The Beginner's Guide to ATM First Line Maintenance

Keeping Your ATM Running Smoothly

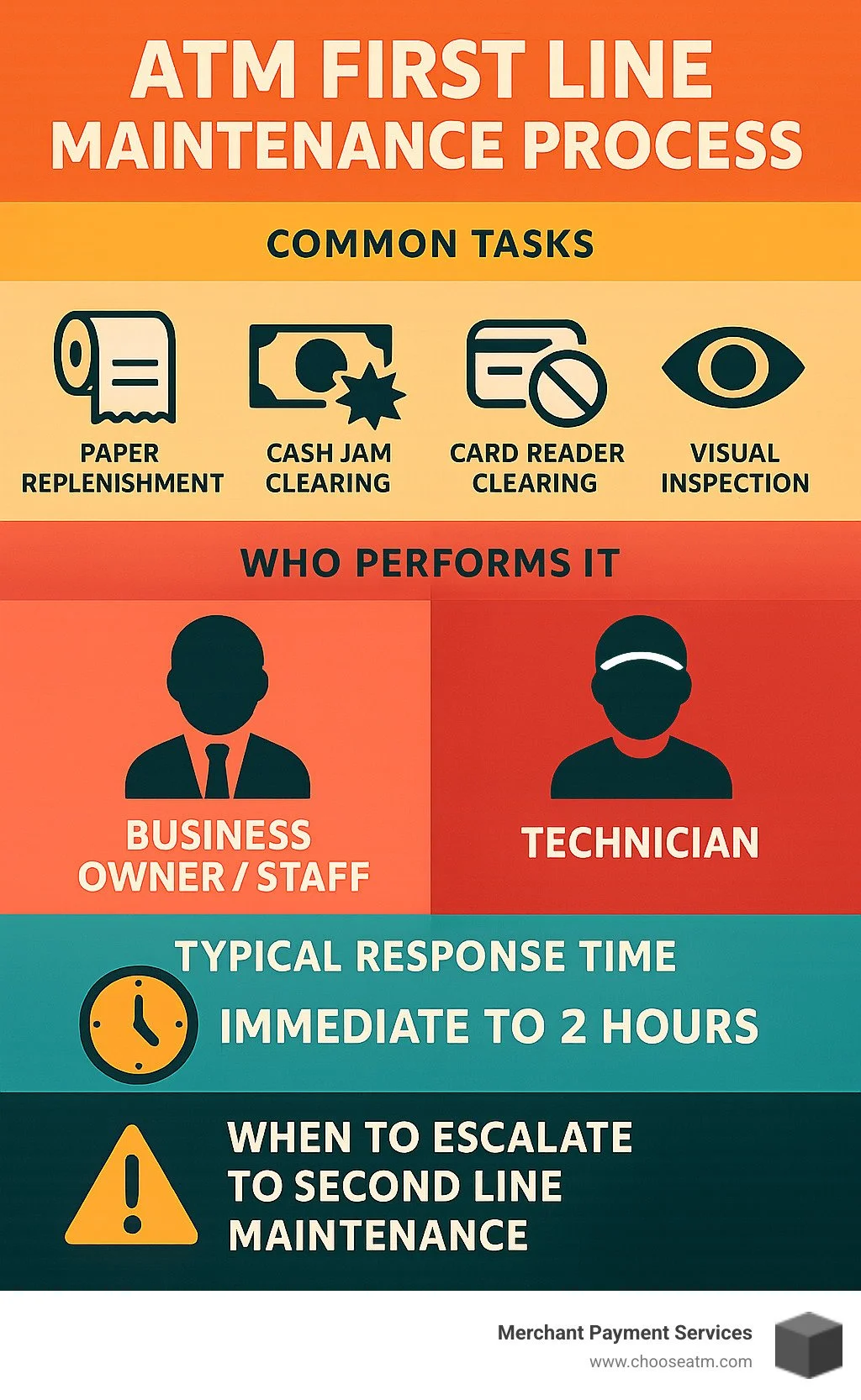

ATM first line maintenance refers to basic service tasks that don't require tools or replacement parts but are essential to keep ATMs operational. Here's what you need to know:

Definition: Basic troubleshooting and service tasks that don't require technical expertise or parts replacement

Common Tasks: Clearing jams, replenishing receipt paper, cleaning machine surfaces, checking for unauthorized devices

Response Time: Typically aims for a 2-hour average response during business hours

Who Performs It: Can be done by ATM owners, branch staff, or dedicated FLM technicians

Benefits: Resolves 60-70% of ATM downtime issues quickly without expensive service calls

When an ATM goes down, it's not just an inconvenience – it directly impacts your business revenue and customer satisfaction. Regular first line maintenance keeps your machines running smoothly, prevents unnecessary downtime, and reduces costly emergency service calls.

