Navigating the Maze of Merchant Fees: A How-To

Understanding the True Cost of Credit Card Processing

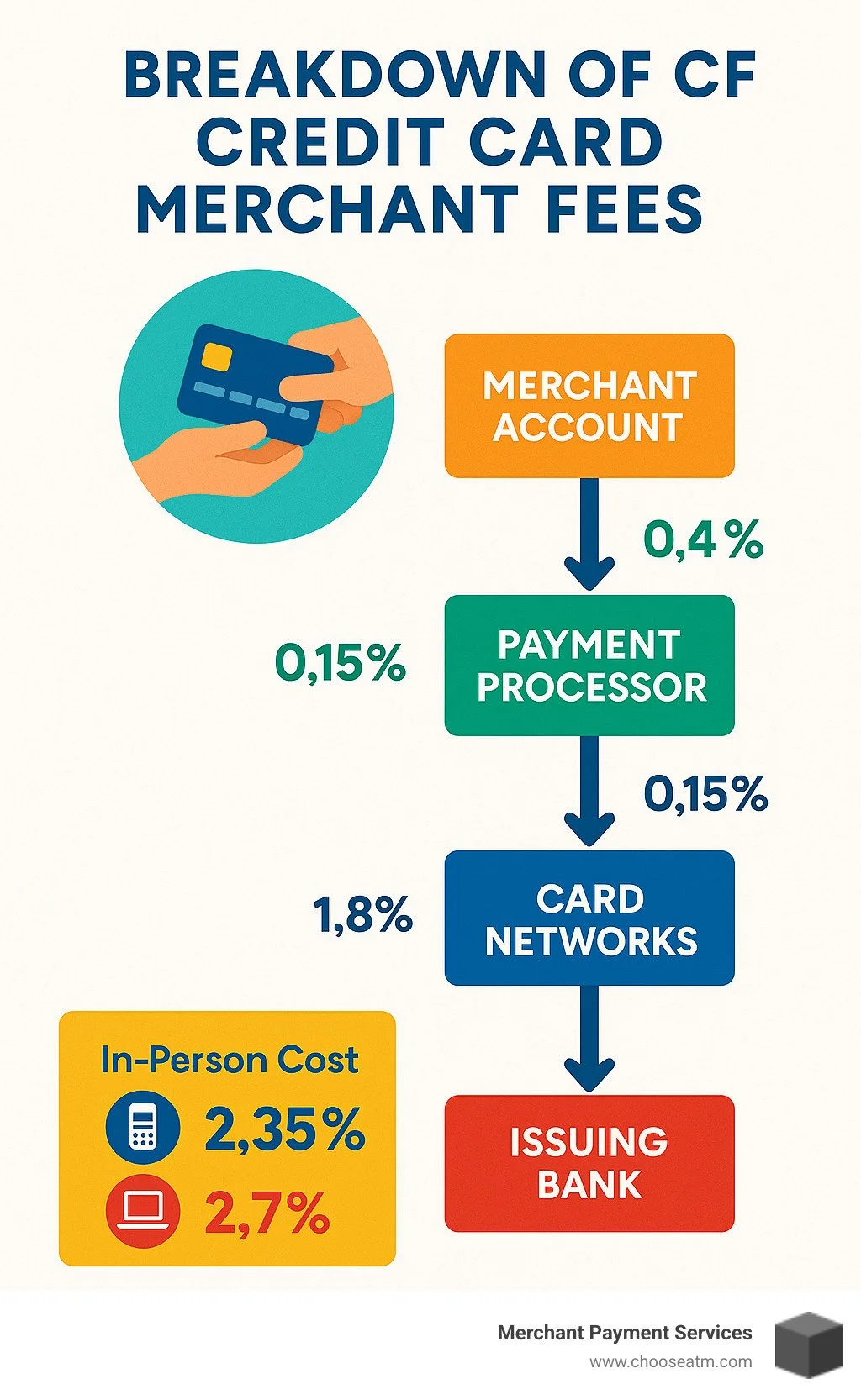

Credit card merchant fees typically range from 1.5% to 3.5% of each transaction total, with the average U.S. merchant paying about 2.24% per swipe. These fees represent a significant business expense, with American merchants collectively paying over $135.75 billion annually to process credit card payments.

