Peek Behind the Curtain: How ATM Security Cameras Actually Work

The Technology Behind ATM Surveillance

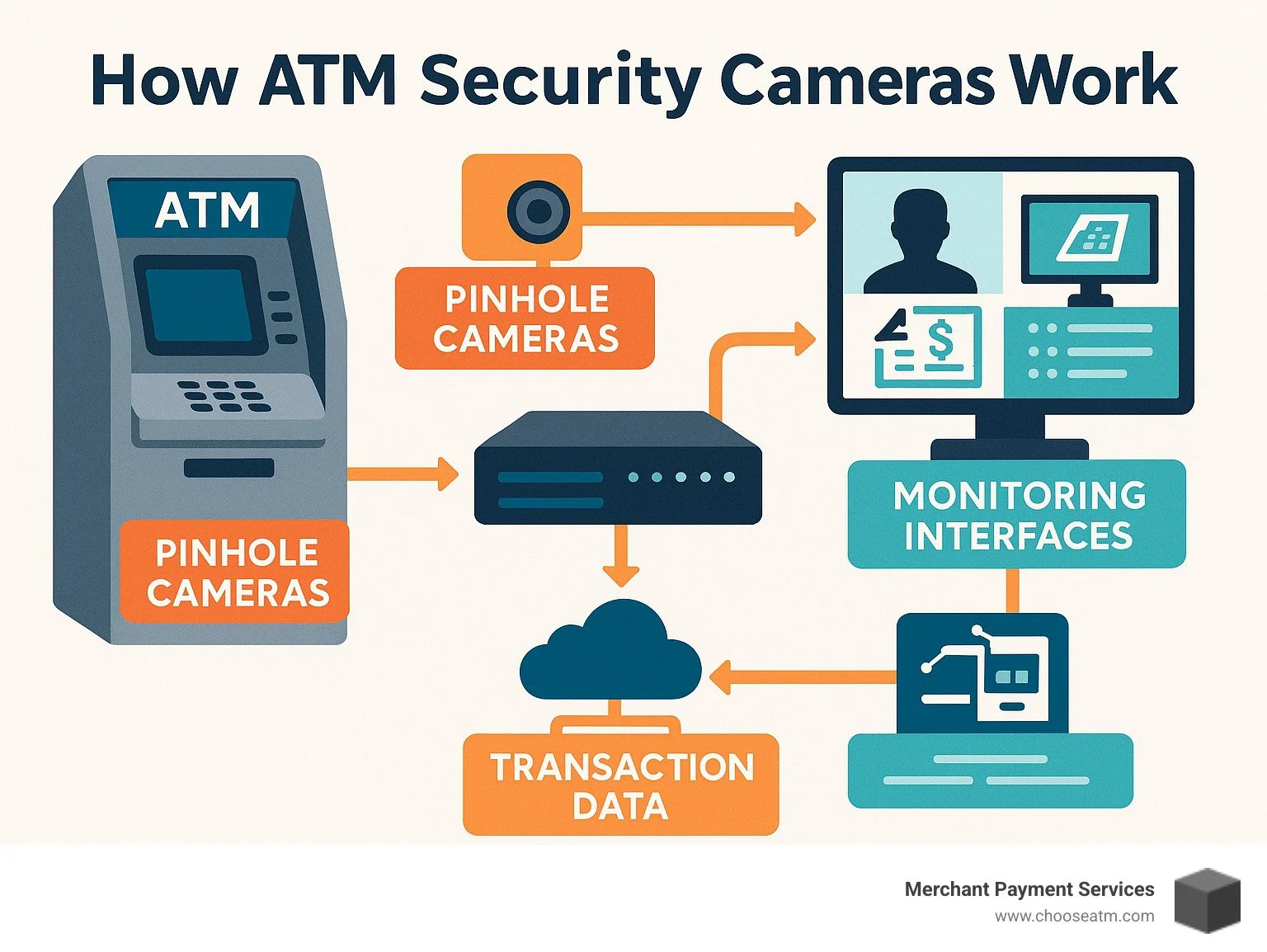

How do ATM security cameras work to protect your money and information? Here's a quick explanation:

ATM Security Camera Basics 1. Capture: High-resolution cameras (often pinhole style) record all ATM interactions 2. Processing: Video is compressed and encoded in real-time 3. Transmission: Footage is sent via encrypted network connections to secure servers 4. Storage: Video is archived according to regulatory requirements (typically 45-90 days) 5. Integration: Footage is linked to transaction data for quick dispute resolution

ATM security cameras serve as the first line of defense against fraud and theft at banking terminals nationwide. According to the FBI, bank robberies have decreased by over 3,500 incidents compared to a decade ago, with advanced surveillance technology playing a key role in this reduction.