"Luckily, ATM machines are generally very reliable, and most breakdowns can be avoided with proper maintenance," notes industry research. The key is understanding what issues you can handle yourself versus when to call in the professionals.

I'm Lydia Valberg, co-owner of Merchant Payment Services, where I've overseen ATM first line maintenance operations for our clients' machines for over a decade, ensuring maximum uptime and customer satisfaction through proactive maintenance protocols.

What Is ATM First Line Maintenance?

ATM first line maintenance is really the backbone of keeping your cash machines up and running smoothly. Think of it as the simple fix-it tasks that don't require special tools or replacement parts but make all the difference in keeping your ATM available for customers.

In plain language, FLM covers those everyday support tasks like clearing paper jams, refilling receipt paper, and basic troubleshooting that almost anyone can handle with minimal training. These are the quick fixes that solve the most common ATM headaches before they become major problems.

The whole point of good ATM first line maintenance is maximizing uptime—keeping that machine dispensing cash and serving customers. Industry standards recognize this too, with financial service competency frameworks highlighting how proper FLM is essential for "ensuring customer service and operational efficiency." When done right, these simple maintenance steps prevent the vast majority of service interruptions.

I've seen at Merchant Payment Services how consistent first line maintenance dramatically cuts down on expensive service calls. Over our 35+ years in this business, we've fine-tuned our approach to keep machines running reliably for our clients.

Most ATM first line maintenance involves managing basic consumables that keep the machine functional. This includes keeping receipt paper stocked, replacing printer ribbons on older models, restocking envelopes for deposit ATMs, and making sure deposit slips are available. These might seem like small details, but as we often tell our clients, "Without receipt paper or a working card reader, your ATM might as well be an expensive paperweight!"

ATM First Line Maintenance Checklist

A solid ATM first line maintenance routine includes several regular checks that prevent problems before they start. Here's what we recommend to our clients:

Your daily tasks should include checking receipt paper levels (nothing frustrates customers more than completing a transaction only to get no receipt!), inspecting the ATM for any signs of tampering, wiping down exterior surfaces, verifying indicator lights are working, confirming the machine is processing transactions correctly, and emptying the reject bin if it's getting full.

When it comes to clearing jams, you'll want to know the proper techniques for different situations. For paper jams, carefully removing and reinstalling receipt paper often does the trick. Card reader jams require gentle extraction of stuck cards. Cash dispenser jams typically need cassette removal and reinsertion. And deposit-taking ATMs sometimes need special attention to clear depositor mechanisms.

Visual inspections are your first line of defense. Look for loose cables, physical damage, environmental issues like excessive heat or humidity, check that your surveillance system is working, and make sure the ATM area is clean and accessible.

As we like to tell our clients, "A clean ATM is a happy ATM." Regular cleaning not only looks better to your customers but actually prevents many mechanical issues that could leave your machine out of service.

ATM First Line Maintenance Limitations

While ATM first line maintenance is essential, it's just as important to know its boundaries. Understanding when to call in the professionals saves time and gets your machine back in service faster.

First line maintenance doesn't cover hardware replacements like swapping out card readers or cash dispensers. It doesn't include fixing software bugs or making programming changes. You won't be using specialized tools or test equipment, performing internal mechanical repairs, troubleshooting electronic components, modifying security systems, or updating operating systems.

Industry documentation makes this clear: "First Line Maintenance (FLM) calls are considered standard support tasks and do not include replacing hardware, resolving software bugs, or using advanced tools." When these more complex issues arise, it's time to escalate to second-line maintenance with qualified technicians.

At Merchant Payment Services, we help our clients understand these distinctions clearly. When something falls outside the FLM scope, our streamlined escalation process ensures your ATM gets the right level of technical attention with minimal downtime. After all, every minute your ATM is down means lost revenue and frustrated customers.

For more comprehensive information about ATM maintenance competency standards, you can refer to the Australian Government's training resources on ATM maintenance, which provides valuable insights into industry-recognized maintenance practices.

