ATM Machines and Cameras – What You Need to Know

Why ATM Security Cameras Matter for Your Business

Does atm machine has camera is one of the most common questions business owners ask when considering ATM placement. The short answer is yes - most ATM machines are equipped with cameras, but the setup varies significantly depending on location and operator requirements.

Quick Answer:

• Built-in cameras: Many modern ATMs include integrated pinhole cameras

• External surveillance: Bank branches and retail locations typically have additional CCTV coverage

• Footage retention: Most operators store video for 90 days on average

• Crime prevention: Cameras deter theft, skimming, and fraud attempts

• Legal compliance: Video evidence is admissible in court investigations

ATM cameras serve multiple purposes beyond simple recording. They capture transaction images, detect tampering attempts, and provide real-time alerts when suspicious activity occurs. According to industry data, ATM attacks in Europe increased 27% in recent years, making surveillance more critical than ever.

For business owners, understanding camera capabilities helps you choose the right ATM setup for your location. Whether you're installing a machine in a convenience store, restaurant, or retail space, cameras protect both your investment and your customers' safety.

As representatives of Merchant Payment Services, we've helped hundreds of business owners steer ATM security decisions over the past decade, including answering does atm machine has camera questions during initial consultations. Our experience shows that proper camera setup directly impacts both customer confidence and operational success.

Does Every ATM Machine Have a Camera?

Does atm machine has camera is a question we hear almost daily, and the answer might surprise you. While not technically required by law, the vast majority of ATMs across the United States do have camera surveillance. In fact, finding an ATM without some form of video monitoring has become increasingly rare.

Here's what makes this interesting: most people assume all ATMs have cameras, but the reality is more nuanced. Built-in cameras are now standard on modern machines, external CCTV systems provide area coverage, and federal guidelines strongly encourage surveillance even though they don't mandate it.

The game changed significantly when manufacturers like Genmega started including cameras as standard equipment. Since 2021, every new Genmega ATM comes with their GenCam system at no extra cost. This isn't just basic surveillance either - we're talking about crisp 2.1MP/1080p video at 30 frames per second, capturing two images per transaction and storing everything for the industry-standard 90-day retention period.

The deterrence factor alone makes cameras worthwhile. When potential criminals see that an ATM is monitored, they're far more likely to move along. It's simple psychology - nobody wants their face recorded while committing a crime.

