Cheap and Cheerful EFTPOS Terminals for Aussie Businesses

Why Finding the Cheapest EFTPOS Terminal Matters for Your Business

The cheapest eftpos terminal can save your small business thousands of dollars annually while keeping customers happy with fast, secure card payments. With cash transactions almost halving in the last decade, finding an affordable payment solution isn't just smart—it's essential for survival.

Quick Answer: Top Budget EFTPOS Options

• Square Reader - $65 upfront, 1.9% per transaction, no monthly fees

• Zeller Terminal - $259 upfront, 1.4% flat rate, no rental fees

• Smartpay Zero Cost - $0 fees by passing costs to customers via surcharge

• Mint M10 - Free for businesses over $2,000 monthly revenue

The payment landscape has shifted dramatically. More than 2 billion EFTPOS transactions happen each year in Australia, and American businesses face similar pressure to accept cards or lose sales. Yet many small business owners still pay $250-$300 monthly in fees to major banks when cheaper alternatives exist.

The key is understanding the real cost structure. Some terminals look cheap upfront but hit you with hidden monthly fees, transaction charges, and contract penalties. Others offer "zero cost" models that work by adding small surcharges to customer payments—perfectly legal when done right.

Your choice depends on your monthly card volume, business type, and whether you prefer paying upfront or spreading costs over time. Mobile food trucks need different features than busy retail counters, and what works for a weekend market stall won't suit a restaurant taking tableside payments.

I'm Lydia Valberg from Merchant Payment Services, and I've spent over 35 years helping businesses steer payment solutions and find the cheapest eftpos terminal options that actually work long-term. My family's business has seen every pricing trick and hidden fee in the industry, so I'll show you exactly what to look for and what to avoid.

What Is an EFTPOS Terminal and How Does It Work?

An EFTPOS terminal is your business's gateway to accepting card payments—think of it as a smart translator that speaks fluent "bank language" on behalf of your customers and your business. Whether someone's buying coffee with a tap of their phone or paying for dinner with a chip card, this little device handles the complex dance of moving money securely from their account to yours.

The magic happens through several key technologies working together. EMV chip cards get inserted into the terminal, where encrypted microprocessors create unique transaction codes that are nearly impossible to counterfeit. Contactless payments use Near Field Communication (NFC) technology—the same tech that lets you tap your phone to open up doors or pair Bluetooth devices.

Behind your terminal sits a payment gateway, which acts like a digital traffic controller. It takes your transaction data and routes it through the maze of card networks, banks, and security checkpoints. Your merchant account—essentially a special business bank account designed for card payments—receives the funds through a settlement process that typically takes 1-3 business days.

Every bit of sensitive information gets wrapped in end-to-end encryption from the moment the card touches your terminal until the transaction is complete. It's like sending a secret message that only the intended recipient can decode.

The Payment Flow in 3 Seconds

When your customer taps their card, here's the lightning-fast journey their payment takes:

Tap or insert the card, and your terminal immediately reads the payment information and creates a unique tokenization code—think of it as a temporary alias for the real card number. This token is what actually travels through the payment network, keeping the real card details safe.

Next comes authorization, where your payment gateway shoots the encrypted transaction data to the customer's bank faster than you can blink. The bank checks the account balance, looks for any red flags, and sends back either a thumbs up or thumbs down.

Finally, all approved transactions get bundled together during batch close—usually happening automatically overnight—and the money moves from various customer accounts into your business account while you sleep.

The whole process is so seamless that most customers don't realize dozens of security checks and data exchanges just happened in the time it takes to say "thank you."

Security Standards Every Terminal Must Meet

Every legitimate terminal in the US must follow PCI-DSS (Payment Card Industry Data Security Standard) rules—basically a strict security rulebook that keeps card data safe. Think of it as the payment industry's version of a bank vault, except the vault is digital and travels with every transaction.

