Unlocking Passive Income: Cincinnati's Best Kept Secrets

Building Wealth While You Sleep: Cincinnati's Passive Income Potential

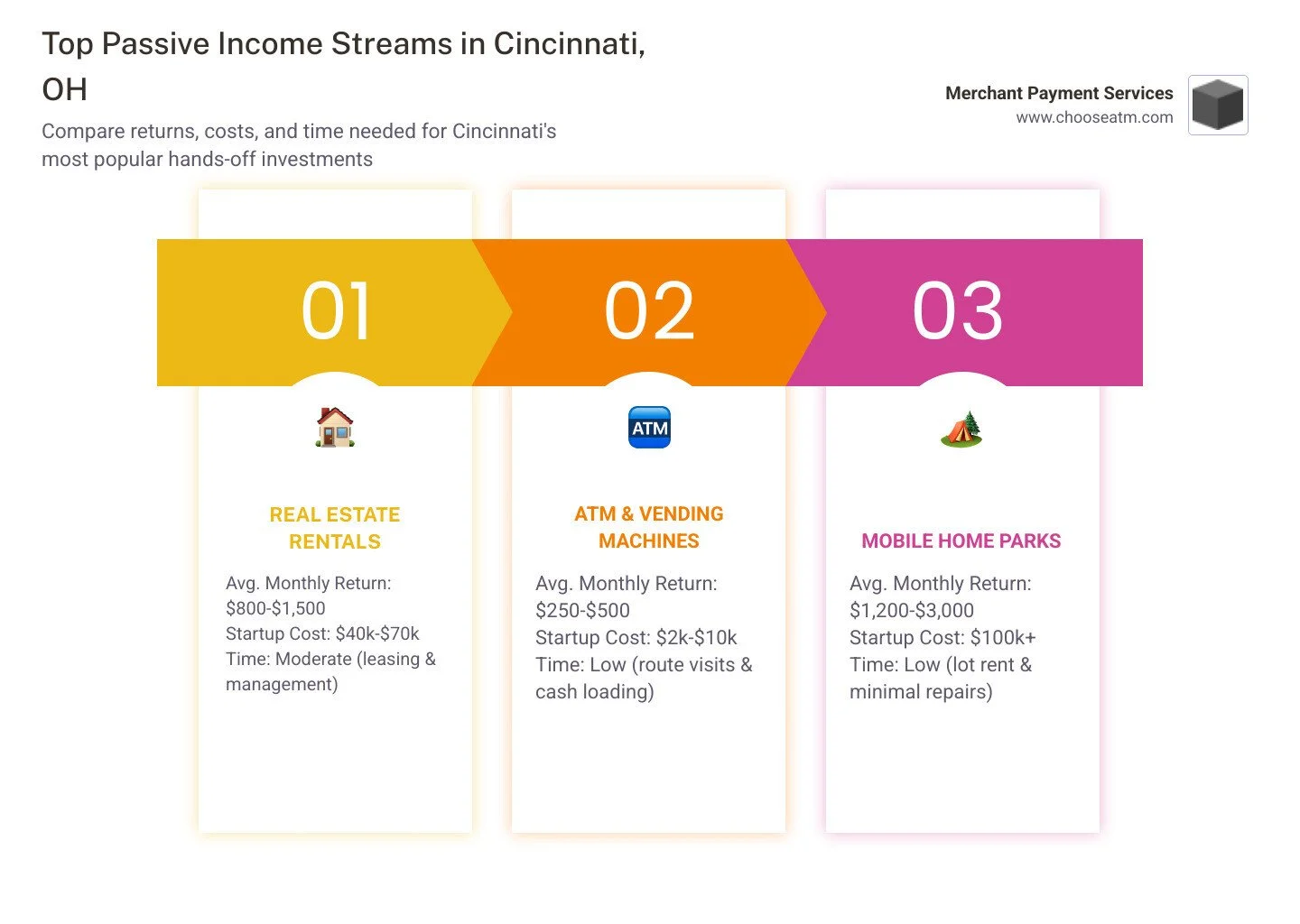

Passive income Cincinnati OH opportunities are abundant for investors looking to generate recurring revenue with minimal day-to-day involvement. Here are the top ways to create passive income streams in the Queen City:

Real Estate Investments: Long-term rentals, vacation properties, and house hacking in neighborhoods like Hyde Park and Northside

Turnkey Properties: Fully managed rental properties requiring no landlord responsibilities

Automated Businesses: ATMs, vending machines, and collectible toy dispensers

Mobile Home Parks: Low-maintenance investments with steady lot rent income

Commercial Properties: Multi-unit buildings and flex spaces with business tenants

Cincinnati's combination of affordability, stable population, and diverse economy creates an ideal environment for passive income generation. The city's median home prices remain below national averages, while rental demand stays consistently strong due to the presence of major universities and growing employment sectors.

