Are You Always on Camera at the ATM? Let's Find Out

The Hidden Eyes Watching Over Your Cash

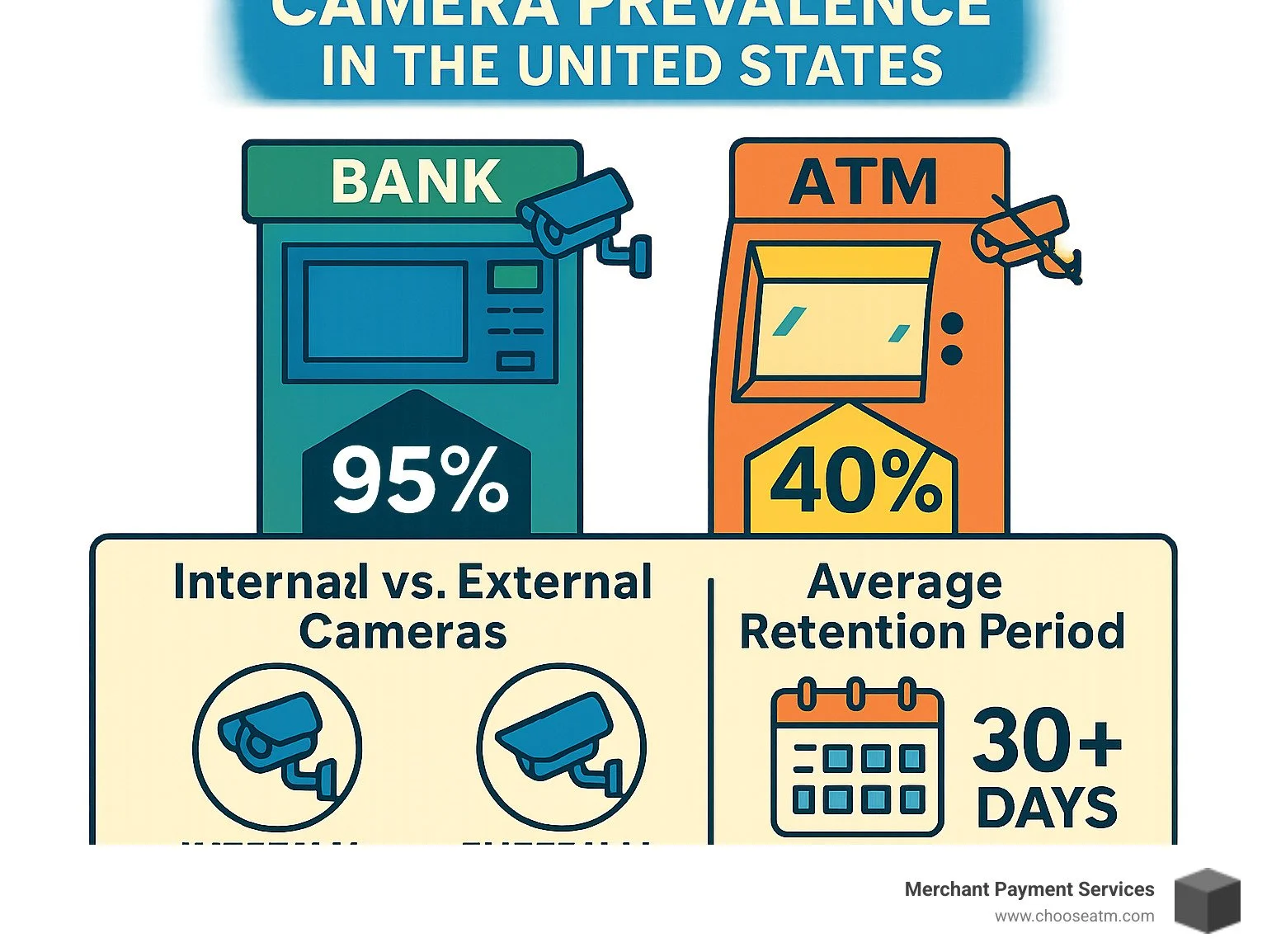

Do all ATMs have security cameras? No, not all ATMs have security cameras. While most bank-owned ATMs are equipped with surveillance cameras, privately owned ATMs (like those in gas stations and retail stores) often lack built-in cameras. Here's a quick breakdown:

ATM Type Camera Presence Typical Features Bank-owned ATMs Yes (almost always) Built-in cameras, multiple angles, high resolution Credit Union ATMs Yes (almost always) Similar to bank-owned ATMs Retail/Gas Station ATMs Sometimes May rely on store cameras or have no surveillance Standalone ATMs Rarely Often lack dedicated surveillance

Every time you step up to an ATM, you might wonder if someone is watching. Not just the person behind you in line, but through the unblinking eye of a security camera. This question isn't just about privacy – it's about safety and security in an age where ATM fraud and theft continue to evolve.

The truth about ATM surveillance is more nuanced than many realize. While those bank-branded machines you use downtown likely have multiple cameras capturing your every move, that convenience store ATM might be operating with minimal or no dedicated surveillance at all.

I'm Lydia Valberg from Merchant Payment Services, where I've spent years helping business owners steer ATM security concerns including the complex landscape of do all ATMs have security cameras regulations and implementation strategies that protect both businesses and consumers.

Do All ATMs Have Security Cameras? Spoiler: It Depends

The burning question on many people's minds has a somewhat unsatisfying answer: no, not all ATMs have security cameras. The reality is much more nuanced and depends on several key factors.

When you're withdrawing cash from your bank's ATM downtown, you're likely being recorded from multiple angles. But that convenient ATM at the corner gas station? You might be completely on your own.

The difference comes down to ownership, location, and the patchwork of regulations across the country. Bank-owned ATMs almost always have robust surveillance systems—they're required to. These financial institutions must follow federal guidelines like FDIC Part 326, which mandates security programs including surveillance systems for all insured banks.

The story changes dramatically when we talk about privately owned ATMs. That machine in your local convenience store, bar, or laundromat operates under completely different rules. There's no universal federal law requiring all ATMs to have cameras, creating what we at Merchant Payment Services have observed as a significant security gap.

Some states have stepped up where federal regulations fall short. New York's regulation 75-C, for example, requires specific security measures including proper lighting and surveillance for certain ATM locations. But cross state lines, and you'll find entirely different standards—or none at all.

Do all ATMs have security cameras in convenience stores?

In a word: no. This is where the security gap becomes most apparent. Convenience store ATMs are typically owned by independent operators rather than banks, and many lack built-in surveillance cameras altogether.

In our years of installing ATMs in retail locations, we've noticed a common misconception: store owners often assume the ATM has its own surveillance system. The truth? Many retail kiosks rely entirely on the store's existing security cameras—which may not adequately cover the ATM itself. This creates a dangerous blind spot where criminals can install skimming devices or tamper with the machine undetected.

The security risk is compounded because these locations typically have less foot traffic and fewer security personnel than bank branches. For fraudsters looking for vulnerable targets, these minimally monitored machines present an attractive opportunity.

Do all ATMs have security cameras at bank branches?

Yes, you can count on it. Virtually every ATM at a bank branch has not just one camera, but an entire surveillance ecosystem. These aren't aftermarket add-ons—they're sophisticated systems built into both the ATM's design and the bank's comprehensive security infrastructure.

When you use a bank ATM, you're typically being monitored by:

Built-in cameras within the ATM housing, positioned to capture clear facial images

Overhead cameras watching the ATM and surrounding area

Additional cameras covering approach and exit paths

Specialized cameras in drive-thru ATMs that capture vehicle details

Today's bank ATMs feature high-definition cameras with night vision capabilities, ensuring crystal-clear footage regardless of whether you're making a withdrawal at noon or midnight. These cameras connect to centralized monitoring systems where security personnel can observe transactions in real-time or review footage when necessary.

