Chip In or Pay Up! Understanding ATM EMV Compliance

What You Need to Know About ATM EMV Compliance

ATM EMV compliance refers to ensuring your ATM machines accept chip cards according to standards set by Europay, Mastercard, and Visa. If you own or operate ATMs, this is critical information for your business:

ATM EMV Compliance Requirements Why It Matters 1. Install EMV card reader hardware Prevents fraud liability 2. Update ATM software for EMV processing Required for chip transactions 3. Complete end-to-end certification Network approval needed 4. Enable EMV functionality in settings Necessary for compliance

Since the liability shift deadlines (MasterCard: October 2016, Visa: October 2017), ATM owners who haven't upgraded to EMV-compliant technology are now responsible for fraudulent transactions that occur on their machines. This change has made EMV compliance essential rather than optional.

France reported an 80% reduction in counterfeit fraud after implementing EMV technology, highlighting the security advantages of chip cards over traditional magnetic stripes. The chip generates a unique code for each transaction, making it significantly harder for criminals to clone cards or commit fraud.

The upgrade process involves both hardware and software components, and while the initial investment may seem substantial, the protection from fraud liability makes it worthwhile for ATM operators of all sizes.

I'm Lydia Valberg, and with over 35 years of industry experience at Merchant Payment Services, I've guided countless businesses through ATM EMV compliance upgrades to protect them from fraud liability and ensure seamless operations.

What Is EMV & Why It Matters for ATMs

Ever wondered what that little chip on your credit card actually does? EMV—short for Europay, Mastercard, and Visa—is much more than just a piece of metal on your plastic. It's a global security standard that's revolutionized how we pay for things, especially at ATMs.

Unlike the old magnetic stripes that contain the same information every time you swipe (making them easy targets for thieves), EMV chips are like tiny computers that create a unique code for each transaction. Think of it as having a different password every time you use your card—even if someone steals one code, it's useless for future purchases.

The numbers tell the story: nearly 14 billion EMV chip cards circulate globally as of 2023—that's a 7% jump from just a year earlier. And almost 95% of in-person transactions worldwide now use this technology. That's not just a trend; it's a complete change in payment security.

For ATM owners like you, this matters tremendously because:

Fraudsters always target the path of least resistance

The U.S. was the last major economy to adopt EMV, making non-compliant ATMs prime targets

ATM skimming attacks have spiked in recent years

The financial burden for fraud now falls on whoever hasn't upgraded (that could be you!)

One Miami auto service business learned this lesson the hard way—they lost $15,000 to chargebacks after processing EMV cards on their outdated terminal before finally making the upgrade. Don't let that be your story!

Defining ATM EMV Compliance

ATM EMV compliance isn't just a buzzword—it's a specific set of requirements that ensure your ATM can properly handle chip cards. There are two main technical components you need to understand:

First, there's EMV Level 1 Compliance, which involves the physical card reader hardware that makes contact with the chip. This reader (called an Interface Module or IFM) needs certification to confirm it can properly communicate with the chip.

Second, there's EMV Level 2 Compliance, which focuses on the software "kernel" that processes the transactions. This kernel must be certified to handle EMV applications, manage all the cryptographic functions, and process the complex EMV transaction flow correctly.

But ATM EMV compliance goes beyond just these technical aspects. Your ATM also needs:

Support for Application Identifiers (AIDs) for all payment networks you accept

Properly configured Terminal Action Codes

Updated receipt formats with EMV-specific information

Clear on-screen instructions for customers using chip cards

Certification with each payment network

This isn't a one-and-done process. EMVCo (the organization managing these standards) requires recertification—Level 1 approvals last four years, while Level 2 kernel approvals expire after three years.

Security Advantages Over Mag-Stripe

The security boost from upgrading to EMV is both substantial and measurable. Here's why EMV runs circles around the old magnetic stripe technology:

Dynamic Authentication is the game-changer. While mag stripes contain the same data every time (like leaving your house key under the doormat), EMV chips generate a unique, one-time code for each transaction. Even if someone intercepts this code, it's worthless for future transactions.