Modern ATM cameras do far more than simply record. They integrate with transaction data, employ facial recognition, detect tampering attempts, and can even trigger automatic responses like door locks or police notification when suspicious activity is detected.

While traditional systems required manual retrieval of footage from each machine, today's networked solutions enable centralized management and real-time monitoring across entire ATM fleets. This allows financial institutions to respond immediately to security threats and quickly resolve customer disputes.

At Merchant Payment Services, we understand that effective ATM security is essential for both business owners and customers. As we've helped countless businesses implement robust ATM security camera solutions that protect assets while maintaining customer trust and confidence in how do ATM security cameras work.

How Do ATM Security Cameras Work? The Nuts and Bolts

Ever wonder what happens when you step up to an ATM? Behind that simple transaction lies a sophisticated security system keeping your money safe. Let's pull back the curtain on how ATM security cameras work – from the moment they capture your image to the secure storage of that footage.

Think of an ATM camera as your silent guardian. When you approach the machine, light enters through a tiny lens and hits an image sensor (either CMOS or CCD technology). This sensor transforms light into electrical signals, which the camera's brain then converts into digital video.

"The speed of modern ATM security systems is just incredible," shares a security VP at a regional bank. "What used to take hours of manual tape review can now be accomplished in minutes through digital systems."

Your image then gets compressed using smart technology like H.264 or the newer H.265 codec, which shrinks file sizes by up to 50% without sacrificing quality. This compression is crucial – without it, banks would need massive storage facilities just for video!

Most modern ATM cameras use something called PoE (Power over Ethernet) – a clever solution that sends both power and data through a single cable. This makes installation cleaner and maintenance easier for the ATM Security Camera systems we install for our clients.

How do ATM security cameras work at the hardware level?

These cameras are engineering marvels packed into tiny spaces. Most use pinhole designs with lenses barely 2-3mm wide – about the size of a pencil eraser! Despite their small size, they pack a powerful punch.

These mini-marvels typically offer wide viewing angles up to 106.6°, capturing everything from your face to your fingers on the keypad. And don't let their size fool you – modern ATM cameras record in crystal-clear high definition (1080p or better) at 30 frames per second.

What about at night? That's where infrared LEDs come in. These special lights illuminate the scene with light you can't see, but the camera can. This ensures clear footage whether it's high noon or midnight.

Modern ATM cameras are also pretty smart about protecting themselves. They include tamper sensors that trigger alerts if someone tries to cover, move, or disable the camera. When that happens, security gets notified immediately, and some systems will even lock down the ATM altogether.

How do ATM security cameras work within the bank's network?

Gone are the days of security guards collecting physical tapes. Today's ATM cameras are networked devices that send video data instantly across secure networks to central servers.

Security is absolutely critical here. The video travels encrypted with protocols like TLS (Transport Layer Security) – the same technology that protects your online banking. Many systems meet FIPS 140-2 standards for encryption, ensuring your private banking moments stay private.

Within a bank's network, these cameras join a larger security family. They connect to network video recorders (NVRs) or digital video recorders (DVRs) that juggle multiple video streams at once. Banks don't take chances here – they build in backup power and redundant storage to keep everything running smoothly.

"IT departments really appreciate digital systems because they can implement formal processes for log-ins, backups, and other procedures," explains a banking security consultant. "This creates accountability and ensures proper handling of sensitive surveillance data."

These networked systems provide a foundation for comprehensive ATM Network Security that protects both the physical machine and digital transactions.

How do ATM security cameras work with storage & retrieval?

Banks face two big challenges with all this video: storing it efficiently and finding specific footage quickly when needed.

Modern compression technology like H.265 is a game-changer here. Without it, a single ATM camera might generate 100GB of footage daily – with compression, that drops to around 30GB. Still a lot, but much more manageable!

