Ohio's Best: Credit Card Processing and Merchant Services

Understanding Credit Card Processing in Ohio: The Essentials

When you're running a small business in the Buckeye State, navigating credit card processing Ohio shouldn't feel like trying to understand a foreign language. Let me break down what you really need to know in plain English.

Here in Ohio, we have some advantages when it comes to payment processing. For starters, our state allows credit card surcharges (up to 3% thanks to Visa's cap) as long as you properly disclose them to customers. This gives you options that merchants in some other states simply don't have.

Many of my clients are pleasantly surprised to learn that local providers like Midwest Payment Processing regularly help Ohio businesses slash their processing fees by 40-50%. That's real money back in your pocket! Typically, Ohio merchants pay between 2.5-3.5% per transaction, but with the right setup, you can do significantly better.

Of course, there are still rules to follow. Credit card processing Ohio businesses must maintain PCI compliance (protecting customer data) and follow EMV standards (those chip readers aren't just for show). But don't worry – this isn't as complicated as it sounds with the right partner guiding you.

One approach that's gained tremendous popularity among my Ohio clients is implementing cash discount programs. These are completely legal alternatives to surcharges and often easier to explain to customers. With a properly structured program, you can effectively eliminate processing fees while staying fully compliant.

Despite the digital revolution, cash still plays a significant role in U.S. commerce. This means Ohio merchants need flexible solutions that work across all payment methods while keeping costs manageable. The biggest headache isn't finding available services – it's avoiding excessive fees that quietly eat away at your profits.

I've seen how small business owners from Columbus to Cleveland to Cincinnati have saved thousands annually simply by switching to Ohio-based processors who truly understand our local market. The right provider doesn't just cut costs – they ensure your customers enjoy seamless experiences whether they're shopping in-store, online, or through mobile devices.

I'm Lydia Valberg, and my family has been helping Ohio businesses with their payment processing needs for over 35 years at Merchant Payment Services. We've built our reputation on creating transparent systems that protect both you and your customers while maximizing your bottom line.

Credit Card Processing Ohio: How It Works & Why It Matters

When your customer hands over their credit card at your Ohio business, they're not just giving you a piece of plastic – they're initiating a sophisticated financial dance that happens in milliseconds. Understanding this behind-the-scenes process isn't just interesting – it's essential for making smart decisions about your payment systems.