CC Merchant Fee Component Typical Range What It Covers Interchange Fees 1.10% - 3.15% Paid to card-issuing banks Assessment Fees 0.13% - 0.17% Paid to card networks Processor Markup 0.25% - 0.75% Paid to payment processor

Behind every swipe, tap, or online payment lies a complex ecosystem of fees that can significantly impact your bottom line. As a small business owner, you're likely familiar with the frustration of watching a portion of each sale disappear to processing charges. What many merchants don't realize is that these fees aren't fixed—they can be negotiated, reduced, and sometimes even passed on to customers.

The complexity of cc merchant fees often leaves business owners paying more than necessary. With different pricing models (flat-rate, tiered, interchange-plus, and subscription), various card types (each with their own rates), and processing methods (in-person vs. online) all affecting what you pay, it's no wonder many merchants feel lost in the fee maze.

Card-present transactions (in-store) generally cost less than card-not-present transactions (online or phone orders), with average rates of 1.98% vs. 2.52% respectively. This difference reflects the higher fraud risk associated with transactions where the physical card isn't presented.

I'm Lydia Valberg, Co-Owner of Merchant Payment Services, where I've spent over a decade helping business owners steer the complexities of cc merchant fees and implement strategies to minimize their impact on profit margins. My family's 35-year history in merchant services has given me unique insight into how these fees work and the most effective ways to manage them.

CC Merchant Fees 101

Every time a customer swipes, dips, or taps their card, your business pays a price. These cc merchant fees are the unavoidable costs of accepting card payments, silently deducted before the money ever reaches your bank account.

If you've ever squinted at your processing statement wondering where your money went, you're not alone. Think of these fees like a three-layer cake that everyone wants a slice of:

Interchange fees: The bottom (and biggest) layer, typically gobbling up 70-80% of your total fees. This money goes straight to the customer's card-issuing bank, like Chase or Capital One.

Assessment fees: The middle layer, paid to card networks like Visa and Mastercard for using their payment highways.

Processor markup: The top layer, which your payment processor takes for handling all the transaction logistics.

Here's a sobering thought: U.S. families spent an average of $1,102 just on credit and debit card swipe fees in 2023. Those costs don't disappear – they get baked into prices that everyone pays, even cash customers.

Why CC Merchant Fees Exist

"Why on earth are these fees so high?" It's a question I hear almost daily from frustrated business owners. There are legitimate reasons behind the charges:

Risk coverage is a big one – when a customer disputes a charge or commits fraud, the card issuer takes the financial hit. The processing infrastructure that enables those instant approvals costs billions to maintain. And those rewards programs your customers love? Those airline miles and cash-back perks are largely funded by merchant fees. Finally, let's be honest – bank revenue is a factor, as interchange fees represent a significant income stream for issuing banks.

As Maria, a local boutique owner, told me recently, "I used to just accept credit card fees as the cost of doing business. But once I understood the system, I found ways to trim thousands from my annual processing costs."

Real-World Math of CC Merchant Fees

Let's make this concrete with a simple example. When a customer makes a $100 purchase using a credit card at the average processing rate of 2.24%:

Your total fee is $2.24, leaving you with $97.76 in your pocket.

But here's where it gets interesting – how the customer pays makes a big difference:

In-Person Transaction (Card Present)

Visa will cost you about 1.79% + $0.08 = $1.87

Mastercard runs higher at 1.98% + $0.08 = $2.06

American Express takes the biggest bite at 2.68% + $0.08 = $2.76

Find (formerly Find) charges around 2.05% + $0.08 = $2.13

Online Transaction (Card Not Present)

Visa jumps to 2.43% + $0.25 = $2.68

Mastercard increases to 2.51% + $0.25 = $2.76

American Express climbs to 3.18% + $0.25 = $3.43

Find rises to 2.40% + $0.25 = $2.65

The difference might seem small per transaction, but it adds up quickly. For a business processing $500,000 annually, shifting just 20% of transactions from online to in-store could put over $1,000 back in your pocket each year.