Most banks use a smart, tiered approach to storage:

Recent footage (7-14 days) stays on local devices for quick access

Medium-term storage (45-90 days) lives on central servers

Important incidents get flagged and archived long-term in the cloud

The real magic happens when you need to find something specific. Modern systems let security teams search by date, time, transaction number, or even card number (with appropriate PCI DSS-compliant masking for privacy). This integration between your transaction data and the video makes investigations lightning-fast.

As one dispute manager told us, "What used to take hours of manual searching can now be accomplished in minutes." That means faster resolution when questions arise about a transaction – something we at Merchant Payment Services know is crucial for both businesses and their customers.

The next time you visit an ATM, take a moment to appreciate the invisible shield of technology working to keep your money – and your identity – safe and secure.

Core Technologies You'll Find Inside Modern ATM Cameras

The world of ATM security cameras has come a long way from the grainy, black-and-white footage of yesteryear. Today's cameras are sophisticated mini-computers that do much more than just record. Let's peek under the hood at what makes these modern marvels tick.

Remember when ATM cameras used to produce footage so fuzzy you could barely tell if the person was wearing a hat, let alone identify their face? Those days are gone! High-definition resolution is now the standard, with most ATM cameras capturing crisp 1080p images. Many banks are even upgrading to 4K resolution that can pick up the tiniest details—from facial features to subtle card manipulations.

One of the biggest headaches for ATM security has always been lighting. Think about it—ATMs are installed everywhere from sun-drenched exteriors to dimly lit convenience stores. That's where Wide Dynamic Range (WDR) technology comes in. It's like having a camera with superhuman eyes, balancing extremely bright and dark areas in the same frame. This is especially crucial for ATMs near windows or entrances where bright backlighting would normally turn a person's face into a dark shadow.

The proof is in the pudding, as they say. According to FBI data, there were 1,724 robberies at U.S. financial institutions in 2021—a dramatic decrease from previous decades. While many factors contribute to this decline, improved security cameras and their integration with other systems have played a significant role in making banks and ATMs safer spaces.

Camera Types and Form Factors

When it comes to ATM cameras, one size definitely doesn't fit all. Different situations call for different types of eyes in the sky:

Pinhole Cameras are the ninjas of the surveillance world—tiny, discreet, and incredibly effective. With lenses as small as 2-3mm, they can be hidden within the ATM itself to capture close-ups of faces and PIN entries without customers even noticing them.

Dome Cameras are those familiar half-spheres you often see mounted on ceilings. They're perfect for monitoring the entire ATM area, and their design keeps criminals guessing about which direction they're actually pointing.

Bullet Cameras don't try to hide—and that's the point. These highly visible cameras serve as both watchdogs and warning signs. They practically scream, "Don't even think about it!" to potential wrongdoers, especially at exterior ATM locations.

Panoramic Cameras are the overachievers of the bunch. Using either multiple sensors or special fisheye lenses, they can capture a full 180° or even 360° view. One panoramic camera can potentially replace multiple standard cameras, though they do require special software to "unwarp" the images.

Concealed Mount Cameras play hide-and-seek with criminals, tucked away in walls, ceilings, or even inside ATM signage. When visible cameras deter most criminals, these hidden eyes catch the bold ones who think they've outsmarted the system.

As one bank security expert told me with a chuckle, "It's like having both a visible security guard and an undercover officer at the same location—the best of both worlds."

Advanced Features That Raise the Bar

Modern ATM cameras aren't just passively recording—they're actively working to protect your money and information:

How do ATM security cameras work with face detection? They're constantly scanning for human faces during transactions. This ensures the ATM is being used by an actual person, not just someone manipulating a card from off-camera. More sophisticated systems can even match faces against databases of known fraudsters—like having a virtual security guard with an incredible memory.

For drive-up ATMs, license plate recognition adds another layer of security by capturing vehicle information. If something suspicious happens, investigators have both face and vehicle data to work with.

Line crossing and loitering detection uses artificial intelligence to spot potentially suspicious behavior. Is someone hanging around an ATM without using it? Is a person entering a restricted area? The system can trigger alerts for security personnel to investigate.