For busy professionals or high-net-worth individuals seeking hands-off investment opportunities, Cincinnati offers multiple pathways to create mailbox money – income that arrives regularly without your daily attention. Local operators provide turnkey solutions across various sectors, from property management to automated retail.

I'm Lydia Valberg, co-owner of Merchant Payment Services, where we've helped Cincinnati business owners establish passive income streams through ATM placement for over 35 years, providing passive income Cincinnati OH solutions that increase foot traffic while generating surcharge revenue.

Passive income Cincinnati OH: Why the Queen City Is Ripe for Cash Flow

There's something special happening in Cincinnati that smart investors are noticing. While many Midwestern cities watch their populations dwindle, Cincinnati stands strong with a stable community and growing pockets of young professionals putting down roots. This stability isn't just good news for the city – it's fantastic news for your investment portfolio.

The numbers tell a compelling story. Cincinnati's cost of living sits about 8% below the national average, but the real eye-opener? Housing costs are nearly 25% lower than national medians. For investors like you and me, this creates a perfect scenario: affordable properties to purchase with rental rates that still deliver healthy cash flow.

As a local turnkey real estate provider perfectly summed it up: "Our economy is diverse, our population is stable, and your dollar can go a long way here." This diversity spans healthcare, education, finance, and manufacturing – creating a recession-resistant environment that doesn't live and die by a single industry's fortunes.

Ohio's landlord-friendly laws are another reason Passive income Cincinnati OH opportunities shine. The balanced regulations protect your interests as a property owner while ensuring fair treatment for tenants. This legal landscape helps you avoid many of the headaches investors face in states with more tenant-favored laws.

Cincinnati's educational ecosystem creates a perpetual stream of potential renters. With major institutions like the University of Cincinnati, Xavier University, and Cincinnati State, there's always demand from students, faculty, and staff looking for quality housing. This institutional presence provides a reliable tenant base, especially for properties near campus areas.

Getting started with Passive income Cincinnati OH

Ready to jump into Cincinnati's passive income opportunities? You're entering at a great time. The median home price hovers around $230,000 (as of 2023), making those first investment properties much more accessible than in coastal markets where you might need twice that amount just to get started.

Before making your first move, consider this practical first-deal checklist that local real estate mentor Steve Wagoner recommends:

Build a separate emergency fund that won't touch your investment capital

Be honest about your risk tolerance and available time commitment

Research specific neighborhoods (not just the city as a whole)

Assemble your professional team, especially a real estate agent who understands investment properties

Start simple – perhaps with a single-family home or duplex to learn the ropes

"Focus on the fundamentals!" is the battle cry from Cincinnati investment groups. The math needs to work – your rental income should comfortably cover all costs with enough buffer for those inevitable vacancies and maintenance surprises.

Most successful Cincinnati investors suggest starting with at least $30,000-$50,000 for your first property with a conventional mortgage. But don't let that number discourage you if you're not quite there. Creative financing approaches, finding the right partner, or exploring automated businesses like ATMs can significantly lower that entry barrier.

The beauty of Passive income Cincinnati OH opportunities is their accessibility – whether you're a local resident or an out-of-state investor looking for markets with strong fundamentals. Cincinnati's combination of affordability, job growth, and landlord-friendly laws creates the perfect environment for building your passive income empire, one cash-flowing asset at a time.

Residential Real Estate: Long-Term Leases & House Hacking

When it comes to building Passive income Cincinnati OH, long-term residential rentals remain the bread and butter for local investors. Cincinnati's diverse neighborhoods offer something for every investment strategy, with reliable tenant pools and reasonable acquisition costs.

Hyde Park stands out as a premium rental market, attracting professionals who value its tree-lined streets and proximity to downtown. These tenants typically have solid incomes and are willing to pay higher rents for well-maintained properties with character. Meanwhile, Northside offers a completely different vibe with its artistic community and eclectic charm. Property prices here tend to be more accessible, yet rental demand stays strong thanks to creative professionals and service industry workers who love the neighborhood's unique energy.

