The Essential Guide to ATM Maintenance

Why ATM Maintenance Matters to Your Bottom Line

ATM maintenance is the regular care and upkeep of automated teller machines to ensure optimal performance, security, and customer satisfaction. For small business owners, proper maintenance is essential to maximize profits and avoid costly downtime.

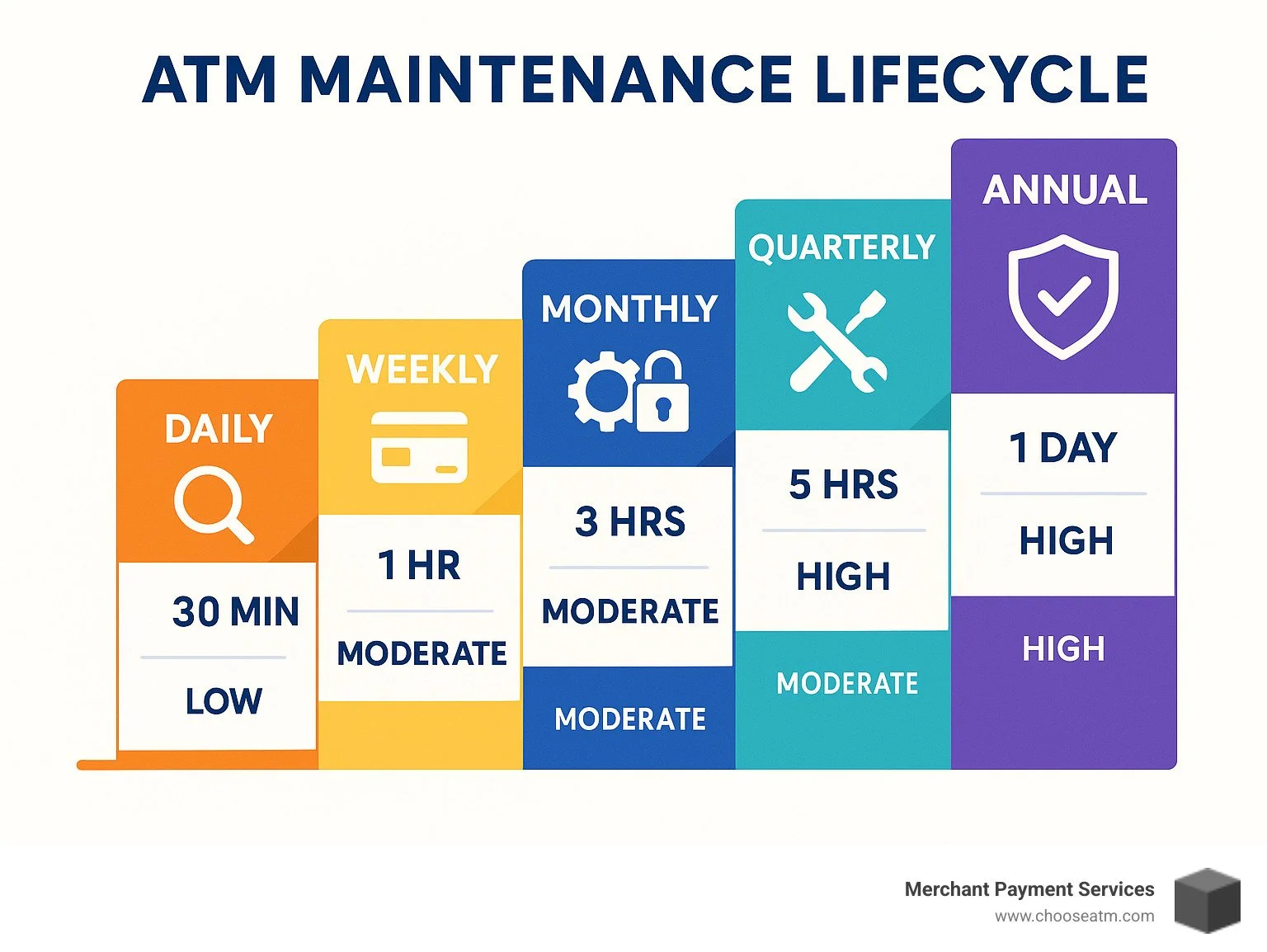

Quick Guide to ATM Maintenance:

Daily Tasks: Visual inspection, screen cleaning, transaction verification

Weekly Tasks: Card reader cleaning, receipt paper check, dust removal

Monthly Tasks: Software updates, security checks, cash flow optimization

Quarterly Tasks: Full hardware inspection, preventive part replacement

Annual Tasks: Compliance audit, security protocol review

ATM breakdowns don't just interrupt cash access—they can drive customers away from your business entirely. Regular maintenance prevents these costly disruptions while extending the lifespan of your investment.

