The ATM Advantage: A List of Services You Didn't Know Existed

Modern ATM Services: Beyond Just Cash Withdrawal

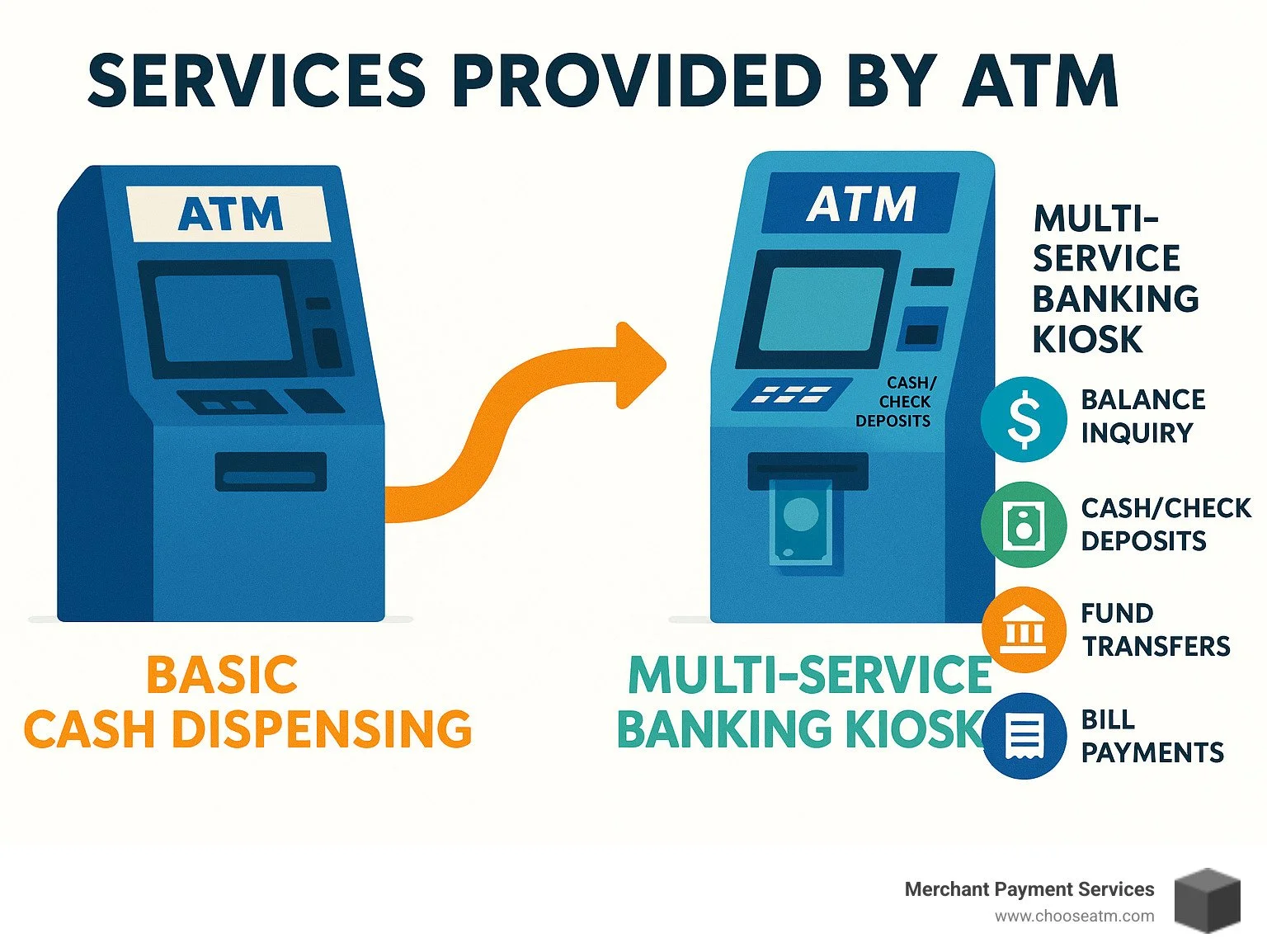

The services provided by ATM machines have evolved dramatically since the first machine was installed in 1967. Today's ATMs offer far more than just cash access.

