ATM Security Cameras and Footage Storage Explained

Understanding ATM Camera Footage Retention

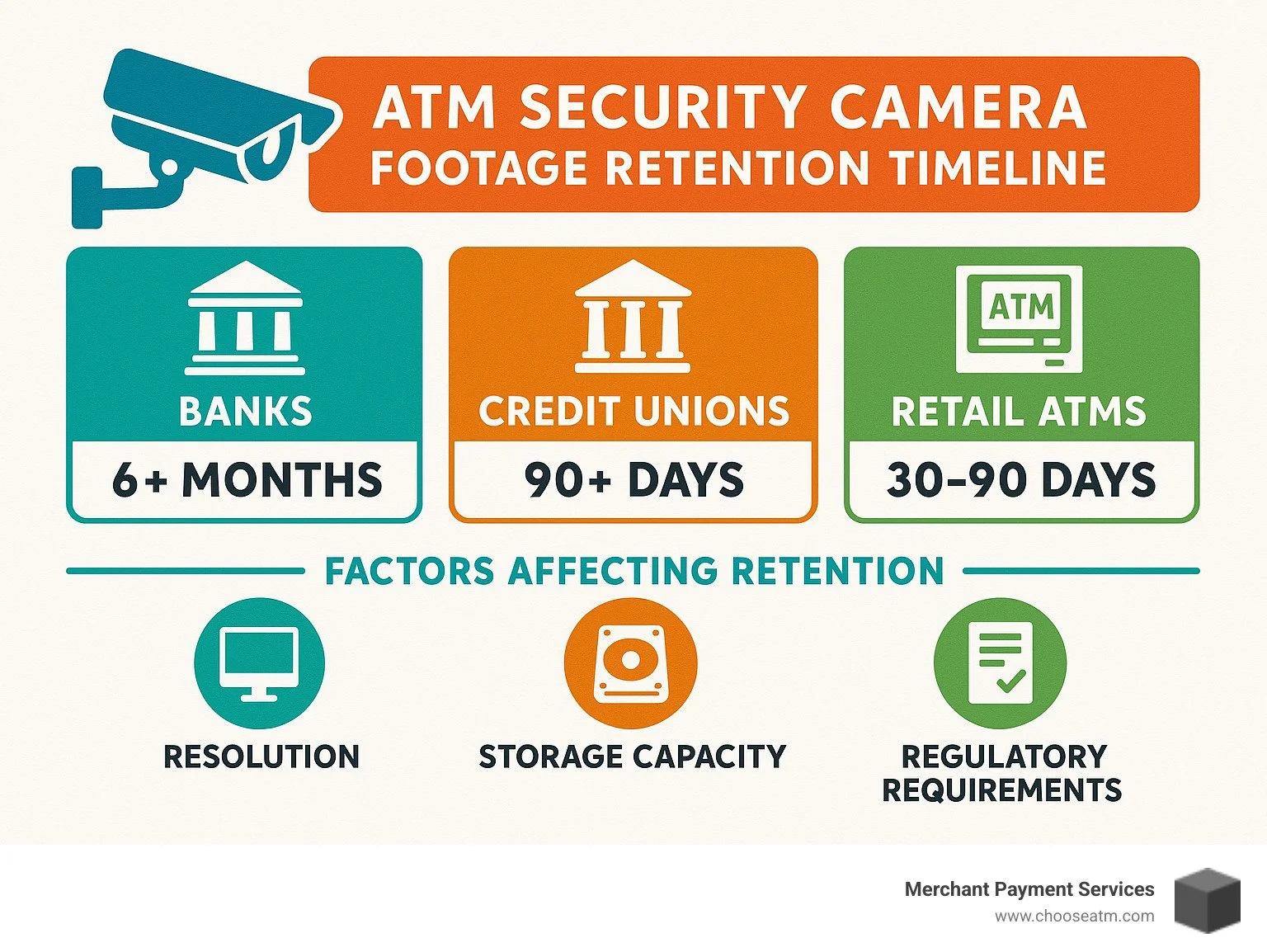

How long do ATM security cameras keep footage? Banks and financial institutions typically retain ATM security camera footage for 6 months to 1 year on average. However, retention periods can vary based on:

Minimum standard: 90 days for most ATMs Banking institutions: 6 months to 7 years (regulatory requirement) Independent ATMs: 30-90 days (depending on storage capacity) Storage method: Cloud solutions offer longer retention than local DVR/NVR systems Recording mode: Motion-activated recording extends storage duration

When you use an ATM, you're likely being recorded. How long ATM security cameras keep footage is a critical question for both ATM operators and customers concerned about transaction disputes or security incidents.