ATM First Line Maintenance vs. Second Line Maintenance

When it comes to keeping your ATMs running smoothly, understanding the difference between first and second line maintenance is absolutely essential. Think of it like the difference between basic car maintenance you might do yourself versus repairs that need a professional mechanic. Here's how they compare:

Aspect First Line Maintenance (FLM) Second Line Maintenance (SLM) Definition Basic troubleshooting without tools or parts Advanced repairs requiring tools, parts or specialized knowledge Complexity Low to moderate Moderate to high Response Time Typically 2 hours or less Usually 4-24 hours depending on contract Who Performs ATM owners, branch staff, or FLM technicians Certified technicians with specialized training Tools Required Minimal to none Specialized tools and diagnostic equipment Examples Clearing jams, replenishing paper, basic cleaning Hardware replacement, software updates, mechanical repairs Cost Lower cost, often included in basic service Higher cost, may incur additional charges Parts Needed No parts replacement May require replacement components

I've seen many business owners get confused about these distinctions, but industry documentation makes it clear: "First-line maintenance includes routine support, consumable restocking, and minor jam resolution; second-line maintenance involves replacing or repairing worn parts and updating software."

Why the Distinction Matters

Understanding the boundary between ATM first line maintenance and second line maintenance isn't just technical jargon—it directly impacts your bottom line and customer satisfaction in several important ways.

Downtime Reduction Here's something impressive we've finded at Merchant Payment Services: properly implemented FLM can resolve about 60-70% of ATM problems without waiting for a specialized technician. One of our retail clients was experiencing frequent downtime until we helped them implement proper FLM protocols—they reduced their overall ATM downtime by nearly 40%! This meant fewer frustrated customers and more transaction revenue.

SLA Tiers Your service contracts will typically specify different response times for different maintenance levels. Industry standards usually aim for ATM first line maintenance to be performed within two hours of receiving a service call, while SLM might have a much longer window. Knowing this distinction helps you set realistic expectations about when your machine will be back up and running.

Budgeting Let's talk dollars and cents—FLM is generally less expensive and often included in your basic service package. SLM, on the other hand, typically costs more because it requires specialized skills and parts. I've worked with convenience store owners who saved thousands annually by training staff to handle basic FLM tasks rather than calling for service on issues they could easily fix themselves.

As one of our technicians likes to say, "A little first-line TLC keeps the second-line calls away." At Merchant Payment Services, we help our clients develop clear maintenance strategies that maximize what can be handled through FLM, optimizing both uptime and cost-efficiency. With over 35 years in the industry, we've seen how this simple distinction can make a dramatic difference in the profitability of your ATM program.

For more comprehensive information about maintaining your machines, check out our ATM Maintenance Services Handbook, which provides detailed guidelines for both maintenance levels.

Core Tasks & Common Issues Resolved by FLM

When your ATM stops working, it's often something simple that's causing the problem. That's where ATM first line maintenance comes in – tackling those everyday issues that can shut down your machine but don't require complex repairs or replacement parts.

Paper jams in the receipt printer happen all the time and can completely disable an ATM. Our technicians are experts at carefully removing jammed paper without damaging any components, then properly reloading fresh paper to get things running again. It's a simple fix that makes a big difference to your customers.

Cash jams are another headache we regularly handle. Bills can get stuck in the dispenser, especially if they're worn, folded, or loaded incorrectly. Our FLM process includes safely accessing the dispenser, clearing the jam, and making sure the currency cassettes are properly seated to prevent it from happening again.

Ever had a customer call about their card being captured? It happens when security protocols activate or there's a mechanical hiccup. Our team can safely retrieve these cards and reset the card reader, always following proper financial regulations for documentation. We know how important this is for your customers!

Running out of receipt paper might seem minor, but it can stop transactions in their tracks. Regular paper checks and timely replacement keep your ATM running smoothly. Our technicians are also trained to clean dust and debris from ATM sensors – another simple task that prevents unnecessary downtime.

We don't just look at the machine itself. Environmental checks are part of thorough ATM first line maintenance, including inspecting for water leaks, excessive heat, dust, or other factors that could affect operation. As one service guide puts it, "policing the machine area for debris" is essential preventive maintenance.

With fraud concerns on the rise, our technicians always check for unauthorized devices like card skimmers or cameras during maintenance visits. This security check protects both your customers and your business reputation.