When properly maintained, ATMs serve as reliable revenue generators through surcharge fees and increased foot traffic. Conversely, neglected machines lead to frustrated customers, security vulnerabilities, and potentially significant repair costs.

I'm Lydia Valberg, co-owner of Merchant Payment Services, where I've overseen ATM maintenance operations for businesses across the country as part of our family's 35-year commitment to payment solutions excellence. My experience has shown that preventive care consistently delivers better returns than reactive repairs, helping small businesses maximize both ATM uptime and customer satisfaction.

ATM Maintenance 101: What It Is & Why It Matters

Think of ATM maintenance as healthcare for your cash machine. Just like we need regular checkups to stay healthy, your ATM needs consistent care to keep serving your customers and generating revenue. It's not just about fixing things when they break—it's about preventing problems before they start.

When we talk about ATM maintenance, we're really talking about two different levels of care:

First Line Maintenance (FLM) Second Line Maintenance (SLM) Performed by ATM owners/operators Performed by certified technicians Basic cleaning and inspection Component repair and replacement Paper replenishment Hardware troubleshooting Cash loading/balancing Software updates and patches Simple jam clearing Circuit board repairs No special tools required Requires specialized tools and parts Daily/weekly frequency As-needed or quarterly frequency

Most small business owners can handle FLM tasks themselves—think of it as the regular oil changes and tire rotations you do for your car. SLM is more like taking your vehicle to a mechanic for more complex issues. At Merchant Payment Services, we've seen that businesses who balance these approaches tend to enjoy the best uptime and customer satisfaction.

Why Neglecting ATM Maintenance Hurts Profitability

Let me be straight with you—skipping ATM maintenance is penny-wise but pound-foolish. Here's how neglect silently eats away at your bottom line:

When your ATM goes down, you're not just losing surcharge fees (though that hurts enough). A busy location processing 500 transactions monthly could lose hundreds in direct revenue from just one day of downtime. But the real damage goes deeper.

Your customers come to expect reliable service. When they find your ATM out of order, they're not just disappointed—they're 40% less likely to return for future transactions. That's a customer trust problem that extends to your entire business, not just the ATM.

Security vulnerabilities from outdated software or worn hardware components create opportunities for fraud. I've seen business owners face thousands in losses from a single security breach that could have been prevented with routine updates.

Then there are the regulatory penalties. Banking authorities and card networks don't take kindly to non-compliant ATMs, with fines that can quickly escalate from hundreds to thousands per violation.

Perhaps most frustrating is the premium you'll pay for emergency repairs. Unplanned service calls typically cost 30-50% more than scheduled maintenance. One convenience store owner in Dallas learned this lesson during a busy festival weekend when his neglected ATM failed. Beyond the $800 in lost transaction fees, he estimated losing over $3,000 in potential in-store purchases from customers who left to find working ATMs elsewhere.

Key Components That Need Routine Attention

Understanding what makes your ATM tick helps you know where to focus your maintenance efforts:

The cash dispenser is the heart of your ATM. This component needs regular cleaning to prevent jams and misfeeds. Dust, debris, and worn rollers can quickly turn a smooth operation into a customer service nightmare.

Your card reader might seem simple, but as one of our technicians likes to say, "Without a readable card, the ATM is 100% useless." Card readers collect dust, oils from cards, and occasionally foreign objects that customers accidentally insert. A quick cleaning every week can prevent frustrating card capture issues.

Don't underestimate the importance of the receipt printer. While it might seem minor, many customers rely on those little slips of paper. Paper jams and print quality issues can turn an otherwise successful transaction into a negative experience.