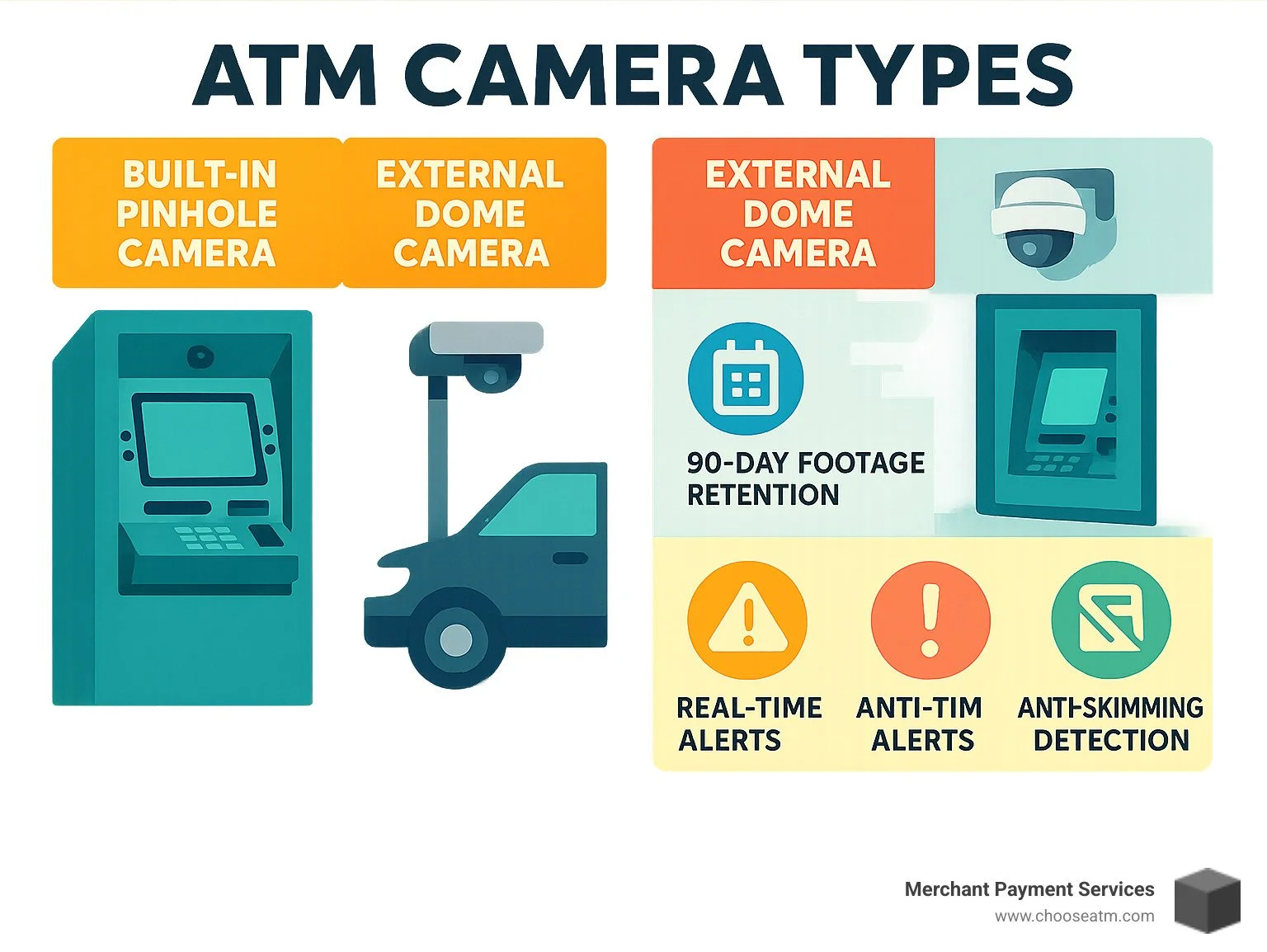

Most ATM surveillance comes in three flavors. Built-in pinhole cameras hide inside the machine housing, virtually invisible to users but capturing incredible detail. External CCTV systems monitor approaches and surrounding areas. And many locations use both, creating overlapping coverage that's tough to avoid.

Does atm machine has camera in retail locations?

Retail environments present unique challenges for ATM security. Unlike bank branches with dedicated security teams, mall ATMs, convenience stores, and standalone units often operate in less controlled environments.

Mall ATMs typically enjoy the best of both worlds. The machine's built-in camera captures transaction details while the mall's security system provides broader coverage. Most shopping centers maintain their own 90-day footage retention, giving you backup if the ATM camera has issues.

Convenience stores create interesting situations. Store owners often position ATMs where existing security cameras can provide additional angles, but the ATM's internal camera usually does the heavy lifting. We've found that placement near the checkout counter works well - customers feel safer, and store cameras can capture anyone tampering with the machine.

Standalone units in parking lots or outdoor locations need the most robust camera systems. These machines face weather, vandalism, and isolation challenges that indoor units never see. Weatherproof housing, infrared night vision, and cellular connectivity for remote monitoring become essential features rather than nice-to-haves.

Does atm machine has camera at bank branches?

Bank-operated ATMs represent the gold standard for surveillance coverage. Banks don't mess around when it comes to protecting their assets and customers, investing heavily in comprehensive camera systems.

Drive-thru lanes showcase some of the most sophisticated setups we see. The ATM's pinhole camera captures user interactions up close, while external pole-mounted cameras monitor vehicle approaches and can even capture license plates. Those wide-angle lenses can reach over 106 degrees of coverage - that's almost fish-eye territory.

Lobby machines benefit from multiple camera angles working together. Overhead dome cameras provide bird's-eye views while the ATM's built-in camera focuses on facial details and PIN pad interactions. It's like having a security team watching from several positions at once.

24-hour vestibules require extra attention since they operate after banking hours. These locations typically feature motion-activated lighting, tamper alarms, and high-resolution cameras with excellent night vision. Banks know that after-hours transactions present higher risks, so they plan accordingly.

The bottom line? Whether you're a business owner considering ATM placement or a customer wondering about privacy, cameras have become an integral part of the ATM ecosystem. They protect everyone involved - operators, location owners, and users alike.

Camera Types & Placement Inside and Around ATMs

When business owners ask "does atm machine has camera", they're often surprised by the sophisticated technology packed into these compact devices. Modern ATM cameras have come a long way from the grainy security footage you might remember from old crime shows.