Step-by-step Paper-Jam Fix

Paper jams frustrate customers and shut down ATMs, but they're usually pretty straightforward to fix with proper ATM first line maintenance. Here's our tried-and-true approach:

First, we properly access the receipt printer by opening the upper cabinet or service panel following security protocols. The printer assembly is typically near the top of the ATM, and we carefully release any locking mechanisms to get to it.

Next comes the delicate part – removing the jammed paper. We gently pull the printer assembly forward and carefully remove visible jammed paper, always pulling in the direction of the paper path to avoid tears. We're meticulous about checking for tiny paper fragments that might be hiding, and we never use sharp objects that could damage the print head.

Before reloading, we inspect the printer mechanism thoroughly. This means checking the print head and rollers for obstructions, ensuring sensors are clean, and verifying the print head moves freely. These small details prevent repeat jams.

Reloading properly is crucial. We'll install a fresh paper roll that unrolls from the bottom, thread it correctly through the path and rollers, and leave a small amount extending from the printer. As our maintenance team likes to say, "The key to successful paper jam clearing is gentle handling and proper paper loading. Rushing this process often leads to repeat jams or printer damage."

Finally, we test and reset everything – closing the printer assembly, securing locks, performing a test print, clearing error messages, and returning the ATM to service mode. It's a simple process that keeps your customers happy and your ATM running.

Quick Cash-Jam Clearance

When money gets stuck, you need it fixed fast and securely. Our ATM first line maintenance team follows these proven steps for resolving cash jams:

Security comes first – we always follow proper protocols to access the ATM vault, documenting the opening according to security procedures. Whenever possible, we have a second authorized person present for dual control.

We carefully slide out the cash dispensing module and inspect the cassettes. By pressing the release lever, we can access and remove the affected cassette, checking for visible jams in both the cassette interface and dispenser path. This methodical approach helps us spot the problem quickly.

Clearing the jam requires a gentle touch. We carefully remove jammed currency without forcing or tearing the bills, then thoroughly inspect the pick rollers and stacker area for additional notes. The reject bin gets checked too – you'd be surprised how often notes end up there!

One of our most effective techniques is to fan and inspect the notes. We remove the currency stack from the cassette, fan the bills to ensure they're not stuck together, and remove any folded, torn, or damaged bills. This extra step ensures consistent quality and prevents future jams.

Before finishing, we properly reload the currency with approximately a ½ inch gap on the pusher plate (a tip straight from maintenance documentation), reinsert the cassette, lock it securely, return the dispenser module to position, and perform a dispense test. At Merchant Payment Services, we've learned that proper cash handling during loading prevents the majority of cash jams our clients experience.

Need help with your ATM maintenance? Check out our comprehensive ATM Troubleshooting Guide for more solutions to common problems.

Service Levels, SLAs & Best Practices for High Uptime

When it comes to keeping your ATMs running smoothly, having a clear service level agreement (SLA) for ATM first line maintenance isn't just paperwork—it's your uptime insurance policy. In our experience at Merchant Payment Services, the industry gold standard is a two-hour average response time for FLM calls during regular business hours.

A well-crafted SLA doesn't need to be complicated, but it should cover all your bases. You'll want clearly defined response times so you know exactly when help will arrive after you report an issue. Resolution targets tell you how quickly you can expect your ATM to be back in business. Your SLA should also spell out coverage hours—because let's face it, ATM issues don't always happen between 9 and 5.

"Having a solid SLA in place is like having a roadmap for when things go wrong," says our service team leader. "It removes the guesswork and frustration for everyone involved."

Good SLAs also include straightforward escalation procedures. Think of this as your "Plan B" when an issue turns out to be bigger than expected. We've found that clear performance metrics and thorough reporting requirements keep everyone accountable and help prevent future problems.

The ATM maintenance world has come a long way from just sending a technician when something breaks. Today's remote triage capabilities mean many issues can be diagnosed—and sometimes even fixed—without anyone physically visiting your machine. This means less downtime and happier customers.

The real game-changer has been predictive monitoring. As one industry leader notes, "More than 150,000 devices are connected to Diebold Nixdorf's AllConnect Data Engine for proactive maintenance and monitoring." This technology is like having a crystal ball that tells you when parts might fail before they actually do.

At Merchant Payment Services, we're big believers in regular preventive maintenance visits. These scheduled check-ups are like dental cleanings for your ATM—addressing small issues before they become big, expensive problems that leave your customers staring at an "Out of Order" sign.