Understanding these fee structures is your first step toward taking control of this significant business expense. In the following sections, we'll dig deeper into each component and show you proven strategies to reduce what you pay.

Anatomy of a Credit Card Transaction

Ever wonder what happens in those few seconds between your customer swiping their card and the "approved" message appearing on your terminal? There's actually a fascinating dance of data taking place behind the scenes – one that helps explain where all those cc merchant fees come from.

When a customer hands over their plastic, the transaction follows three main steps:

Authorization: Your customer's card information zips through your payment processor to the card network and then to the issuing bank. The bank checks if funds are available and sends back an approval (or denial) in seconds.

Clearing: Once approved, the transaction details travel to the card network, which forwards everything to the issuing bank for processing.

Settlement: Finally, the issuing bank transfers the funds to your acquiring bank (your merchant bank), which deposits them into your account – minus all those fees we've been discussing.

"It's like a digital relay race where each runner takes a small fee for their leg of the journey," as one of our clients put it. And they're right – this lightning-fast process involves multiple players:

Your customer's issuing bank (like Chase or Capital One) provides the funds. The card network (Visa, Mastercard, etc.) maintains the infrastructure that makes it all possible. Your acquiring bank receives and deposits the funds, while your payment processor orchestrates the entire transaction.

Interestingly, your business type plays a significant role in what you pay. Every merchant is assigned a Merchant Category Code (MCC), which influences your interchange rates. For example, a grocery store (MCC 5411) typically qualifies for lower rates than a jewelry store (MCC 5944) because card networks consider jewelry sales higher risk.

More info about Cost of Credit Card Processing

Interchange Fees—The Biggest Slice

Interchange fees are the heavyweight champions of the cc merchant fees world, typically claiming 1.10% to 3.15% of each transaction. These fees go straight to the bank that issued your customer's card – not to Visa or Mastercard as many merchants believe.

Each card network publishes detailed interchange tables that get updated twice yearly (typically April and October). Your rates vary based on several factors:

Card type makes a huge difference – basic cards cost less to process than those premium rewards cards offering airline miles or cash back. Transaction channel matters too – in-person swipes are cheaper than online payments because they're less prone to fraud. Your business category (that MCC we mentioned) determines your risk level, while transaction size can trigger different rate tiers for certain businesses.

To put this in perspective, a restaurant accepting a basic Visa card in person might pay 1.54% + $0.10, while that same restaurant processing a platinum rewards card would pay 2.10% + $0.10. That difference adds up fast!

American Express operates differently, typically charging higher rates (2.3% to 3.5%) because they use a closed-loop system where they act as both the card network and issuing bank. This is why some small businesses still hesitate to accept AmEx.

Scientific research on interchange fees

Assessment & Network Fees

While interchange fees get most of the attention, assessment fees silently claim their share of your revenue too. These fees go directly to the card networks (Visa, Mastercard, Find, and American Express) for using their payment infrastructure.

Unlike interchange fees, assessments are calculated on your total monthly card sales rather than per transaction. The typical rates are:

Visa: 0.14%

Mastercard: 0.1375%

Find: 0.13%

American Express: 0.17%

Card networks also tack on various other charges – international service assessments when you accept foreign cards, network access fees for connecting to their systems, brand usage fees for displaying their logos, and risk fees to offset fraud concerns.

"These fees are like death by a thousand paper cuts," one retail client told me. "Each one seems small, but together they take a real bite." He's right – for a business processing $1 million annually through Visa cards, assessment fees alone would cost around $1,400.

More info about Credit Card Processing Fee Breakdown

Processor & Incidental Fees

The final layer of cc merchant fees comes from your payment processor – the company that actually handles your transactions. This is where many merchants overpay without realizing it.

Your processor charges a markup fee (typically 0.25% to 0.75% plus a per-transaction fee) – this is their profit margin and is often negotiable. If you accept online payments, expect gateway fees (usually $0.05-$0.10 per transaction plus a monthly fee) for the virtual equivalent of a physical terminal.

Then come the incidentals: statement fees for monthly paper statements ($5-$10), PCI compliance fees for security standards ($99-$199 annually), and chargeback fees when customers dispute charges ($20-$100 each time). Many processors also push terminal leases or rentals, which can be surprisingly expensive over time.