The heart of most ATM surveillance systems is the pinhole camera - a tiny lens that's smaller than a dime but captures crystal-clear video. These little powerhouses can shoot in high definition and work just as well at midnight as they do at noon. What makes them so effective is their size - customers barely notice them, but they see everything.

Visible dome cameras take a different approach. Instead of hiding, they make their presence known. There's something about that reflective dome that makes potential troublemakers think twice. The beauty of dome cameras is that criminals can't tell exactly where they're pointing, which keeps them guessing about blind spots (spoiler alert: there usually aren't any).

For operators who want the best of both worlds, concealed cameras can be painted to match the ATM's color scheme or hidden behind panels. Wide-angle lenses maximize what each camera can see, while night vision capabilities ensure your ATM stays protected around the clock.

Camera Type Visibility Coverage Area Best Use Case Pinhole (Built-in) Hidden Close-range facial capture Transaction monitoring Dome (External) Visible Wide area surveillance Deterrence and area coverage Bullet (External) Visible Focused directional view Parking lot monitoring Concealed (Built-in) Hidden PIN pad and user area Covert fraud detection

Inside the Housing

The cameras inside your ATM are like having a security guard who never blinks. Pinhole modules now include smart technology that can actually detect when someone's trying to mess with your machine. If a criminal attempts to attach a card skimmer, the system doesn't just record it - it can shut down the ATM immediately and send alerts to your phone.

Transaction snapshots create a complete story of every customer interaction. The camera captures key moments throughout each transaction, building a detailed record that can be searched later if needed. Think of it as creating a digital fingerprint for every cash withdrawal.

Tamper alarms work hand-in-hand with the camera system. If someone tries to drill into your machine or attach suspicious devices, sensors trigger both recording and instant notifications. It's like having an alarm system that actually shows you what's happening in real time.

Exterior Overwatch

The cameras outside your ATM extend your security bubble far beyond the machine itself. Lobby domes keep watch over customer lines and can spot when multiple people are working together on something suspicious. These overhead cameras catch behavior that might not be obvious from other angles.

Drive-thru poles position cameras at just the right height to capture both license plates and faces clearly. Some advanced systems can even recognize license plates automatically and flag vehicles that have been involved in previous incidents.

Lighting integration ensures your cameras work effectively whether it's bright noon or pitch black outside. Modern systems automatically adjust their settings based on lighting conditions and can even trigger additional lights when they detect movement.

Surrounding Infrastructure

Smart ATM security thinks beyond just the machine itself. Parking lot coverage monitors how customers approach your ATM and can detect individuals who might be targeting your customers for robbery after they withdraw cash.

Facial capture zones are strategically positioned to get clear images of anyone approaching the ATM. These systems have gotten so advanced they can detect when someone is trying to hide their face with masks or hoods.

Anti-mask analytics represent the cutting edge of ATM security technology. These systems can identify attempts to conceal identity and may require additional verification or temporarily refuse service when risk levels are too high. It's like having a bouncer who can spot trouble before it starts.

How ATM Cameras Prevent Skimming, Fraud & Robbery

ATM cameras have become the front line of defense against financial crime across the United States. The numbers tell a sobering story - according to the European Safe Transaction Association, physical attacks on ATMs jumped by 27% in 2018, with stolen amounts climbing 16% to €36 million. But here's the encouraging news: locations with comprehensive camera systems consistently show much lower crime rates.

When business owners ask "does atm machine has camera" during our consultations, they're really asking about protection. Modern ATM cameras don't just sit there recording - they actively fight crime in real-time.

Real-time alerts have completely changed the game. These smart systems can spot trouble as it happens and respond within seconds. Picture this: someone approaches your ATM at 2 AM and starts attaching a suspicious device to the card reader. The camera detects this immediately, locks down the machine, and sends alerts to security teams before the criminal can finish their work.

PIN-pad monitoring catches skimming attempts that would have been invisible just a few years ago. The cameras watch for unauthorized devices placed over keypads or tiny cameras positioned to record PIN entries. Some systems are so advanced they can recognize tampering patterns and automatically shut down operations before customers are affected.

Face detection technology adds an extra security layer that surprises many people. If the system doesn't detect a human face during a transaction, it may refuse to dispense cash. This prevents certain types of fraud where criminals try to use stolen cards without the actual cardholder present.