Building a Rock-Solid FLM SLA

Creating an SLA for ATM first line maintenance that actually works for your business isn't rocket science, but it does require attention to a few key details:

First, be crystal clear about your coverage hours. When can you expect that two-hour response time? A typical SLA breaks this down into primary coverage (business hours), extended coverage (evenings and weekends), and after-hours emergency service. This clarity helps set realistic expectations—both for you and your service provider.

Most standard SLAs include language like: "Technicians aim to maintain a monthly aggregate average response time for First Line Maintenance within two (2) hours of receiving a service call during primary coverage hours." That's service-speak for "we'll be there within two hours during regular business hours."

Every good SLA needs a clear escalation path. This is the "what happens next" plan when a problem turns out to be more complex than expected. At Merchant Payment Services, our escalation process is simple: our FLM technician assesses the situation, determines if it needs to be kicked upstairs, hands it off to our second-line team if necessary, and keeps tracking the issue until it's resolved.

To make sure you're getting what you pay for, your SLA should include measurable performance indicators. We typically track average response time, first-time fix rate (because nobody wants repeat visits for the same problem), and mean time to repair. We also monitor ATM availability percentage—because at the end of the day, what matters most is how often your machine is actually working for your customers.

We've found that working with clients to develop custom SLAs that balance response time needs with budget constraints leads to the best outcomes for everyone involved.

Proactive vs. Reactive FLM

The old way of handling ATM first line maintenance was pretty straightforward: wait for something to break, then fix it. This reactive approach is simple but comes with a major downside—every problem means downtime for your ATM and potentially frustrated customers.

The reactive maintenance cycle is all too familiar: Your ATM stops working, someone reports the issue (often an unhappy customer), a technician is dispatched, and eventually, the machine gets fixed. Meanwhile, you're losing transactions and potentially damaging customer relationships.

"The difference between reactive and proactive maintenance is like the difference between waiting for your car to break down on the highway versus getting regular oil changes," explains one of our senior technicians. "One approach is always more expensive and disruptive in the long run."

Today's smart approach is proactive maintenance, which uses technology to stay ahead of problems. Modern ATMs are constantly sending data about their performance and condition. Our monitoring systems analyze this information to spot patterns that might indicate a developing issue. When certain thresholds are reached—like a receipt printer starting to show signs of strain—we can dispatch a technician before the machine fails completely.

As industry research confirms, "Shifting the paradigm from reactive to a truly predictive service model" is now possible thanks to IoT, machine learning, and AI technologies that trigger maintenance before incidents occur.

At Merchant Payment Services, our remote monitoring keeps an eye on critical factors like cash levels, receipt paper status, successful transaction rates, card reader performance, and even environmental conditions like temperature and humidity. This approach lets us address many issues during off-hours or scheduled maintenance windows, significantly reducing unexpected downtime.

The result? Higher ATM availability, happier customers, and fewer emergency service calls. That's a win for everyone—especially your bottom line.

Skills, Tools & Safety for FLM Technicians

When it comes to ATM first line maintenance, it's not just about knowing what to do—it's about having the right skills and tools to do it safely and effectively. Think of FLM technicians as the first responders of the ATM world, needing to be prepared for whatever they might encounter.

At the foundation, technicians need a solid understanding of basic electronics. This isn't about being an electrical engineer, but rather knowing enough to work safely with electronic components without causing damage or creating hazards. When our technicians at Merchant Payment Services approach an ATM, they're equipped with this fundamental knowledge that helps them recognize connection issues, understand power requirements, and spot potential electrical problems before they become dangerous.

Cash handling is another critical skill—and one that comes with serious responsibility. ATM first line maintenance often involves accessing areas where currency is stored, requiring strict adherence to security protocols. Our technicians follow detailed procedures for handling cash, documenting every interaction, and maintaining accountability throughout the maintenance process.

Safety always comes first in this line of work. The proper use of personal protective equipment (PPE) isn't optional—it's essential. This includes using anti-static wrist straps when working with sensitive electronic components to prevent damage from static electricity, wearing gloves when handling cash or mechanical parts, and using eye protection when cleaning with compressed air. These simple precautions prevent both injuries and equipment damage.

In today's connected world, mobile diagnostic tools have revolutionized how we approach ATM first line maintenance. Our technicians use specialized apps that guide them through diagnostic procedures step-by-step, ensuring consistency and thoroughness. These digital tools also streamline documentation, making reporting more accurate and efficient.