Banks also implement extra surveillance during high-risk scenarios like cash deliveries, with dedicated camera coverage when armored cars service the machines. This multi-layered approach shows just how seriously banks take ATM security—creating a stark contrast with the limited measures at many retail locations.

The bottom line? If you're concerned about security, not all ATMs have security cameras you can rely on. Bank ATMs offer significantly more protection than their retail counterparts, a fact worth remembering next time you need cash in an unfamiliar location.

For more insights on how ATM surveillance actually works, check out this detailed explanation of ATM video surveillance capabilities.

Why Cameras Matter: Deterrence, Evidence, Compliance

Let's talk about why those little lenses watching over ATMs are so important. They're not just there to make you feel self-conscious about your hair on a bad day – they serve some pretty crucial functions.

I've seen how effective good surveillance can be. The numbers back this up too. According to the European Safe Transaction Association, physical attacks on ATMs in Europe jumped by 27% in just one year, with thieves making off with €36 million (up 16% from the previous year). While these stats come from Europe, the trend is sadly universal.

Think of ATM cameras as silent guardians doing multiple jobs at once. They're like the Swiss Army knife of security measures. Visible cameras scare off potential criminals before they even attempt anything. That's prevention at its finest – the best crime is the one that never happens. When someone does try something, high-quality footage helps identify and prosecute the bad guys, giving law enforcement the evidence they need.

Beyond catching criminals, cameras help with everyday issues too. When a customer swears they only withdrew $100 but their account shows $200, video evidence can resolve these disputes quickly. They're also excellent at spotting fraud devices like skimmers before they can do much damage.

Modern systems don't just record passively – they're actively working to protect you. Real-time monitoring can alert security teams the moment something suspicious happens. Plus, having cameras helps banks and ATM operators stay on the right side of regulations, while giving customers that reassuring feeling that someone's looking out for them.

Camera features every ATM needs

Not all cameras are created equal – and when it comes to ATM security, the details matter. At Merchant Payment Services, we've learned what separates an adequate camera from an excellent one.

First and foremost, do all ATMs have security cameras with high-definition resolution? They should. We recommend nothing less than 1080p, with 4K becoming the gold standard for crystal-clear facial identification. When you're trying to identify someone who's up to no good, those extra pixels make all the difference.

Good ATM cameras need to handle challenging lighting situations – like the harsh contrast between bright daylight and shadows, or the dim lighting of a convenience store at night. That's where Wide Dynamic Range (WDR) technology comes in, adjusting automatically to capture clear images regardless of lighting conditions.

Night vision capabilities are non-negotiable for 24/7 protection. Whether using infrared or specialized low-light technology, cameras should see clearly even when humans can't. Add in motion detection to trigger recording when activity is detected, and you've got a system that's both effective and efficient.

The best cameras are housed in tamper-resistant enclosures – because what good is a security camera if someone can just redirect it or cover the lens? Modern systems also use advanced digital compression (H.264 or H.265) to store more footage without sacrificing quality, and include pre-record and post-record buffering to capture crucial moments before and after triggered events.

Integration with other security layers

A camera working alone is like a goalkeeper with no defenders – helpful, but not enough. The most secure ATMs integrate surveillance with multiple other security measures.

When cameras work together with alarm systems, any tampering attempt triggers immediate alerts. Access control mechanisms ensure only authorized personnel can get to sensitive components inside the ATM. One particularly clever feature is transaction synchronization, which links video footage directly to specific transactions, making investigations much faster and more efficient.

Some cutting-edge systems now incorporate face detection technology that verifies a human is physically present before dispensing cash – a smart defense against various fraud techniques. Real-time alert systems notify security teams instantly when something suspicious occurs, while anti-skimming devices work alongside cameras to create a comprehensive defense against card data theft.

I've seen how dramatically these integrated systems can reduce investigation time when resolving customer disputes or tracking down fraud. Instead of sifting through hours of footage, staff can jump directly to the relevant transaction's video – turning what used to be a day-long project into a 15-minute task.

