Installing an ATM Machine Without Losing Your Mind (or Your Money)

Why the ATM Installation Process Matters for Your Business Success

The atm installation process can transform your business into a cash magnet while cutting credit card fees by over 20%. Here's what you need to know:

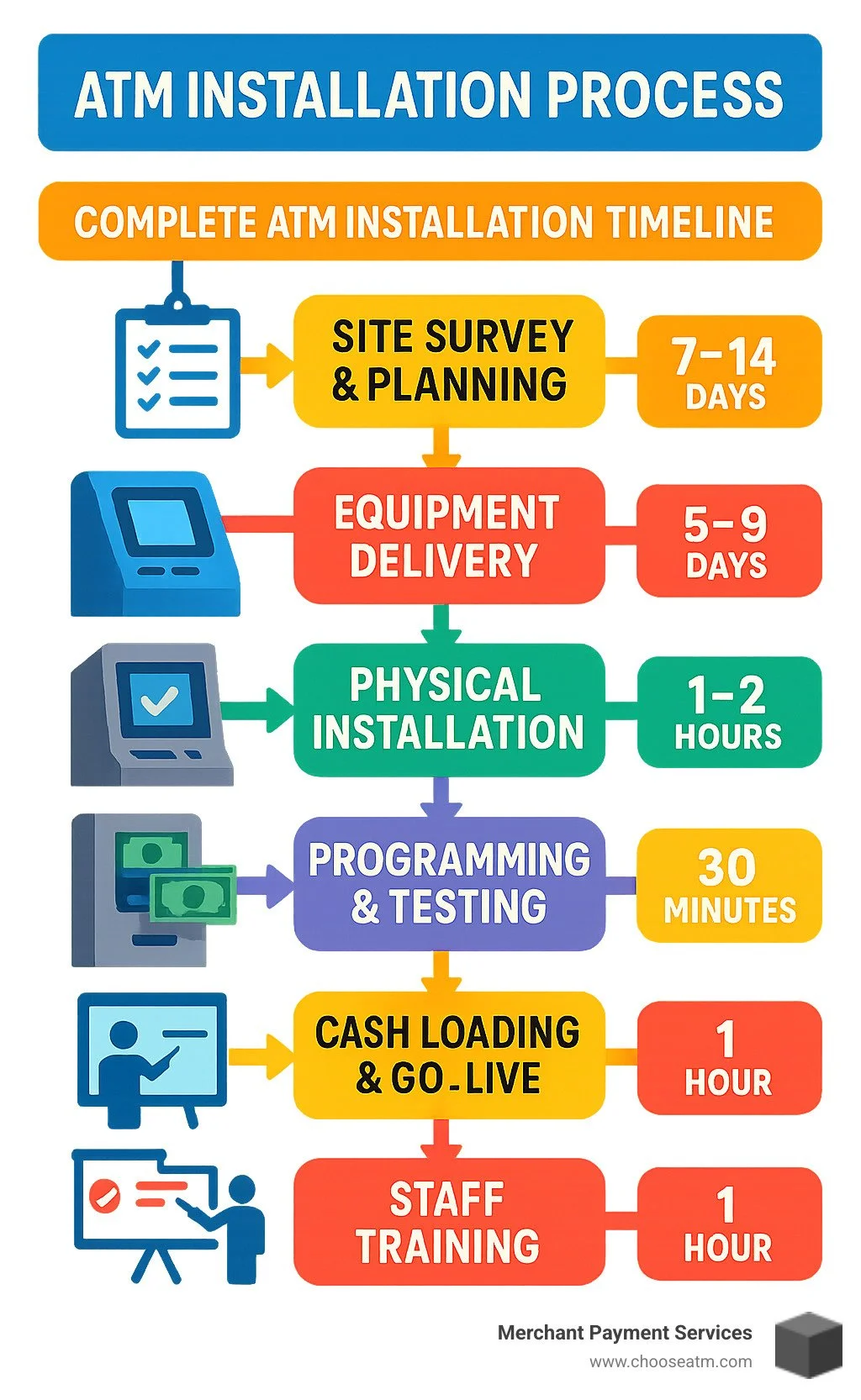

Complete ATM Installation Timeline:

Site Survey & Planning (7-14 days) - Location assessment, permits, ADA compliance

Equipment Delivery (5-9 days for plug-and-play, 14 days with technician)