Core ATM Services at a Glance:

Cash Withdrawal - Access your money 24/7

Balance Inquiry - Check account balances instantly

Cash/Check Deposits - Make deposits without visiting a branch

Fund Transfers - Move money between accounts

Bill Payments - Pay utilities, credit cards, and more

PIN Changes - Update your security credentials

Mini Statements - View recent transactions

Mobile Phone Recharges - Top up prepaid accounts

Modern ATMs now function as full-service banking kiosks, with advanced features including biometric authentication, cardless transactions, and even pre-approved loan applications. With over 450,000 ATMs across the United States, these machines remain essential despite the rise of digital payment methods.

I'm Lydia Valberg, co-owner of Merchant Payment Services, where we've specialized in optimizing services provided by ATM solutions for small businesses for over 35 years. Our expertise helps merchants increase foot traffic while creating new revenue streams through strategically placed ATMs.

Service #1: 24/7 Cash Withdrawal & Balance Inquiry — The Classic Services Provided by ATM

When you think of an ATM, what's the first thing that comes to mind? For most of us, it's the ability to grab cash whenever we need it. Cash withdrawal and balance checks are the bread and butter of services provided by ATM machines across America. These seemingly simple functions revolutionized banking by freeing us from banker's hours and putting financial access literally at our fingertips.

Despite our increasingly digital world, cash dispensing remains the star of the show. The familiar ritual—sliding in your card, tapping in your PIN, selecting withdrawal, choosing an amount, and that satisfying moment when crisp bills appear—continues to be the most used ATM function nationwide. While most machines traditionally dispense $20 bills, newer ATMs now offer a variety of denominations including $5, $10, $50, and even $100 bills for greater flexibility.

Balance inquiries might seem basic, but they're incredibly powerful for everyday money management. With a few button presses, you can instantly check your account balance before making a withdrawal, helping avoid those dreaded overdraft fees and keeping your financial picture clear while on the go. No smartphone app needed—just your card and a nearby ATM.

Fee Type In-Network ATM Out-of-Network ATM Usage Fee $0 $2.50-$3.50 Bank Surcharge $0 $1.50-$3.50 Total Cost $0 $4.00-$7.00

Note: The average total ATM fee in the U.S. reached $4.77 in 2024, up from $4.73 the previous year.

As banking expert Bill Hardekopf points out, "ATMs are a convenient way for people to quickly access their bank accounts, but that convenience factor often comes with fees, especially when using machines outside your bank's network." These words ring true for many of us who've felt the sting of those out-of-network charges.

For more detailed information about the fundamentals of ATM usage, check out the latest research on ATM basics.

How these services provided by ATM keep your money moving

Behind every ATM transaction lies the humble PIN—those four (or sometimes six) digits that stand between your money and the outside world. This security feature authenticates your identity with each transaction while modern encryption keeps your information safe during transmission. It's simple yet remarkably effective.

Remember those little paper slips that used to litter ATM locations? Receipt printing provides valuable transaction documentation, though many machines now offer eco-friendly alternatives like declining a paper receipt or having it emailed instead. These digital records help you track spending and resolve any issues that might arise.

Life sometimes throws financial curveballs—perhaps you're traveling or making a large purchase. When your standard daily limit won't cut it, many banks now allow temporary limit increases through a quick call to customer service or a few taps in your mobile banking app. This flexibility lets you access more cash when needed without permanently changing your security settings.

Fee-saving hacks for the services provided by ATM

Nobody likes paying fees for accessing their own money. Fortunately, there are several ways to minimize or eliminate these charges entirely.

Using in-network ATM locator apps can save you a bundle. Most banks offer mobile apps with GPS functionality to help find fee-free ATMs nearby—perfect when you're in an unfamiliar area and need cash fast.

Planning your cash needs ahead of time makes a big difference too. By withdrawing larger amounts less frequently, you'll minimize transaction fees while still having cash on hand when you need it.

Consider getting cash back at checkout when shopping. Many retailers offer free cash back with purchases, letting you skip the ATM altogether. It's like getting two errands done at once—shopping and cash withdrawal—without any extra fees.

If you're a credit union member, you're in luck! Credit union shared branching often provides access to thousands of surcharge-free ATMs nationwide through cooperative networks, giving you big-bank convenience with community institution benefits.

Some checking accounts now offer ATM fee reimbursement as a perk, refunding a certain number of out-of-network ATM fees each month. This feature is especially valuable for frequent travelers or those who can't always access their bank's ATMs.