At Merchant Payment Services, we believe the best security doesn't rely on any single measure but creates layers of protection that work together seamlessly. Just like you wouldn't rely solely on a deadbolt for your home security (you'd add an alarm system, good lighting, and maybe a noisy dog), ATMs need multiple security elements working in harmony to truly keep your money safe.

Bank-Owned vs. Retail ATMs: Different Rules, Different Risks

When it comes to ATM security, not all cash machines are created equal. The gap between bank ATMs and those standalone units in gas stations isn't just about location—it represents one of the biggest vulnerabilities in our financial system.

I've visited hundreds of ATM locations over my years at Merchant Payment Services, and the contrast is striking. Bank ATMs often look like mini fortresses with multiple cameras watching your every move. Meanwhile, that convenience store ATM might have nothing more than the shop's grainy overhead camera keeping an occasional eye on it—if you're lucky.

Banks pour serious resources into their ATM security. They're not just checking a compliance box; they're protecting their reputation and assets with multiple cameras, alarm systems, and teams of people monitoring for suspicious activity.

On the flip side, retail ATMs often exist in a security gray zone. Many store owners assume these machines come with built-in security features, but the reality is much different. When we install ATMs for our clients, we often have to explain that additional security measures might be necessary beyond what comes standard.

Here's how the security landscape typically breaks down:

Feature Bank-Owned ATMs Retail ATMs Built-in cameras Multiple (2-4 typically) Rare or none Camera quality High-definition Variable (if present) Monitoring 24/7 security centers Limited or none Integration Connected to central systems Often standalone Maintenance Regular checks and updates Infrequent Insurance Comprehensive coverage Limited coverage Liability Clear protocols Often disputed

The types of cameras also vary dramatically between these environments. Bank ATMs typically feature sophisticated built-in cameras nestled right into the ATM housing, often alongside discreet pinhole cameras that capture close-up details of users and their transactions.

Many banks complement these with external dome cameras mounted on ceilings or walls for broader coverage, and some even employ fancy PTZ cameras (that's Pan-Tilt-Zoom) that can swivel to follow activity and zoom in on suspicious behavior.

At Merchant Payment Services, we're working to bridge this security divide. We help business owners implement better security for their retail ATMs—not just because regulations might require it, but because stronger security is good for everyone. It protects your business reputation and gives your customers peace of mind.

Regulatory minimums & footage retention

"So how long do they keep those videos of me getting cash at 2 AM in my pajamas?" It's a question I hear often, and the answer isn't as straightforward as you might think.

There's no one-size-fits-all rule in the US. Instead, retention periods typically follow these patterns:

Most bank-branded ATMs hold onto footage for at least 90 days. Many financial institutions extend this to about 6 months, while some keep recordings for a full year, especially in high-risk locations.

These timeframes reflect a balance between regulatory requirements, practical storage limitations, and costs. By comparison, banks in the UAE must keep footage for a full year by law—one of the strictest standards worldwide.

In the US, retention requirements are shaped by a mix of federal banking regulations, state-specific ATM laws, insurance requirements, and each institution's own risk policies. This creates a patchwork of practices that can vary dramatically from one ATM to another.

This inconsistency creates real challenges for law enforcement and fraud investigators. Imagine finding fraudulent withdrawals on your statement from two months ago, only to learn the footage has already been deleted. That's why we always emphasize the importance of reporting suspicious activity immediately.

For our business clients who operate ATMs, understanding these retention requirements isn't just about compliance—it's about protecting yourself from liability. At Merchant Payment Services, we help our clients develop appropriate retention policies based on their specific needs and local regulations. After all, the right security approach isn't just about checking boxes; it's about creating a safer environment for everyone who uses your ATM.

Who Gets to See the Footage—and For How Long?

Ever wonder who's watching those ATM camera recordings? It's not like YouTube where anyone can view them. Access to do all ATMs have security cameras footage is carefully controlled to protect your privacy while still serving its security purpose.