Advanced Cryptography protects the communication between the card, terminal, and issuer. This ranges from basic Static Data Authentication to the high-security Combined DDA/Application Cryptogram that prevents both card cloning and transaction tampering.

Skimming Protection means that even if criminals attach devices to your ATM, the data they capture from EMV transactions is essentially useless for creating fake cards.

Security Feature Magnetic Stripe EMV Chip Data Storage Static, unchanging Dynamic, transaction-specific Counterfeit Protection Minimal Strong cryptographic safeguards PIN Protection Basic encryption Multiple verification methods Skimming Vulnerability High Low (data not reusable) Fraud Reduction Minimal Up to 80% (based on France's experience)

The real-world results speak volumes: Europe saw card fraud plummet by more than 80% after introducing EMV in France back in 1992. In the U.S., Visa reported that merchants who upgraded to EMV experienced a 70% drop in counterfeit fraud from December 2015 to September 2017.

When you look at these scientific research findings on chip cards, the security benefits become undeniable. ATM EMV compliance isn't just about following rules—it's about protecting your business and your customers.

The EMV Liability Shift: "Compliant or Responsible"

Remember when you could leave your front door open uped? The world of ATM fraud liability used to be just as simple. Card issuers paid for fraud losses, and ATM operators slept soundly at night. Those days are long gone.

The EMV liability shift fundamentally changed the rules of the game. Before this shift, card issuers generally shouldered the financial burden when fraud occurred. Now? The party using the less secure technology gets stuck with the bill.

For ATM operators, these liability shift dates weren't just calendar reminders—they were financial turning points:

MasterCard: October 1, 2016

Visa: October 1, 2017

What does this mean in plain English? If a customer uses an EMV chip card at your non-EMV compliant ATM and fraud occurs, you're on the hook for those losses. This isn't some government regulation passed down from Washington—it's an industry policy change implemented by the card networks themselves.

As the EMV Migration Forum put it: "The liability shift provides a very strong practical incentive even without a formal mandate." Translation: No law forces you to upgrade, but your wallet will certainly feel the difference if you don't.

It's worth noting that the Federal Reserve's guidance on Regulation II (the Durbin Amendment) addresses how EMV adoption impacts debit routing requirements. Their FAQ makes it clear that even with EMV implementation, ATM operators must still ensure customers have routing choices for their transactions.

How Liability Now Lands on ATM Operators

Before the shift, card issuers treated fraud losses like a rainy-day fund—just part of doing business. Now, your ATM EMV compliance status directly determines who pays when fraud happens.

Here's the new reality in simple terms:

Your ATM is EMV-compliant and processes a chip card properly? The card issuer pays for any counterfeit fraud.

Your ATM isn't EMV-compliant and processes a chip card using the magnetic stripe? You're paying for any resulting counterfeit fraud.

Customer uses a card without an EMV chip? The issuer remains responsible regardless of your ATM's EMV status.

Many ATM operators still don't fully grasp this shift. As one industry expert told me, "Many companies are still unaware that if they are not EMV-compliant, fraudulent transactions are directly blamed on them."

The financial impact isn't small change, either. Chargebacks for fraudulent transactions can quickly add up to thousands of dollars. And unlike retail merchants who might fight chargebacks, ATM operators have very limited options once liability shifts to them.

Scenarios That Trigger Operator Liability

Let's break down exactly when you, as an ATM owner, become the responsible party. Think of these as your "liability triggers":

Scenario 1: Fallback Transactions When a customer inserts a chip card but the chip can't be read (maybe it's damaged), the transaction may "fall back" to the magnetic stripe. In this case:

If your ATM is EMV-capable but the chip is legitimately damaged, the issuer typically remains liable

If your ATM isn't EMV-capable, forcing all transactions to use the magnetic stripe, you bear the liability

Scenario 2: Non-EMV Terminal Processing EMV Card When a customer with an EMV chip card uses your non-EMV ATM:

Your machine processes the transaction using the magnetic stripe

If fraud occurs, you're liable because you used the less secure technology

Scenario 3: Counterfeit Card Fraud When a fraudster creates a fake magnetic stripe card using stolen card data:

If the original card had an EMV chip but your ATM wasn't EMV-capable, you're liable

If the original card didn't have an EMV chip, the issuer remains liable

Scenario 4: Lost/Stolen Card Fraud For transactions involving physically stolen cards:

If your ATM uses chip-and-PIN verification, the issuer is typically liable

If your ATM uses chip-and-signature or magnetic stripe, liability may shift to you depending on specific network rules

One ATM owner learned this lesson the hard way: "We had a 2015-era ATM that we thought was secure. After receiving several fraud chargebacks, we learned that simply having a newer ATM wasn't enough—it needed to be specifically EMV-enabled. That lesson cost us nearly $8,000 in fraud losses before we upgraded."

Upgrading for ATM EMV Compliance: Hardware, Software & Certification

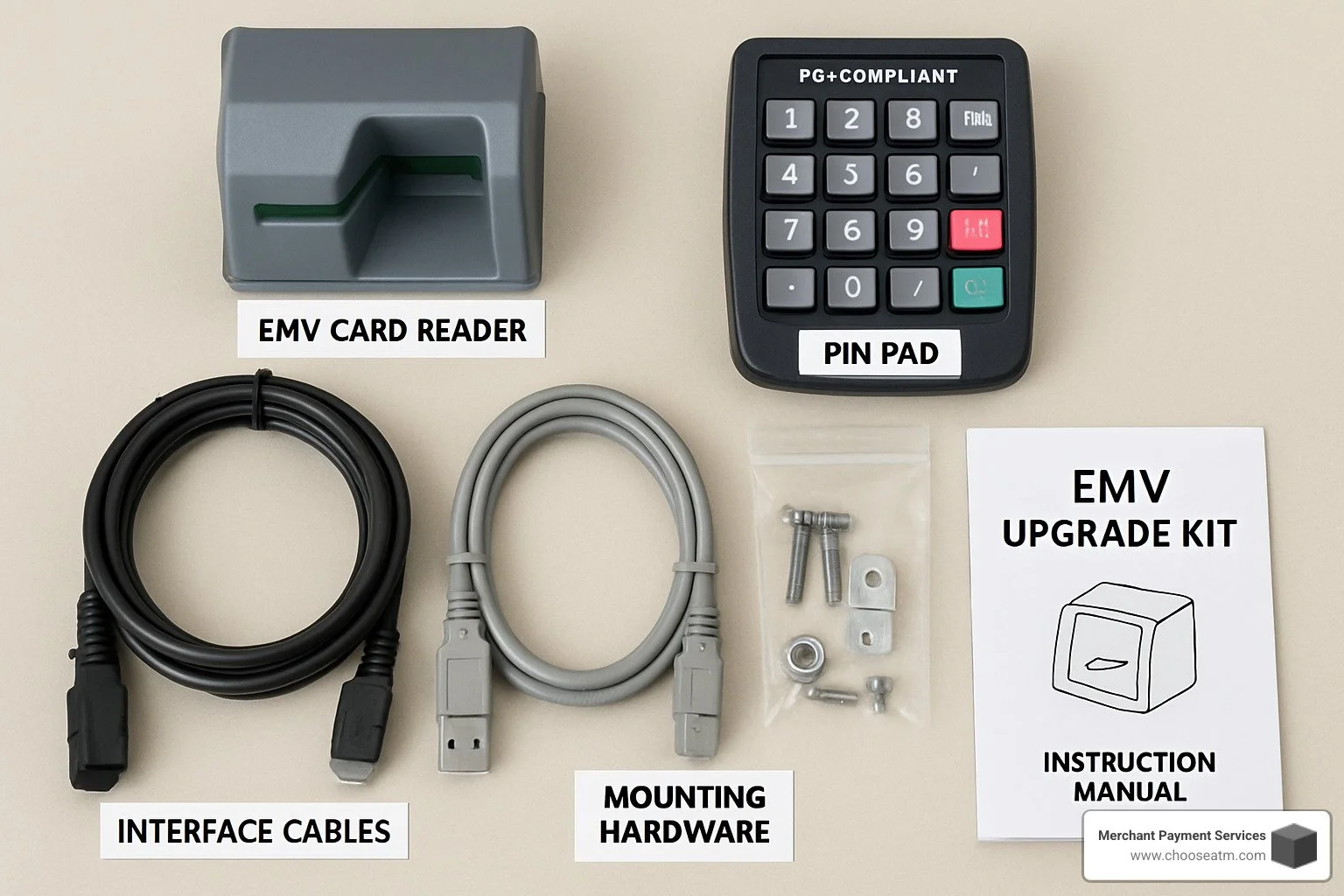

Getting your ATM ready for EMV compliance isn't just about swapping out a card reader—it's more like giving your machine a complete transaction processing makeover. Think of it as upgrading from a flip phone to a smartphone; there's a lot more happening under the hood than meets the eye.

Let's talk hardware first. The star of the show is the EMV card reader, which comes in two main flavors:

The motorized EMV reader is like the luxury model. It gently pulls the customer's card completely into the machine, holds it securely during the transaction, and returns it when everything's done. These readers offer better security (no chance of someone yanking their card out too early) and typically last longer since customers can't damage them as easily. The downside? They're pricier than their simpler cousins.

The dip EMV reader is your economy option. Customers insert and remove their cards themselves—kind of like using an old DVD player. While these readers cost less upfront, they tend to wear out faster and require clearer instructions for customers who might be tempted to pull their card too soon.

Beyond just the reader, your ATM will need:

A PCI-compliant Encrypting PIN Pad (EPP) that meets current security standards

Enough memory and processing power to handle the more complex EMV transactions

Updated communication protocols to safely transmit all that EMV data

On the software side, your shopping list includes:

An EMV-certified Level 2 kernel (think of it as the "brain" that processes chip transactions)

Updated ATM application software that supports the EMV workflow

Configuration settings for all the card networks you accept

New screen flows that won't leave customers scratching their heads

Updated receipt templates that include all the EMV-specific information

The certification process is like getting your ATM's passport stamped. You'll need:

EMV Level 1 and Level 2 certifications for your hardware and software

End-to-end testing with each payment network you support

Verification that your ATM handles chip failures gracefully

Confirmation that your receipts contain all required information

Most ATM operators find this whole process takes about 3-6 months from start to finish, depending on your ATM model, processor, and the networks you support.

Step-by-Step Upgrade Checklist

Ready to tackle your EMV upgrade? Here's your roadmap to success:

1. Audit Your ATM Fleet

Start by taking stock of what you have. Make notes of each ATM's make, model, and current software version. Figure out which machines can be upgraded and which ones are so outdated they'll need complete replacement. Some of your ATMs might already have EMV readers installed but not enabled (a pleasant surprise!). While you're at it, check if your PIN pads meet current PCI standards.

2. Consult with Key Partners

Don't go it alone! Reach out to your ATM processor about their EMV certification timeline. Chat with your ATM manufacturer about available upgrade options for your specific models. Touch base with your sponsoring bank to understand their requirements. And most importantly, identify qualified technicians who can handle the hardware installation—this isn't typically a DIY job.

3. Order Appropriate Hardware

Once you know what you need, place your orders for EMV card readers or complete upgrade kits. Double-check that everything you're buying is compatible with your specific ATM models. Smart operators order some spare parts at the same time to minimize future downtime if something breaks. And verify that any new PIN pad meets current PCI PTS standards—no sense in upgrading twice.

4. Schedule Hardware Installation

Coordinate with your technicians for the physical installation work. Try to schedule upgrades during slower business periods to minimize customer impact. Allow extra time for testing after the hardware is installed, and prepare some simple signage explaining any temporary service interruptions.

5. Update ATM Software

Get the latest EMV-compatible software from your ATM manufacturer. Plan to do these updates during off-peak hours. Verify that the software includes an EMV Level 2 certified kernel. And always—always—back up your current configuration before making any changes.

6. Configure EMV Settings

Now it's time to flip the switch! Enable the EMV functionality in your ATM settings. Configure all the Application Identifiers (AIDs) for the networks you support. Set appropriate Terminal Action Codes (TACs). Update your screen flows and messaging to guide customers through the chip transaction process.