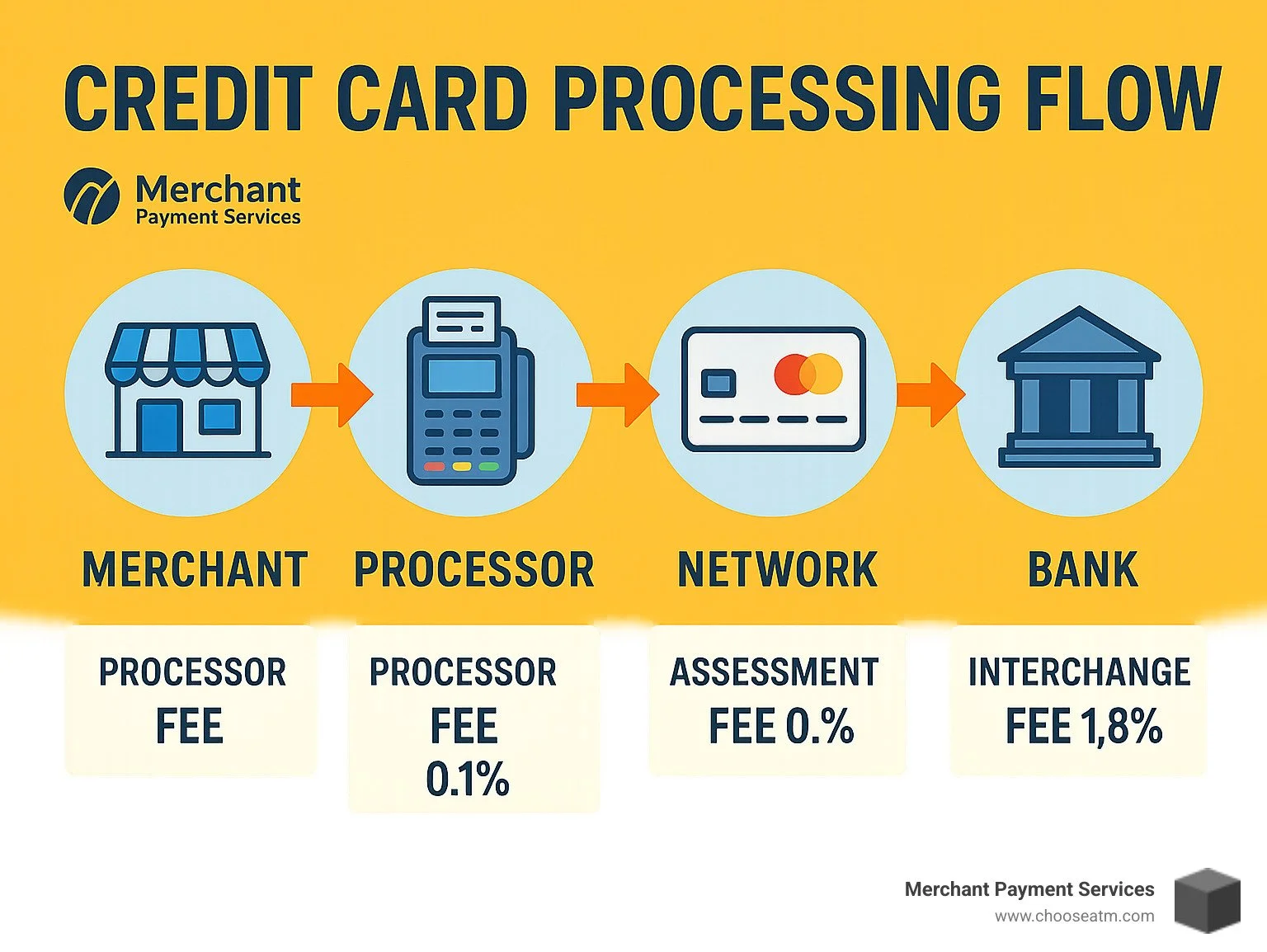

Think of a credit card transaction as a relay race with five key runners passing the baton:

Your Business (Merchant): Where the transaction begins

Acquiring Bank: Your business's bank that receives funds

Payment Processor: Handles the transaction data

Card Networks: Visa, Mastercard, Find, American Express

Issuing Bank: The customer's card-issuing bank

Let me walk you through how this relay race actually works in your Ohio shop or restaurant.

The Three-Step Money Path in Credit Card Processing Ohio

Step 1: Authorization When a customer presents their card in your Columbus coffee shop or Cleveland boutique, your terminal sends their card information to your processor. This information races through the card network to reach the issuing bank. Within seconds, the bank checks if funds are available and sends back an approval or decline. That quick "approved" message is just the beginning!

Step 2: Batching At the end of your busy day, your terminal automatically bundles all those approved transactions into a batch and sends them to your processor for settlement. This is that "batch out" process you might do at closing time. It's like packaging up all the day's sales and shipping them off for payment.

Step 3: Funding Now comes the part you've been waiting for! Your processor instructs the issuing banks to transfer funds to your acquiring bank, which then deposits the money into your merchant account. For most Ohio credit card processing relationships, this takes 1-2 business days, though some local processors offer next-day or even same-day funding.

Ben Capodagli, who runs a popular wine shop in Cincinnati, shared his experience: "The efficiency of this three-step process can make or break a small business's cash flow. When we switched processors, we not only saved on fees but also received our funds faster, which made a huge difference in our operations."

Key Players & Technology Stack for Credit Card Processing Ohio

The technology making all this possible is more complex than most merchants realize:

POS Terminals are the physical devices that read cards and process payments. Modern terminals in Ohio businesses now support chip cards, contactless payments, and even digital wallets.

Payment Gateways act as the secure bridge transmitting transaction data. Think of them as the armored cars of the digital payment world.

Processor Networks provide the infrastructure connecting Ohio merchants to banks nationwide.

Bank Sponsor Relationships involve the financial institutions that actually move the money from one account to another.