Physical Installation (2-4 hours) - Mounting, power, network connections

Programming & Testing (1-2 hours) - Software setup, transaction tests

Cash Loading & Go-Live (30 minutes) - Stock machine, final checks

Staff Training (1 hour) - Basic operations and troubleshooting

Key Success Factors:

Choose high-traffic locations with 200+ daily visitors

Ensure ADA compliance (48" max height, 4'×4' clear space)

Plan for dedicated power and network within 3 feet

Budget $2,000-$5,000 total startup costs

Expect ROI in under 6 months

The numbers don't lie. At least 25% of cash withdrawn from convenience store ATMs gets spent in the store. For bars and casinos, that number jumps to 80%. With 4-6% of your foot traffic likely to use an ATM, you're looking at serious revenue potential.

But here's the reality check: "A man who does not plan long ahead will find trouble at his door" - and that wisdom from Confucius applies perfectly to ATM installations. Poor planning during the atm installation process leads to costly delays, compliance headaches, and frustrated customers.

I'm Lydia Valberg from Merchant Payment Services, where we've guided countless small businesses through the atm installation process over 35 years. Our family-owned approach ensures you get personalized support that turns ATM ownership from a headache into a profit center.

Planning the Perfect Site & Meeting US Regulations

Think of the atm installation process like building a house - you wouldn't start hammering nails before checking the foundation, right? Yet we see business owners rush into ATM placement all the time, only to find their perfect spot violates ADA rules or needs expensive electrical work.

Smart planning saves you from those "oops" moments that cost real money. A proper site survey 15-30 days before installation reveals everything from power issues to permit requirements. Trust me, it's much easier to move an ATM on paper than after it's bolted to your floor.

During every site assessment, we check the essentials that make or break your installation. Power accessibility means having that dedicated 120V outlet within reach - no extension cords allowed. Network connectivity covers your options: phone lines, ethernet, or wireless coverage that actually works when customers need it.

Security features matter more than you might think. Existing cameras, good lighting, and clear visibility protect both your investment and your customers. Nobody wants to use an ATM tucked away in a dark corner.

The big one? ADA compliance zones with proper wheelchair access paths. Get this wrong and you're looking at fines plus the cost of moving everything. Local permit requirements vary wildly across the US, so checking zoning laws and business licensing early prevents nasty surprises.

Choosing the Best US Location

Here's the truth about ATM placement: location beats everything else. We've seen identical machines in similar stores perform completely differently based on where they sit. The numbers tell the story - 3-5% of convenience store customers typically use an on-site ATM, but smart placement can push that higher.

Convenience stores near checkout areas with 200+ daily visitors are goldmines, especially when customers can see the ATM while waiting in line. Gas stations with extended hours serve cash-heavy customers who need quick access without the hassle of driving elsewhere.

But the real winners? Bars and nightclubs where up to 80% of ATM cash gets spent on-site. People come to have fun, not hunt for a bank. 24-hour retailers serving shift workers and late-night customers also perform well - these folks often need cash when banks are closed.

Cash-only businesses naturally drive ATM usage. If you run a laundromat, car wash, or accept cash for tips, an on-site ATM becomes a customer service that pays for itself.

Position your ATM near existing security cameras for theft deterrence that doesn't cost extra. Well-lit areas make customers feel safe and confident about using your machine. Keep clear sight lines from staff positions so your team can help if needed.

Avoid blocking emergency exits or creating bottlenecks in high-traffic walkways. Consider proximity to complementary services like lottery tickets or money orders - customers already thinking about cash transactions make natural ATM users.

Lower-income and busy neighborhoods generally outperform high-end tourist areas. Why? Regular customers who know your ATM is there beat occasional visitors every time.

Compliance Checklist That Saves Fines

ADA compliance isn't a suggestion - it's the law. Violations bring hefty fines and accessibility complaints that damage your reputation. The atm installation process must nail these requirements from day one, no exceptions.

Maximum 48" from floor to highest operable control - this isn't negotiable. 48" × 30" minimum clear floor space gives wheelchair users room to maneuver safely. You also need an unobstructed approach path to the ATM plus audio guidance and Braille instructions for customers with visual impairments.

State and local requirements vary across the US, but they're all serious business. Some states like Massachusetts require ATM registration with state authorities. Your business insurance needs updates to cover the ATM and its operations. Local zoning compliance for commercial equipment placement protects you from shutdown orders.