House hacking has become something of a local sensation in neighborhoods like Clifton, Pleasant Ridge, and College Hill. This clever strategy lets you live in one unit of a multi-family property while renting out the others – essentially having your tenants pay your mortgage!

"I bought a duplex in Pleasant Ridge for $275,000 using an FHA loan with just 3.5% down," shares Cincinnati investor Mark T. with a smile. "I live upstairs and rent the lower unit for $1,200 a month, which covers about 80% of my mortgage. I'm basically living for $300 monthly while building equity. It's like getting paid to own my home!"

Another avenue worth exploring is Section 8 housing. The Cincinnati Metropolitan Housing Authority runs this program, which guarantees a portion of rent payments for qualifying low-income tenants. Yes, there's additional paperwork and inspections involved, but many Cincinnati landlords appreciate the predictable payment schedule and reduced vacancy concerns. For investors seeking truly Passive income Cincinnati OH opportunities, Section 8 properties can provide steady cash flow with minimal payment headaches.

Expected returns & risks

One of Cincinnati's biggest draws for real estate investors is the attractive cap rates, typically ranging between 6-8%. This significantly outperforms coastal markets where cap rates often squeeze below 4%, making our Queen City a cash flow paradise by comparison.

"You can still find properties in Cincinnati that follow the 1% rule – where monthly rent equals 1% of the purchase price," explains a veteran local property manager. "Look in emerging neighborhoods like Westwood and Price Hill. That kind of return is becoming unicorn-rare in many American cities."

Of course, every investment comes with risks that need managing:

Plan for at least one month of vacancy each year (even in hot rental markets)

Set aside 5-10% of gross rents for ongoing maintenance and repairs

Reserve another 5-10% for major capital expenditures like roof replacements

Budget for property management fees (typically 8-10% of monthly rent) if you won't self-manage

The power of leverage remains one of real estate's greatest advantages for Cincinnati investors. With conventional loans requiring 20-25% down, you can control substantial assets while using other people's money. Even better, as inflation marches forward, it gradually erodes the real value of your fixed-rate debt while your property value and rental income typically increase over time.

For busy professionals looking to build wealth while maintaining their day jobs, Cincinnati's residential rental market offers that rare combination of affordability, stability, and genuine cash flow potential that's becoming increasingly difficult to find elsewhere.

Short-Term & Vacation Rentals on the Riverfront

Cincinnati's revitalized riverfront districts have become a goldmine for short-term rental investors. The Banks and nearby Newport on the Levee (just across the river in Kentucky) buzz with tourists year-round, drawn by Bengals and Reds games, riverfront festivals, and Cincinnati's growing reputation as a weekend getaway destination.

Over-the-Rhine (OTR) tells one of Cincinnati's most remarkable change stories. Once considered a troubled neighborhood, OTR now boasts some of the city's hottest restaurants, craft breweries, and entertainment venues. The gorgeous historic architecture has been lovingly restored, creating perfect spaces for vacation rentals that command impressive nightly rates.

"My one-bedroom loft in OTR brings in about $2,800 monthly in gross revenue," shares Cincinnati investor Sarah K. with a smile. "That's nearly double what I'd collect from a long-term tenant, even after accounting for the higher vacancy and management expenses."

If you're considering the short-term rental market in Cincinnati, be aware of the regulatory landscape. Since 2019, the city requires permits for non-owner-occupied short-term rentals, with regulations covering registration fees, safety inspections, and occupancy tax collection. Don't let this discourage you though – many local property management companies specialize in vacation rentals and can handle these compliance details seamlessly.

Diversifying your Passive income Cincinnati OH portfolio

Like many Midwestern cities, Cincinnati experiences seasonal fluctuations in tourism. Smart investors have developed creative approaches to maintain profitability throughout the year:

Dynamic pricing software has become essential for Cincinnati vacation rental owners. These tools automatically adjust your nightly rates based on local demand, major events, and booking patterns – maximizing your revenue during Bengals games while keeping rooms filled during quieter periods.

Business traveler targeting provides stability during weekday and off-season periods. Properties located near major employers like Procter & Gamble, Kroger headquarters, and Cincinnati Children's Hospital can attract corporate guests who appreciate the homey feel of a rental over a hotel room.

Flexible rental strategies allow savvy investors to adapt to seasonal patterns. Some owners use 6-month leases during the slower winter months, then switch back to nightly rentals when tourism picks up in spring and summer.