For credit card processing Ohio businesses, this technology stack must comply with national standards like PCI-DSS (Payment Card Industry Data Security Standard) and EMV (Europay, Mastercard, and Visa) chip technology. These standards aren't just fancy acronyms – they actually reduce fraud liability for your business while protecting your customers.

When comparing card transactions to cash, the differences become clear. While cash is immediate, it comes with counting errors, theft risks, and bank deposit hassles. Card payments take a small cut but offer security, convenience, and detailed reporting that helps you understand your business better. For Ohio merchants, finding the right balance between these payment methods can significantly impact your bottom line.

Ohio Fees & Cost-Saving Strategies

If you're running a business in Ohio, you're likely feeling the pinch of credit card processing fees. The typical Ohio merchant hands over between 2.5% and 3.5% of every transaction to various payment players. Let's break down where your hard-earned dollars are actually going:

The fee pie is sliced into several pieces: interchange fees (the non-negotiable 1.5-2.5% set by card networks), assessment fees (another 0.13-0.15% that networks collect), your processor's markup (their profit margin of 0.25-1.5%), and those pesky monthly fees for statements and PCI compliance.

Here's the kicker – many Ohio business owners don't even realize they're overpaying. Victoria J. Nixon from a dental association finded this firsthand: "Merchant Payment Services analyzed our transactions and eliminated a significant amount of excess billing we didn't even know we were paying."

Credit Card Processing Ohio—Top Ways to Reduce or Eliminate Fees

You don't have to accept these high costs as a necessary evil. Smart Ohio merchants are fighting back with several proven strategies.

Cash discount programs reward customers who pay with cash, essentially giving them a break on prices. Surcharging takes the opposite approach by passing credit card fees to customers who choose plastic over cash. If transparency is your goal, interchange-plus pricing shows exactly what you're paying for each component of the processing fee.

Don't overlook the power of batch optimization – simply processing transactions correctly can qualify you for lower rates. And never underestimate good old-fashioned negotiation. Regular reviews of your statements can reveal opportunities to push for better rates.

"We've helped Ohio businesses reduce their credit card processing Ohio fees by 40% to 50%," says Merchant Payment Services, which maintains an impressive client retention rate compared to the industry average.

Credit Card Processing Ohio—When Zero-Fee Really Means Zero

"If you are paying credit card fees, you are doing it wrong," declares Eli Bowman, an Ohio merchant services expert. This bold statement refers to properly implemented cash discount programs that can effectively eliminate your processing costs.

A genuine zero-fee program operates on a simple principle: your advertised prices already include a service fee (typically 3-4%), and customers paying with cash receive a discount equal to that fee. The service fee covers your credit card processing costs, meaning you keep your full advertised price regardless of payment method.

For this approach to stay on the right side of Ohio regulations:

Your receipts must clearly show both the service fee and any discount

You need visible signage explaining your pricing policy

The program must apply consistently to all customers

This isn't just clever accounting—it's a legitimate business strategy that keeps more money in your pocket. More info about How to Reduce Credit Card Processing Fees

At Merchant Payment Services, we've seen how these strategies transform Ohio businesses from fee-frustrated to financially empowered. The right approach doesn't just save money—it creates a more transparent relationship with your customers while protecting your bottom line.

Ohio Laws & Compliance Checklist

Navigating the legal landscape for credit card processing Ohio businesses can feel like walking through a maze. Let me guide you through what you need to know to stay compliant while maximizing your payment options.

Ohio merchants enjoy more flexibility than those in many other states, but there's still a framework of rules to follow:

Ohio State Law on Surcharges: Ohio allows credit card surcharges, which is good news for merchants looking to offset processing costs. Unlike some stricter states, Ohio doesn't specifically require written notice of surcharges under state law. However—and this is important—card networks still require proper disclosure regardless of what state law says.

"While you technically won't be in violation of Ohio state law if you don't post notice of the surcharge, you could be subject to penalties from the card networks," explains Matt Rej, a payment compliance expert who works with Ohio businesses.