7. Complete Network Certification

This is the testing phase. Coordinate end-to-end testing with your processor. Run test transactions for each type of card you'll accept. Verify that your ATM handles chip read failures appropriately. Finally, get formal certification from each payment network.

8. Go Live and Monitor

The big day arrives! Activate EMV processing on your ATM. Keep a close eye on the first batch of transactions to catch any issues. Maintain detailed transaction logs for troubleshooting. And have a backup plan ready in case something goes sideways.

As one of our clients at Merchant Payment Services shared: "We thought we could handle the EMV upgrade ourselves, but quickly realized the complexity involved. Working with Merchant Payment Services saved us countless hours and ensured our certification went smoothly. Their technicians knew exactly how to configure our machines for both EMV compliance and optimal customer experience."

Common Pitfalls & How to Avoid Them

Even the best-laid plans can hit snags. Here are the potholes to watch for on your EMV upgrade journey:

Supply Chain Delays

When liability shift deadlines loom, EMV readers and upgrade kits often become as scarce as concert tickets for popular shows. Order your hardware at least 3-4 months before you plan to upgrade. Consider stocking some spare parts for your busiest or most profitable ATMs.

Firmware/Software Mismatches

Some EMV readers are picky about which software versions they'll play nice with. Always verify compatibility between your chosen EMV reader model and ATM software version before swiping your credit card. Test everything in a controlled environment before rolling changes out to your entire fleet.

Failed Certification Tests

Your first attempts at certification might not go as smoothly as hoped. Review all your AID configurations and terminal parameters with a fine-tooth comb. Consider bringing in an EMV specialist to look over your setup before formal testing begins—it's cheaper than failing and retesting multiple times.

Customer Confusion

People who've spent years swiping cards may struggle with the "insert and wait" approach of chip transactions. Install clear signage and on-screen instructions. For dip readers especially, make it crystal clear that customers should leave their card in the machine until prompted to remove it.

Fallback Transaction Abuse

If you're seeing high rates of fallback to magnetic stripe (when the chip supposedly can't be read), it might be a sign of tampering or fraud attempts. Keep close tabs on fallback rates. Any ATM showing fallback transactions exceeding 5-10% of its total deserves immediate investigation.

PIN Pad Compliance Issues

While focusing on EMV, don't overlook PCI requirements for PIN pads. Double-check that your PIN pad meets current PCI PTS standards. Many older ATMs need both new EMV readers and PIN pad upgrades at the same time.

Incomplete Network Certification

It's easy to certify with some networks but forget others your ATM supports. Create a simple checklist of all networks and track your certification status for each one. Don't activate EMV until all your certifications are complete.

One ATM technician we work with put it perfectly: "The biggest mistake I see is operators rushing through software configuration after installing the hardware. EMV compliance requires precise parameter settings—one misaligned setting can cause certification failure or even approved transactions to be declined. Take your time and test thoroughly."

Budget & ROI: Costs, Savings, and Surcharge Upside

Let's talk money—because upgrading your ATMs for EMV compliance is an investment that deserves careful consideration. As someone who's helped countless ATM operators through this process, I can tell you it's not just about avoiding liability; it's about protecting and potentially growing your business.

The price tag for EMV upgrades varies widely depending on your current equipment. For most operators, the costs break down into a few key categories:

For existing machines, you're looking at the EMV card reader hardware ($400-$900), software licenses ($200-$500), and potentially a new PIN pad if yours is outdated ($300-$700). Add in labor costs for installation ($150-$300 per ATM) and certification testing fees ($500-$1,500 per processor), and a typical upgrade runs about $2,000 per ATM.

If your ATMs are older models that can't be upgraded, replacement costs start around $2,500 for basic units and can exceed $8,000 for high-end machines with advanced features.

"I was shocked when I got hit with a $3,200 chargeback from a single compromised card," shares one of our clients who delayed upgrading. "That fraud incident would have paid for upgrading that ATM plus another one. I learned my lesson the hard way."