Perhaps the most valuable feature is transaction integration—directly linking video footage with transaction data. This means if a customer disputes a withdrawal, bank investigators can quickly pull up the exact video by searching for the card number or transaction time. What used to take hours of manual review can now be accomplished in minutes.

Some systems even work hand-in-hand with anti-skimming devices, triggering additional recording or alerts when they detect potential tampering or installation of skimming equipment. You can learn more about these threats on our ATM Skimming page.

"The technology has become so sophisticated that it's almost like having a digital security expert watching each ATM 24/7," one bank security director shared. "We've seen fraud attempts plummet since installing cameras with advanced analytics. The system catches subtle behaviors that even trained human observers might miss."

At Merchant Payment Services, we stay on top of these technologies to ensure our ATM solutions offer the best protection for both businesses and their customers. After all, a secure ATM isn't just about preventing losses—it's about building trust.

From Real-Time Alerts to Investigations: Turning Footage Into Action

The true value of ATM security cameras lies not just in capturing footage, but in how that footage is used to prevent crime and resolve incidents. Modern ATM surveillance systems have evolved from passive recording devices to active security tools that generate real-time alerts and streamline investigations.

When suspicious activity is detected—whether it's tampering with the card reader, loitering, or an unusual transaction pattern—these systems can immediately notify security personnel via mobile alerts, email, or integrated security dashboards.

A real-world example demonstrates this capability: "While servicing an ATM, a worker was overpowered by three suspects who stole approximately $150,000 in cash and an ATM cassette tracker. Thanks to integrated tracking and surveillance systems, law enforcement was able to pursue the suspects in a highway chase and recover all the stolen funds."

The integration of video with transaction data creates a powerful investigative tool. When a customer disputes a transaction, claiming they never received cash from an ATM, bank personnel can quickly search for the exact transaction and view the associated video evidence. What once took hours or days can now be resolved in minutes.

Preventing & Detecting Physical and Logical Attacks

ATM security cameras play a crucial role in preventing and detecting both physical and logical attacks:

Skimming Detection: Cameras positioned to view the card slot can detect the installation of skimming devices. Some advanced systems use machine learning to identify when the card reader's appearance changes, triggering immediate alerts.

Jackpotting Prevention: This sophisticated attack involves forcing ATMs to dispense all cash. Cameras that monitor both the customer interface and service areas can detect unusual access to the ATM's components and alert security before the attack succeeds.

Tampering Alerts: Modern ATM cameras include motion and vibration sensors that detect physical tampering attempts. If someone tries to cover the camera, move the ATM, or access service panels, the system immediately triggers alerts.

Some financial institutions have begun integrating ATM cameras with innovative defensive measures like fog cannons. When a physical attack is detected, these systems can fill the ATM area with harmless but disorienting fog, forcing criminals to flee while the cameras continue recording.

"Video surveillance is the first line of defense," explains a security expert. "When combined with other security layers like alarm sensors and physical deterrents, it creates a comprehensive protection system that addresses multiple threat vectors."

Role in Customer Dispute Resolution & Fraud Cases

Beyond security, ATM cameras serve a critical function in resolving customer disputes and fraud investigations:

Transaction Verification: When customers claim they didn't receive the correct amount of cash or that an ATM malfunction occurred, video evidence linked to transaction data provides clear documentation of what actually happened.

A dispute manager at a regional bank shared this example: "A customer reported no cash dispensed despite being debited. Within minutes, we reviewed the transaction-linked footage and confirmed the cash was indeed dispensed and taken by the customer. This prevented a fraudulent claim and saved hours of investigation time."

Fraud Pattern Recognition: By analyzing video from multiple fraud incidents, banks can identify patterns and methods used by fraudsters, helping them improve preventive measures.

Regulatory Compliance: ATM footage serves as documentary evidence for regulatory audits and investigations, demonstrating that proper security measures are in place and functioning correctly.

The ability to quickly search for and retrieve specific transaction videos has transformed the dispute resolution process. Modern systems allow searches by card number, transaction ID, time/date, or event type, with results available in seconds rather than the hours required with older tape-based systems.

Installation, Compliance & Best Practices in the U.S.

Setting up ATM security cameras isn't just about mounting hardware—it's about creating a system that balances security, compliance, and customer comfort. If you're managing ATMs in the United States, you'll need to steer both technical considerations and a maze of regulations.