At Merchant Payment Services, we understand both sides of the ATM equation. We help businesses strategically place ATMs to benefit both merchants and customers—providing convenient cash access while generating valuable surcharge revenue. After 35 years in the business, we've seen how these classic services provided by ATM machines continue to play a vital role in America's financial landscape.

Service #2: Instant Cash & Check Deposits

Gone are the days when ATMs could only dispense cash. Modern machines offer sophisticated deposit capabilities that transform how customers interact with their accounts.

Remember those old-school envelopes we used to stuff with cash and checks at ATMs? Those days are thankfully behind us! Today's services provided by ATM include sophisticated envelope-free technology that makes depositing money a breeze. When you feed cash directly into these smart machines, they count your bills instantly, check them for authenticity, and credit your account right away—no envelope licking required.

Check deposits have gotten equally impressive. Just insert your check, and the ATM's advanced imaging technology captures both sides, reads the amount (yes, even your handwriting!), and processes your deposit. The best part? Many banks offer same-day credit if you complete your deposit before their cut-off time, getting your money working for you faster.

"Deposit automation was the single biggest advancement in ATM features over the past 15 years," says Bill Budde, VP of Banking Strategy and Solutions at Hyosung Innovue. "It created the baseline for transaction automation/transaction migration and started the push for branch change."

Most banks across America allow cash deposits up to $10,000 per transaction, though some set lower thresholds for security reasons. Check deposits typically follow similar limits, with potential holds on larger amounts or out-of-town checks as outlined in Federal Reserve Regulation CC guidelines. If you're curious about the ins and outs of cash loading services, more info about cash loading services is available on our blog.

Why these services provided by ATM save you a branch trip

There's something deeply satisfying about completing a deposit without having to rearrange your schedule around bank hours. ATM deposits offer several real-life advantages that make branch visits increasingly optional.

Extended hours mean you can make deposits when it fits your schedule—evenings after work, weekends while running errands, or even holidays when branches are locked tight. As a night owl who does my banking at 10 PM, I particularly appreciate this flexibility!

Digital record-keeping provides peace of mind with electronic confirmations and images of deposited checks sent straight to your mobile device or email. No more wondering, "Did I actually deposit that check last Tuesday?"

Reduced wait times are another blessing, especially during lunch hours or paydays when teller lines can stretch out the door. With deposit-enabled ATMs, you're in and out in minutes.

For business owners, these machines serve as a perfect night-drop alternative, allowing after-hours deposits without the uncertainty of traditional night-drop boxes. The improved security features of modern ATMs, including cameras and transaction tracking, create a reliable audit trail that protects both customers and financial institutions.

Small business owners find particular value in these deposit features. Imagine being able to have employees make deposits throughout the day without leaving the store—reducing both security risks and the operational disruption of sending staff to the bank during busy hours.

At Merchant Payment Services, we've helped countless business owners implement ATM solutions with deposit functionality that creates a win-win: customers enjoy the convenience of full-service banking, while merchants benefit from increased foot traffic and sales. After all, when people visit your location to make a deposit, they're more likely to make a purchase while they're there.

Service #3: On-the-Spot Transfers & Bill Payments

Did you know your local ATM might be a financial Swiss Army knife? Beyond cash withdrawals, the services provided by ATM machines now include powerful money movement tools that can save you time and hassle.

When you're standing at the ATM, you're actually at a mini financial command center. With just a few taps, you can instantly move money between your checking, savings, and credit card accounts. This comes in handy when you need to cover an upcoming payment, avoid an overdraft fee, or make a last-minute credit card payment without logging into online banking.

The bill payment capabilities have grown impressively over the years. Today's ATMs let you handle nearly all your regular expenses in one stop:

"The ability to pay bills at ATMs provides a critical service for the underbanked population," explains financial inclusion expert Maria Rodriguez. "Not everyone has reliable internet access or is comfortable with mobile banking, making ATMs an essential channel for financial services."

From rent to recharge: bills you can kill at the keypad

Remember the days of writing checks and buying stamps to pay bills? That's becoming as outdated as VHS tapes. Modern ATMs now let you handle everything from your electric bill to your streaming services right at the keypad.

Your services provided by ATM now typically include paying your electric, water, and gas bills from major utility companies that have partnered with ATM networks. Need to top up your prepaid phone? Many ATMs can handle that too, with immediate activation so you're never left without service.