In today's world of digital banking, ATM security cameras serve as silent witnesses to every transaction, button press, and customer interaction. But unlike the endless video archives we see in movies, real-world storage limitations and regulatory requirements dictate exactly how long this footage remains available.

Understanding ATM footage retention isn't just about technical storage capacity0it's about balancing security needs, regulatory compliance, and practical limitations of video storage systems.

Whether you're a business owner with an ATM on your premises, someone investigating a disputed transaction, or simply curious about your privacy at the cash machine, knowing how long that footage exists matters.

I'm Lydia Valberg, co-owner of Merchant Payment Services with over 35 years of family experience in the payment industry, and how long ATM security cameras keep footage is one of the most common questions our clients ask when considering ATM placement in their businesses.

Why Retention Matters for U.S. ATMs

The length of time ATM security footage is retained isn't just a technical consideration0it serves several critical purposes:

Fraud Deterrence: Visible security cameras with known retention periods discourage criminal activity. According to FBI statistics, banks and ATMs with visible security measures experience fewer robbery attempts.

Dispute Resolution: When customers claim unauthorized withdrawals or incorrect dispensing amounts, footage provides objective evidence to resolve these claims. At Merchant Payment Services, we've seen countless cases where footage has helped resolve transaction disputes fairly.

Robbery Evidence: In case of physical ATM robberies or attacks, longer retention periods give law enforcement more time to identify and prosecute perpetrators.

Customer Trust: Knowing that transactions are monitored and recorded builds confidence in the banking system. Our clients report that customers appreciate seeing security cameras at ATMs, viewing them as a sign of protection rather than invasion of privacy.

As one of our convenience store clients in Dallas told us, "Having that footage available for 90 days saved us thousands of dollars when a customer falsely claimed the ATM short-changed them." This real-world example demonstrates why proper retention policies matter.

How Long Do ATM Security Cameras Keep Footage? The Short Answer

When folks ask me "how long do ATM security cameras keep footage," I always tell them it depends on who owns the ATM. The industry standard minimum is about 90 days for most machines across America, but many financial institutions hold onto those recordings much longer.

Banks and credit unions typically store their ATM footage for 6 months to 1 year. This longer timeframe isn't just because they have bigger budgets0it's because they need time to thoroughly investigate fraud cases, which customers sometimes don't notice or report until weeks after they happen.

Most ATM recording systems work on what we call an automatic overwrite cycle. Rather than someone manually deleting old footage, the system simply records over the oldest videos once it runs out of storage space. It's like a self-cleaning oven for video files!

How machines record also affects how long footage sticks around. Some ATMs record 24/7, which fills up storage quickly but captures everything. Others use motion-activated recording that only turns on when someone approaches the ATM, which saves considerable space. Some systems are even smarter, triggering only during actual transactions.

The FBI tells us that people typically report ATM crimes about 30 days after they happen. That's why that 90-day industry minimum makes good sense0it gives a comfortable cushion for investigations to happen.

Typical Retention Windows by ATM Owner Type

Different ATM operators have different approaches to video retention:

Bank-Owned ATMs typically maintain the longest retention periods, ranging from 6 months all the way up to 7 years for some larger institutions. Major players like Chase, Bank of America, and Wells Fargo generally keep footage for at least 6 months. Some even use a tiered approach0storing high-quality footage for 90 days, then lower-resolution versions for up to a year.

Independent ATM Deployers (IADs) and ISOs like us at Merchant Payment Services usually keep footage for 30-90 days. We actually recommend our clients maintain at least 90 days of footage0I've seen too many cases where a dispute pops up on day 45 or 60, and having that video evidence saves everyone a massive headache.

Credit Unions follow similar patterns to banks, typically storing footage for at least 90 days, with many extending to 6 months to better protect their members.

Convenience Stores and Retail Locations often have more limited storage capacity, typically holding onto footage for 30-90 days. That said, I've noticed more store owners upgrading their storage as costs drop. Just last month, one of our convenience store clients in Houston upgraded from a 30-day to a 90-day system after they had a dispute arise 45 days after the transaction. That upgrade has already prevented several potential losses.

