processing fee amount, which typically ranges from 2.5-3.5% of credit card volume. For a business processing $30,000 monthly in credit card sales, that's $750-1,050 back in your pocket every month.

Will I lose customers? This is the question that keeps many merchants up at night. The good news? Research and merchant experiences suggest that while some customers may initially object, most adapt quickly when given clear options. Offering alternatives like debit (with no surcharge) minimizes negative reactions. Most merchants report minimal impact on overall sales volume after the initial adjustment period.

What about FSA/HSA cards? FSA/HSA cards that function as debit cards cannot be surcharged. Those that function as credit cards can be surcharged up to 3% in most states. Your terminal should be programmed to recognize these distinctions automatically.

How quickly will I receive my funds? Most zero-fee processors offer next-day funding with a cutoff time (typically 11 PM EST). Transactions processed after the cutoff are funded in two business days – similar to traditional processing timeframes.

Conclusion & Next Steps

Free credit card processing for small business isn't magic—but it's not a myth either. It's a practical solution that can transform your bottom line when implemented thoughtfully. By shifting processing fees to customers who choose credit cards, your business can keep 100% of every sale.

Before jumping in, take a moment to consider what matters for your specific situation:

Your monthly processing volume tells you how much you stand to save. A café processing $30,000 monthly in card payments might save nearly $1,000 every month—that's a new espresso machine every quarter!

Your state matters too. While cash discount programs work nationwide, surcharging faces restrictions in California, Connecticut, Maine, and Massachusetts. Colorado merchants can surcharge, but only up to 2%.

Think about your customers. Will they understand the change? Most do when it's explained clearly. As one retailer told me, "We were nervous at first, but our regulars adapted within a week once they saw they could save by using debit."

Don't forget about equipment costs, PCI compliance fees, and potential chargebacks. The processing might be free, but these other expenses still exist.

Consider your competitive landscape. If you're the only shop in town adding a surcharge while competitors absorb the cost, you might need to rethink your approach or improve your communication strategy.

For many small businesses, the potential savings—often $10,000+ annually—make these programs incredibly valuable. As our economy continues to move away from cash, having a strategy for card processing costs becomes essential for healthy profits.

Here at Merchant Payment Services, we've spent over 35 years in the payments industry helping small businesses like yours implement compliant zero-fee processing solutions. We understand the delicate balance between saving money and keeping customers happy.

We also offer ATM management services that can create additional revenue streams for your business—turning a cost center into a profit center.

Whether you decide to eliminate your processing fees or just want to explore options for reducing them, taking action now will have a real impact on your profitability this year and beyond. The small businesses that thrive in today's economy are the ones that actively manage these seemingly small costs that add up quickly.

When you're ready to take the next step, we're here to help with straightforward advice and solutions custom to your specific business needs.