Setting up a short-term rental requires more upfront investment than a traditional lease. Cincinnati investors typically spend between $5,000-$15,000 furnishing and equipping a one-bedroom vacation rental. The good news? These costs can be depreciated for tax purposes, and quality furnishings directly contribute to better guest reviews and higher nightly rates.

"I've found that diversification across both short and long-term rentals gives my Passive income Cincinnati OH portfolio the perfect balance," explains veteran investor Robert M. "My long-term properties deliver that steady, predictable monthly income, while my vacation rentals bring in higher cash flow – albeit with more ups and downs. Together, they create a really solid approach to building wealth in Cincinnati real estate."

Turnkey Properties & Passive Syndications

Looking for a truly hands-off way to build Passive income Cincinnati OH? Cincinnati's turnkey property market might be your perfect match. These investments let you enjoy the benefits of real estate ownership without the midnight maintenance calls or tenant headaches.

Turnkey investing in Cincinnati works beautifully for busy professionals. Specialized local companies do all the heavy lifting—they find promising properties, renovate them to rental-ready condition, place quality tenants, and then sell these income-producing assets to investors like you. The best part? They continue managing everything afterward.

"Turnkey real estate investing is hassle-free investing where you leverage the expertise of a proven real estate company," as one Cincinnati-based provider puts it. "Investors receive monthly cash flow without needing to learn the real estate business themselves."

Think of it as having your own real estate business without actually running it. You own the asset, collect the checks, and build equity while someone else handles the day-to-day operations. For doctors, executives, and other time-strapped professionals, this approach creates genuine Passive income Cincinnati OH opportunities that fit into already demanding schedules.

Private lending has also gained serious traction in Cincinnati's investment community. Instead of owning property directly, you can lend capital to experienced local real estate operators for their acquisition and renovation projects. Your loan is secured by the property itself—creating a safer investment with typically 8-12% fixed returns over 6-24 month terms. This creates predictable passive income without any landlord responsibilities whatsoever.

If you've reached accredited investor status (meeting specific income or net worth requirements), Cincinnati offers excellent real estate syndication opportunities. These investments pool capital from multiple investors to purchase larger properties like apartment complexes or commercial buildings. Several Cincinnati syndicators specialize in "value-add" multifamily projects—they buy underperforming properties, improve them substantially, then increase both rental income and property value.

As one Cincinnati syndication company eloquently states: "We help busy professionals like you create passive income and wealth like the 1% so you can free up your time, upgrade your lifestyle, and create generational wealth for your loved ones."

Many Cincinnati investors start with a single turnkey property to get comfortable with the process, then gradually expand their portfolio across different property types and investment structures. This diversification creates multiple streams of Passive income Cincinnati OH while spreading risk across different asset classes and neighborhoods.

The beauty of these passive approaches is their scalability—you can start with a relatively modest investment and systematically build toward complete financial independence through regular cash flow. Many Cincinnati investors eventually reach a tipping point where their passive income exceeds their active income, creating genuine freedom to work because they want to, not because they have to.

Still wondering if turnkey investing might be right for you? The team at Ohio Turnkey offers comprehensive resources about this approach, including expected returns in the Cincinnati market and common pitfalls to avoid.

Automated Cash Businesses: Vending Machines & ATMs

Looking beyond real estate, Cincinnati offers some truly exciting "set it and forget it" business opportunities that can pad your bank account while you focus on other priorities. These automated cash businesses have become a favorite among locals seeking Passive income Cincinnati OH without the headaches of tenant calls at midnight.

Believe it or not, collectible toy vending machines have emerged as a surprisingly profitable niche in Cincinnati. One recent business listing revealed a collectible toy vending route generating a steady $54,000 yearly revenue with monthly cash flow exceeding $4,500. The profit margins? Impressively high.

"Want a business that practically runs itself?" the listing asks. And honestly, who doesn't? These collectible toy vending businesses thrive by establishing high-traffic routes with minimal operating costs, offering plenty of room to grow.

The secret sauce for vending success in Cincinnati comes down to location, location, location—securing spots with the right demographic foot traffic makes all the difference. Smart operators keep costs low through efficient route planning, stock products with healthy margins, and implement simple systems to manage inventory and maintenance without consuming their weekends.