The keypad takes a beating from thousands of finger presses. Physical wear, dirt accumulation, and occasional liquid spills can affect responsiveness. Since this is where customers literally connect with your machine, keeping it clean and functional is essential.

Your ATM's display screen needs special attention, especially if it's a touchscreen. Regular, proper cleaning maintains both visibility and functionality. Even non-touch displays need care to ensure customers can clearly read instructions.

Behind the scenes, the power supply quietly keeps everything running. Power fluctuations can damage internal components, so checking surge protectors and backup power solutions should be part of your routine.

Finally, don't forget the network communication devices. About 25% of all ATM service calls relate to connectivity issues. Modems, routers, and cables need periodic inspection to ensure your machine stays connected and available.

The most successful ATM operators we work with at Merchant Payment Services create a simple maintenance schedule that addresses each component at appropriate intervals. It's not complicated, but it does require consistency—just like any good health regimen.

For more detailed information about specific maintenance procedures, check out our comprehensive guide to ATM Maintenance Services.

Proactive ATM Maintenance Framework (Tasks, Software & Cash)

Let's face it—nobody likes surprises when it comes to ATMs, especially the kind that leave your machine out of service during a busy weekend. That's why shifting from a "fix-it-when-it-breaks" mindset to a proactive ATM maintenance approach makes all the difference in the world.

As NCR Atleos (who handles over 590,000 ATMs globally) wisely puts it, "even the most reliable technologies can face unexpected problems. The key is resolving them fast." But what if you could prevent many of those problems from happening in the first place?

A truly effective maintenance strategy combines three essential elements: regular hands-on care, timely software updates, and smart cash management. Let's break down what this looks like in the real world.

Daily ATM Maintenance Checklist

Think of these quick daily checks as your morning coffee for the ATM—they wake everything up and get the day started right. The best part? They only take 5-10 minutes.

Start with a visual inspection each morning. Walk around your ATM looking for anything fishy—unusual attachments, drilled holes, or anything that looks different from yesterday. This simple habit has stopped countless fraud attempts before they could harm customers.

Next, give that screen a quick clean with a soft, anti-static cloth. For touchscreens, stick to approved cleaning solutions—household glass cleaners can damage the sensitivity. As one of our clients jokes, "Fingerprints are great for CSI, not for ATM screens."

Run a test card through the reader to make sure it's grabbing cards smoothly. Any unusual sounds or resistance? That's your early warning system for bigger problems ahead.

Check your receipt paper levels daily. Nothing frustrates customers more than completing a transaction only to receive a blank or partial receipt. While you're at it, verify the printing is clear and legible.

Finally, process a small test transaction to confirm everything's working from start to finish. This verifies your network connection, dispensing mechanism, and receipt printer all in one go.

As one of our most successful convenience store owners in Texas puts it, "A clean ATM is a happy ATM—and happy ATMs make happy customers who come back."

Weekly & Monthly Preventive Tasks

Building on your daily routine, these more thorough maintenance activities keep your ATM humming along without unexpected hiccups.

Weekly, plan to remove dust from your machine's inner workings. A can of compressed air works wonders for blowing dust from the cash dispenser, card reader, and printer assemblies. "Remove debris from the bottom of the vault and vacuum out dust," as our service technicians always recommend.

Don't forget to clean those pick wheels and belts that handle your cash. These components get dusty and dirty, leading to the dreaded cash jams that can shut down your machine. A simple wipe with approved cleaning solution prevents most dispensing errors.

For card readers, use specialized cleaning cards that contain cleaning solution—run them through 2-3 times to remove the invisible buildup of dirt and oils that accumulate from hundreds of card swipes.

Monthly tasks dig a bit deeper. Start by printing your journals to free up system memory. As one of our ATM experts always says, "Your ATM's memory is like a closet—it needs regular cleaning out or things start to malfunction."

Apply a touch of approved lubricant to moving parts in the cash dispenser. Just like your car needs oil, your ATM's mechanical components need occasional lubrication to prevent wear and tear.

Check your receipt printer alignment monthly. Misaligned printers cause paper jams and partial receipts that leave customers guessing about their transaction details.