How Long Do ATM Security Cameras Keep Footage in High-Risk Locations

When it comes to high-risk areas, how long ATM security cameras keep footage often exceeds those standard timeframes. Smart ATM operators in these locations implement extended retention policies.

ATMs in urban crime hotspots often warrant retention periods of 6-12 months, regardless of whether they're bank-owned or independently operated. For example, machines in certain neighborhoods of Chicago, New York, or Los Angeles typically maintain footage twice as long as the standard period.

Cash-intensive locations like casinos, nightclubs, and high-volume convenience stores also benefit from extended retention periods. These places tend to experience more disputes and therefore need longer access to historical footage.

At Merchant Payment Services, we carefully analyze location risk factors when recommending retention policies. Just recently, we helped a high-volume nightclub in Miami implement a 180-day retention system. Their combination of late-night operations, cash-intensive transactions, and the location's crime statistics made this longer retention period a smart investment rather than an unnecessary expense.

U.S. Regulations & Industry Standards

If you've ever wondered how long ATM security cameras keep footage, the answer isn't as straightforward as you might think. While there's no single federal law with a clear-cut requirement, several regulatory bodies provide guidance that shapes retention practices across the country.

The regulatory landscape includes oversight from multiple federal agencies. The Federal Deposit Insurance Corporation (FDIC) doesn't explicitly mandate specific retention periods, but their examiners typically look for what they consider "reasonable" retention0usually interpreted as at least 90 days. Similarly, the Office of the Comptroller of the Currency (OCC) expects national banks to keep footage long enough to help with criminal investigations, which also tends to translate to that same 90-day minimum.

The Federal Financial Institutions Examination Council (FFIEC) takes a risk-based approach in their IT Examination Handbook, recommending retention periods based on each institution's unique risk assessment. Again, 90 days emerges as the common baseline in practice.

Other regulatory frameworks like the Gramm-Leach-Bliley Act (GLBA) and Payment Card Industry Data Security Standard (PCI DSS) don't directly specify retention periods but do influence how footage is stored and protected. For instance, PCI DSS requirements affect ATMs that capture card data, particularly regarding secure storage methods and who can access that footage.

I've seen how these regulations create a patchwork of requirements that ATM operators must steer. At Merchant Payment Services, we help our clients understand which regulations apply to their specific situation, saving them from the headache of sorting through complex regulatory language.

Federal Banking Agency Guidance

When it comes to record retention, federal banking agencies provide more detailed guidance than you might expect. The FFIEC's Bank Secrecy Act/Anti-Money Laundering Examination Manual recommends banks maintain records that could assist in financial crime investigations.

For ATM operators, this translates to retention periods that serve multiple purposes. First, there's the need for internal investigations0giving the institution enough time to review any suspicious activities. Then there's customer dispute resolution, ensuring footage exists long enough to address claims about unauthorized transactions. Finally, there's law enforcement cooperation, maintaining evidence that might be requested by authorities.

One crucial aspect that many ATM operators overlook is the concept of investigative holds. When an incident occurs or is suspected, you must place what's called a "litigation hold" on relevant footage. This prevents deletion even if the footage would normally be overwritten according to your standard retention schedule.

"We had a client who thought their 90-day retention policy was sufficient," explains Lydia Valberg of Merchant Payment Services. "But when a fraud case emerged, they needed to preserve specific footage beyond that window. Having a clear process for investigative holds saved them from potentially serious legal issues."

State-Level Mandates & Law-Enforcement Requests

Beyond federal guidelines, state laws can significantly impact how long ATM security cameras keep footage. While most states default to the 90-day federal minimum, some have enacted more specific requirements. Some states require financial institutions to keep footage for at least 180 days, while others base retention requirements on factors like the ATM's location or local crime statistics.

Law enforcement interactions represent another layer of complexity in footage retention. When police investigate crimes involving ATMs, they typically follow a structured process that begins with a formal request or subpoena for specific footage. Once received, the ATM operator must preserve that footage beyond their normal retention period. The footage is then exported in a format usable by investigators, with careful documentation to maintain what's called the "chain of custody"0ensuring the evidence remains admissible in court.