Federal and Network Restrictions: The federal government caps credit card surcharges at 4%, but Visa tightens this further with a 3% limit on transaction amounts. These aren't just suggestions—penalties for violating Visa's rules can range from $50,000 to a whopping $1,000,000. That's definitely not a risk worth taking for any Ohio business!

Beyond surcharge rules, Ohio merchants must also maintain:

Annual PCI DSS validation (usually a self-assessment for smaller merchants)

EMV chip reader implementation (to avoid liability for counterfeit fraud)

Proper data privacy protections for all customer information

To learn more about these global security requirements, see the detailed summary of Payment Card Industry Data Security Standard (PCI DSS) on Wikipedia.

Posting Surcharges Legally in Ohio

To implement surcharges without running afoul of network rules in Ohio, follow these four key steps:

First, post clear signage at store entrances and all points of sale. Second, make sure your receipts itemize the surcharge so customers can see exactly what they're paying. Third, apply the same surcharge percentage to all credit card brands—this brand-neutral application is required by the networks. Finally, keep your surcharges at or below 3% to comply with Visa's cap, even though federal limits are slightly higher.

Debit, Gift & Loyalty Card Restrictions

Debit Cards: I can't stress this enough—surcharging debit cards is illegal nationwide under the Durbin Amendment to the Dodd-Frank Act. This applies everywhere, including Ohio. Many merchants don't realize there's this critical distinction between credit and debit cards.

Gift Cards: When offering gift cards in your Ohio business, remember these federal regulations:

Gift cards must remain valid for at least five years from issuance

You can only charge inactivity fees after 12 months without use

Most customers (71%) spend more than the card's initial value—making gift cards a smart addition to your payment options

Loyalty Programs: These programs are fantastic for building repeat business, but when collecting customer data:

Be transparent about what information you're gathering

Clearly explain how you'll use their data

Secure all information according to PCI standards

#1 In-Person Terminal Systems (Countertop & Wireless)

For brick-and-mortar Ohio businesses, in-person terminal systems remain the backbone of payment processing. Modern terminals offer:

EMV chip readers for secure transactions

Contactless payment capabilities (tap-to-pay)

Built-in receipt printers

Integration with POS systems

Tip adjustment features for service businesses

These systems can be either:

Standalone terminals: Independent devices that connect via ethernet or cellular

Integrated POS terminals: Connected to your point-of-sale system for streamlined operations

"Having the right terminal makes all the difference," says Colin from DynaPay, an Ohio payment processor. "Our clients know they can call anytime for help with payments, and having reliable equipment is essential for smooth operations."

Credit Card Processing Ohio—Retail Use Cases

Different Ohio businesses have unique terminal needs:

Quick-Serve Restaurants:

Speed is crucial—look for terminals with fast processing times

Tip options and receipt printing are essential

Contactless payment capabilities reduce wait times

Salons and Spas:

Terminals with customizable tip options (15%, 20%, 25%, custom)

Integration with appointment scheduling software

Mobile terminal options for service at different stations

Wineries and Tasting Rooms:

Terminals that work in rural areas with limited connectivity

Inventory management integration

Tab functionality for tastings and tours

Ben Kremer, an Ohio business owner, reports: "We switched to a local processor a couple of years ago and have saved thousands of dollars in processing fees. Their team helped us find the right terminal solution for our specific needs."

#2 Online Payment Gateways & E-Commerce

If your Ohio business has an online presence, you'll need a reliable payment gateway—the digital version of your in-store terminal. These gateways create the secure bridge between your website and the processing networks that make online sales possible.

Today's e-commerce payment solutions do so much more than just process transactions. They've become powerful tools that can help your business grow while keeping customer data safe.

"Online payments must be seamless yet secure," explains a payment solutions expert from the Ohio Chamber of Commerce. "Customers expect the same level of service online as they would receive in person."

Modern gateways seamlessly integrate with popular platforms like Shopify, WooCommerce, and Magento, making setup relatively painless. They also use advanced security features like tokenization, which replaces sensitive card data with unique identification symbols. This means you can offer convenient recurring billing options without storing actual card numbers.

Most Ohio merchants are surprised to learn that fraud prevention tools come built into quality gateways. These filters analyze transactions in real-time, flagging suspicious activity before it turns into a costly chargeback. And with mobile-responsive checkout pages, you won't lose sales when customers shop from their phones.