End-to-end encryption means your customer's card information gets scrambled into unreadable code the instant it's captured, and stays that way until it reaches the secure banking networks. Even if someone managed to intercept the data, they'd just get a bunch of meaningless characters.

Modern terminals also include fraud monitoring that works like a smart security guard, watching for unusual patterns that might signal trouble. If someone tries to run fifty transactions in a row or use a card that's been reported stolen, the system can automatically pause and ask questions.

The beauty of choosing the cheapest EFTPOS terminal from a reputable provider is that you still get all these enterprise-level security features without paying enterprise prices. For more detailed information about the fees associated with different security levels, check out our guide on card machine fees.

Types of EFTPOS Terminals & Must-Have Budget Features

Finding the cheapest eftpos terminal isn't just about the sticker price—it's about matching the right device to your business needs. I've watched too many small business owners get talked into expensive all-in-one systems when a simple mobile reader would have saved them thousands.

The secret is understanding that different business models need different solutions. A food truck has completely different requirements than a busy retail counter, and what works perfectly for weekend farmers' markets might be a disaster for a restaurant taking tableside orders.

There are four main terminal types, each designed for specific situations. Mobile readers connect to your smartphone and cost the least upfront, perfect for businesses just starting with card payments. Portable smart terminals include everything built-in and work great for table service. Countertop terminals offer rock-solid reliability for high-volume locations. Integrated POS terminals combine payments with inventory management for businesses planning serious growth.

When you're shopping on a budget, focus on features that prevent costly problems down the road. Dual-SIM connectivity automatically switches cell networks if one goes down, keeping you processing payments even during network outages. All-day battery life means you won't lose sales because your terminal died during the lunch rush.

A cloud-based analytics dashboard helps you spot trends and optimize your business without expensive consulting fees. And 24/7 technical support can save you hundreds in lost sales when something goes wrong at the worst possible moment—like during your busiest weekend.

Mobile Readers for Pop-Ups

Mobile readers represent the absolute cheapest eftpos terminal option for businesses testing the waters with card payments. These little devices typically cost between $65-$100 upfront and charge no monthly rental fees, making them perfect for low-volume businesses.

The beauty of mobile readers lies in their simplicity. They connect to your smartphone via Bluetooth and turn your phone into a complete point-of-sale system through a smartphone app. Most models accept swipe, dip, and tap payments, covering every card type your customers might use.

This setup works brilliantly for farmers' markets, craft fairs, delivery services, and home-based businesses. You can literally process payments anywhere you have cell phone coverage, and the learning curve is practically zero since most people already know how to use smartphone apps.

The trade-off is dependence on your phone's battery and data connection. If your phone dies, your payment processing dies with it. The small size can also be awkward during busy periods when you're handling multiple customers quickly.

Portable Smart Terminals for Table Service

All-in-one portable terminals hit the sweet spot for most small businesses, combining professional features with reasonable costs. These self-contained units typically run $250-$300 upfront and eliminate monthly rental fees while providing everything you need for smooth operations.

The best part about portable terminals is their independence. They include built-in receipt printers, connect via Wi-Fi and 4G, and many offer tipping options that customers can select right on the screen. This makes them ideal for restaurants, hair salons, and service businesses where customers expect to add tips.

Battery life typically covers a full business day, and the charging dock keeps everything ready between uses. The larger touchscreen makes training new staff much easier, and the cordless design lets you bring payments directly to customers—something they really appreciate.

Many portable terminals also integrate with hundreds of existing point-of-sale platforms, so you can grow your business systems without replacing your payment hardware.

Countertop Terminals for High-Volume Counters

Fixed countertop terminals excel when speed and reliability matter more than portability. These workhorses connect via Ethernet for the fastest possible transaction processing and include signature capture screens for the occasional older card that requires it.

The hard-wired power connection eliminates any battery concerns, and the robust internal components typically last longer than portable alternatives. This makes countertop terminals the smart long-term choice for busy retail environments, pharmacies, and convenience stores.