Court orders add yet another dimension to retention requirements. If a judge determines footage may be relevant to an ongoing investigation or pending litigation, they can order an ATM operator to preserve specific timeframes indefinitely0regardless of standard policies.

I remember a client in Arizona who received a court order to preserve footage from six months prior. Because they had implemented our recommended 180-day retention policy (exceeding their state's 90-day minimum), they were able to comply with the order and help solve a fraud case that ultimately led to a conviction.

Understanding these regulatory nuances isn't just about compliance0it's about protecting your business and your customers. At Merchant Payment Services, we've guided countless clients through the complex landscape of financial service security regulations, helping them implement retention policies that satisfy both legal requirements and practical business needs.

Factors & Technologies Affecting Retention Length

When customers ask me, "How long do ATM security cameras keep footage?," I always explain that the answer depends on several technical factors. It's not just about setting a date and forgetting it0there's some interesting tech behind those retention periods!

Resolution makes a huge difference in how much space your footage takes up. Think of it like the difference between regular and high-definition TV. Higher resolution cameras (1080p or 4K) capture much clearer images0perfect for identifying faces or reading card numbers0but they also create much larger files. A 4K camera might need 4-8 times more storage than a standard definition one!

Frame rate is another big factor that many ATM owners overlook. A camera recording at 30 frames per second (like smooth TV) requires twice the storage of one recording at 15fps. Most of our clients at Merchant Payment Services find that 15-20fps hits the sweet spot0smooth enough to see what's happening without eating up storage unnecessarily.

Modern compression technology like H.265 (also called HEVC) has been a game-changer for our clients. This newer compression can cut storage needs by up to 50% compared to older H.264 standards, while keeping similar quality. That's like magically doubling your retention time without buying new hardware!

The number of cameras watching each ATM directly impacts storage needs. Most setups we install have 2-4 cameras capturing different angles0one on the face, one on the keypad, maybe one on the surrounding area. Each additional camera multiplies your storage requirements.

I remember working with a convenience store owner in Chicago who wanted to extend his retention from 30 to 90 days without buying more storage. We switched him from continuous recording to motion-activated recording, which only captures video when someone approaches the ATM. This simple change extended his retention period nearly four times!

Storage capacity sets the ultimate limit on retention. Most modern ATM surveillance systems we install start with at least 2TB of storage, but we're seeing more clients opt for 4-8TB systems as prices have dropped below $20 per terabyte. This affordability has made longer retention periods much more feasible for small business owners.

Nearly all ATM systems use loop recording, which automatically overwrites the oldest footage when storage fills up. This ensures continuous recording without someone having to manually delete old files0a huge convenience factor for busy business owners.

How Long Do ATM Security Cameras Keep Footage When Using 1080p vs 4K

Resolution is perhaps the biggest factor in determining how long ATM security cameras keep footage. Let me break down the real-world numbers:

Resolution Bitrate (Mbps) Storage per Camera (30 days, 24/7) Typical Retention with 4TB Storage 720p 2-3 Mbps 650-975 GB 120-180 days 1080p 4-6 Mbps 1.3-1.95 TB 60-90 days 4K 8-16 Mbps 2.6-5.2 TB 30-45 days

These calculations assume modern H.265 compression and a standard 15fps frame rate. For most of our clients' ATMs, we recommend 1080p resolution as the "goldilocks zone"0clear enough to identify faces and read transaction details, but efficient enough to store footage for 60-90 days with reasonable storage.

One clever approach we've implemented for several clients is a hybrid resolution strategy. For a jewelry store with an ATM in Phoenix, we set up:

A 4K overview camera (retained for 30 days) that captures the entire area

1080p cameras focused on the PIN pad and transaction area (retained for 90 days)

A 720p camera that archives general approach footage for up to 180 days

This way, they get the detail they need where it matters most, while maximizing retention periods for each purpose.