Building permits for electrical and structural modifications might seem like paperwork hassles, but they prevent bigger problems down the road. Network provider agreements and installation schedules need coordination to avoid delays.

Document everything: site survey photos and measurements, ADA compliance verification forms, insurance policy updates, permit applications and approval certificates. This paperwork protects your investment and proves compliance if questions arise.

More info about ATM Installation & ATM Site Preparation

The ATM Installation Process Step-by-Step

Now comes the exciting part - turning your careful planning into a working cash machine. The physical atm installation process is where everything comes together, and honestly, it's pretty satisfying to watch your ATM transform from a heavy box into a profit-generating asset.

Think of this phase as building the foundation for years of reliable service. We've learned that rushing through installation creates headaches down the road, while taking time to do things right sets you up for smooth sailing.

Your ATM needs some basic infrastructure to thrive. A dedicated 120V electrical outlet with surge protection is non-negotiable - power surges are expensive lessons you don't want to learn the hard way. You'll also need a network jack within 3 feet of your ATM location, because nobody wants to see extension cords snaking across your floor.

The concrete floor needs to handle anchor bolts securely. Most commercial floors work perfectly, but we always verify before drilling. Your ATM doors need room to swing open - the vault door alone requires significant clearance for cash loading and maintenance.

We coordinate delivery logistics around your business hours to minimize disruption. Plug-and-play installations typically ship in 5-9 days, while technician installations take around 14 business days from order to completion. The secret is having your site preparation finished before that truck arrives at your door.

Unboxing to Bolt-Down: The 8 Core Moves

Here's our battle-tested sequence for getting your ATM properly installed. We've refined this process over thousands of installations, and following these steps prevents the vast majority of issues.

Step 1: Inspect the crate thoroughly before signing any delivery paperwork. Use that green bubble level to check if everything arrived level and undamaged. Missing hardware at this stage is much easier to resolve than finding it mid-installation.

Step 2: Position and level your ATM in its final home. This isn't a one-person job - these machines are heavy and awkward. Make sure you have 90-degree swing clearance for all doors, because finding clearance issues after bolting down is nobody's idea of fun.

Step 3: Mark your anchor holes using the ATM base as your template. Double-check that 4'×4' ADA clear space one more time. Measure twice, drill once - moving anchor holes in concrete is expensive and time-consuming.

Step 4: Start with pilot holes to prevent concrete cracking. Carbide-tipped masonry bits work best for this job. Account for any floor coverings in your depth calculations - vinyl or tile can throw off your measurements.

Step 5: Install those anchor bolts properly. You need minimum 2¾" depth into concrete for security. Use expanding anchors in 5/8" diameter holes, and don't forget to pre-install washers and nuts before hammering.

Step 6: Tighten to specification - exactly 60 ft-lbs torque. Over-tightening cracks concrete, under-tightening creates security risks. Test stability by giving your ATM a firm push - it shouldn't budge.

Step 7: Route your cables neatly through the base. Connect power through that surge protector we mentioned earlier. Keep network cables organized to prevent interference issues that cause transaction failures.

Step 8: Complete your tamper check by verifying the ATM can't be moved, lifted, or compromised. Test all door locks and security switches. This final step ensures your investment stays protected.

Programming & Testing During the atm installation process

This is where your hardware becomes a real ATM. The programming phase requires patience and attention to detail, but it's fascinating to watch your machine come alive and start talking to the banking networks.

EMV key loading happens first - these encryption keys protect every transaction. Your processor can handle this remotely or on-site, depending on their setup. Remote loading speeds up the atm installation process significantly when network conditions allow.

Processor IP configuration connects your ATM to the banking networks. Think of this as giving your machine its phone number in the financial system. We configure primary and backup connections to keep you running even if one network has issues.

The cash-dispense test is always exciting - watching those first bills come out confirms everything's working correctly. We test multiple denominations and amounts to verify accuracy. Your receipt printer gets tested too, because customers expect clear, readable receipts.

Balance verification ensures your ATM knows exactly how much cash it contains. This prevents embarrassing situations where customers try to withdraw money from an empty machine.

Connectivity Choices for the atm installation process

Your network connection determines how fast transactions process and how reliably your ATM operates. We've seen all three options work well in different situations, so let's break down what works best where.