Must-Have Gateway Features for Ohio Merchants

When shopping for a credit card processing Ohio gateway solution, certain features should be non-negotiable.

Level 2/3 Data Processing might sound technical, but it's actually a money-saver. This feature captures additional transaction information for B2B sales, potentially qualifying your business for lower interchange rates. For Ohio companies that process a lot of commercial transactions, this can mean significant savings.

AVS/CVV Verification adds an extra layer of protection by checking that the billing address and security code match what's on file with the card issuer. This simple verification dramatically reduces fraud attempts and the headaches that come with chargebacks.

Real-Time Analytics give you visibility into your payment ecosystem. Instead of waiting for monthly statements, you can see transaction volumes, approval rates, and potential issues as they happen. Many Ohio merchants use these insights to spot trends and make quick adjustments to their online strategy.

For businesses with customers beyond Ohio's borders, Multi-Currency Support is essential. The ability to display prices and process payments in different currencies creates a more comfortable shopping experience for international customers.

Finally, API Flexibility ensures your payment system can grow with your business. A good gateway offers programming interfaces that allow for custom integration with your existing systems, from inventory management to customer relationship tools.

"E-commerce businesses need payment solutions that grow with them," notes a payment processing expert. "The right gateway provides security while maintaining a frictionless customer experience."

At Merchant Payment Services, we've helped countless Ohio businesses select and implement the right online payment solution for their unique needs. The perfect gateway balances security, user experience, and cost-effectiveness—three factors that directly impact your bottom line.

More info about Online Payments

#3 Mobile & Contactless Readers

Remember when taking credit cards meant being tied to a counter? Those days are long gone for Ohio businesses. Today's mobile card readers turn your smartphone or tablet into a pocket-sized payment powerhouse—perfect for when you need to meet customers wherever they are.

These handy devices have become game-changers for so many credit card processing Ohio businesses. Whether you're running curbside pickup during busy times, taking payments tableside at your restaurant, or busting lines during your shop's rush hour, mobile readers deliver serious flexibility.

What makes these readers so valuable is their surprising capability packed into such small packages. Modern mobile readers offer EMV chip reading for security, tap-to-pay options for customers using Apple Pay or Google Pay, and even work in offline mode when your connection gets spotty (we all know those cellular dead zones around Ohio!).

Many readers now support QR code payments too—a feature that skyrocketed in popularity during the pandemic and shows no signs of slowing down. And instead of wasting paper on receipts that get tossed, these systems can text or email digital receipts directly to your customers.

Field-Service & Event-Based Processing

Ohio's diverse economy thrives on businesses that aren't tied to a single location, and mobile payment processing has been for these merchants.

Farmers Markets across the state have acceptd this technology wholeheartedly. From Cleveland's West Side Market to Cincinnati's Findlay Market, local producers report 30-40% sales increases when they switch from cash-only to accepting cards. As one Athens farmer told me, "I was leaving money on the table every weekend before I got my card reader."

Food Trucks have become fixtures in Ohio's culinary scene, and mobile payment technology keeps their lines moving quickly. Whether they're parked outside Columbus breweries, serving lunch crowds in downtown Cincinnati, or catering events in Cleveland, these mobile vendors need reliable, flexible payment options.

Trade Shows and Conventions fill Ohio's event centers year-round, from the massive Columbus Convention Center to Cleveland's I-X Center. Vendors at these temporary setups need payment solutions that work immediately without complicated setup processes.

"Mobile payment technology has revolutionized how we do business," a North Market vendor in Columbus shared with me recently. "We can now accept payments anywhere, anytime, which has significantly increased our revenue."

If you're looking into mobile processing for your Ohio business, focus on finding providers offering no long-term contracts and pay-as-you-go pricing. You'll also want hardware tough enough to handle Ohio's variable weather if you're operating outdoors, along with battery life that lasts through a full market day. And remember—the best systems are the ones that don't require a tech degree to set up and use!

#4 Integrated POS & Data-Analytics Platforms

Remember when payment processing was just about swiping cards? Those days are long gone for savvy Ohio businesses. Today's integrated POS systems are like having a business consultant working 24/7, quietly collecting insights while handling payments.