Edge vs Central Recording: Impact on Days Stored

The way you structure your recording system dramatically affects how long ATM security cameras keep footage. Let me walk you through the options:

SD Card/Edge Recording is like having a memory card right in the camera itself:

Most modern ATM cameras can record to built-in SD cards (32GB-256GB)

This typically gives you 7-30 days of footage depending on your settings

It's great as a backup if your network goes down

The downside? If someone steals the camera, they take your footage too

Network Video Recorder (NVR) with RAID is what we recommend for most of our clients:

This is a central "brain" that stores footage from multiple cameras

RAID configurations (essentially multiple hard drives working together) protect against drive failures

With typical capacities of 2TB-16TB, you can store 30-180 days of footage

The best part? You can keep the NVR locked away in a secure room, separate from the ATM

Cloud Storage has become increasingly popular among our more tech-savvy clients:

It offers virtually unlimited retention potential (though costs increase with longer retention)

You can scale up or down based on your needs

The catch? You need reliable internet with good upload speeds

Instead of a big upfront hardware purchase, you pay a monthly subscription

Internet bandwidth is a real consideration for cloud solutions. Each 1080p camera needs about 4-6 Mbps of consistent upload bandwidth. For ATMs in rural areas or places with spotty internet, we often recommend hybrid solutions.

I remember helping a client with a chain of convenience stores across rural Texas. We created a custom hybrid solution that keeps 90 days of high-quality footage on local NVRs, while automatically uploading motion-triggered events to the cloud for a full year. When they had an insurance claim six months after an incident, that cloud backup saved them thousands of dollars!

At Merchant Payment Services, we analyze your specific needs and location constraints to recommend the perfect storage solution0balancing security, budget, and practical retention periods for your ATM business.

Storage Solutions for ATM Video (On-Prem vs Cloud)

When it comes to the question of how long ATM security cameras keep footage, your storage solution makes all the difference. Think of it as choosing between keeping your family photos in a physical album at home or storing them in the cloud—each has its own advantages.

On-Premises Solutions are like having your own security vault right on site:

DVR/NVR Systems: These workhorses typically come with 2TB-16TB of built-in storage, sitting quietly in your back office recording everything.

SD/SSD Storage: Some systems record directly to memory cards or solid-state drives, which are compact but mighty.

The beauty of on-premises storage is that you own it outright—no monthly bills and no reliance on internet connectivity. You're in complete control. However, just like keeping all your valuables in one place, there's vulnerability to theft, fire, or simply running out of space.

Cloud Solutions offer a different approach:

Pure Cloud: Everything goes straight to secure servers somewhere else in the country.

Hybrid Cloud: The best of both worlds—keep recent footage on-site while backing up important clips to the cloud.

Cloud storage shines with its scalability—need to keep footage longer? Just adjust your plan rather than buying new hardware. Plus, you can check your footage from anywhere with an internet connection, which is perfect for multi-location businesses.

The peace of mind comes from robust security features like AES-256 encryption (the same level used by banks for online transactions) and automatic redundancy that keeps multiple copies of your footage safe. If disaster strikes your location, your evidence remains intact off-site.

At Merchant Payment Services, we've seen the hybrid approach work wonders for our clients. One of our customers, a family-owned jewelry store in Arizona with an in-store ATM, sleeps better at night knowing they have 60 days of footage stored locally, while all transaction events are safely archived in the cloud for a full year.

On-Prem DVR/NVR Best Practices

If you're keeping your ATM footage on-site, think of it like maintaining a well-oiled machine—it needs proper care to run smoothly and reliably.

RAID-5 Arrays might sound technical, but they're simply a smart way to arrange multiple hard drives so that if one fails, you don't lose any footage. It's like having a spare tire always ready to go. For ATMs, this redundancy isn't just convenient—it could be the difference between having evidence of fraud or losing it forever.

Uninterruptible Power Supply (UPS) systems are the unsung heroes of video storage. When the lights flicker during a summer storm, your recording doesn't skip a beat. We recommend this for all our clients—it's a small investment that prevents big headaches.

Automatic Overwrite Configuration ensures your system knows what to do when storage gets full. Like a responsible librarian, it removes the oldest books to make room for new ones—except for those special volumes you've marked to keep.

The physical security of your recording equipment matters too. We always tell our clients: "Don't keep your evidence in the same place as what might be stolen." Mount that NVR in a locked closet away from the ATM itself.

Regular maintenance goes a long way. One of our hotel clients in San Diego has maintained perfect footage integrity for three years running with their RAID-6 system that provides 120 days of retention. The secret? Quarterly check-ups and keeping the equipment in a temperature-controlled room.

Cloud & Hybrid Models

The cloud has revolutionized how we think about how long ATM security cameras keep footage. It's like having a storage unit that magically expands whenever you need more space.