Stopping Skimmers Before They Strike

Overlay detection represents one of the biggest breakthroughs in ATM security. These smart cameras can spot when someone attaches foreign objects to card readers, even if they're carefully painted to match the machine's colors. The system constantly compares what it sees now to baseline images of how the ATM should look, flagging any differences instantly.

We've seen criminals get incredibly creative with skimming devices. They'll spend hours making fake card readers that look nearly identical to the real thing. But cameras don't get fooled by paint jobs or clever disguises - they notice when something doesn't belong.

White-noise jammers team up with cameras to stop electronic skimming. While cameras catch physical tampering, jammers disrupt the radio frequencies that skimmers use to transmit stolen card data. It's like having both a guard dog and a security fence working together.

Transaction matching creates an unbreakable link between camera footage and transaction records. When a customer reports a fraudulent transaction, operators can instantly pull up the corresponding video by searching for the specific card number, time, or transaction amount. What used to take hours of searching through tapes now happens in minutes.

Evidence & Investigation Workflow

Modern ATM camera systems have revolutionized how fraud investigations work in the United States. Card-number search capabilities let investigators quickly find every transaction tied to a specific card, cutting investigation time from days to hours. This speed often makes the difference between catching criminals and losing the trail.

Time-stamped images provide rock-solid documentation of exactly when events occurred. This precision is crucial for building criminal cases and helps investigators spot patterns of fraudulent activity across multiple locations. Defense attorneys have a much harder time creating doubt when video evidence includes precise timestamps.

Law-enforcement access follows careful protocols that protect everyone involved. Banks maintain the footage securely, but they provide it to investigating authorities through proper legal channels like subpoenas. The standard 90-day retention period ensures evidence stays available for most investigations while respecting customer privacy concerns.

As ATM operators, we've seen how this evidence workflow transforms investigations. Instead of relying on witness statements or circumstantial evidence, law enforcement can watch exactly what happened and when. This clarity helps honest customers get their money back faster and puts real criminals behind bars where they belong.

The ATM Skimming threat continues evolving, but camera technology evolves faster. For insights into broader security strategies, check out this detailed audio guide: ATM Security – 10 Things ATM Robbers Don't Want Victims to Know.

Compliance, Privacy & Footage Storage Rules

When business owners ask does atm machine has camera, they're often surprised to learn about the complex web of regulations governing how that footage can be used. ATM camera operations walk a careful line between protecting customers and respecting their privacy rights.

Data-retention laws create the foundation for how long footage must be kept. While rules vary across different states, most ATM operators in the US stick to the 90-day industry standard. This timeframe gives banks enough time to investigate disputes while avoiding the costs and privacy concerns of storing footage indefinitely.

The financial industry takes data protection seriously, and PCI DSS masking requirements reflect that commitment. These rules mandate that any sensitive card information be automatically obscured in surveillance footage. Modern ATM cameras are smart enough to blur out card numbers and magnetic stripe data while keeping facial images crystal clear - pretty impressive for a machine that fits in a convenience store corner.

Access control might be the most important privacy protection of all. Banks can't just let anyone peek at customer footage. Access is typically limited to trained security personnel, compliance officers, and designated investigators. Every time someone views footage, the system creates a permanent log - so there's always a trail showing who looked at what and when.

For customers wondering about their privacy, customer privacy protections have shaped how modern ATM cameras work. The cameras capture enough detail to identify users and detect tampering, but they're specifically positioned to avoid directly recording PIN entries. It's a clever balance that keeps your money safe without compromising your personal security.

Who Can View the Video?

Bank security teams get first access to footage, but they're not casual observers. These personnel undergo thorough background checks and receive extensive training on privacy regulations. They're looking for fraud patterns, investigating disputes, and monitoring for security threats - not browsing customer interactions for entertainment.

When law enforcement needs footage, they must follow the subpoena process. Police and federal investigators can't simply call up and request video. They need proper legal documentation, which protects customer rights while ensuring legitimate investigations can proceed. This process typically takes several days, which is why the 90-day retention period is so important.

Third-party processors sometimes need access for technical support and system maintenance, but this access comes with strict limitations. These technicians can typically only view footage related to specific technical issues, and their access is closely monitored and logged.

Balancing Security With Privacy

The positioning of ATM cameras reflects years of refinement in balancing competing interests. Camera angle limits ensure that customers remain identifiable for security purposes without creating unnecessary privacy intrusions. The cameras capture faces and can detect tampering attempts, but they're not positioned to spy on personal conversations or behaviors unrelated to the transaction.