While the upfront cost runs higher ($300-$500), countertop terminals often qualify for lower per-transaction fees due to their direct network connections. When you're processing dozens of transactions daily, those savings add up quickly.

Integrated POS Terminals for Inventory Lovers

Businesses serious about growth should consider integrated terminals that combine payment processing with comprehensive business management. These systems include barcode scanners, cloud reporting, and API hooks that connect to accounting software and inventory management systems.

The upfront investment runs higher ($500-$1,000), but integrated systems eliminate the need for separate software subscriptions and manual data entry. They provide detailed sales analytics that help you optimize pricing, track inventory, and understand customer patterns.

For businesses planning to scale beyond basic card processing, integrated terminals often prove to be the cheapest eftpos terminal option over time due to their efficiency gains and reduced software costs.

For more detailed information about comparing different processing options and their associated costs, check out our credit card processing comparison guide.

Cheapest EFTPOS Terminal Options: Upfront & Ongoing Costs

Finding the cheapest eftpos terminal means looking beyond the sticker price to understand the real cost over time. I've watched too many business owners get excited about a "free" terminal, only to find they're paying $50+ monthly in hidden fees that could have bought them three terminals outright.

The payment industry loves to confuse small businesses with complex pricing structures, but the math is actually pretty straightforward once you know what to look for. Purchase models hit you with higher upfront costs but eliminate those sneaky monthly rental fees that drain your cash flow. Rental plans let you spread costs over time, which sounds nice until you realize you could have owned the device for less money. Fee-free surcharge models shift all costs to your customers through small surcharges—perfectly legal and increasingly common.

Here's how the numbers actually break down:

Model Type Upfront Cost Monthly Fee Transaction Rate Best For Entry-Level Purchase $65-$100 $0 1.6-1.9% Low volume, mobile Mid-Range Purchase $250-$400 $0 1.4-1.6% Growing businesses Fee-Free Surcharge $0 $0 0% (customer pays) High volume, price-sensitive

The sweet spot for most small businesses? Buy a decent terminal outright and avoid the rental trap entirely. Your wallet will thank you in six months when rental fees would have already paid for the device.

The Outright-Purchase Route to the Cheapest EFTPOS Terminal

Buying your terminal outright is like paying cash for a car instead of leasing—it hurts upfront but saves you thousands over time. With one-time hardware fees ranging from $65 to $400 and no monthly rental charges, you'll typically break even within 6-12 months compared to rental plans.

The beauty of owning your terminal lies in the simplicity. You pay once, then enjoy flat processing rates between 1.5% and 1.9% without worrying about equipment fees eating into your profits. The Square Reader exemplifies this approach perfectly—$65 upfront, 1.9% per transaction, and you're done. No monthly surprises, no contract complications.

For businesses processing more than $5,000 monthly in card payments, stepping up to a mid-range terminal like the Zeller makes financial sense. That $259 investment open ups lower processing rates around 1.4%, and the savings quickly compensate for the higher purchase price.

Ownership also gives you freedom. Want to switch payment processors because you found better rates? No problem—you keep your terminal. Found a better deal elsewhere? Pack up and go without returning rented equipment or paying early termination fees.

Rental Plans Under $30/Month

Monthly rental plans work for businesses that need low commitment and month-to-month flexibility, especially when you're testing the waters with card payments. The Mint M10 offers free rental for businesses processing over $2,000 monthly, making it genuinely attractive for companies hitting that threshold consistently.

Below that volume, rental fees typically hover between $11 and $35 monthly. While $25 per month sounds reasonable, that's $300 annually—enough to buy a solid terminal outright. After two years of rentals, you've paid $600 for equipment you could have owned for $259.

The rental model does offer some advantages worth considering. Equipment swap-outs become the provider's problem if your terminal breaks, and you can upgrade to newer models without additional purchase costs. For businesses with uncertain futures or seasonal operations, this flexibility might justify the higher long-term costs.