When it comes to camera placement, strategic positioning makes all the difference. Your cameras should clearly capture the customer's face, the card reader (without revealing PIN entries), the cash dispenser, and the surrounding approach areas. Think of it as creating a complete visual story of each transaction.

"The biggest mistake we see is poor camera positioning," shares a security consultant with 15 years in the financial sector. "A camera that captures beautiful footage of the ceiling doesn't help anyone."

Lighting plays an equally crucial role. Even the most advanced camera will struggle in poor lighting conditions. ATM installations should feature consistent, even illumination that eliminates shadows and prevents the "silhouette effect" that happens when customers stand with bright light behind them.

For U.S. financial institutions, several regulatory bodies oversee aspects of ATM surveillance:

FDIC guidelines on physical security measures

OCC bulletins regarding risk management

State banking authorities with location-specific requirements

PCI DSS standards for protecting cardholder data

ADA compliance matters too—your camera setup shouldn't interfere with accessibility requirements for ATM height and clearance specifications.

Best Practices for Ongoing Maintenance

A security camera is only as good as its maintenance program. Just like you wouldn't ignore oil changes for your car, neglecting camera upkeep can lead to failure when you need footage most.

Regular lens cleaning should be part of your routine. Dust, fingerprints, and environmental debris can seriously degrade image quality. For exterior ATMs exposed to the elements, quarterly cleaning may not be enough—consider monthly maintenance instead.

"We learned this lesson the hard way," admits a convenience store owner. "We had an incident but couldn't identify the person because our camera lens was covered in pollen and dust. Now we clean our ATM camera monthly without fail."

Firmware updates are your defense against emerging security threats. Modern systems can push these updates remotely across your entire ATM network, but you'll need to verify they're actually happening. Outdated firmware can leave vulnerabilities hackers are eager to exploit.

Health monitoring has transformed how we maintain camera systems. Advanced surveillance setups now perform daily automated checks, sending alerts when cameras go offline or show signs of degraded performance. This proactive approach means you'll know about problems before you need the footage for an incident.

Quarterly performance audits should verify that cameras remain correctly positioned, properly focused, and capturing clear images in various lighting conditions. Include test recordings in your audit process to confirm video quality meets your standards.

Regulatory Must-Knows for Financial Institutions

Navigating regulations around ATM surveillance in the U.S. requires attention to several key areas:

Video retention periods vary by location, but the industry standard falls between 45-90 days for general surveillance footage. Some states set specific minimums—New York requires at least 45 days of retention for ATM footage. Your retention policy should balance compliance, storage costs, and investigative needs.

Proper signage isn't just a good idea—it's legally required in most states. Signs informing customers about video surveillance serve dual purposes: legal disclosure and crime deterrence. The psychological impact of visible notices shouldn't be underestimated.

Audio recording faces much stricter regulation than video. In many states, recording conversations without consent is prohibited, which is why most ATM cameras capture video only. If your system does record audio, you must provide explicit notice to customers and understand the specific audio surveillance laws in your state.

Data security for footage is non-negotiable. Video containing customer information requires protection comparable to other sensitive financial data. Access should be strictly limited to authorized personnel, with encrypted transmission and storage.

"Compliance isn't just about avoiding fines," explains a banking regulatory expert. "It's about maintaining customer trust. When people know you're handling their information responsibly, they feel comfortable using your services."

At Merchant Payment Services, we understand the complexity of balancing security needs with regulatory requirements. With over 35 years in the industry, we've helped countless businesses implement compliant, effective ATM security camera systems that protect both assets and customer trust.

Maximizing Effectiveness Across Your ATM Network

Managing security cameras across multiple ATMs doesn't have to give you a headache. In fact, with the right approach, you can turn what might seem like a complicated task into a streamlined security system that actually saves you time and money.

Think of it like upgrading from having separate stereos in each room of your house to having one smart home system that controls everything. That's the kind of change we're talking about with ATM surveillance.