Ethernet connections deliver the fastest, most reliable performance. When you have a network jack within 3 feet, this is almost always our recommendation. Transactions process quickly, costs stay low, and reliability stays high.

Wireless modems work great at $17.99 per month for cellular connectivity. These shine in locations where running ethernet isn't practical. You'll see slightly higher latency than wired connections, but modern cellular networks handle ATM traffic beautifully.

Phone line connections serve as excellent backup options, though they're getting harder to find as landlines disappear. VPN encryption keeps transactions secure, and fallback dialing provides redundancy when primary connections fail.

Connection Type Speed Reliability Monthly Cost Best For Ethernet Fastest Highest $0-50 Indoor locations Wireless Fast High $18-40 Remote/outdoor sites Phone Line Slow Medium $25-45 Backup only

Securing, Monitoring & Maintaining Your Cash Machine

Think of your ATM as a small bank branch that never sleeps. Just like any financial institution, it needs multiple layers of protection and constant attention to serve customers reliably.

Physical security forms your first line of defense. We recommend bollards or concrete barriers around your ATM to prevent vehicle attacks - yes, this actually happens more than you'd think! Security cameras with night vision not only deter thieves but also help resolve customer disputes about transactions.

Alarm contacts should integrate directly with your existing business security system. When someone tries to tamper with your machine at 2 AM, you want to know about it immediately. Anti-skimming devices protect your customers' card information, which protects your reputation and keeps people coming back.

Digital security runs deeper than most business owners realize. Your ATM processes financial transactions, so it needs encrypted communication protocols for every interaction. Regular software updates patch security vulnerabilities before criminals can exploit them.

Real-time transaction monitoring catches suspicious patterns that human eyes might miss. If someone tries to use 20 different cards in 10 minutes, that's probably not a coincidence.

Remote monitoring has completely changed how we manage ATMs. Almost 1 million ATMs and self-service devices are monitored by advanced systems worldwide, and the results speak for themselves. Availability rates jump from 70% to 95% after implementing comprehensive monitoring solutions.

The numbers get even better with predictive maintenance. We see 30% improvement in first-time fix rates when technicians arrive with real-time diagnostic data. 15% more problems get resolved remotely without any truck roll at all. Some of our clients automate 90% of routine tasks and achieve over 15% operational savings through optimized maintenance schedules.

Your ATM tells you what it needs before it breaks down. Modern monitoring systems track everything from cash levels to component temperatures, sending alerts when something needs attention.

Staff Training that Prevents 70% of Issues

Here's a reality check: most ATM problems aren't actually ATM problems. They're training problems.

When your staff knows how to handle daily operations properly, you'll prevent about 70% of service calls. That saves money and keeps your ATM available for customers who want to spend cash in your business.

Daily operations training covers the basics that keep your machine humming. Cash loading procedures ensure bills feed properly and don't jam. Receipt paper replacement seems simple until someone loads it backwards and customers get blank receipts for three hours.

Basic troubleshooting empowers your team to fix minor issues instantly. Power cycling resolves many temporary glitches. Clearing paper jams takes two minutes when you know the right technique. Card reader cleaning with approved cleaning cards prevents transaction failures.

Your staff also needs to understand transaction fee management. When you run promotions or adjust surcharge amounts, they should know how to explain changes to customers and update settings correctly.

Emergency procedures matter more than you think. Security incidents require specific responses to protect staff and preserve evidence. Hardware failures need proper documentation for warranty claims. Customer disputes get resolved faster when staff knows what information to collect.

Cash handling protocols protect everyone involved. Safe loading procedures prevent injuries and ensure accurate counts. Balance reconciliation catches discrepancies before they become major problems.

We provide an error code cheat sheet that translates technical messages into plain English solutions. Power issues usually mean checking surge protectors and outlet connections. Network errors start with verifying cable connections and testing internet connectivity.

Troubleshooting Like a Pro

When problems arise, systematic troubleshooting saves time and prevents unnecessary service calls. We've learned that most issues have simple solutions when you approach them methodically.

Power reset procedures solve about 40% of all ATM problems. Start by checking your surge protector and circuit breaker status - sometimes the solution is literally flipping a switch. Verify all cable connections are secure because vibration and cleaning can loosen plugs over time.

Power cycling your ATM requires following manufacturer procedures exactly. Don't just unplug and replug - use the proper shutdown sequence, wait for the complete startup process, and test functionality before declaring victory.