These processor fees vary wildly between companies and are where savvy merchants can find significant savings. At Merchant Payment Services, we recently helped a coffee shop owner eliminate unnecessary fees that were costing over $800 annually – with just a simple phone call and contract review.

One restaurant owner we worked with was paying $35 monthly for a terminal lease – adding up to over $2,000 during their five-year contract. We helped them purchase the terminal outright for $300, saving them $1,700. As they told us afterward, "I never realized I was renting a device that costs less than my phone!"

Pricing Models Compared

The way your processor packages your cc merchant fees can make a huge difference to your bottom line. Let's walk through the four main pricing models you'll encounter – each with its own set of pros and cons.

Flat-Rate Pricing

Remember those "2.9% + $0.30 per transaction" ads from Square or PayPal? That's flat-rate pricing in action. It's beautifully simple – one consistent rate regardless of card type or transaction method.

Flat-rate works wonderfully for small businesses just getting started. The predictable costs make budgeting easy, and there's usually no monthly fee to worry about. The downside? You're often overpaying once your volume increases. Those convenience stores and coffee shops processing hundreds of transactions daily are leaving money on the table with flat-rate pricing.

"When we first opened our food truck, Square's simplicity was perfect," shares Maria, a taco truck owner in Austin. "But once we hit $15,000 monthly in sales, we realized we were hemorrhaging money on processing fees."

Interchange-Plus Pricing

Think of interchange-plus as the "what you see is what you get" model. Your statement clearly shows the actual interchange fee (which goes to the card-issuing bank), plus your processor's markup (e.g., interchange + 0.3% + $0.10).

This transparency typically translates to lower overall costs. For example, if the interchange rate is 1.65% + $0.10 and your markup is 0.3% + $0.10, you'll pay a total of 1.95% + $0.20 per transaction. The catch? Your monthly statements look like they were written in another language, and your costs fluctuate based on which cards your customers use.

Established businesses with steady monthly volumes tend to benefit most from this model.

Tiered Pricing

With tiered pricing, your processor sorts transactions into different buckets – qualified (lowest rate), mid-qualified, and non-qualified (highest rate). While the statements look simpler than interchange-plus, there's a catch: your processor decides which transactions go into which tier.

That premium rewards card your customer proudly presented? It's probably landing in the "non-qualified" tier with rates approaching 3%. And guess what? Most processors design their systems so the majority of transactions fall into the more expensive tiers.

I rarely recommend tiered pricing to merchants. The lack of transparency usually results in higher costs, and you have little visibility into how transactions are categorized.

Membership/Subscription Pricing

The newcomer to the processing world, membership pricing charges a flat monthly fee (say $99) plus the direct interchange cost and a small per-transaction fee (often around $0.05-$0.10). There's minimal or no percentage markup.

For high-volume merchants, this can mean significant savings. A restaurant processing over $30,000 monthly might save hundreds compared to other pricing models. The obvious drawback is paying that monthly fee regardless of your processing volume – making it a poor choice for seasonal businesses or those processing under $10,000 monthly.

Your true cost for any pricing model is reflected in your effective rate – simply divide your total monthly fees by your total monthly sales. If you processed $10,000 and paid $250 in fees, your effective rate is 2.5%.

Flat-Rate vs Interchange-Plus: CC Merchant Fees Showdown

Let's compare these two popular models for a business processing $20,000 monthly:

Flat-Rate (2.6% + $0.10)

500 transactions at $40 each = $20,000 in sales

Fees: 2.6% × $20,000 = $520 + (500 × $0.10) = $50

Total fees: $570

Effective rate: 2.85%

Interchange-Plus (Interchange + 0.3% + $0.10)

Same 500 transactions at $40 each

Average interchange: 1.65% × $20,000 = $330

Assessment: 0.14% × $20,000 = $28

Processor markup: 0.3% × $20,000 = $60 + (500 × $0.10) = $50

Total fees: $468

Effective rate: 2.34%

That's $102 monthly savings with interchange-plus – enough to cover a nice dinner out or $1,224 annually toward new equipment or employee bonuses.