Comparison: Decentralized vs. Centralized ATM Video Storage Decentralized Approach Centralized Approach Video stored locally at each ATM Video streamed to central servers Manual retrieval required Remote access to all footage Limited retention (storage constraints) Extended retention capabilities Inconsistent video quality Standardized quality control Vulnerable to ATM theft/damage Protected from local incidents Higher maintenance costs Reduced field service requirements Delayed incident response Real-time alerting and response

One thing you'll need to think about is bandwidth planning. Just like you wouldn't try to stream 4K movies on a dial-up connection, you need to make sure your network can handle all that video data without slowing to a crawl.

I love hearing success stories from our clients. As one security director at a mid-sized bank told us: "When we switched to a centralized video management system, our investigation time decreased by 70%. No more sending someone to physically check each machine, and we can spot patterns across locations that help us catch organized fraud rings."

Centralized Video Management Benefits

Switching to a centralized video management system is like going from having to visit each ATM to check its security footage to being able to see everything from your office (or even your phone!). Here's why it makes such a difference:

Fleet-wide Visibility means you can see what's happening at all your ATMs at once. Imagine having a digital control room where you can check on any machine with just a few clicks.

Remote Updates and Configuration save you countless hours and miles on the road. Need to adjust camera settings or update firmware? You can do it for your entire fleet without leaving your desk.

Accelerated Investigations might be my favorite benefit. When a customer calls with a problem, you can pull up the relevant footage instantly instead of scheduling a service call to retrieve it days later.

Scalability means your system grows with your business. Adding a new ATM? No problem – it plugs right into your existing security infrastructure.

Advanced Analytics help you spot patterns that might otherwise go unnoticed. Is there a particular ATM that seems to have more suspicious activity? Your system can flag that for you.

One regional bank manager explained it perfectly: "Before centralization, investigating a multi-location fraud case could take weeks. Now we can correlate video from different ATMs in minutes, which has been instrumental in identifying organized fraud rings."

Integrating Cameras With Other Security Layers

The real magic happens when your cameras work together with other security systems. It's like having a team where everyone communicates instead of working in isolation.

When physical alarms are triggered, your cameras can automatically increase their recording quality and send alerts with live video feeds to security personnel. No more wondering if it's a false alarm or a real threat.

Access Control Synchronization creates a visual record of everyone who services your ATMs. This means you'll know exactly who accessed the machine and when – creating an automatic audit trail without any extra work.

Linking video with cash and cassette tracking gives you powerful protection against theft. If a cassette is removed unexpectedly, the system captures video evidence and sends immediate alerts.

Transaction Monitoring integration means your system can flag unusual patterns and instantly provide the video to go with it. Seeing a spike in declined cards at one location? You can check the footage right away to see if someone's testing stolen cards.

Beyond security, these systems provide valuable business intelligence. You can analyze customer traffic patterns, service times, and usage trends to optimize your ATM placement and operations.

"The integration of our ATM cameras with our central security platform has transformed our operation," one operations director shared with us. "What was once a fragmented collection of security tools is now a cohesive system that provides both protection and business intelligence."

At Merchant Payment Services, we've helped businesses of all sizes implement these integrated solutions. With over 35 years of experience, we understand that how do ATM security cameras work is just the beginning – it's how they work together with your entire security ecosystem that truly maximizes their effectiveness.

Frequently Asked Questions about ATM Security Cameras

What resolution do ATM cameras record at?

When you're at an ATM, those tiny cameras are capturing your transaction in impressive detail. Most modern ATM security cameras record at 1080p HD resolution—that's 1920×1080 pixels of crystal-clear footage, plenty to identify faces and activities with confidence.

The industry is steadily moving toward 4K resolution (3840×2160 pixels), which packs in four times more detail than standard HD. This higher resolution isn't just about keeping up with technology—it allows security teams to digitally zoom into specific areas of the footage while still maintaining enough clarity to identify people or activities.

"We've found that 1080p hits the sweet spot for most locations," shares a surveillance system designer I spoke with recently. "It gives excellent detail while keeping storage needs reasonable. That said, we're installing more 4K systems at high-risk ATMs where that extra detail could make all the difference."

Some clever ATM cameras even adjust their resolution on the fly—ramping up to higher quality when they detect motion or during transactions, then scaling back during quiet periods to save valuable storage space. This smart approach helps balance security needs with practical storage limitations.

How long is footage kept in the U.S.?