Some ATMs even support tax payments to the IRS, generating special identification numbers you can use for verification later. And if you're feeling generous, certain machines allow you to make donations to registered charities and religious organizations.

Even your mortgage or car loan payments can often be handled right at the ATM. It's like having your own personal financial assistant available 24/7.

To use these features, you'll typically need to register your billers with your bank first – either through their website or at a branch. Once that's done, they'll appear in your ATM payment options, making future payments quick and simple.

At Merchant Payment Services, we've seen how businesses thrive when their customers have easy access to these financial tools. Our ATM solutions help merchants create valuable service hubs that not only attract repeat visitors but also generate revenue through surcharge fees. With ATM management solutions that simplify the process, we help turn what used to be just a cash machine into a complete financial service center.

Service #4: Cardless, Contactless & Mobile Wallet Access

The ATM world has acceptd the digital wallet revolution, changing how we access our money. Today's modern services provided by ATM let you leave your plastic cards at home while still getting the cash you need.

Remember when forgetting your debit card meant no access to cash? Those days are gone. Now you can tap your smartphone, scan a code, or enter a temporary password to make ATM magic happen.

Most cardless ATM transactions work in one of three user-friendly ways. With NFC technology, you simply tap your phone against the ATM's reader – just like you would at your favorite coffee shop. The QR code method involves either scanning a code displayed on the ATM screen with your banking app, or showing a code from your app to the ATM's scanner. And with one-time codes, your banking app generates a temporary password that works for just a single transaction.

These innovations play nicely with the mobile wallets we've all grown to love – Apple Pay, Google Pay, and Samsung Pay – making ATM access feel like a natural extension of how we already pay for things.

"Contactless ATM transactions represent a significant advancement in both convenience and security," notes cybersecurity expert James Wilson. "By eliminating the card insertion, these methods effectively neutralize the threat of skimming devices that have plagued traditional ATM transactions."

Safe, fast, and touch-free: the new normal at ATMs

The security benefits of cardless ATM access are impressive enough to make even the most cautious among us feel comfortable.

Instead of transmitting your actual card number (which could potentially be intercepted), these systems use tokenization – creating one-time-use codes that become worthless after your transaction completes. Each transaction also generates a new security code through dynamic CVV technology, unlike the unchanging code printed on your physical card.

Many banking apps add another layer of protection by requiring your fingerprint or facial recognition before allowing ATM access. And in our post-pandemic world, the ability to complete transactions with minimal touching of shared surfaces remains an attractive bonus.

The numbers back up these security improvements. ATMs with contactless technology have seen fraud attempts drop by up to 30% compared to traditional card-reading machines. Plus, these transactions typically finish 15-20 seconds faster than conventional methods – saving you time with every visit.

At Merchant Payment Services, we understand that staying current with technology isn't just about looking modern – it's about providing genuine value to customers. That's why we help businesses implement ATM solutions that support contactless access. When your ATM offers the convenient, secure payment methods your customers prefer, everybody wins – they get easier access to cash, and you maintain a valuable service that drives foot traffic to your business.

Service #5: Smart Cash Recycling & Mixed-Denomination Payouts

Remember when ATMs only gave out cash? Those days are long gone! The newest star in services provided by ATM is cash recycling technology, which is completely changing how these machines handle your money.

These smart machines don't just dispense cash – they actually reuse the bills that customers deposit. When you make a deposit, the ATM authenticates each bill, sorts it by denomination, and then stores it to be given out in future withdrawals. It's like a mini circular economy right inside the machine!

"With cash recycling, ATMs can filter out deposited cash and reuse it for customers to withdraw," explains Jodi Neiding, VP of Americas Banking Portfolio at Diebold Nixdorf. "This decreases downtime, replenishment visits and in turn saves costs for banks."

The benefits are pretty impressive. These recycling ATMs can cut ownership costs by up to 20% and reduce the need for cash replenishment by as much as 75%. They also minimize the risks associated with transporting cash and lower insurance costs. Plus, your customers will love that the machine is less likely to run out of cash during busy periods.

Another cool feature? Mixed-denomination payouts. Instead of getting a stack of twenties when you withdraw $100, customers can choose their preferred bill mix. Need some fives and tens for tipping? No problem! This flexibility makes customers happier and helps maintain a balanced cash inventory inside the machine.

Environmental and economic wins behind recycling ATMs

The green benefits of these smart ATMs might surprise you!