Common issues have predictable patterns once you know what to look for. Transaction timeouts usually indicate network connectivity problems or processor status issues. Cash dispense errors often trace back to improperly installed cassettes or damaged bills that jam the mechanism.

Receipt printer problems typically involve paper loading, dirty print heads, or worn ribbons. Card reader failures respond well to cleaning magnetic heads and testing with known good cards.

Our escalation process ensures problems get resolved quickly without wasting anyone's time. Level 1 starts with staff troubleshooting using provided guides. Level 2 involves phone support with our technical help desk. Level 3 dispatches on-site technicians for hardware issues. Level 4 engages manufacturer warranty service for major repairs.

The atm installation process includes setting up this support structure from day one. You'll have contact numbers, troubleshooting guides, and escalation procedures ready before your first customer uses the machine.

ATM Management Solutions Guide

Latest research on AI-driven monitoring

Costs, Timelines & DIY vs Professional Help

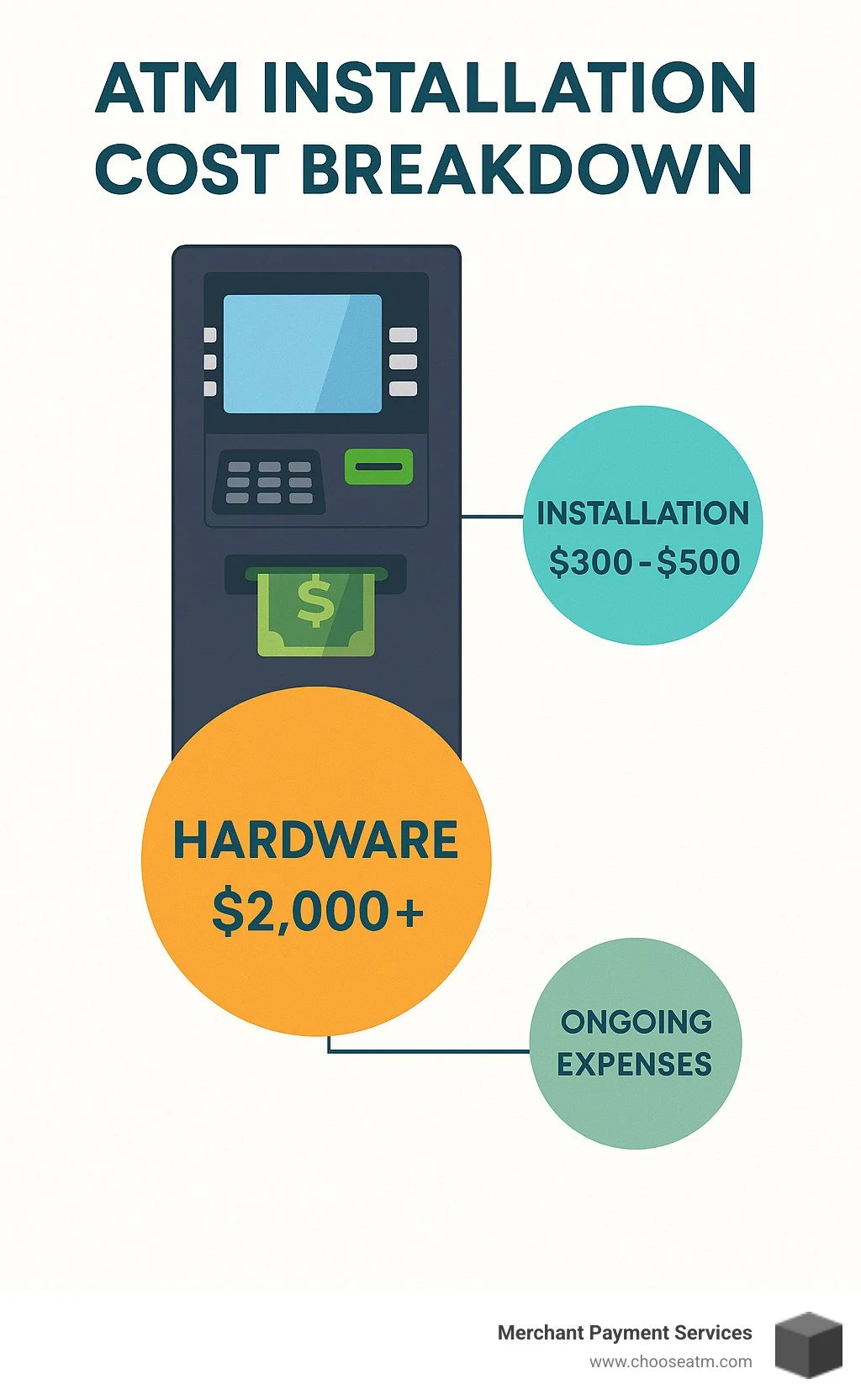

Let's talk money - because understanding the real costs of the atm installation process means no surprises when you're ready to pull the trigger on your ATM investment.

Here's something that might surprise you: most business owners break even on their ATM investment in under six months. That's faster than most equipment purchases, and unlike that fancy espresso machine, your ATM keeps making money 24/7.

Your timeline depends on which route you choose. Plug-and-play installations ship in 5-9 days and you can have them running the same day they arrive. It's like adult Lego - everything connects exactly where it should. Professional technician installations take 7-9 days for delivery plus 2-3 days to schedule your tech visit.

The professional installation cost runs $399-$499 depending on how complex your setup gets. Need pre-programming? That's an extra $49 for plug-and-play units. Think of it as paying someone to do the homework so you can skip straight to collecting the profits.

We've watched hundreds of business owners go through this decision. The plug-and-play option has become incredibly popular because modern ATMs are designed for simplicity. You're basically connecting three things: power, network, and cash. Then you're in business.

Budget Breakdown You Can Bank On

Let's break down what you're really looking at investment-wise, because nobody likes financial surprises.

Your upfront investment starts with the ATM itself - new EMV-compliant units run $2,295 and up, while used units that meet all current standards start around $1,795. Installation costs range from zero if you go DIY to $499 for full professional service. Shipping and delivery typically add $150-$300 for standard freight, though this varies based on your location.

Don't forget about site preparation costs of $200-$500 for electrical and network setup. Most locations need minimal work, but older buildings sometimes require electrical upgrades or network improvements.