"After switching from flat-rate to interchange-plus, our coffee shop saved over $3,600 in the first year alone," reports one Merchant Payment Services customer. "That's enough to cover a part-time barista for a month."

More info about Credit Card Processing Fee Percentage

When Membership Pricing Wins on CC Merchant Fees

For businesses processing hefty monthly volumes, subscription pricing can be a game-changer. Let's look at a business processing $50,000 monthly with an average transaction of $100:

Interchange-Plus (Interchange + 0.3% + $0.10)

500 transactions at $100 each = $50,000

Average interchange: 1.65% × $50,000 = $825

Assessment: 0.14% × $50,000 = $70

Processor markup: 0.3% × $50,000 = $150 + (500 × $0.10) = $50

Total fees: $1,095

Effective rate: 2.19%

Membership ($99/month + Interchange + $0.08)

Same 500 transactions at $100 each

Monthly fee: $99

Interchange: 1.65% × $50,000 = $825

Assessment: 0.14% × $50,000 = $70

Transaction fees: 500 × $0.08 = $40

Total fees: $1,034

Effective rate: 2.07%

The monthly savings of $61 might seem modest, but that's $732 annually – perhaps enough for a new POS system every couple of years. As your volume grows, so do your savings. Businesses processing over $100,000 monthly often save thousands annually with membership pricing.

Hidden Traps in Tiered & Billback Plans

Watch out for these sneaky tactics that can drain your profits:

In tiered pricing, processors control which transactions qualify for which tier. That "qualified rate" of 1.49% they advertised? It might apply to just 10% of your transactions, with everything else falling into pricier tiers. Those fancy rewards cards your customers love? Almost always dumped into the most expensive "non-qualified" tier.

With billback (sometimes called ERR or Improved Recovery Reduced), the deception is even more elaborate. Your initial statement shows a low rate, but surprise charges appear on subsequent statements. One hardware store owner told me: "I thought I was paying 1.7%, but after finding all the billback charges on later statements, my actual rate was over 3.2%!"

Red-flag contract clauses to watch for include auto-renewals with narrow cancellation windows, early termination fees exceeding $300, equipment leases (almost always overpriced), liquidated damages clauses, hefty PCI non-compliance fees, vaguely defined "non-qualified" surcharges, and minimum monthly fees over $25.

As one retail store owner shared: "My processor advertised a 1.49% qualified rate, but when I calculated my effective rate, I was paying close to 3.2% because most of my transactions were classified as 'non-qualified.' Switching to interchange-plus saved me over 0.7% across all transactions."

How to Reduce & Offset Your Fees

Nobody likes watching a chunk of their hard-earned sales disappear to cc merchant fees, but there's good news: you have more control than you might think. While these fees are a reality of accepting cards, you don't have to simply accept whatever rates come your way.

Think of your processing fees like a cell phone bill—the advertised rate is rarely what you actually pay, and there's almost always room to negotiate. At Merchant Payment Services, we've helped businesses cut their effective rates by an average of 0.4%, which translates to $2,000 in annual savings for a business processing $500,000.

Start by having a heart-to-heart with your current processor. Bring competitive quotes as ammunition—nothing motivates a processor like the threat of losing your business. If they won't budge? Don't be afraid to walk away. The processing world is competitive, and someone else will value your business more.

Consider encouraging customers to use debit cards instead of credit cards. The interchange rates are typically lower, which means more money stays in your pocket. And here's a simple tip many merchants overlook: batch your transactions daily. Forgetting to settle can trigger higher fees that add up quickly over time.

That terminal lease might seem convenient, but it's a money pit. We've seen merchants pay $35 monthly for equipment worth $300—that's $2,100 over a five-year contract for something they could own outright! Always purchase your equipment instead.

Many savvy merchants are implementing cash discount programs or surcharges to offset their cc merchant fees entirely. With a properly structured program, you can either offer a discount to cash-paying customers or pass the processing fee to those who choose credit cards. Just be sure to follow the rules (more on that below).

"I never realized how much I was overpaying until I actually sat down and calculated my effective rate," one of our retail clients told me. "Just by switching processors and implementing a few of these strategies, we're saving over $400 monthly. That's our utility bill covered!"