Every good technician knows you're only as good as your toolkit. For effective FLM, this typically includes sealed receipt paper rolls (to prevent dust contamination), anti-static cleaning wipes for safe surface cleaning, compressed air canisters for removing dust from hard-to-reach spots, basic hand tools like screwdrivers and pliers, a reliable flashlight or headlamp for seeing inside dark machine compartments, documentation materials, and proper security access devices. At Merchant Payment Services, we've carefully curated our technicians' toolkits based on years of field experience, ensuring they have everything needed to resolve issues quickly and safely.

Training & Certification Pathways

Becoming proficient in ATM first line maintenance doesn't happen overnight. There are several paths to developing the necessary expertise, and the best technicians often combine multiple approaches.

Many learn through hands-on, on-the-job training under the guidance of seasoned professionals. There's simply no substitute for real-world experience handling common troubleshooting scenarios, learning machine-specific procedures, following security protocols, and completing required documentation. This apprenticeship model has proven extremely effective in our industry.

For more structured learning, Original Equipment Manufacturers (OEMs) offer specialized training courses for their specific ATM models. These programs dive deep into model-specific maintenance procedures, highlight common failure points and their solutions, teach proper use of diagnostic tools, and guide technicians through the software interfaces used for maintenance functions. We regularly send our team members to these manufacturer-specific courses to ensure they're up-to-date on the latest equipment.

The industry also has formal competency standards, such as the FNSRTS307A unit ("Maintain Automatic Teller Machine services"), which defines the specific skills and knowledge required for FLM in financial services. These standards cover everything from restocking and servicing ATMs to properly replenishing and balancing cash while maintaining security.

Given the sensitive nature of ATM work, background checks are standard practice before anyone can become an FLM technician. This typically includes criminal background checks, credit history verification, employment history verification, and drug screening. At Merchant Payment Services, we take these security measures seriously—our clients trust us with their machines and their customers' financial security, and we honor that trust through thorough vetting of all our technicians.

Security & Compliance Checkpoints

When performing ATM first line maintenance, security isn't just important—it's paramount. Every procedure must adhere to strict protocols that protect both the physical security of the machine and compliance with industry regulations.

Whenever possible, we implement dual control—having two authorized individuals present during maintenance that involves accessing secure areas of the ATM. This "four eyes" principle isn't just about preventing theft; it's also about reducing procedural errors and providing verification for sensitive operations. Two people seeing the same process creates accountability and accuracy.

Detailed audit logs are non-negotiable in our industry. Every maintenance action must be thoroughly documented, including the date and time of service, reason for maintenance, specific actions performed, any parts or consumables used, technician identification, and the before-and-after status of the machine. These records serve both security purposes and regulatory compliance requirements, creating a paper trail that can be audited if questions arise later.

The Americans with Disabilities Act (ADA) establishes specific accessibility requirements for ATMs, and checking compliance is an important part of maintenance. Our technicians verify voice guidance functionality, appropriate button height and spacing, proper Braille instructions, screen visibility, and physical accessibility during their visits. These checks ensure that ATMs remain accessible to all customers.

The Payment Card Industry Data Security Standard (PCI DSS) includes specific requirements that impact ATM maintenance as well. These include proper handling of customer data, secure access to ATM components, protection against unauthorized device installation, and regular inspection for tampering or skimming devices. "Check for unauthorized devices on and around the ATM fascia" isn't just a suggestion—it's a standard part of our first line maintenance procedures.

At Merchant Payment Services, we've developed comprehensive security protocols for all maintenance activities over our 35+ years in the industry. These protocols ensure both the physical security of the machines and the protection of sensitive customer information. We understand that an ATM isn't just a cash dispenser—it's a critical access point to the financial system that requires the highest levels of security and compliance.

Outsourcing FLM & Cost Impact for Financial Institutions

Let's face it – maintaining your ATM fleet can quickly become a full-time job. That's why many financial institutions and businesses are finding that outsourcing ATM first line maintenance just makes good financial sense.

When we talk with our clients at Merchant Payment Services, we often hear the same concerns: "Is it worth paying someone else to handle maintenance we could potentially do ourselves?" The answer is almost always yes, and here's why.

The labor savings alone can be substantial. Training your own staff to properly maintain ATMs takes time and resources that could be better spent on your core business. As one industry study bluntly puts it, "Managing first-line and second-line maintenance in-house quickly becomes too resource-intensive," especially as you add more machines to your network.