Think of ATM footage as following a strict "need-to-know" chain of custody:

First, the ATM operators and bank security teams can review footage for legitimate security concerns. Law enforcement officers can obtain recordings too, but they need proper legal authorization like a warrant or subpoena—they can't just walk in and demand to see it. Insurance investigators may access footage when investigating claims, and in rare cases, court proceedings might require footage as evidence.

What about you as a customer? Here's the thing—you typically cannot view ATM footage directly. I know this frustrates many people who've had suspicious transactions, but banks maintain this policy to protect everyone's privacy and maintain investigation integrity.

Privacy laws add another layer of complexity. While video recording in public spaces is generally permitted, audio recording follows much stricter rules. That's why most ATM cameras capture only video, not sound. States like California and Washington require two-party consent for audio recording, making it legally problematic for ATMs to capture conversations.

Requesting footage after suspected fraud

If you suspect you've been a victim of fraud at an ATM, time is absolutely critical. Those recordings won't stick around forever!

Start by immediately contacting your financial institution. Report the suspected fraud and provide exact details about when and where you used the ATM. File a police report—this is crucial because law enforcement has formal channels to request footage that you as an individual don't have.

Document everything carefully—transaction times, locations, and any suspicious activity you noticed. Then specifically request that your bank review the camera footage as part of their investigation.

The most important thing to remember is follow-up. Stay in regular contact with both your bank and the police. Many cases fall through the cracks simply because people don't stay on top of them.

At Merchant Payment Services, we've seen many cases where quick reporting made all the difference between recovering funds and permanent loss. Banks typically won't release footage directly to you, but they will use it in their investigation and may share it with law enforcement.

Limitations & common failures

Do all ATMs have security cameras that work perfectly all the time? Unfortunately, no. Even the best security systems have limitations and failure points.

Camera tampering is a major concern—criminals often try to block, spray paint, or redirect cameras. Power outages can create surveillance gaps, especially at standalone ATMs without backup power systems. And even when cameras are working, poor image quality from inadequate resolution, improper lighting, or dirty lenses can make footage practically useless.

Many retail ATMs have limited camera angles, creating blind spots that savvy criminals exploit. Technical glitches in storage systems can prevent proper recording, and neglected maintenance is surprisingly common—a camera that worked perfectly last year might be completely non-functional today if nobody's checked it.

These limitations highlight why relying solely on cameras for ATM security is insufficient. The most secure ATMs employ multiple protective measures working together—cameras, alarm systems, transaction monitoring, and physical security features.

For business owners with ATMs on their premises, we recommend quarterly security audits to ensure all components, including cameras, function properly. At Merchant Payment Services, we help our clients implement comprehensive security protocols that go beyond just having cameras—because knowing the limitations of any security measure is the first step toward creating truly effective protection.

Staying Safe When the Camera Fails You

While ATM cameras provide an important security layer, you shouldn't rely solely on surveillance for protection. Your personal vigilance remains your best defense against ATM fraud and theft.

I've seen too many customers assume they're completely protected just because they're at an ATM. The truth is, even with cameras watching, you need to be your own first line of defense. Always inspect before you insert your card by checking for unusual attachments or modifications to the card reader. Those little plastic overlays can be remarkably convincing to the untrained eye!

Covering your PIN might seem old-fashioned, but it's still one of the most effective ways to protect yourself. Even if nobody's physically watching you, hidden cameras installed by criminals could be. I always cup my hand over the keypad, even at my trusted bank branch ATM.

Choose wisely when selecting which ATM to use. Well-lit, high-traffic areas offer natural security that isolated machines simply can't match. I tell my customers to stay alert and trust their gut feelings—if something feels off about an ATM, it probably is.

Late-night ATM visits sometimes can't be avoided, but they do come with additional risks. Limit after-hours use when possible, and if you must use an ATM at night, bring a friend along or choose one in a 24-hour location with staff present.