ATM placement represents another compelling Passive income Cincinnati OH opportunity that we know quite well at Merchant Payment Services. We've helped hundreds of Cincinnati business owners establish steady income streams through strategic ATM ownership and placement. These machines generate revenue through surcharge fees every time someone needs cash—and in Cincinnati's vibrant entertainment districts, that happens quite frequently!

"ATMs create a win-win situation," explains our co-founder. "Business owners receive a share of surcharge revenue while seeing increased foot traffic and higher sales. Customers typically spend 20-25% more when they have cash in hand—something every shop owner appreciates."

A well-placed ATM in Cincinnati can generate $300-$600 monthly in surcharge revenue while demanding just 1-2 hours of monthly attention. With our turnkey program, we handle the complicated parts—installation, processing, and technical support—turning this into truly passive income for busy professionals.

Best ATM Machine for Small Business

Finding the best ATM machine for small business success in Cincinnati boils down to a few critical factors that can make or break your passive income dreams.

Location selection truly makes all the difference. High-traffic areas with limited banking options deliver the highest transaction volumes—think convenience stores, the busy nightlife in OTR district, The Banks entertainment area, and neighborhood business districts like Clifton and Hyde Park. These spots offer prime placement opportunities where cash-hungry customers regularly need access to funds.

Cash replenishment represents the main ongoing task for ATM owners. At Merchant Payment Services, we offer cash loading services for owners who prefer a completely hands-off approach. Many Cincinnati business owners handle this simple task themselves, typically spending just 15-20 minutes refilling cash 2-4 times monthly, depending on how popular their machine becomes.

Remote monitoring technology has been a game-changer for ATM management. Today's smart machines include real-time monitoring capabilities that send alerts about cash levels, technical hiccups, or security concerns directly to your phone. This technology minimizes unexpected downtime and keeps the passive income flowing consistently.

With Merchant Payment Services' turnkey ATM program, Cincinnati business owners receive everything needed for success: leading ATM brands with cutting-edge technology, professional installation with training, transaction processing, technical support, marketing materials, and ongoing maintenance.

"Our ATM has become a valuable passive income source," shares Cincinnati convenience store owner James L. "It generates about $450 monthly in surcharge revenue while bringing in customers who typically purchase additional items. The machine practically pays for itself while requiring minimal attention."

For more details on establishing your own ATM income stream, check out our resources on ATM Business Opportunities, ATM Business Cash Flow, and Best ATM Machine for Small Business. ATMs represent just one of many potential side hustle ideas that creative Cincinnati entrepreneurs are leveraging for financial freedom.

Mobile Home Parks, Parking Spaces & Commercial Assets

Mobile home parks represent an often-overlooked passive income Cincinnati OH opportunity that many investors simply walk right past. But here's the thing - they offer some truly compelling advantages that smart investors are quietly capitalizing on.

Unlike traditional rental properties where you're constantly fixing toilets and replacing carpets, mobile home park investors typically own only the land and infrastructure while residents own and maintain their homes themselves. This creates a beautiful hands-off situation for investors.

"Mobile home park investments in Cincinnati and Northern Kentucky offer low overhead and stable monthly lot rent," notes a local real estate advisor with a smile. "Since residents typically own and maintain their homes, this sector provides a reasonably easy way to earn passive income without those midnight maintenance calls."

The ownership structure creates several wonderful benefits for investors. You'll enjoy lower maintenance responsibilities and costs since residents handle their own home repairs. Tenant turnover stays remarkably low because, let's face it, moving a mobile home is expensive and complicated. This translates to consistent lot rent with minimal vacancy periods. Plus, there are plenty of opportunities to boost value through simple infrastructure improvements.

Cincinnati's surrounding communities like Fairfield, Hamilton, and Northern Kentucky contain numerous mobile home parks with potential. Investors consistently report capitalization rates of 7-10%, significantly higher than many other real estate sectors where competition has squeezed margins thin.

Parking spaces offer another wonderfully low-maintenance passive income Cincinnati OH opportunity, particularly near Cincinnati's downtown, hospital districts, and university areas where parking remains about as scarce as common sense at a football tailgate. Creative entrepreneurs have purchased or leased parking lots, then rented spaces on monthly contracts to nearby businesses, students, or downtown workers.

One Cincinnati investor, David R., shared his success story: "I lease a 20-space lot near UC's campus for $2,000 monthly, then rent individual spaces to students for $125-$150 each. After expenses, I clear about $1,000 monthly with almost no maintenance or management requirements. The students are happy, I'm happy, and my only real job is depositing checks."