Your initial cash float is where many people get sticker shock - you'll need $1,000-$3,000 to stock your machine initially. This isn't an expense, it's your inventory. Modern ATMs hold up to $16,000, so you can scale up as your volume grows.

Monthly expenses stay pretty manageable. Wireless connectivity runs $17.99 per month if you need it. Processing fees vary by transaction volume, but they're typically covered by your surcharge income. Insurance premiums run $50-$150 monthly for comprehensive coverage, and maintenance contracts cost $75-$200 monthly for full service.

Here's where the math gets exciting. With an average surcharge of $2.66 per transaction and 4-6% of your customers using the ATM, a location with 200 daily visitors generates 8-12 ATM transactions daily. That translates to $640-$960 monthly in surcharge income, or $7,680-$11,520 annually. Most installations pay for themselves in under six months.

When to Call the Pros (and Keep Your Sanity)

The DIY versus professional installation debate usually comes down to three factors: complexity, confidence, and time. We've seen successful installations both ways, but certain situations practically scream for professional help.

Call the professionals when you're installing multiple ATMs across several locations. The coordination alone will save you weeks of headaches. Complex electrical or network requirements also warrant professional installation - nobody wants to find compliance issues after the fact.

If you're uncertain about ADA compliance or local regulations, professional installation includes guaranteed compliance with all requirements. High-volume venues with strict uptime requirements benefit from the warranty protection and ongoing technical support relationship that comes with professional installation.

DIY installation works beautifully for single ATM installations in straightforward locations. Budget-conscious small business owners love the cost savings, especially when they already have power and network infrastructure in place. If you've got technically capable staff and you're dealing with a simple convenience store or retail environment, DIY often makes perfect sense.

Professional installation brings peace of mind through guaranteed compliance, comprehensive staff training, and warranty protection for the installation work. You also get an ongoing technical support relationship and faster resolution of complex issues down the road.

DIY installation offers lower upfront costs and faster deployment. You control the timing completely, gain valuable learning experience for ongoing maintenance, and avoid scheduling dependencies on technicians. Plus, you'll have immediate troubleshooting capability since you did the original setup.

The honest truth? Most of our customers who choose DIY installation are pleasantly surprised by how straightforward the atm installation process has become. Modern ATMs are designed for business owners, not just technicians.