According to scientific research on small business payment adoption, businesses that own their terminals consistently report higher satisfaction and lower total costs over three-year periods. The data doesn't lie—ownership wins for most scenarios.

Fee-Free "Surcharge" Models for the Cheapest EFTPOS Terminal

Zero-cost models represent the cheapest eftpos terminal option for high-volume businesses willing to pass processing costs directly to customers. The automatic surcharge system adds a small fee (typically 1.4-1.7%) to each card transaction, covering all your processing expenses while keeping your costs at exactly zero.

This approach works because regulations cap surcharges at actual processing costs, preventing businesses from using fees as profit centers. Customers see the surcharge clearly displayed before completing their payment, and transparency has become the key to customer acceptance.

Customer perception of surcharging has improved dramatically as the practice spreads across restaurants, professional services, and retail stores. Most customers understand that small businesses face real costs for providing card payment convenience, and clear signage explaining the policy prevents most complaints.

The catch? You need substantial card volume—typically $10,000+ monthly—to qualify for zero-cost programs. Below that threshold, providers can't absorb the administrative costs of managing surcharge compliance and regulatory reporting.

Cutting Ongoing Costs: Fees, Surcharging & Hidden Traps

Finding the cheapest eftpos terminal is only half the battle—the real savings come from avoiding the sneaky ongoing fees that can triple your costs over time. I've watched too many business owners celebrate their "great deal" only to get hit with surprise charges that make their cheap terminal very expensive.