Modern integrated systems bring together everything that matters to your business:

Inventory sync that automatically updates when items sell, eliminating those embarrassing "I thought we had that in stock" moments with customers. When a Columbus boutique implemented this feature, they reduced inventory discrepancies by 94%.

Accounting exports that save hours of manual data entry and reduce bookkeeping errors. QuickBooks, Xero, and other popular platforms connect seamlessly with most modern POS systems.

ERP APIs for larger Ohio businesses that need enterprise-level integration across multiple locations or departments.

Customer dashboards that track spending habits, preferences, and visit frequency – turning anonymous transactions into relationships you can nurture.

"We used to spend hours every week just trying to figure out what was selling and what wasn't," shares Maria, a Cleveland retail owner. "Now our POS system tells us exactly what's moving, when, and who's buying it. It's like having an extra employee who never sleeps."

Turning Payment Data into Actionable Intel

The gold mine in your payment system isn't just the money flowing through it – it's the data. Here's how Ohio merchants are putting that information to work:

Basket size analysis reveals surprising connections between products. A Cincinnati grocery found that customers who purchased craft beer were 73% more likely to also buy premium cheeses, leading them to create a successful cross-merchandising display.

Peak hours tracking goes beyond just knowing you're busy at lunch. Detailed analysis might show that Tuesdays from 1-3 PM bring your highest-spending customers, or that rainy Thursdays see a 40% increase in certain product categories.

Loyalty triggers help you identify the patterns that turn occasional shoppers into regulars. For a Toledo coffee shop, data showed that customers who visited three times in two weeks were 82% likely to become weekly regulars if offered a personalized incentive on their fourth visit.

"In today's data-driven world, data might as well be currency," notes a payment solutions expert. "The right analytics tools help you visualize trends, filter information, and make better business decisions."

The best part? You don't need a data science degree to benefit. Modern systems present information in clear, actionable dashboards designed for busy business owners, not analysts.

Payment solutions that partner with the Ohio Chamber of Commerce offer "real-time reporting through an online customer portal" that helps businesses track transactions and identify opportunities for growth.

At Merchant Payment Services, we've watched Ohio businesses transform their operations using these insights – often finding profit opportunities they never knew existed. The right credit card processing Ohio solution doesn't just move money; it moves your business forward.

More info about ATM Management Ohio

#5 Cash Discount & Surcharge Programs

Let's talk about something that's changing the game for credit card processing Ohio businesses—cash discount and surcharge programs. These approaches aren't just trendy; they're legitimate ways to significantly reduce or completely eliminate those pesky processing fees eating into your profits.

A cash discount program works beautifully in its simplicity:

You set your base prices including a small service fee (usually 3-4%)

Customers who choose to pay with cash receive a discount equal to that fee

The service fee covers your credit card processing costs

On the flip side, a surcharge program flips the model:

Your base prices are set without any processing fee built in

You add a surcharge only when customers pay with credit cards

This way, the customer directly covers the processing fee

Both approaches are perfectly legal in Ohio, but there are some important differences to keep in mind. Cash discount programs generally face fewer restrictions, while surcharges must be clearly disclosed to customers and capped at 3% (Visa's limit). It's also important to note that you can never apply surcharges to debit card transactions—that's illegal nationwide. Whatever pricing model you choose needs to be consistent for all customers.

Building a Legal Cash-Discount Program in Ohio

If you're considering implementing a cash discount program (and honestly, why wouldn't you?), here's how to do it right:

First, make sure your terminal settings are programmed correctly. Your payment equipment needs to properly apply and display both the service fee and cash discount. This isn't just about accounting—it's about transparency.

Staff training is absolutely crucial. Your team needs to understand how to explain the program to customers in simple, positive terms. "We offer a discount when you pay with cash" sounds much better than "We charge extra for credit cards," even if the math works out the same.

Customer communication can't be overlooked. Post clear, friendly signage explaining that all prices include a service fee and that customers receive a discount for paying with cash. Make it feel like you're offering them a deal, not penalizing a payment choice.