If you've ever wondered how long banks keep those video recordings, the typical retention period for ATM security camera footage in the U.S. ranges from 45 to 90 days. Several factors influence exactly how long your bank holds onto this footage:

State regulations vary considerably—New York State, for instance, requires ATM footage to be kept for at least 45 days, while other states might have different requirements or none at all.

Many banks choose to exceed minimum requirements as part of their security policies, especially for ATMs in areas with higher crime rates. And while storage limitations used to be a major constraint, today's cloud storage options have made longer retention periods much more feasible.

"The industry standard of 90 days strikes a good balance," a banking compliance officer told me. "It gives enough time for issues to surface while keeping storage costs reasonable. But when there's a confirmed incident, we'll preserve that footage much longer—sometimes for years if it's part of an ongoing investigation."

When a suspicious transaction is flagged in the system, that specific footage is typically marked for extended retention and might be preserved indefinitely if it becomes evidence in a criminal case or lawsuit.

Can customers request ATM footage?

Despite what you might see in movies, you generally can't walk into your bank and ask to see ATM footage. There's a specific process that needs to be followed:

If you believe you've been a victim of fraud or theft at an ATM, your first step should be filing a police report. Law enforcement can then formally request the footage from your bank as part of their investigation.

For customers to receive actual footage, it typically requires a court order or subpoena. This formal legal process ensures that sensitive information is only shared when absolutely necessary and with proper authorization.

Banks take privacy extremely seriously, especially since ATM footage often captures other customers who have a right to their privacy. Your bank might review footage internally to resolve your dispute without actually releasing the video to you.

"While we use ATM security camera footage every day to investigate customer claims," explains a bank security officer, "we're very careful about who gets access to actual video files. We'll absolutely use the footage to verify what happened in a disputed transaction, but the raw video typically stays within the bank unless law enforcement or a court requires it."

Many customers are surprised to learn that even though they can't get a copy of the video, their bank is likely using that footage behind the scenes to verify claims and resolve disputes. If you report that an ATM didn't dispense the correct amount, your bank might review the footage, confirm what happened, and credit your account accordingly—all without you ever seeing the actual video.

At Merchant Payment Services, we understand the importance of robust security for your ATM operations. Our solutions include access to advanced security camera systems that protect both your business and your customers while meeting all regulatory requirements.

Conclusion

When you think about it, ATM security cameras are pretty amazing. They've come a long way from the fuzzy recordings and clunky systems of the past. How do ATM security cameras work today is a testament to how far technology has advanced – these aren't just passive recording devices anymore, but smart, integrated systems that actively protect both banks and their customers.

Throughout this journey exploring ATM surveillance, we've seen that modern systems do so much more than just record. They analyze situations in real-time, send instant alerts, connect directly with transaction data, and even predict potential threats before they happen.

I love how these systems deliver benefits that go well beyond basic security:

First, they're proactive rather than reactive. Today's smart cameras can spot suspicious behavior and alert security teams instantly – often stopping problems before they even start. That's peace of mind you can count on.

They also make resolving disputes incredibly simple. Remember when investigating a complaint meant hours of manually searching through footage? Now, with transaction data linked directly to video, finding exactly what happened during a specific ATM visit takes just minutes.

Beyond security, these systems provide valuable insights into how people actually use ATMs. This helps banks and businesses optimize their services in ways that weren't possible before.

And let's not forget about compliance. With regulations constantly evolving, having properly implemented camera systems helps financial institutions stay on the right side of the law while demonstrating their commitment to protecting customers.

Here at Merchant Payment Services, we've spent over 35 years helping businesses just like yours implement effective ATM solutions. We understand that good security isn't just about protection – it's about building trust with your customers while protecting your bottom line.

Our approach makes ATM ownership straightforward and stress-free. We give you access to top-quality machines with built-in security features that not only keep your assets safe but also maximize your revenue potential. We're proud to offer solutions that protect both your business and your customers.

The future of ATM security cameras looks even brighter, with artificial intelligence, advanced facial recognition, and predictive analytics all evolving rapidly. By staying current with these technologies, banks and businesses can maintain rock-solid security while actually improving the customer experience.

Want to learn more about implementing effective ATM security for your business? Visit our website or reach out to our friendly team today. We're here to help you steer ATM security with confidence.