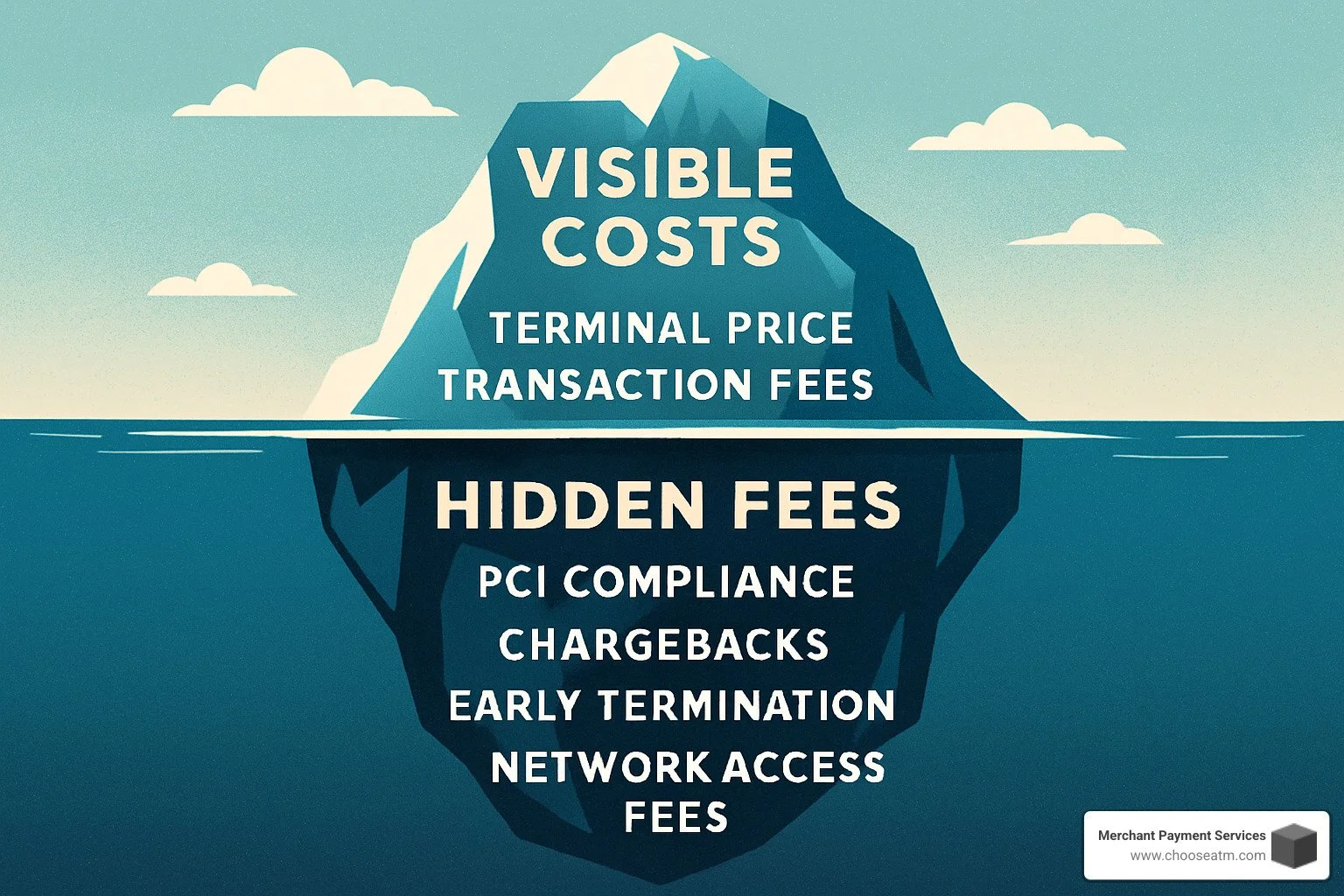

The fee iceberg runs deep. While you'll see the obvious transaction rates upfront, lurking beneath are setup fees that can reach $200, PCI compliance charges adding $5-$15 monthly to your bill, and chargeback fees of $15-$25 every time a customer disputes a transaction—even if you win the dispute.

Network access fees represent another creative way providers inflate costs. Some charge $10-$20 monthly just for connecting to the payment networks, while batch fees add small charges for each day's transaction settlement. These nickels and dimes add up to hundreds annually.

The biggest trap? Early termination penalties hidden in contracts with automatic renewal clauses. I've seen businesses pay $500+ to escape agreements they thought were month-to-month. Always negotiate these terms before signing anything.

Pros & Cons of Passing Fees to Customers

Surcharging transforms payment processing from a business expense into a customer choice—and it's completely legal when done properly. The psychology is simple: customers who want the convenience of card payments cover the associated costs, while cash customers aren't penalized.

The benefits are substantial. Your processing costs drop to zero, cash flow improves immediately, and you can even offer cash discounts to encourage lower-cost transactions. Many restaurants and professional services have acceptd surcharging as a way to maintain competitive pricing while protecting their margins.

But surcharging isn't without potential downsides. Some customers will abandon purchases rather than pay the extra fee, especially for small transactions. Others might complain loudly, creating awkward situations for your staff. The key is transparent communication—customers accept surcharges much better when they're clearly explained rather than sprung as a surprise.

Best practices include prominent signage at your entrance and counter, terminal prompts that show the exact surcharge amount before payment, and staff training to handle questions professionally. When implemented thoughtfully, most customers view surcharging as fair and reasonable.

Spotting Hidden Clauses Before You Sign

Contract language often reads like it was designed to confuse rather than inform. Automatic renewal clauses are particularly sneaky—your agreement might extend for another full year unless you provide written notice 30-90 days before expiration. Miss that deadline and you're locked in at potentially outdated rates.

Minimum turnover requirements create another potential penalty. Some providers charge extra fees if your monthly processing drops below agreed levels, which can hurt during slow seasons or economic downturns. This essentially punishes you for reduced sales when you can least afford additional costs.

Equipment insurance clauses might require you to pay full replacement costs for damaged terminals, even when the damage results from normal wear or manufacturing defects. Some contracts also include rate adjustment clauses that allow providers to increase fees with minimal notice.