Commercial flex spaces and warehouses have gained tremendous popularity among Cincinnati passive income investors looking to diversify beyond residential properties. These versatile properties accommodate various business types while typically requiring less intensive management than residential properties. The best part? Tenants often sign longer leases (3-5 years) and handle more maintenance responsibilities themselves.

A local commercial broker explains it well: "Commercial multi-unit acquisitions face less fierce competition than residential properties in Cincinnati. They often provide more stable, long-term cash flow once leased to quality tenants. Plus, you're dealing with business owners who understand the importance of maintaining their space properly."

Queen City Investment Group, founded in 2023, focuses specifically on "Multi-Family & Flex Space Investments" in Cincinnati, highlighting the growing interest in these commercial passive income vehicles that combine reasonable entry points with solid cash flow potential.

For investors seeking truly passive income sources in Cincinnati, these alternative real estate options offer compelling advantages worth exploring - particularly when paired with other passive strategies like generating a passive income through real estate or ATM placement through providers like Merchant Payment Services.

Legal, Tax & Team-Building Essentials

Getting your legal and tax foundation right is like building a house on solid ground – it makes everything else more secure. For Passive income Cincinnati OH investors, this means making smart choices about how you structure and protect your investments.

Most folks I talk to in Cincinnati choose one of these legal structures for their passive income ventures:

Structure Liability Protection Tax Treatment Formation Complexity Sole Proprietorship None Pass-through Simple LLC Strong Pass-through Moderate Partnership Limited Pass-through Moderate S-Corporation Strong Pass-through with potential tax advantages Complex

LLCs are the clear favorite among Cincinnati investors, and it's easy to see why. They give you solid protection for your personal assets, pass-through taxation (so you avoid double taxation), and they're relatively straightforward to set up. At just $99 to file in Ohio, it's an affordable way to protect yourself.

"I tell all my clients that an LLC is like building a fence between your personal life and your business," says a Cincinnati attorney who specializes in real estate. "If something goes wrong with a tenant or property, that fence keeps your personal assets safe."

Each type of passive income in Cincinnati comes with its own set of rules to follow:

If you're a residential landlord, you'll need to understand Ohio's landlord-tenant laws and register with Cincinnati's rental property registry. Short-term rental owners need specific permits and must collect the right taxes from guests. ATM owners have financial regulations to follow, while vending machine operators need proper business licenses.

The tax advantages for real estate investors can be substantial. Depreciation deductions can shelter a good chunk of your rental income from taxes. Your mortgage interest and property taxes are deductible, lowering your overall tax bill. And when you're ready to sell, 1031 exchanges can help you defer capital gains taxes if you reinvest in another property.

Building a reliable team is where the "passive" in passive income really comes into play. Cincinnati has plenty of professionals who can help:

Property managers who handle the 2 AM maintenance calls so you don't have to. Investment-focused real estate agents who know which neighborhoods offer the best returns. Attorneys who can guide you through Cincinnati's landlord-tenant laws. Accountants who understand investment tax strategies. And perhaps most valuable of all – mentors who've already succeeded in the Cincinnati market.

"The best money I ever spent wasn't on a property – it was on coffee with someone who'd been investing in Cincinnati for 20 years," shares Maria T., a new investor. "They steered me away from a neighborhood that looked good on paper but had serious issues only locals would know about."

At Merchant Payment Services, we've seen how having the right team makes ATM ownership truly passive. While the machines generate steady cash flow through surcharge revenue, having experts handle installation, maintenance, and technical support means owners can focus on other priorities while the income flows in.

Truly passive income doesn't happen by accident – it's the result of intentional planning, proper legal structures, and building relationships with professionals who can handle the day-to-day details while you enjoy the benefits.

Frequently Asked Questions about Passive income Cincinnati OH

How much capital do I need to start?

The beauty of Cincinnati's investment landscape is its accessibility at various budget levels. Your starting capital needs really depend on which Passive income Cincinnati OH strategy catches your eye:

For residential real estate, expect to set aside $20,000-$50,000 to cover your down payment and necessary reserves when using conventional financing. If you're open to house hacking (living in one unit while renting others), FHA loans can dramatically lower this entry point with down payments as low as 3.5%.

Turnkey properties offer a truly hands-off approach but typically require $30,000-$75,000 upfront for a down payment on a property that's already renovated and occupied by tenants.