One of the biggest advantages we've seen for our clients is fleet scalability. Whether you have one ATM or fifty, a professional FLM service can provide consistent quality across all locations. This becomes particularly valuable when you're expanding to new locations – you don't have to worry about training new maintenance staff at each site.

The real financial magic happens in what we call the uptime ROI. Every minute your ATM sits out of service, you're losing potential transaction revenue and possibly frustrating customers. Professional maintenance teams typically respond faster, fix problems right the first time, and even prevent issues before they happen. We've seen businesses increase their ATM availability by up to 20% simply by switching to professional maintenance.

Working with a vendor-neutral partner like Merchant Payment Services offers unique benefits, especially if you operate ATMs from different manufacturers. "A vendor-agnostic platform can integrate best-in-class security protocols dynamically," notes one industry source, rather than being locked into one manufacturer's proprietary solutions.

Perhaps most exciting is how modern FLM providers use data to predict problems before they happen. This predictive approach means fewer emergency service calls (which are always more expensive) and less revenue lost to unexpected downtime. Our clients typically see a 15-20% reduction in overall maintenance costs when they switch from in-house to our professional services.

Choosing a Vendor-Neutral Partner

When selecting an ATM first line maintenance partner, vendor neutrality should be high on your priority list. Here's why it matters so much:

Vendor lock-in is a real problem in the ATM world. When you're tied to a single manufacturer's maintenance program, you often end up paying premium prices with little room to negotiate. As one research report candidly states, "Vendor lock-in not only raises costs but also stifles innovation and hides strategic performance data."

A good vendor-neutral partner gives you the freedom to choose the best hardware for your needs, implement the most effective solutions, and maintain flexibility as your business grows. You're not stuck with proprietary service restrictions that can box you in.

This becomes especially important for businesses with multi-brand ATM fleets. Instead of juggling relationships with three different service providers for three different ATM brands, a vendor-neutral partner provides consistent service across your entire fleet. This unified approach makes everything simpler – from placing service requests to managing contracts and reviewing performance reports.

The best vendor-neutral providers also offer comprehensive analytics dashboards that work across all your machines. At Merchant Payment Services, our clients particularly value seeing their entire ATM network on a single screen, regardless of manufacturer. These tools provide real-time status updates, performance trends, and predictive maintenance alerts that help prevent problems before they impact customers.

Our vendor-neutral approach means we service any ATM brand with equal expertise, giving our clients maximum flexibility while maintaining consistent service quality. It's about making your life easier while keeping your ATMs running smoothly.

Total Cost of Ownership Snapshot

When considering the true financial impact of ATM first line maintenance, you need to look beyond just the service call costs. Here's a more complete picture of what affects your bottom line:

Downtime Costs hit harder than most people realize. Every hour your ATM sits out of service represents lost transaction fees, reduced cash withdrawal volume, and potentially frustrated customers who might think twice before using your ATM again. Good FLM dramatically reduces these hidden costs by keeping your machines up and running.

Managing a Parts Inventory is another often-overlooked expense. Keeping receipt paper, cleaning supplies, and other consumables on hand requires both storage space and someone to track inventory levels. Professional FLM services typically handle this for you, eliminating both the capital investment and the management headache.

Smart Cash Forecasting is a benefit many businesses don't expect from their maintenance provider. Advanced FLM services can help optimize cash levels in your ATMs, reducing both excess cash holdings (improving your capital efficiency) and emergency cash replenishment costs. As one industry expert notes, "Real-time cash flow analytics reduces idle cash and emergency refills," directly improving your operational efficiency.

Staff Training Costs add up quickly. ATM technology changes constantly, requiring ongoing training to keep in-house maintenance staff current. Outsourcing eliminates these training expenses while ensuring you have access to continuously updated expertise.

Staying on top of Regulatory Compliance is another challenge that professional FLM providers handle for you. They stay current with changing requirements, reducing your compliance risks and potential penalties.

At Merchant Payment Services, we help our clients analyze their total cost of ownership and develop maintenance strategies that make financial sense. Our experience shows that a well-structured FLM program typically reduces total ownership costs by 15-25% compared to reactive, in-house approaches. That's real money back in your business.

Frequently Asked Questions about ATM First Line Maintenance

How fast should a technician arrive for FLM?