Finally, pay attention to receipt clarity. Your receipts should clearly itemize any service fee applied and show any discount provided. This transparency builds trust with customers and keeps you compliant.

"We will cut your credit card costs at literally ZERO cost to you," is a promise you'll hear from many Ohio payment processors. While it might sound too good to be true, properly implemented cash discount programs can indeed eliminate your processing fees by shifting them to a service fee model that rewards cash-paying customers.

The beauty of these programs is that they work for businesses of all sizes across Ohio. From the corner coffee shop in Cleveland to the boutique clothing store in Cincinnati, merchants are finding that they don't have to accept credit card fees as an unavoidable cost of doing business. With the right program in place, you can keep more of what you earn while still offering customers the convenience of card payments.

Choosing the Right Processor in Ohio

Finding the perfect partner for credit card processing Ohio can feel like searching for a needle in a haystack. With so many companies promising the moon and delivering considerably less, how do you separate the real deals from the raw deals?

Start with transparency. The best processors in Ohio don't hide their fee structures behind confusing industry jargon or vague promises. They'll clearly explain exactly what you're paying and why – typically through interchange-plus pricing rather than mysterious "qualified" and "non-qualified" tiered rates that leave you guessing.

"When we switched to a transparent pricing model, we finally understood what we were actually paying for," shares Maria, a boutique owner in Cleveland. "No more surprise fees showing up on our monthly statements."

Contract flexibility matters too. The most confident processors in our state stand behind their service without locking you into multi-year commitments. If they're truly providing value, they know you'll stay without being contractually obligated. Be wary of processors requiring long-term contracts with hefty early termination fees – they're essentially admitting they expect you to want out.

There's also something special about working with local Ohio-based processors. They understand our state's business climate, can meet face-to-face when needed, and generally provide more personalized support than faceless national corporations. Plus, they're invested in maintaining their reputation in our community.

How quickly will money reach your bank account? This funding timeline varies dramatically between processors – from same-day to several business days. For small businesses managing tight cash flows, this timing can make a significant difference in your operations.

Checklist for Vetting "Credit Card Processing Ohio" Providers

Before signing anything, run potential processors through this essential checklist:

✓ Rate Review: Will they analyze your current processing statements to show exactly where you could save? The best providers will do this free consultation without pressure.

✓ PCI Compliance: Do they offer tools and support to help you maintain compliance, or just charge fees when you fall short? Look for partners who help you succeed, not just penalize failures.

✓ Equipment Flexibility: Can you use your existing terminals or are you forced to lease/purchase proprietary hardware? Watch out for expensive terminal leases that can cost thousands more than buying outright.

✓ Future-Proofing: How do they plan to keep up with evolving payment technologies? The processor you choose should have a clear vision for incorporating emerging payment methods.

✓ Customer Support: Who exactly will you call when problems arise? Is it a dedicated representative who knows your business, or an anonymous call center? Is help available 24/7/365?

✓ Fee Transparency: Ask specifically about PCI compliance fees, statement fees, batch fees, monthly minimums, and early termination fees. Get everything in writing.

"We've been with our local processor for two years now," says Steve Silverberg, an Ohio business owner. "Their rates are fantastic, but what really sets them apart is their customer service. When I have a question, I get a real person who knows my account – not some overseas call center reading from a script."

At Merchant Payment Services, we take pride in offering Ohio businesses the transparent pricing and local support they deserve. Our family has been serving local merchants for over 35 years, and we understand the unique challenges Ohio businesses face. We complement our payment processing with innovative ATM management solutions that create additional revenue streams through surcharge opportunities – helping you turn payment processing from a necessary expense into a profit center.

More info about Best CC Processing Rates

Frequently Asked Questions about Credit Card Processing Ohio

Are credit card surcharges legal in Ohio?

Yes, credit card surcharges are completely legal in Ohio. While some states have strict bans on these fees, Ohio takes a more business-friendly approach, allowing merchants to recover their processing costs through surcharges.

That said, there are some important guardrails to keep in mind. Federal regulations cap surcharges at 4% of the transaction amount, but Visa goes a step further by limiting them to just 3%. This Visa restriction effectively becomes your ceiling in most cases.