Keypad blind spots represent one of the most thoughtful privacy protections in ATM design. While cameras can easily detect when someone attaches a foreign object to the keypad, they cannot see the actual numbers being pressed. This protects customer PINs even if footage is compromised, stolen, or viewed by unauthorized personnel.

Most states require signage requirements that notify customers about camera surveillance. These signs serve multiple purposes - they maintain transparency about data collection, preserve the crime-deterrent effect of visible security measures, and help businesses comply with local privacy laws. The signs are usually small and discreet, but they're an important part of the legal framework that makes ATM cameras possible.

For more details on how long footage is typically stored, check out our guide on How Long Are ATM Security Cameras Keep Footage.

Staying Safe: Tips for Customers & ATM Operators

Even though most people ask "does atm machine has camera" for security reasons, cameras alone can't prevent all fraud attempts. The best protection comes from combining smart camera systems with vigilant customers and proactive operators.

Think of ATM security like home security - you wouldn't rely on just one alarm sensor to protect your house. The same principle applies to ATMs. While cameras capture evidence and deter many criminals, your personal awareness and machine maintenance create multiple layers of protection.

We've seen how simple precautions can save customers thousands of dollars and protect business owners from liability issues. The good news? Most safety measures take just seconds and quickly become second nature.

Machine inspection should happen every time you approach an ATM. Before touching anything, take a quick look at the card reader, keypad, and screen area. Does everything look flush and properly aligned? Criminals often attach skimming devices that create slight gaps or make surfaces appear thicker than normal.

PIN coverage remains your strongest defense against hidden cameras that criminals sometimes install. Even though legitimate ATM cameras don't record your PIN directly, covering your hand while typing protects you from unauthorized recording devices.

Indoor locations dramatically reduce your risk of robbery. Criminals overwhelmingly target isolated outdoor machines where they can operate without witnesses. Choosing ATMs inside busy stores, bank lobbies, or shopping centers makes you a much less attractive target.

Customer Checklist

Visual inspection takes just a few seconds but can save you major headaches. Look for anything that seems loose, crooked, or recently attached around the card slot and keypad. Legitimate ATM components fit precisely with no visible seams, glue marks, or unusual thickness.

Pay attention to cameras pointed directly at the PIN pad - this is a red flag since banks position their cameras to capture faces and detect tampering, not record keypad entries. If you spot a tiny camera aimed at the numbers, walk away and report it immediately.

Hand-shield PIN entry by using your body, wallet, or even a piece of paper to block the view from behind and above. Be aware of anyone standing unusually close or appearing to watch your transaction. Complete your business quickly without getting distracted by conversations or phone calls.

Report tampering the moment you notice something suspicious. Don't use a machine that appears altered, even if you're in a hurry. Call the phone number displayed on the ATM or notify nearby bank staff immediately. If you suspect active fraud, contact local law enforcement and take photos of suspicious devices if it's safe to do so.

Operator Best Practices

Routine audits should happen at least weekly and include physical inspection of all ATM surfaces, not just relying on camera footage. Check for new scratches, gaps, or anything that looks out of place. Test your tamper alarms and verify that camera views remain clear and unobstructed.

Anti-skimming hardware provides crucial protection beyond what cameras alone can offer. Card reader encryption makes stolen data worthless to criminals, while motorized card readers are nearly impossible to overlay with skimming devices. Vibration sensors detect drilling attempts, and jamming devices disrupt wireless communications that skimmers rely on.

Remote monitoring capabilities let you receive real-time alerts on your phone and view live camera feeds from anywhere. When tampering is detected, you can shut down the ATM immediately and coordinate with law enforcement during active incidents.

At Merchant Payment Services, we help operators implement comprehensive ATM security solutions that combine advanced cameras with proven anti-fraud hardware. Our experience shows that proactive security measures protect both your investment and your customers' confidence in using your machine.

Frequently Asked Questions about ATM Cameras

How clear is the footage at night?

You'll be pleased to know that modern ATM cameras work remarkably well after dark. Does atm machine has camera technology has advanced significantly in recent years, with most built-in systems now featuring infrared illumination that captures crystal-clear images even in pitch-black conditions.

The cameras automatically sense when light levels drop and seamlessly switch to night vision mode. This infrared lighting is completely invisible to you as a customer, but it provides excellent illumination for the camera sensors. You won't see any red glow or obvious lighting - the system works silently in the background.