Finally, thoroughly test your network connections—both primary and backup. Connectivity issues cause about 25% of all ATM service calls. A simple connection test can identify problems before they interrupt your service.

Software & Security Update Playbook

While physical maintenance keeps your ATM running smoothly, digital maintenance keeps it running securely. Think of software updates as your ATM's immune system—they protect against new threats.

Mark your calendar for quarterly operating system patches or apply them as they're released by your manufacturer. These updates fix bugs and close security holes that could be exploited. Similarly, update your ATM application software monthly or quarterly according to your provider's recommendations.

When it comes to security patches, time is of the essence. Implement critical updates within 30 days of release. As a security expert we work with notes, "Operating system vulnerabilities are a primary attack vector for ATM malware." Don't give criminals that opening.

Don't overlook your peripheral device firmware. Card readers, dispensers, and printers all have their own software that needs semi-annual updates to maintain compatibility and security.

For improved security, apply whitelisting technology that blocks unauthorized programs from running on your ATM. Install and regularly check anti-skimming devices that prevent criminals from capturing card data.

Use tamper-evident seals on access points and check them during your regular maintenance. One creative tip we share with our clients: install adhesive-backed height markers on your ATM's door frame. These make it easier to identify suspicious individuals on security footage by providing a visual reference for height.

For administrative access, enable two-factor authentication to prevent unauthorized changes to your ATM systems. This simple step has prevented countless security breaches across the country.

A convenience store owner in Chicago learned the importance of this security playbook the hard way. His ATM experienced a skimming attack that compromised customer data because the security software hadn't been updated in over eight months. A simple update would have prevented the attack entirely, saving him thousands in remediation costs and untold damage to his business reputation.

For more detailed guidance on handling specific issues, check out our comprehensive ATM Troubleshooting Guide. And if you operate a Hyosung HALO II, bookmark the Owners Manual for Hyosung HALO II for model-specific maintenance instructions.

By following this proactive framework, you'll keep your ATM running smoothly, securely, and profitably—turning what could be a business headache into a reliable revenue stream.

Costs, Outsourcing & Troubleshooting Strategies

Let's talk money – because when it comes to ATM maintenance, understanding the financial side helps you make smarter decisions for your business. Think of it as finding that sweet spot between handling things yourself and calling in the pros.

The cost of keeping your ATM humming along smoothly typically falls into one of four buckets:

Most service providers (including us at Merchant Payment Services) offer per-transaction pricing that aligns maintenance costs with how much your ATM actually gets used. National ATM Systems describes this approach as "worry-free and cost-effective" – you pay more when your ATM is busier (and making you more money), and less when it's quieter.

Some businesses prefer the predictability of fixed service contracts with a set monthly or annual fee. No surprises, no matter how many service calls you need. Others opt for time-and-materials billing, paying only when something needs attention – perfect if you're comfortable handling the day-to-day stuff yourself.

There are also hybrid models that combine elements of these approaches, often with tiered service levels and response times. Most transaction-based maintenance programs run about $0.05-$0.15 per transaction, while fixed contracts typically range from $50-$150 monthly depending on your ATM model and service level.

DIY ATM Maintenance vs Professional Repair

Knowing when to roll up your sleeves versus when to call in the cavalry can save you both money and headaches.

You can absolutely handle the basics yourself – cleaning the exterior, restocking receipt paper, clearing simple jams, and loading cash. A quick reboot can often resolve minor glitches, and most ATMs have basic troubleshooting guides for common error codes. These DIY tasks require no special training and help keep your machine running smoothly between professional service visits.

But when should you pick up the phone? When you're dealing with hardware failures, persistent error codes that don't resolve with basic troubleshooting, or mechanical issues with the cash dispenser. The same goes for software update failures, security concerns, or network problems that stick around after you've checked all the connections.

As one ATM troubleshooting guide puts it, "ATM Troubleshooting can be broken down into two categories. First Line Maintenance (FLM) and Second Line Maintenance (SLM)." You handle the first line; the pros handle the second.

The math is pretty straightforward: If the cost of downtime (in lost transactions and frustrated customers) exceeds the cost of a service call, it's time to bring in the experts. For busy locations pulling in $500+ monthly in surcharge revenue, even half a day of downtime justifies calling a pro.