Frequently Asked Questions about Installing an ATM in the US

Let's tackle the questions we hear most often about the atm installation process. After helping countless businesses over 35 years, we know exactly what keeps ATM owners up at night - and the good news is, most concerns are easier to address than you might think.

What hardware and power do I need?

Your ATM is surprisingly simple when it comes to power needs. You'll need a dedicated 120V electrical outlet with surge protection rated at least 1500 joules. Think of it like plugging in a small refrigerator - the machine only draws 25W when sitting idle and bumps up to 145W when dispensing cash.

The real key is reliable internet connectivity within 3 feet of your installation spot. Ethernet works best, but phone lines or wireless connections get the job done too. Most business owners are pleasantly surprised that their existing internet setup handles ATM transactions without missing a beat.

Essential hardware includes expanding anchors for concrete mounting, network cables, and that surge protector. Most ATMs ship with mounting hardware included, though you might need additional lag screws or masonry anchors depending on whether you're installing on concrete, tile, or other flooring materials.

Here's what catches people off guard: the installation is much more straightforward than setting up a new computer system. If you can handle basic home improvement projects, the atm installation process won't intimidate you.

How do I keep my ATM ADA compliant?

ADA compliance sounds scary, but it's really about common-sense accessibility. The highest operable control must be no more than 48" from the floor, with a clear 48" × 30" floor space for wheelchair access. Picture someone in a wheelchair rolling up to use your ATM comfortably - that's the goal.

You must provide an unobstructed approach path and ensure your ATM offers audio guidance for visually impaired customers. Modern ATMs come with these features built-in, so you're not retrofitting old technology to meet new standards.

The installation must include Braille instructions and maintain proper reach ranges for all controls. This isn't something you need to figure out yourself - manufacturers design ATMs with ADA compliance from the ground up.

Regular compliance audits might sound like a hassle, but they're your insurance policy against violations that can result in hefty fines and accessibility complaints. Think of it as preventive maintenance for your legal protection.

What ongoing maintenance is required?

ATM maintenance is less demanding than most business owners expect. Monthly preventive maintenance covers cleaning, software updates, and cash replenishment - tasks that become routine quickly.

Daily tasks include checking receipt paper, verifying cash levels, and reviewing transaction logs for any error patterns. Most of our customers tell us these checks take less than five minutes and become as automatic as checking your cash register.

The cash management piece is where you have real control. Most customers stock their machines with $1,000-$3,000 to balance refill frequency with cash flow needs. A busy convenience store might refill weekly, while a smaller retail location could go two weeks between cash loads.

Remote monitoring systems can automate many maintenance tasks and provide predictive alerts before issues impact your customers. It's like having a technician watching your ATM 24/7, catching problems before your customers ever notice them.

The reality is that modern ATMs are remarkably reliable. With proper setup during the atm installation process and basic ongoing care, your machine will run smoothly while generating steady revenue for your business.

Conclusion

The atm installation process doesn't have to feel like solving a Rubik's cube blindfolded. When you follow the right steps and work with people who actually know what they're doing, installing an ATM becomes surprisingly straightforward.

Think about it this way: you're not just bolting a machine to your floor. You're adding a profit center that works 24/7, never calls in sick, and brings cash-carrying customers right to your business. The average ATM pays for itself in under six months - that's faster than most business investments deliver returns.

At Merchant Payment Services, we've been helping business owners steer the atm installation process for over 35 years. We've seen every possible installation challenge, from cramped convenience stores to sprawling casino floors. Our family-owned approach means you get real people who care about your success, not just another transaction number.

Here's what sets us apart: we don't just drop off equipment and disappear. We stick around to make sure your ATM becomes a reliable revenue generator. From that initial site survey through years of remote monitoring, we're your partners in making ATM ownership actually profitable instead of problematic.

Whether you're ready to tackle a plug-and-play installation yourself or want our technicians to handle every detail, the important thing is starting with a plan. Your customers are already looking for convenient cash access - an ATM simply gives them what they want while putting money in your pocket.

The numbers speak for themselves. Reduced credit card fees, increased customer spending, and steady surcharge revenue add up quickly. Most of our clients wonder why they waited so long to install their first ATM.

Ready to turn that empty corner of your business into a cash-generating asset? Let's talk about how the atm installation process can work for your specific situation.