More info about Lower Credit Card Processing Fees

Legal Cash-Discount & Surcharge Programs

You have two main options for offsetting cc merchant fees by involving your customers: cash discounts and surcharging. Both can be effective, but they come with different rules.

Cash discount programs are the more flexible option—they're legal everywhere in the U.S. and relatively simple to implement. You simply set your regular prices to include the cost of credit card processing, then offer a discount to customers who pay with cash. The key is transparency: you must clearly post the discount at your entrance and register. Something like "Save 3% when you pay with cash!" works well.

Surcharging takes the opposite approach by adding a fee only to credit card transactions. While effective, it's a bit more complicated. Currently, surcharging remains prohibited in Massachusetts and Connecticut (though this continues to evolve), and you'll need to register with card networks at least 30 days before implementation.

If you decide to surcharge, remember these critical rules: the fee can't exceed your actual cost of acceptance or 4% (whichever is lower), it can never apply to debit or prepaid cards, and customers must be clearly informed before they decide to purchase. Your receipts must also show the surcharge as a separate line item.

"We were nervous about customer pushback when we implemented surcharging," a hardware store owner shared with us. "But we trained our staff to explain that customers could avoid the fee by using debit instead of credit, and honestly, most people don't even mention it. Our processing costs are effectively zero now."

The signage for surcharging needs to be crystal clear. Post notices at your entrance and register with language like: "A 3% surcharge applies to all credit card transactions. This fee is not greater than our cost of acceptance. No surcharge on debit cards."

Scientific research on surcharge laws

Step-by-Step Fee Negotiation Checklist

When it comes to negotiating lower cc merchant fees, preparation is everything. Follow these seven steps to put yourself in the strongest position:

First, calculate your effective rate by dividing your total monthly fees by your total sales volume. This gives you your true processing cost—the number processors don't want you to focus on. Armed with this knowledge, collect competitive quotes from at least three different processors. Having written offers creates leverage.

Understand that your volume matters. Processing $50,000 monthly gives you more negotiating power than processing $5,000. Use this to your advantage by mentioning your volume early in negotiations.

Don't be shy about requesting fee waivers. Those pesky statement fees, PCI fees, and monthly minimums? They're often negotiable or completely removable. One restaurant owner I worked with saved $250 annually just by asking for these to be waived.

Focus your negotiation efforts on the processor's markup, not interchange fees. Interchange is set by the card networks and isn't negotiable, but the processor's markup absolutely is. Be specific in your requests: "I've received a quote for interchange plus 0.2% and $0.08 per transaction with no monthly fees. Can you match or beat this to keep my business?"

Always request month-to-month terms instead of locking yourself into long contracts with termination fees. This flexibility keeps processors honest and gives you the freedom to leave if rates creep up.

Finally, get everything in writing. Verbal promises disappear as soon as your sales rep moves on to another company. If they promise a rate or waived fee, make sure it appears in your contract.

A cafe owner recently told me, "I was so intimidated by the whole process that I'd been overpaying for years. When I finally negotiated using these steps, I cut my effective rate from 3.1% to 2.4%. On $400,000 in annual card sales, that's $2,800 back in my pocket—enough to upgrade my espresso machine!"

The worst they can say is no. But in my experience, processors almost always have room to negotiate when faced with losing a merchant's business.

Compliance, Chargebacks & Security Costs

When you're tallying up the true cost of accepting credit cards, don't forget that cc merchant fees are just the beginning of the story. There's a whole ecosystem of related expenses that can significantly impact your bottom line.

PCI DSS compliance isn't just a fancy acronym—it's a mandatory security standard that protects cardholder data. Falling short on compliance can hit your wallet hard with monthly penalties ranging from $20-$50, increased processing rates, and worst of all, potential liability if a data breach occurs. I've seen small businesses absolutely blindsided by these costs because they didn't realize compliance was their responsibility.

The security infrastructure needed to protect transactions comes with its own price tag too. EMV chip card terminals (which shield you from counterfeit fraud liability), point-to-point encryption systems, tokenization for stored card data, and Address Verification Service for online transactions all represent investments in your business's security posture.