Looking for something more affordable? ATM ownership through Merchant Payment Services starts at just $2,500-$8,000 per machine including purchase and professional installation. Similarly, vending machines can get you started in the $5,000-$15,000 range for a small route of 5-10 machines.

For those with a bit more capital, private lending opportunities usually begin at $25,000-$50,000, while real estate syndications typically maintain the same minimum for accredited investors.

"Start where you can, but start," as Cincinnati real estate mentor Steve Wagoner often tells his clients. "Many successful investors began with a single property or machine and reinvested profits to build substantial passive income portfolios over time."

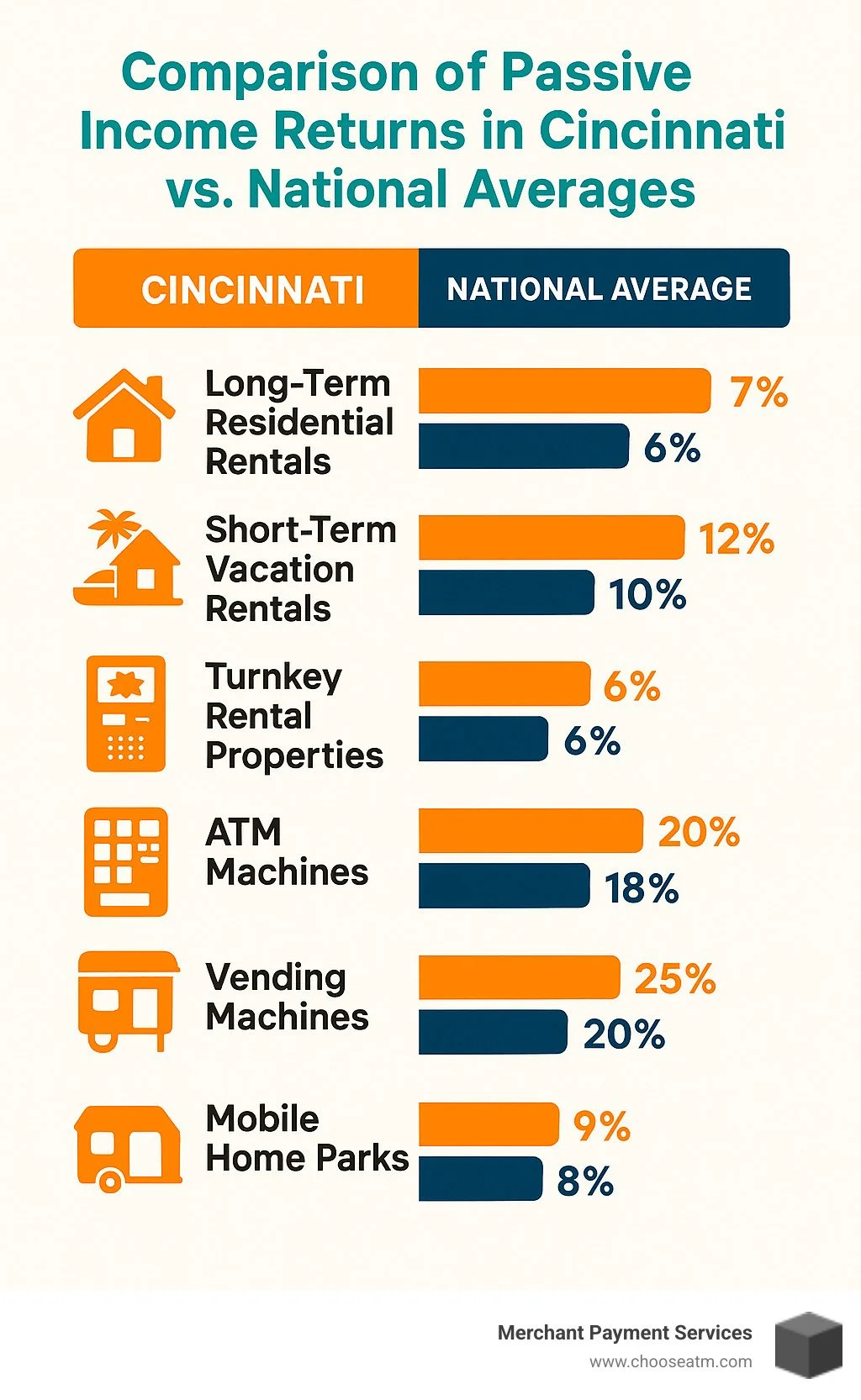

What returns can I realistically expect?