When your ATM goes down, every minute counts. That's why industry standards typically target a two-hour average response time for ATM first line maintenance during regular business hours.

"We aim to have a technician on-site within two hours of receiving your service call," is what you'll hear from most reputable service providers. But let's be realistic - this is an average target, not an ironclad guarantee for every single service call.

Response times naturally vary based on several factors. If your ATM is located in downtown Chicago, you might see faster response times than if it's in rural Montana. Weather conditions (think snowstorms or hurricanes), time of day, and technician availability all play a role in actual response times.

At Merchant Payment Services, we understand that ATM downtime directly impacts your bottom line. That's why we've built our service network to exceed industry standards whenever possible. Your customers expect your ATM to work - and so do you.

What's excluded from ATM First Line Maintenance?

Understanding what's not covered by ATM first line maintenance helps set proper expectations and ensures faster resolution when bigger issues arise.

Think of FLM as the "no tools, no parts" level of service. If the fix requires replacing hardware components, addressing software bugs, or using specialized technical tools, you're looking at second-line maintenance territory.

Also outside the FLM scope are security system modifications, electrical work beyond the machine itself, and structural repairs to the ATM cabinet or housing. As one service manual clearly states, "Lock installation, key combination changes, and additional keys" don't fall under first-line service either.

I once had a client who was frustrated that an FLM technician couldn't resolve their issue, not realizing the problem required replacing the card reader - a second-line task. By understanding these boundaries upfront, you'll know exactly when to expect a quick fix versus when more specialized help is needed.

Can on-site staff perform routine FLM?

Absolutely! With proper training, your own staff can handle many routine ATM first line maintenance tasks, often resolving issues before they impact customers.

This approach offers several real advantages. When a receipt paper jam happens, having someone on-site who can fix it immediately means your ATM is back in service in minutes instead of hours. This not only improves customer experience but also reduces service call costs.

Your staff can easily manage tasks like:

Replenishing receipt paper before it runs out

Clearing simple jams in the receipt printer or card reader

Performing basic cleaning to prevent buildup that causes malfunctions

Conducting visual security inspections to spot potential tampering

Rebooting the ATM when simple software hiccups occur

However, proper training is essential. Anyone handling these tasks needs to understand security protocols, proper cash handling procedures, basic troubleshooting steps, and when to call in the professionals.

At Merchant Payment Services, we've found that a hybrid approach works best for most businesses. We offer training programs that empower your staff to handle those quick, simple fixes while providing professional backup for more complex issues. This gives you the best of both worlds - immediate response capability with professional support when you need it.

Conclusion

ATM first line maintenance isn't just a technical necessity—it's the heartbeat of a successful ATM operation. When done right, it keeps your machines humming, your customers happy, and your revenue flowing without interruption.

At Merchant Payment Services, we've been in the trenches of ATM maintenance for over 35 years. What we've learned is crystal clear: a well-structured FLM program can quickly resolve 60-70% of ATM issues without expensive service calls. That's money back in your pocket and fewer headaches for you and your customers.

Think of FLM as preventive medicine for your ATM. Those simple, consistent actions—checking paper levels, clearing jams promptly, wiping down surfaces, and keeping a watchful eye for security issues—add up to a machine that just works when people need it.

"An ounce of prevention is worth a pound of cure" has never been more true than with ATM maintenance. Every minute spent on proactive care saves hours of downtime and frustration later.

The maintenance landscape is changing too. We're moving beyond the "fix it when it breaks" model toward something smarter—predictive maintenance that uses real-time data to spot potential issues before they cause problems. It's like having a check engine light for your ATM, and it's revolutionizing how we keep machines running.

Merchant Payment Services stands ready as your single US-based source for no-hassle ATM ownership and dependable maintenance. We're not just service providers—we're partners invested in your success. Our goal is simple: maximize your return while ensuring your machines stay up and running whenever your customers need cash.

Remember this: a well-maintained ATM does more than dispense cash—it builds trust. Every time a customer completes a successful transaction, it reinforces their confidence in your business. That trust translates directly to loyalty and repeat business.

The path to ATM reliability isn't complicated, but it does require commitment. Invest in proper maintenance today, and you'll enjoy the rewards of increased uptime, happier customers, and healthier profits for years to come.

Ready to take your ATM maintenance to the next level? Contact Merchant Payment Services today to learn how our solutions can transform your ATM operations from a source of stress to a reliable revenue generator.