For starters, fewer armored truck visits mean a smaller carbon footprint. Each skipped cash delivery trip keeps those heavy, gas-guzzling vehicles off the road. The machines themselves also last longer since they experience less mechanical wear from frequent cash loading.

From a business perspective, cash recycling means less money sitting idle in ATMs. Think about it – traditional ATMs are basically storage boxes filled with cash waiting to be withdrawn. Recycling ATMs put that money to work more efficiently, creating a more dynamic cash flow.

Perhaps most importantly for your customers, these machines offer dramatically improved uptime. Nothing frustrates ATM users more than the dreaded "temporarily out of service" message. By reducing cash-out situations, recycling ATMs provide more reliable service that keeps customers coming back.

These machines are especially valuable in locations where cash deposits and withdrawals happen in roughly equal amounts – think grocery stores, convenience stores, and busy retail locations.

At Merchant Payment Services, we've helped countless businesses upgrade to cash recycling ATMs, and the results speak for themselves. Our 35 years of experience means we can guide you through the entire process, from selecting the right machine to optimizing its placement for maximum efficiency. We handle the technical details so you can focus on what matters most – running your business and keeping your customers happy.

Want to learn more about how these smart machines can streamline your cash management? Check out our detailed guide on ATM cash management.

Service #6: Biometric Security, PIN Resets & Account Management

The services provided by ATM have evolved dramatically to include sophisticated security features and account management options that once required a visit to your local branch or logging into online banking.

Modern ATMs now feature cutting-edge biometric authentication that makes transactions more secure than ever. Fingerprint readers verify your unique fingerprint patterns, sometimes eliminating the need for a PIN altogether. Some advanced machines use facial recognition cameras that compare your face to stored images for contactless verification. The most sophisticated ATMs even employ iris scanning or palm vein detection, which identifies the unique pattern of blood vessels in your palm.

"We're witnessing a rise in demand for alternative authentication methods, such as biometric authentication and contactless features," notes Jodi Neiding of Diebold Nixdorf. This shift is changing ATMs from simple cash dispensers into comprehensive banking kiosks.

Beyond improved security, today's ATMs offer a surprising range of account management capabilities. Need to change your PIN? Do it instantly at the keypad without making a special trip to the bank. Want to check recent transactions? Print a mini-statement right on the spot. Some machines even allow you to apply for pre-approved loans with instant decisions, open new fixed deposits, or request a new checkbook for delivery to your home address.

Future-proof authentication at the keypad

The battle against ATM fraud never stops, which is why services provided by ATM now include remarkable security innovations. Liveness detection ensures biometric samples come from an actual person, not a photo or replica. Physical and electronic anti-skimming shields prevent criminals from installing card-reading devices that steal your information.

Behind the scenes, AI-powered fraud detection algorithms constantly monitor for unusual transaction patterns, triggering additional verification when something seems off. Privacy screens help protect your information from wandering eyes by limiting the viewing angle of the display. Some machines even employ jamming technology that disrupts unauthorized electronic devices attempting to capture your card data or PIN.

These security advancements aren't just nice-to-have features—they provide genuine peace of mind while significantly reducing fraud-related losses for banks. As cybercriminals become increasingly sophisticated, ATM technology continues to evolve to stay one step ahead of emerging threats.

At Merchant Payment Services, we take security seriously in all our ATM solutions. We ensure both businesses and their customers benefit from the latest protective technologies through regular security updates and proactive monitoring that identifies potential vulnerabilities before they can be exploited.

Frequently Asked Questions about ATM Services

What are the typical withdrawal and deposit limits at U.S. ATMs?

Wondering how much cash you can get from your local ATM? Most U.S. banks set daily withdrawal limits between $300 and $1,500, depending on your account type. If you've got a premium or high-tier account, you might enjoy higher limits—sometimes up to $2,000 or $3,000 per day.

It's worth remembering that these limits exist regardless of your account balance. Even if you've got $10,000 in your account, you can't withdraw more than your daily limit without contacting your bank for a temporary increase. This is actually for your protection, limiting potential losses if someone gets unauthorized access to your card.

For deposits, the story is a bit different. Most ATMs accept cash deposits up to $10,000 per transaction, though individual machines might have lower limits based on their capacity. Check deposits follow similar guidelines, though larger deposits might be subject to longer hold periods before the funds become available.