High-end camera systems can capture facial details clearly enough for positive identification during nighttime transactions. The image quality is typically sharp enough to read clothing details, distinguish facial features, and even capture license plate numbers from vehicles in drive-thru lanes.

Weather conditions like rain or snow may slightly reduce image clarity, but the cameras are designed to maintain usable footage quality in most situations. The infrared technology penetrates light fog and precipitation better than traditional visible-light cameras.

How long do banks keep ATM camera footage?

The standard across the United States is 90 days of footage retention, though some financial institutions keep recordings longer based on their internal policies and state regulations. This three-month window strikes a balance between providing adequate time for fraud investigations and managing storage costs.

Most customers find and report ATM fraud within this 90-day timeframe, making the retention period practical for investigation purposes. If you notice suspicious activity on your account, it's important to contact your bank promptly to ensure the relevant footage is still available.

The footage gets stored digitally on secure servers with strict access controls. Only authorized bank security personnel and compliance officers can view the recordings, and every access attempt is logged and monitored. When the 90-day period expires, the footage is automatically deleted to protect customer privacy.

Some banks may preserve footage longer if it's part of an active investigation or legal proceeding. In these cases, the relevant recordings are flagged in the system and exempted from automatic deletion until the case concludes.

Can criminals disable or avoid ATM cameras?

While criminals sometimes attempt to disable ATM cameras, modern security systems make this extremely challenging. Does atm machine has camera setups today include multiple layers of protection that make tampering nearly impossible without triggering immediate alerts.

Most ATM cameras are positioned inside tamper-resistant housing within the machine itself, where they can't be easily accessed or disabled. Attempting to reach these cameras would require breaking into the ATM, which triggers multiple alarm systems and immediate law enforcement notification.

Some criminals try to avoid detection by wearing masks, hoods, or sunglasses, but newer camera systems include analytics that can detect these concealment attempts. When the system notices someone trying to hide their identity, it may trigger additional security protocols or refuse to complete transactions.

The reality is that comprehensive ATM security typically includes multiple camera angles - both inside the machine and in the surrounding area. Even if someone managed to disable one camera, backup systems would continue recording. External dome cameras, parking lot surveillance, and building security systems create overlapping coverage that's virtually impossible to avoid completely.

Smart criminals have learned that attempting to tamper with ATM cameras often creates more evidence against them than simply conducting their illegal activity quickly and leaving the scene.

Conclusion

Understanding ATM camera systems is crucial for business owners considering ATM placement. Does atm machine has camera isn't just about whether surveillance exists - it's about ensuring comprehensive protection for your investment and customers.

The answer is overwhelmingly yes - modern ATMs come equipped with sophisticated camera systems that go far beyond simple recording. These systems offer real-time tampering detection, crystal-clear night vision, and intelligent analytics that can actually prevent fraud before it happens. It's like having a security guard who never sleeps and never misses a detail.

The combination of built-in pinhole cameras and external surveillance creates multiple layers of security that work together seamlessly. Think of it as a security net - if criminals somehow bypass one camera, several others are watching from different angles. This comprehensive approach not only deters criminals but provides rock-solid evidence when incidents do occur.

For business owners, comprehensive camera systems directly impact your bottom line. Customers feel genuinely safer using well-monitored ATMs, and that confidence translates into higher transaction volumes and increased revenue. It's a simple equation: better security equals more customers equals more profit.

The technology has evolved dramatically over the past few years. Today's ATM cameras can detect skimming devices, recognize tampering attempts, and even identify when someone is trying to conceal their identity. They're not just recording events - they're actively protecting your customers and your investment.

At Merchant Payment Services, we understand that ATM security extends far beyond cameras. It's about creating a complete ecosystem that protects your business while serving your customers effectively. With over 35 years of experience in ATM management, we've seen every type of security challenge and know exactly how to address them.

Whether you're installing your first ATM or upgrading existing equipment, our team guides you through security options that fit your specific location and customer base. From tiny pinhole cameras to comprehensive surveillance networks, we ensure your ATM investment stays protected with cutting-edge security technology.

The peace of mind that comes with proper ATM security is invaluable. You can focus on running your business while knowing your customers are safe and your investment is protected.

Learn more about our comprehensive ATM security solutions and how we can help maximize your cash flow while keeping customers safe at our home page.