The solution is reading everything carefully and asking direct questions about worst-case scenarios. What happens if you want to leave early? What fees apply during slow months? How much notice do rate changes require? A reputable provider will answer these questions clearly and put guarantees in writing.

For comprehensive strategies to minimize these long-term costs, check out our detailed guide on how to reduce credit card processing fees.

Buying Guide & Quick-Start Checklist

Finding the cheapest eftpos terminal isn't just about the lowest sticker price—it's about matching the right features to your actual business needs. I've watched too many business owners get excited about a $65 mobile reader only to realize it can't handle their busy lunch rush.

Start by honestly assessing your daily reality. A coffee shop processing 200 transactions needs different capabilities than a plumber taking occasional card payments. Hardware compatibility with your existing systems matters more than fancy features you'll never use.

Connectivity testing should happen before you commit to any provider. That sleek Wi-Fi terminal works great until your internet goes down during peak sales hours. Smart business owners insist on 4G backup connectivity or dual-SIM options that automatically switch networks when one fails.

Settlement speed directly impacts your cash flow. Standard processing takes 1-3 business days, but some providers offer same-day deposits for businesses that need faster access to funds. The small additional fee often pays for itself in improved cash management.

Don't forget about support hours when comparing options. A terminal that breaks down at 6 PM on Friday becomes useless if technical support closes at 5 PM. The cheapest eftpos terminal can become expensive fast when you're losing sales due to equipment problems.

Switching to a Cheaper Provider Without Downtime

The biggest mistake businesses make when switching providers is trying to do everything overnight. Smart switching steps involve running both systems parallel for a few days while you work out any kinks.

Inventory transfer requires special attention if you're using integrated POS systems. Your product database, pricing, and customer information need to migrate cleanly to avoid confusion at checkout. Test this thoroughly during slow periods, not when customers are waiting.

Payment gateway re-pointing sounds technical but usually involves updating a few settings in your existing software. Most modern systems make this process straightforward, though you'll want to verify all integrations work correctly before going live.

Staff training makes or breaks any transition. Even the simplest terminals have different button layouts and menu systems. Schedule training sessions during quiet hours and create simple reference cards for the first week. Your team's confidence with the new system directly affects customer experience.

Day-One Setup for Your New Terminal

Modern terminals arrive surprisingly ready to work. Merchant ID activation typically happens automatically once you complete the online setup process—no phone calls or waiting for business hours.

Your first test transaction should use a small amount on your own card. This confirms everything works and lets you experience the customer side of the process. Many business owners find important details about receipt options or signature requirements during this test.

Receipt customization takes just a few minutes but makes a professional impression. Add your business name, contact information, and return policy to every receipt. Consider enabling email or SMS receipts to reduce paper costs and provide customers with digital records they won't lose.

The terminal might process those first few transactions slightly slower as it downloads final configuration updates, but speeds normalize quickly. Don't panic if the initial setup takes an extra few seconds—that's completely normal and won't affect your ongoing operations.

Frequently Asked Questions About the Cheapest EFTPOS Terminals

When you're searching for the cheapest eftpos terminal, certain questions come up again and again. After 35 years in the payment industry, I've heard these concerns from thousands of business owners, and the answers might surprise you.

The biggest misconceptions usually revolve around surcharging rules, contract flexibility, and how quickly you'll actually see your money. Let me clear up the confusion with straight answers based on current US regulations and industry practices.

What is the legal limit on credit card surcharges in the US?

The federal landscape allows credit card surcharging in most states, but the rules are more complex than many business owners realize. You can typically add surcharges up to 4% of the transaction amount, but you must notify your payment processor and card networks at least 30 days before starting.

Ten states currently prohibit surcharging entirely: California, Colorado, Connecticut, Florida, Kansas, Maine, Massachusetts, New York, Oklahoma, and Texas. However, some of these states allow "cash discounts" which achieve similar results through different pricing structures.