"Many customers don't realize that ATM limits are separate from their account balance," explains Lydia Valberg of Merchant Payment Services. "These limits are security features, not restrictions on your money access."

How can I avoid paying ATM fees every time I use one?

Nobody likes paying fees just to access their own money! Fortunately, there are several smart ways to minimize or completely avoid those pesky ATM charges:

Use in-network ATMs whenever possible. Your bank's own machines or those in its partner network typically won't charge you a penny. Most banking apps have ATM locators that can help you find the nearest fee-free option.

Choose accounts with fee reimbursement features. Some checking accounts—especially those from online banks—will refund a certain number of out-of-network ATM fees each month, giving you more flexibility.

Get cash back at the register when shopping. Many grocery stores, pharmacies, and other retailers offer free cash back with debit purchases. This essentially turns every checkout lane into a free ATM!

Plan your cash needs ahead of time. By withdrawing larger amounts less frequently, you'll minimize the number of fee-generating transactions. Just be sure to keep that cash secure!

Consider joining a credit union that participates in shared branching networks. This can give you access to thousands of surcharge-free ATMs nationwide—often more than even the biggest banks offer.

At Merchant Payment Services, we help business owners understand how strategic ATM placement can create win-win situations: customers get convenient cash access while merchants generate additional revenue through surcharge fees.

What should I do if an ATM keeps my card or dispenses the wrong cash amount?

It's a sinking feeling when an ATM swallows your card or gives you $20 instead of the $100 you requested. Don't panic—these situations happen, and there are clear steps to resolve them.

If an ATM keeps your card, contact your bank immediately. Call the number on the back of your card (which you hopefully saved somewhere else too!) to report the incident and request a replacement. While you're still at the ATM, look for any on-site branch that might be open—sometimes bank staff can retrieve your card on the spot. Always document the details including time, location, and the ATM's identification number to help with your report.

For cash discrepancies, always count your money before leaving the ATM. If you notice a problem, jot down all the transaction details including the exact time and location. Then contact the ATM operator—you'll usually find their information on the machine itself. If it's your bank's ATM, call their customer service line directly.

"Most people don't realize that ATMs keep incredibly detailed records of every transaction," notes Lydia Valberg. "These machines know exactly how much cash was dispensed, and most have cameras that can verify your claim."

You'll need to file a formal dispute with your bank, who will investigate by reviewing the ATM's transaction logs and possibly surveillance footage. While the process typically takes 7-10 business days, most legitimate disputes are resolved in the customer's favor when reported promptly.

At Merchant Payment Services, we ensure our ATM solutions include proper maintenance and monitoring to minimize these issues, providing reliable service that keeps both merchants and their customers happy.

Conclusion

The evolution of services provided by ATM has transformed these machines from simple cash dispensers into comprehensive self-service banking hubs. What began as a basic way to get cash has blossomed into a robust financial ecosystem that continues to adapt to changing consumer needs.

Modern ATMs have become financial Swiss Army knives – offering everything from biometric security to bill payments, contactless transactions to instant deposits. This remarkable evolution ensures these machines remain relevant even as digital payments gain popularity.

For business owners, ATMs represent more than just a customer convenience. They're potential profit centers that can drive foot traffic while generating surcharge revenue. With over 4 million ATMs operating globally, these machines continue to play a vital role in the financial landscape, particularly for cash-preferred customers and underbanked populations who rely on physical currency.

At Merchant Payment Services, our 35 years of experience has given us unique insight into how businesses can leverage ATM technology effectively. We've seen how a well-placed ATM can transform a business's cash flow while improving customer satisfaction. Our team handles the technical details so you can focus on running your business, not maintaining your ATM.

Whether you're considering your first ATM installation or looking to upgrade existing machines with advanced features, our friendly experts will guide you through every step. We provide access to top ATM brands, competitive processing rates, and ongoing support that ensures your ATM program delivers maximum value year after year.

The future of ATM services continues to evolve with exciting innovations in artificial intelligence, cloud integration, and improved security features. By partnering with Merchant Payment Services, you'll stay ahead of these trends while providing your customers with the financial services they need, exactly when and where they need them.

Ready to explore how an ATM can benefit your business? Contact us today to learn more about our customized solutions and find the ATM advantage for yourself. After all, in a world that's increasingly cashless, the businesses that make cash access convenient often have the competitive edge.