Scalable Retention is perhaps the biggest advantage. With traditional hardware, you're stuck with whatever you bought until you upgrade. With cloud storage, you can adjust on the fly—keep general footage for 90 days, but extend to a year for those suspicious transactions where someone was wearing sunglasses at night.

The cybersecurity benefits are substantial too. Professional cloud providers employ teams of security experts that most small businesses could never afford on their own. They're constantly monitoring for threats, patching vulnerabilities, and maintaining multiple copies of your data across different locations. It's like having a security detail that never sleeps.

Instead of the "sticker shock" of buying expensive NVR systems upfront, cloud solutions offer predictable monthly fees. Depending on your needs, this typically runs between $10-100 per camera monthly—a cost that many of our clients find easier to budget for than large capital expenditures.

The research on storage media longevity is eye-opening. Traditional VHS tapes lose approximately 10% of their quality every decade. Digital storage, when properly maintained, can theoretically last forever because the data can be perfectly copied to new media before any degradation occurs.

We recently helped a regional bank with 15 ATMs across three states implement a hybrid approach. They now keep 30 days of footage locally while sending all transaction events to the cloud for a full year. Not only did this reduce their hardware costs by 60%, but it also extended their effective retention period by 4x. The operations manager told me, "I used to worry about storage space constantly. Now I don't even think about it."

Protecting, Accessing, and Disposing of Footage

When it comes to ATM security footage, knowing how long ATM security cameras keep footage is just the beginning. The entire lifecycle of this valuable data needs careful management 0from the moment it's captured to its eventual deletion.

Think of ATM footage like a digital safe deposit box. It's not just about having one; it's about knowing who has the keys, when they access it, and how to properly empty it when the time comes.

Access Controls form your first line of defense. At Merchant Payment Services, we recommend a tiered approach where different team members have different levels of viewing privileges. Your night manager might need to review today's footage, but probably shouldn't be able to delete last month's records. By assigning unique logins to each person and limiting permissions based on their role, you create accountability while protecting sensitive customer information.

Audit Logs act as your digital paper trail. Every time someone views, exports, or attempts to modify footage, the system should record who did what and when. These logs are invaluable during internal reviews and can help identify suspicious access patterns before they become security breaches.

When it comes to Evidence Export Protocols, details matter. If you've ever watched a courtroom drama where evidence gets thrown out on a technicality, you understand why. Proper exports preserve all the original timestamps and camera identifiers that validate your footage as authentic. This chain of custody documentation isn't just bureaucratic paperwork 0it can make or break a case when ATM fraud occurs.

"One of our convenience store clients in Milwaukee learned this lesson the hard way," shares Lydia Valberg from our team. "They had clear footage of a fraudster at their ATM, but because they emailed a compressed clip rather than following proper export procedures, the evidence was challenged in court."

Secure Deletion practices complete the lifecycle. When footage reaches the end of its retention period, it shouldn't just be deleted 0it should be securely erased following NIST guidelines that make recovery impossible. This protects customer privacy while freeing up valuable storage space for new recordings.

Having a well-documented Incident Response Plan turns chaotic moments into orderly procedures. When suspicious activity occurs, your team should know exactly how to preserve relevant footage, who to notify, and what additional steps to take 0all without hesitation or confusion.

Retrieval Workflow for Investigations

When you need to find that needle in a haystack of video data, having a streamlined retrieval process makes all the difference.

Time Synchronization is the unsung hero of video investigations. When your ATM camera timestamps don't match your transaction logs, piecing together events becomes nearly impossible. That's why we recommend using Network Time Protocol (NTP) to keep all your systems in perfect sync. This simple step has helped countless clients avoid the headache of mismatched timelines during investigations.

Modern systems offer powerful Search Filters that transform hours of searching into minutes. Rather than scrubbing through endless footage, you can jump directly to motion events, specific time ranges, or even particular transactions when your video system integrates with your ATM logs.

Choosing the right Export Format depends on your needs. For sharing with your insurance company, a standard MP4 might suffice. For court evidence, you'll want your system's proprietary format with digital signatures that verify the footage hasn't been altered. For quick identification purposes, high-quality still images often work best.

The Law Enforcement Chain of Custody requires special attention. When providing footage to authorities, documentation matters as much as the video itself. Who accessed it? When was it exported? How was it transferred? These questions need clear answers to maintain evidence integrity.