Your vigilance shouldn't end when you walk away from the machine. Check your statements regularly for unauthorized transactions. Modern banking apps make this easier than ever—in fact, I recommend you set up alerts for all ATM transactions so you'll know immediately if someone accesses your account.

Technology offers additional protection too. Use chip cards whenever possible, as EMV chip technology provides significantly better protection than the older magnetic stripes. These small habits create layers of personal security that complement (or compensate for) whatever cameras might be watching.

Skimming devices—those illegal card readers criminals attach to legitimate ATMs—can capture your card data even at ATMs with excellent camera coverage. These devices have become increasingly sophisticated and may be difficult to detect without careful inspection. Some of the newest models sit completely inside the card slot, making them virtually invisible without special detection tools.

What to do if you suspect an ATM has no camera or is tampered

If you approach an ATM and have concerns about its security—whether due to visible tampering, unusual attachments, or a lack of visible cameras—the best course of action is simple: walk away.

I've heard from customers who felt "silly" or "paranoid" about abandoning a transaction, only to later find their instincts were correct. Trust me, it's better to feel a little foolish than to become a victim of fraud. Find another ATM, preferably at a bank branch where security standards are typically higher.

Don't keep your concerns to yourself. Report suspicious ATMs to the business owner, bank, or property manager immediately. If you spot obvious tampering or suspicious devices, contact local law enforcement. They take these reports seriously because one compromised ATM can affect hundreds of customers.

Also, alert your bank about potentially compromised machines. Financial institutions track fraud patterns and your report might connect dots in a larger investigation. At Merchant Payment Services, we've seen cases where a single customer report led to the findy of widespread skimming operations.

For business owners operating ATMs, customer reports of suspicious activity should be treated as urgent priorities. We provide our clients with emergency response protocols to address potential security breaches quickly because we know how damaging ATM fraud can be to both customers and businesses.

Criminals targeting ATMs rely on users ignoring warning signs and proceeding with transactions despite concerns. Your vigilance not only protects you but also helps prevent others from becoming victims. When it comes to ATM security, sometimes the question isn't just "do all ATMs have security cameras?" but rather, "am I being as careful as I should be?"

For more comprehensive protection strategies, check out our guide to ATM Security Solutions or learn how to Protect Your Finances by Recognizing ATM Skimming Devices.

Frequently Asked Questions about ATM Cameras

How effective are ATM cameras at stopping crime?

When it comes to preventing ATM crime, cameras play a dual role – they're both scarecrows and detectives. As deterrents, those visible cameras make many would-be criminals think twice. But let's be honest – determined criminals might proceed anyway, knowing exactly what they're up against.

The real magic happens after an incident occurs. Those silent witnesses provide crucial evidence that helps catch perpetrators and recover stolen funds. I've seen cases where crystal-clear ATM footage was the key piece of evidence that closed a case.

Several factors determine just how effective these cameras really are:

Camera quality and placement makes all the difference – a fuzzy image of the top of someone's hat isn't helping anyone. Modern high-definition cameras positioned at face level capture the details investigators need.

Integration with other security measures amplifies effectiveness. Cameras work best when they're part of a team – paired with alarm systems, transaction monitoring, and physical deterrents.

Active monitoring transforms passive recording into active protection. Some systems alert security personnel in real-time when suspicious activity is detected, allowing for immediate intervention.

Regular maintenance is often overlooked but absolutely critical. A camera that worked perfectly last year might be completely useless today if nobody's checked it since installation.

While precise statistics on prevention are elusive (how do you count crimes that didn't happen?), our banking partners consistently report that comprehensive surveillance significantly reduces successful attacks and improves case resolution when incidents do occur.

How long do banks really keep the footage?

The honest answer? It varies – sometimes significantly from what's officially stated. While most banks claim to keep footage for 90 days to 6 months, the reality is more complicated.