Building a Budget-Friendly Maintenance Plan

Creating a smart ATM maintenance strategy that won't break the bank starts with understanding what you're already paying for.

Most new ATMs come with manufacturer's warranty coverage for the first 12-36 months. Know exactly what's covered before you start budgeting for additional protection. As your warranty approaches its end, consider extended coverage options. One ATM provider wisely notes, "Downtime when out of warranty can cost more in lost transactions than the warranty itself."

Smart operators keep a small inventory of common replacement parts on hand. "Stock spare card readers, rollers, dispenser parts and receipt tape," suggests an experienced ATM maintenance guide. Having these items ready can turn a potential day-long outage into a 15-minute fix.

When shopping for service providers, pay close attention to their response time guarantees. National ATM Systems, for example, promises to "respond to all service calls within 24 hours, with most being on the same day." Every hour your ATM sits idle costs you money.

Consider investing in remote monitoring solutions that can spot issues before they cause downtime. The upfront cost often pays for itself through fewer service calls and less downtime. Think of it as preventive medicine for your ATM.

A small business owner in Texas shared this real-world experience: "After calculating that each hour of ATM downtime cost me about $30 in lost surcharge fees and an estimated $100 in reduced store purchases, I invested in a per-transaction maintenance plan with same-day service. The peace of mind alone was worth it, but the numbers worked out too—I haven't had more than two hours of downtime in the past year."

Common Troubleshooting Scenarios

Even with the best ATM maintenance routine, you'll occasionally face some hiccups. Here's how to handle the most common issues:

When dealing with cash jams, first power down the ATM and carefully open the dispenser (following proper security protocols). Gently remove any jammed bills and check for foreign objects or damaged currency. Prevent future jams by regularly cleaning those pick wheels and properly loading fresh, crisp bills.

For receipt printer problems, clear any paper jams, check that the paper is properly aligned, and make sure the print head is clean. Using high-quality receipt paper and keeping the paper path clean will minimize these headaches.

If your card reader starts acting up, inspect the card slot for foreign objects and run a cleaning card through it. Make this cleaning part of your regular routine, and always check for signs of tampering or skimming devices.

Network connectivity failures can be particularly frustrating. Start by checking all physical connections, rebooting your communication device, and verifying service with your network provider. Having a backup communication method can be a real lifesaver here.

When facing software lockups or system freezes, perform a proper system restart following the manufacturer's guidelines. Prevent these issues by regularly clearing memory through journal printing, scheduling occasional reboots, and keeping your software updated.

As one ATM technician with over 15 years of experience told me, "About 70% of the service calls I respond to could have been resolved with basic troubleshooting and maintenance. The most common fix I perform is simply cleaning components that haven't been maintained regularly."

For more detailed guidance, check out our comprehensive ATM Service Providers guide and ATM Maintenance Programs handbook.

Frequently Asked Questions About ATM Maintenance

How often should an ATM receive preventive maintenance?

Think of your ATM like your car - regular check-ups keep everything running smoothly. For best results, follow this maintenance rhythm:

Daily checks take just minutes but prevent major headaches - a quick visual inspection and wipe-down keeps your machine looking professional and catches any obvious issues early.

Weekly attention includes deeper cleaning of components and making sure everything's working as it should. This is like checking your tire pressure - simple but important.

Monthly maintenance digs a little deeper with thorough cleaning, software checks, and printing your transaction journals to keep the system memory fresh.

Quarterly visits from a professional technician help catch wear-and-tear before it becomes a problem. They'll inspect the mechanical components that you can't easily access.

Annual comprehensive service is your ATM's "physical" - including preventive part replacement to avoid surprise failures.

As one experienced technician told me, "The ATMs that get daily attention almost never have the catastrophic failures we see with neglected machines." Your maintenance schedule might need adjustment based on how busy your machine is - if you're processing over 500 transactions monthly or your ATM lives in a dusty environment, more frequent care makes sense.

What's the difference between first-line and second-line service?