Then there are chargebacks—the silent profit-killer. Beyond the obvious $20-$100 fee per dispute, you're also losing merchandise, shipping costs, and valuable staff time spent handling paperwork. If your chargeback ratio creeps above 1%, processors may even hike your rates, creating a costly downward spiral.

One retail client of ours was shocked to find they were spending nearly $4,000 annually just on compliance and chargeback-related expenses—costs entirely separate from their standard cc merchant fees. After implementing our recommended solutions, they cut those expenses by almost a third.

More info about How to Reduce Credit Card Processing Fees

Keep Chargebacks Low to Control CC Merchant Fees

"An ounce of prevention is worth a pound of cure" couldn't be more true when it comes to chargebacks. Every disputed transaction takes money directly from your pocket, but with some proactive steps, you can dramatically reduce their frequency.

Start with crystal-clear return and refund policies. I always tell merchants to think of their policies as a contract with customers—display them prominently on receipts, websites, and at checkout. You'd be surprised how many disputes happen simply because a customer didn't understand your policies.

Your billing descriptor—that name that appears on customers' credit card statements—matters more than you might think. Make sure it's instantly recognizable to avoid those "I don't remember this charge" disputes. One restaurant client reduced chargebacks by 40% just by changing their descriptor from their parent company name to their actual restaurant name.

Responsive customer service is your frontline defense. When a customer has an issue, addressing it promptly can prevent them from reaching for the chargeback button. Keep detailed transaction records including signed receipts, AVS results, and delivery confirmations—these are your best friends when fighting invalid disputes.

For online merchants, fraud prevention tools like 3D Secure can be game-changers. One e-commerce client of ours watched their chargeback ratio plummet from an alarming 1.2% to just 0.3% after implementing these strategies. This saved them roughly $7,500 annually in fees alone, not counting the processor rate increase they avoided.

Staying PCI Compliant on a Budget

PCI compliance doesn't have to break the bank. In fact, many merchants are overpaying for services they could get for free.

First, leverage your processor's free tools. Most payment processors offer complimentary compliance assistance—you're already paying them for processing, so why not use everything they offer? I remember one café owner who was paying a third-party company $199 annually until we showed her that her processor offered identical services at no additional cost.

Complete the Self-Assessment Questionnaire (SAQ) appropriate for your business type. This might sound intimidating, but for many small merchants, it's surprisingly straightforward. The questionnaire helps identify security gaps before they become problems.

Quarterly network scans are another requirement that doesn't need to cost extra. Many processors include free scanning services in their package—just ask! And don't forget to train your employees on basic security protocols. A staff member who understands proper card handling can prevent costly mistakes.

One of my favorite tips is to minimize your compliance scope by reducing the systems that touch cardholder data. The less exposure you have, the simpler your compliance requirements become.

"We thought PCI compliance would cost thousands," a boutique owner told me recently. "But by using our processor's free tools and implementing smart practices, we're fully compliant without spending an extra dime." That's music to my ears—and should be to yours too.

Frequently Asked Questions about CC Merchant Fees

What is the typical CC merchant fee percentage?

The typical cc merchant fee ranges from 1.5% to 3.5% per transaction, with most U.S. merchants paying around 2.24% on average. But here's the reality I've seen working with hundreds of business owners: your actual costs depend on several factors that are unique to your business.

If you're running a small coffee shop processing under $10,000 monthly, you might be paying closer to 2.9%-3.5%. Meanwhile, your friend with the busy hardware store doing $50,000+ monthly might have negotiated rates closer to 1.8%-2.3%.

What causes these differences? It's a combination of your industry risk level (your MCC code), the types of cards your customers use (those fancy rewards cards cost you more), how you accept payments (in-person is cheaper than online), your monthly volume, and your pricing structure.

One bakery owner I worked with was shocked to find she was paying nearly 3.2% overall because most of her customers used premium rewards cards. By switching to interchange-plus pricing, we brought her effective rate down to 2.6% – saving her over $1,800 annually.

Can I legally pass CC merchant fees to customers?

Yes, in most states, you absolutely can share these costs with your customers – and many businesses are doing just that. You have two main options:

A cash discount program works in all 50 states without any special registration. You simply advertise credit card prices as your regular prices, then offer a discount to customers who pay with cash. Your signage might read: "Get a 3% discount when you pay with cash or debit." This approach is straightforward and customer-friendly.