The key requirement everywhere is clear disclosure. Customers must see surcharge information at your business entrance and again before completing their payment. The exact surcharge amount should appear on receipts, and you cannot surcharge debit cards—only credit cards qualify.

Many businesses using the cheapest eftpos terminal options find that transparent surcharging eliminates their processing costs entirely while maintaining customer satisfaction. The secret is treating it as a standard business practice rather than an apologetic add-on.

Can I switch providers mid-contract without penalties?

This question keeps many business owners stuck with expensive providers long after better options become available. The honest answer is that it depends entirely on what you signed, but there are more escape routes than most people realize.

Month-to-month agreements typically allow switching with 30 days' notice and minimal fees. Fixed-term contracts are trickier, but many include clauses that void penalties if your provider raises rates, changes terms, or fails to meet service standards.

Early termination fees range from $200-$500 for most contracts, but smart negotiation during signup can eliminate these entirely. Some providers will also waive termination fees if you're switching due to poor service or if they're trying to win your business from a competitor.

The best strategy is reading contracts carefully before signing and negotiating penalty waivers upfront. If you're already locked in, document any service issues or rate increases that might provide legal grounds for penalty-free termination.

How fast will I receive settlement into my bank account?

Settlement speed directly impacts your cash flow, making it a crucial factor when choosing the cheapest eftpos terminal. Most providers offer next-business-day settlement as their standard service, with funds appearing in your account by the following business day.

Same-day settlement is available from many providers for an additional fee, typically 1-1.5% of the transaction amount. This can be worthwhile for businesses with tight cash flow, but the fees add up quickly for high-volume operations.

Weekend and holiday transactions always take longer to settle since banks don't process ACH transfers on non-business days. Friday transactions might not appear until Tuesday if Monday is a holiday, so plan your cash flow accordingly.

Some newer providers offer nightly settlement as a standard feature, moving funds to your account every evening rather than batching them daily. This can improve cash flow without additional fees, making it another factor to consider when comparing total costs.

The settlement speed you actually experience also depends on your business bank—some credit merchant deposits faster than others, and newer business accounts may face temporary holds during your first few months of processing.

Conclusion

Finding the cheapest eftpos terminal is like buying a car—the sticker price tells only part of the story. You need to look at total ownership costs, including those sneaky monthly fees, transaction rates, and hidden charges that can turn a bargain into a budget buster.

The Square Reader remains unbeatable for businesses just starting out or processing fewer than 50 transactions monthly. At $65 upfront with zero ongoing fees, it's hard to argue with the math. The Zeller Terminal hits the sweet spot for growing businesses that need professional features without the professional price tag—that 1.4% flat rate can save hundreds compared to traditional bank terminals.

For high-volume businesses, zero-cost surcharge models can completely eliminate processing expenses. Yes, customers pay a small fee, but most accept it when you're transparent about the costs. It's become as normal as paying for parking or getting charged for extra sauce.

The biggest mistake we see is businesses choosing terminals based on the lowest upfront cost without considering their actual needs. That $65 mobile reader looks tempting until you realize you need tableside payments for your restaurant, or that "free" rental terminal comes with a three-year contract you can't escape.

At Merchant Payment Services, we've spent over 35 years watching payment technology evolve and helping businesses steer these decisions. While we specialize in ATM management solutions, our experience with payment systems has taught us that the cheapest option upfront rarely stays that way long-term.

The right terminal should feel invisible to your daily operations—reliable enough that you forget it's there, affordable enough that it doesn't stress your cash flow, and flexible enough to grow with your business. When you find that balance, you've finded the true cheapest eftpos terminal for your situation.

Your payment processing should improve your business, not complicate it. Take time to understand the real costs, test the options, and choose based on where your business is heading, not just where it is today.

For more information about our payment solutions and how we can help optimize your business's cash flow, visit our home page to explore our full range of services.