A retail client in Nashville recently called us after an ATM skimming incident. Because they followed our retrieval workflow precisely, they were able to provide police with crystal-clear footage showing the installation of the skimming device. The timestamp alignment with transaction records helped investigators identify exactly which customers were affected, leading to faster fraud alerts and ultimately an arrest within the week.

Secure Deletion & Automatic Overwrite Policies

The final chapter in your footage lifecycle deserves as much attention as the beginning. How you delete old footage impacts both security and compliance.

A comprehensive Data Retention Policy should leave no room for guesswork. Everyone in your organization should understand exactly how long different types of footage are kept, what exceptions exist for investigations or disputes, and who has authority to extend retention when needed. This policy shouldn't live in someone's email 0it should be a formal document reviewed annually and accessible to relevant team members.

When it's time to replace storage hardware, End-of-Life Drive Handling becomes critical. Those old drives contain years of sensitive customer interactions that shouldn't end up in a landfill or recycling center intact. Physical destruction, degaussing (magnetic erasure), or certified third-party destruction services are your safest options. One of our banking clients actually makes a team-building event out of their annual hard drive destruction day 0complete with safety goggles and industrial shredders!

NIST Sanitization Standards provide the gold standard for digital media erasure. Following these guidelines ensures that deleted means truly deleted 0not just "removed from view" but actually overwritten with random data multiple times to prevent any possibility of recovery. For ATMs processing financial transactions, this level of thoroughness isn't optional.

Regular Compliance Auditing closes the loop on your deletion policy. Verification that automatic overwrite systems are functioning correctly, confirmation that extended-retention footage hasn't been forgotten, and documentation of all exceptions help you stay ahead of potential issues.

At Merchant Payment Services, we've simplified this complex process for countless clients. For a family-owned grocery chain with in-store ATMs across Texas, we implemented a hybrid policy that automatically archives transaction-related footage for 180 days while allowing general surveillance to overwrite after 60 days. This balanced approach maximizes security while minimizing storage costs 0and gives the owners peace of mind knowing their system runs smoothly without constant manual intervention.

By treating ATM footage with the same care and attention as the cash inside the machine, you protect both your customers and your business from unnecessary risks.

Conclusion

Understanding how long ATM security cameras keep footage isn't just a technical detail—it's a critical aspect of running a secure and compliant ATM operation. While most ATMs maintain footage for between 90 days and one year, your specific needs may vary based on your location, risk level, and regulatory requirements.

At Merchant Payment Services, we've spent over 35 years helping business owners steer the complexities of ATM management, including setting up appropriate video retention systems. I've seen how proper footage retention has saved businesses from costly disputes and helped law enforcement solve crimes that might otherwise have gone unsolved.

The reality is that video retention isn't just about checking a compliance box—it's about protecting your business, your customers, and your reputation in the community you serve.

Based on our decades of experience, here are our top recommendations for ATM operators:

Take time to review your current retention policy against industry standards and regulations that apply to your specific situation. What works for a gas station in rural Kansas might not be sufficient for a nightclub in downtown Miami.

Don't wait for a problem to find your storage is inadequate. Audit your storage capacity regularly to ensure it aligns with your retention needs and risk profile.

Technology keeps improving, and so should your systems. Consider upgrading to modern compression technologies like H.265, which can effectively double your retention period without increasing your storage costs.

The best solutions often combine approaches. Implement hybrid storage solutions that give you the immediate access of local storage with the long-term security and scalability of cloud backup.

Finally, make sure everyone knows the rules. Develop clear procedures for who can access footage, how it should be exported for investigations, and when it should be securely deleted.

When one of our convenience store clients in Houston followed these recommendations, they were able to provide crucial evidence in a fraud case that occurred 78 days before it was reported—just within their 90-day retention window. Had they stuck with their previous 60-day policy, that evidence would have been lost forever.

Whether you're installing your first ATM or managing a fleet across multiple locations, Merchant Payment Services can help you steer the complexities of security camera systems and footage retention. Our expertise ensures you'll have the right footage available when you need it, without unnecessary storage costs or compliance headaches.

For more information about our ATM services and how we can help optimize your security camera setup to protect your business, please contact us today. We're real people who understand your business challenges, and we're here to help.