Surcharging (adding a fee for credit card use) is now legal in 48 states, with only Massachusetts and Connecticut still prohibiting the practice. If you choose this route, you'll need to:

Register with card networks 30 days before implementing

Cap your surcharge at your actual cost or 4% (whichever is lower)

Post clear signage about the surcharge

Never apply surcharges to debit or prepaid cards

Show the surcharge as a separate line on receipts

"We were nervous about adding a surcharge," a restaurant client told me recently, "but 90% of our customers barely noticed, and those who did usually just switched to debit to avoid the fee. It's saving us over $2,000 monthly in processing costs."

At Merchant Payment Services, we've helped hundreds of businesses implement compliant programs that effectively eliminate processing costs while keeping customers happy.

How often do CC merchant fees change?

If there's one constant in cc merchant fees, it's change! Different components of your processing costs update on different schedules:

The interchange fees (the biggest chunk) typically change twice yearly – April and October are when Visa and Mastercard usually roll out their updates. Assessment fees tend to change less frequently, maybe once a year. And your processor's markup? That can change anytime, depending on your contract terms.

During the pandemic, we saw many networks pause their regular increases, but they've since resumed their normal update patterns. Most recently, Visa and Mastercard agreed to cap certain increases as part of a class-action settlement – a rare bit of good news for merchants!

One restaurant owner I work with keeps a calendar reminder for May and November to review his statements after the biannual updates. "I caught a 0.15% increase that wasn't mentioned by my processor," he told me. "That phone call saved me over $900 for the year."

To protect yourself from unexpected increases, request interchange-plus pricing that clearly separates the network costs from your processor's markup. Negotiate rate locks for the processor's portion, avoid auto-renewal clauses with lengthy notification periods, and review your statements monthly to catch any sneaky changes.

While you can't control when card networks change their rates, you can control how your processor handles those changes – and that's where significant savings often hide.

Conclusion

Feeling overwhelmed by cc merchant fees is completely normal—but it doesn't have to stay that way. With the right knowledge and a few strategic moves, you can transform these fees from a frustrating expense into a manageable (and sometimes even profitable) part of your business.

Throughout this guide, we've peeled back the layers of processing costs to reveal opportunities that many business owners miss. The most successful merchants I've worked with over my years at Merchant Payment Services share one common trait: they treat their payment processing like any other vital business function—with regular attention and optimization.

Start by knowing exactly what you're paying. Your effective rate tells the real story, not the flashy "as low as" rates processors advertise. Take 10 minutes each month to divide your total fees by your total sales volume. This simple calculation has helped countless business owners spot creeping costs before they become serious problems.

For most established businesses, interchange-plus or membership pricing delivers the best value and transparency. As one restaurant client told me after switching, "It's like someone finally turned on the lights—I can see exactly where every penny goes now."

Don't be shy about negotiation! Many merchants don't realize that statement fees, PCI fees, and monthly minimums can often be eliminated with a simple conversation. One small retailer saved over $600 annually just by asking for these unnecessary fees to be removed.

If you're looking to effectively eliminate processing costs altogether, consider implementing a legal surcharging or cash discount program. When properly set up, these programs can transform your payment processing from a cost center into a neutral or even profitable operation.

Stay vigilant about compliance and chargebacks. The money you save on negotiating lower rates can quickly vanish if you're hit with PCI non-compliance fees or excessive chargeback penalties. Simple practices like clear return policies and secure payment systems protect your bottom line.

At Merchant Payment Services, we've spent over 35 years helping businesses just like yours steer these waters. Our specialty lies in creating comprehensive solutions that not only reduce your cc merchant fees but also generate new revenue through strategic ATM placement and management.

Many of our clients are surprised to find how ATM solutions complement their payment processing strategy. By providing convenient cash access to customers, businesses often see increased cash payments (avoiding card fees altogether) while earning surcharge revenue from the ATM.

Ready to take control of your cc merchant fees and explore how ATM solutions might benefit your business? We'd love to provide a free, no-obligation consultation and cost analysis. You might be surprised by how much you can save—and potentially earn—with the right strategy in place.