The difference comes down to complexity and who's handling the maintenance:

First-Line Maintenance (FLM) is the everyday care you or your staff can handle without special training. Think of it as the ATM equivalent of checking your oil or filling your windshield wiper fluid. This includes:

Visual inspections to catch anything unusual, basic cleaning to keep everything looking professional, restocking cash and receipt paper, clearing simple jams that don't require getting deep into the machine, and the classic IT solution - turning it off and on again when needed.

As one ATM maintenance guide puts it: "FLM is the simple stuff the owner can handle with just the owner manual as a guide."

Second-Line Maintenance (SLM) is where the professionals step in - like taking your car to a mechanic for more complex issues. This includes:

Hardware repairs and replacement parts, advanced troubleshooting for persistent problems, software updates that keep your machine secure, maintaining security systems, and the precise calibration of mechanical components that require specialized tools and knowledge.

Understanding this difference helps you know when to roll up your sleeves and when to call in the experts. Most ATM owners save time and money by handling the first-line maintenance themselves while relying on professionals for the more complex second-line work.

How do software updates fit into my maintenance schedule?

Software updates are the invisible heroes of ATM maintenance - they keep your machine secure, compliant, and running smoothly behind the scenes. Here's how to work them into your routine:

Operating System Updates should happen quarterly or whenever recommended by your manufacturer. These fundamental updates fix security holes and performance issues that could affect your entire operation.

Application Software needs refreshing monthly or quarterly according to your service provider's guidance. These updates improve how your ATM functions and fix known bugs before they cause problems.

Security Patches require prompt attention - aim to apply them within 30 days of release, or sooner if they address active threats. As one security expert bluntly put it, "Ignoring security patches is like leaving your front door open uped in a high-crime neighborhood."

Firmware Updates for your peripheral devices (card readers, cash dispensers, printers) should happen semi-annually or as recommended by the manufacturer.

Many newer ATMs support remote software updates, which means less downtime and hassle for you. Some older models still need a technician to visit and install updates on-site. Either way, establishing a regular update schedule with your service provider ensures minimal disruption to your business.

One convenience store owner shared his experience: "After a security scare last year, we now have our service provider perform remote updates monthly during our slowest hours. It's been seamless - they handle everything while we sleep, and we haven't had a single security issue since. The small maintenance fee is nothing compared to the peace of mind."

Conclusion

Let's face it—nobody gets excited about maintenance until something breaks down. But when it comes to your ATM, a little TLC goes a long way toward keeping both your machine and your customers happy.

Throughout this guide, we've seen how ATM maintenance isn't just about fixing problems—it's about preventing headaches before they start. Think of it as giving your ATM a regular health check-up rather than rushing it to the emergency room.

When you commit to regular maintenance, you're really investing in peace of mind. Your ATM stays up and running when customers need cash, creating those "thank goodness this ATM works" moments that build loyalty to your business. I've seen how a reliable ATM can become a neighborhood favorite, driving repeat visits and building goodwill.

ATM maintenance also protects your bottom line in ways that aren't always obvious. Beyond avoiding repair costs, you're safeguarding your reputation. In an age where a single frustrated customer can share their experience with hundreds online, a consistently functioning ATM becomes a silent brand ambassador for your business.

The compliance piece can't be overlooked either. Banking regulations and network requirements change regularly, and proper maintenance ensures you stay on the right side of the rules. The alternative—penalties and forced upgrades—is far more expensive than preventive care.

Perhaps most importantly, a well-maintained ATM simply lasts longer. Just like changing the oil in your car extends its life, regular ATM maintenance stretches your initial investment further, improving your overall return.

At Merchant Payment Services, we've spent 35 years watching how the little things make big differences in ATM performance. The businesses that thrive aren't necessarily those with the fanciest machines—they're the ones who consistently care for the equipment they have.

Whether you're a DIY maintenance enthusiast or prefer to leave it to the pros, consistency is your best friend. Even small, regular efforts prevent major issues down the road.

Your ATM often creates first impressions of your business. When a customer needs cash quickly, a smooth ATM experience might be the difference between them becoming a regular or walking away forever.

By following the practical advice in this guide, you're not just maintaining a machine—you're creating positive experiences, protecting your reputation, and securing a valuable revenue stream that works for you 24/7.

Want to take your ATM program to the next level? Contact our team today to learn how we can help implement these best practices and maximize your ATM's potential.