Cincinnati shines when it comes to investment returns, particularly compared to overheated coastal markets. Here's what you can realistically expect:

Traditional long-term rentals typically deliver 6-8% cap rates, though your cash-on-cash returns can jump to 10-15% when you leverage financing wisely. Short-term vacation rentals push those returns even higher—often 10-15% cap rates—though they do require more active management.

Passive income Cincinnati OH opportunities beyond real estate can be even more lucrative. Well-placed ATM machines often generate 15-25% annual returns on investment, while strategic vending machine routes can deliver an impressive 20-35% annual return for attentive operators.

Mobile home parks remain a hidden gem in Cincinnati's investment landscape, offering 7-10% cap rates with relatively low management headaches. Meanwhile, private lending provides predictable 8-12% fixed returns on short-term real estate loans.

What makes Cincinnati special is its sweet spot of reasonable property prices combined with healthy rental rates. As one local turnkey provider puts it: "This balance creates cash flow opportunities that have disappeared in many coastal markets."

How can busy professionals stay hands-off?

If you're juggling a demanding career or family responsibilities, you'll be happy to know Cincinnati offers several truly hands-off investment approaches.

Professional property management companies transform real estate ownership from a part-time job into a genuinely passive investment. For typically 8-10% of gross rents, they handle everything from tenant screening to maintenance calls. Meanwhile, turnkey providers take this convenience even further by delivering fully renovated, tenant-occupied properties with management already in place.

For business-minded investors, ATM placement services like those from Merchant Payment Services handle all the technical aspects—installation, processing, and maintenance—requiring only occasional cash replenishment (which can also be outsourced if you prefer complete hands-off ownership).

Similarly, vending route operators can manage inventory, collections, and maintenance for either a share of revenue or a flat fee, turning a potentially time-consuming business into a true passive income stream.

For those with larger amounts to invest, real estate syndications pool your capital with other investors for projects managed by experienced operators. Your involvement ends after the initial investment, making this perhaps the most hands-off approach of all.

"The key is knowing yourself," shares a Cincinnati investor who balances a medical practice with her real estate portfolio. "Even 'passive' investments need some oversight, but with the right partners, you can build significant wealth while spending just a few hours monthly on your investments."

Local investors working with experienced Cincinnati real estate mentors have reported growing their rental property values by 30% over several years through strategic improvements and effective management—all while maintaining their day jobs and family lives.

Conclusion

Cincinnati offers a perfect storm for passive income investors – a blend of affordability, stable economy, and diverse investment pathways that you simply won't find in many larger markets. The Queen City's unique advantages make it possible for both beginners and experienced investors to build meaningful wealth without the daily grind.

I've seen the most successful passive income Cincinnati OH investors take a thoughtful approach to diversification. Rather than putting all their eggs in one basket, they create a balanced portfolio that might include a rental property in Northside, an ATM at a local convenience store, and perhaps a private lending arrangement with a trusted developer. This mix provides protection when one sector faces challenges while allowing you to capitalize on varying return profiles.

Remember though – even "passive" income requires active due diligence upfront. Take time to walk neighborhoods before investing, verify those promising financial projections against reality, physically inspect any property or equipment, and surround yourself with trustworthy local experts who understand Cincinnati's unique market dynamics.

For those intrigued by the ATM opportunity we've discussed, we at Merchant Payment Services have spent over three decades helping Cincinnati business owners transform unused floor space into reliable monthly income. Our turnkey ATM solutions handle the complex parts so you can focus on simply collecting your surcharge revenue. Many of our clients are surprised by how little time their ATM actually requires once properly set up.

Your journey toward financial freedom through passive income begins with that crucial first step – acquiring an asset that generates cash while you sleep. Cincinnati's reasonable property values, landlord-friendly laws, and growing economic sectors make that initial investment more accessible than in many other cities. Whether you have $5,000 or $500,000 to invest, there's a passive income Cincinnati OH strategy that aligns with your resources.

The strategies we've explored throughout this guide aren't just theoretical – they're being implemented successfully by everyday Cincinnatians right now. By applying these principles and partnering with experienced local professionals, you can build wealth that continues working for you whether you're at your day job, enjoying time with family, or literally sleeping.

Your path to mailbox money starts today. What will your first Cincinnati passive income investment be?