Here's where things get interesting: Ohio state law doesn't technically require written notice of surcharges, but the card networks absolutely do. Ignoring these network requirements can be costly—as Matt Rej points out, "While you technically won't be in violation of Ohio state law if you don't post notice of the surcharge, you could be subject to penalties from the card networks." And these aren't small penalties either—Visa violations can range from $50,000 to a whopping $1,000,000!

The bottom line? Surcharges are legal in Ohio, but you need to follow the card networks' disclosure rules and keep those fees at or below 3% to stay completely in the clear.

Can I surcharge debit cards?

The short answer is no—absolutely not. Surcharging debit cards is illegal nationwide under the Durbin Amendment to the Dodd-Frank Act. This federal prohibition applies in all 50 states, including Ohio, with no exceptions.

What trips up many Ohio merchants is when customers run their debit card as "credit" (without entering a PIN). Even in these cases, it's still a debit card transaction behind the scenes, and surcharges remain illegal.

However, there's good news! Cash discount programs offer a perfectly legal alternative that works for all payment types. With this approach, you set your prices to include a service fee upfront, then offer a discount to customers who choose to pay with cash. Many of our Ohio merchants have found this to be the most customer-friendly way to address processing costs.

What certifications do I need to stay PCI compliant?

Every business that accepts credit cards—from the smallest food truck to the largest retailer—must comply with Payment Card Industry Data Security Standards (PCI DSS). But what this means for your Ohio business depends on your size and how you process payments.

For most small to medium businesses across Ohio, compliance involves:

Completing an annual Self-Assessment Questionnaire (SAQ)

Running quarterly network scans if you accept online payments

Maintaining documented security policies

Training your team on proper card data handling

I've seen too many Ohio merchants treat PCI compliance as just another box to check, but it's really about protecting both your customers and your business. As our partners at U.S. Bank Payment Solutions put it, "PCI compliance isn't just about checking a box—it's about protecting your customers and your business."

At Merchant Payment Services, we've simplified this process for hundreds of Ohio merchants. We provide straightforward guidance and practical tools to maintain compliance without unnecessary complexity or headaches. We believe security shouldn't require an IT degree to implement properly.

Conclusion

Running a business in Ohio means making smart choices about how you handle payments. With all the credit card processing Ohio options available today, it can feel overwhelming to figure out what's best for your specific situation.

From traditional countertop terminals to cutting-edge mobile solutions, from integrated POS systems to innovative cash discount programs that eliminate fees entirely—the possibilities might seem endless. But the right combination of technology, pricing structure, and support can make all the difference for your bottom line.

That's where we come in. At Merchant Payment Services, we've spent over 35 years helping Ohio businesses steer the complex world of payment processing. We're not just another faceless processor—we're your neighbors, and we understand the unique challenges facing Ohio merchants.

Our approach is refreshingly different:

We bring local expertise that understands Ohio's specific business landscape and regulations. When you call us with questions about surcharge compliance or cash discount programs, you're talking to someone who knows exactly how these rules apply in our state.

We believe in transparent pricing without the smoke and mirrors. No hidden fees, no surprise charges on your statement, and no deceptive "teaser rates" that skyrocket after a few months.

We offer innovative solutions that go beyond basic processing. Our ATM management services provide additional revenue streams through surcharge opportunities, turning a necessary business function into a profit center.

Most importantly, we provide personalized support from a team that knows your business by name. When you need help, you won't be talking to an overseas call center reading from a script—you'll be speaking with someone who understands your business and genuinely cares about your success.

"Working with a local processor who actually answers the phone when I call has been a game-changer," shares Melissa, a boutique owner in Cincinnati. "Their cash discount program saved us thousands last year alone, and they walked us through every step of implementation."

By partnering with Merchant Payment Services, you gain more than just payment processing—you get a strategic ally committed to helping your business thrive. Whether you're looking to reduce those painful processing fees, upgrade your payment technology, or add new revenue streams through ATM management, we're here to help your Ohio business succeed.

Ready to transform how your business handles payments? Contact Merchant Payment Services today to find how our solutions can boost your bottom line while creating a seamless experience for your customers. Let's put our 35 years of experience to work for you!