Think about the sheer volume of data – a single ATM with multiple high-definition cameras generates terabytes of footage annually. This creates practical challenges that affect retention:

Storage limitations often force difficult decisions. Some systems automatically downgrade resolution after a certain period to extend retention time. Others simply begin overwriting the oldest footage when storage fills up.

Image quality settings directly impact retention – higher resolution means shorter storage periods unless the bank invests in massive storage infrastructure.

Incident flags can extend retention for specific timeframes. If suspicious activity is reported, that segment of footage is typically preserved beyond standard retention periods.

Technical failures happen more often than banks like to admit. Power outages, hard drive failures, or network issues can create gaps in coverage that nobody finds until the footage is needed.

Overwrite policies vary widely – some systems begin recycling storage space after just 30 days despite official policies stating longer periods.

The takeaway? Don't wait to report suspicious activity. At Merchant Payment Services, we always advise our clients to implement clear, realistic retention policies and ensure their systems can technically support those commitments.

Can ATM cameras record audio?

No, ATM cameras typically don't record audio – and it's not because banks are trying to save on microphones. This limitation stems primarily from legal restrictions rather than technical constraints.

Audio recording laws in the United States create a complex patchwork of requirements that make recording sound at ATMs legally risky. While video surveillance in public spaces is generally permitted, audio recording is subject to much stricter regulation:

One-party consent states allow recording if just one person in the conversation consents (which could theoretically be the bank).

Two-party consent states require all participants to consent before recording – practically impossible at an ATM without explicit notification and consent mechanisms.

The legal headaches and potential liability simply aren't worth it for most financial institutions. Video-only surveillance provides the security benefits they need without the legal complications of capturing conversations.

This limitation does mean that verbal threats or instructions during ATM crimes won't be captured in the recording. However, the visual evidence still provides investigators with crucial information to identify perpetrators and understand what happened.

In my years working with ATM security systems at Merchant Payment Services, I've found that good video footage answers most of the important questions even without audio. The silent film era of ATM surveillance continues – and that's probably for the best, legally speaking.

Conclusion

So, do all ATMs have security cameras? As we've finded throughout this article, the answer is clearly no. There's a significant security divide between the comprehensive surveillance systems at bank-owned ATMs and the often minimal or nonexistent cameras at retail locations. This uneven landscape creates very different experiences for consumers depending on where they choose to withdraw cash.

This security gap isn't just a problem—it's also an opportunity. For business owners operating ATMs, stepping up your security game with quality surveillance doesn't just protect your customers; it can become a genuine competitive advantage. Customers notice and appreciate these safety measures, even if they don't always mention them.

At Merchant Payment Services, we've spent more than three decades helping business owners steer the sometimes confusing world of ATM management and security. We've seen how businesses that prioritize security build stronger customer relationships based on a foundation of trust and confidence.

The most effective ATM security doesn't rely on just one solution. It combines multiple protective layers working together: quality cameras positioned strategically, systems that connect transaction data with video footage, regular security check-ups, clear procedures for handling suspicious activity, and helping customers understand how to protect themselves.

While cameras alone can't prevent every ATM crime, they remain absolutely essential to comprehensive security. Their presence—or absence—significantly impacts both crime prevention and the ability to resolve incidents when they do happen. Think of cameras as both a shield and a witness.

For you as a consumer, understanding this variable security landscape helps you make smarter choices about which ATMs to use and what precautions to take. For business owners, recognizing the value of robust security measures protects both your business reputation and your customers' wellbeing.

ATM technology continues to evolve rapidly, and security measures are advancing right alongside it. The future points toward more sophisticated integrated systems that combine traditional cameras with biometric verification, AI-powered monitoring, and instant alert capabilities. At Merchant Payment Services, we're committed to helping our clients stay ahead of these security advancements rather than playing catch-up.

When it comes to ATM security, we're all in this together. Operators and users share responsibility for creating a safer environment. By working together and staying vigilant, we can make ATM transactions safer for everyone.

Learn more about our ATM services and find how we can help your business implement security solutions that protect both you and your customers.