The good news? Most ATM operators recoup their investment within 12-18 months through a combination of avoided fraud losses and operational improvements. Your EMV-compliant machines will experience fewer card reader jams (a common issue with worn magnetic heads), require less maintenance, and inspire greater customer confidence.

Many of our clients at Merchant Payment Services have even reported a 5-7% increase in transaction volume after upgrading, as security-conscious customers prefer using EMV-compliant ATMs. With average surcharge revenue of $2-3 per transaction, that increased volume adds up quickly.

Typical Price Ranges & Payback Periods

When budgeting for ATM EMV compliance, it helps to have specific numbers in mind. Here's what you can expect to pay:

For upgradeable ATMs (typically those less than 5 years old):

EMV card reader kit: $400-$900 (motorized readers cost more but offer better security)

Software update: $200-$500 (may include ongoing license fees)

Installation labor: $150-$300 (higher for remote locations)

Certification testing: $500-$1,500 (per processor relationship)

This brings the total to approximately $1,250-$3,200 per ATM, with most upgrades averaging around $2,000.

If your ATMs need replacement, expect to pay:

Entry-level ATM: $2,500-$4,000 (basic functionality)

Mid-range ATM: $4,000-$7,000 (standard features)

High-end ATM: $7,000-$12,000+ (advanced features)

Installation and setup: $300-$600

How quickly will you recover this investment? It largely depends on your transaction volume:

High-volume locations processing 1,000+ transactions monthly typically see payback within 6-12 months. Medium-volume sites (500-1,000 transactions) usually break even in 12-18 months, while low-volume locations may take 18-24+ months.

One of our clients who manages a chain of convenience stores told me: "We upgraded 23 ATMs at a cost of about $45,000. Within the first year, we avoided approximately $22,000 in potential fraud liability and saw a 5% increase in transaction volume. By month 15, we had fully recouped our investment."

Hidden Cost Watch-List

Before you finalize your budget, be aware of these often-overlooked expenses that can impact your total investment:

Technician travel expenses can add up quickly, especially for remote ATMs. Weekend or after-hours installation to minimize business disruption typically incurs premium rates, sometimes 50% higher than standard rates.

Software integration challenges might require operating system updates before EMV software can be installed. If you have custom screen flows or branding, these may need redesign for EMV compatibility.

Network certification complexities can lead to unexpected costs. Failed certification tests may require retesting fees, and each payment network requires its own certification process. Missing your scheduled certification slot can delay implementation by weeks.

Downtime costs during installation (typically 2-4 hours per ATM) mean lost surcharge revenue. More importantly, out-of-service ATMs can frustrate customers and potentially impact your primary business if the ATM drives foot traffic.

Training and documentation for staff on new procedures and troubleshooting shouldn't be overlooked. You'll need updated signage and customer instructions to help them steer the chip insertion process.

Ongoing compliance costs include EMV kernel recertification every three years and software update fees to maintain compliance with evolving standards.

Project management overhead is perhaps the most commonly overlooked expense. As one of our clients finded: "We budgeted accurately for the hardware and installation but completely overlooked the cost of managing the project. Coordinating between our processor, hardware vendor, and service technicians consumed nearly 15 hours per week for three months."

At Merchant Payment Services, we've guided hundreds of businesses through EMV upgrades with minimal disruption and maximum ROI. Our experience helps you avoid these hidden costs and ensure a smooth transition to ATM EMV compliance.

Maintaining Compliance & Looking Ahead

Think of ATM EMV compliance as a journey, not a destination. Once you've upgraded your machines, your work isn't done—the payment security landscape keeps evolving, and staying compliant requires ongoing attention.

I've seen many ATM operators breathe a sigh of relief after completing their EMV upgrades, only to be caught off guard by new requirements down the road. Let's look at what you need to keep an eye on:

Your EMV Level 2 kernel certification is only valid for three years. After that, you'll need recertification, which might mean software updates or even hardware changes for older ATM models. Mark these renewal dates on your calendar now—they have a way of sneaking up on you!

Beyond EMV, don't forget about PCI PIN security requirements. The December 31, 2022 deadline for replacing all PCI PTS v1 PIN pads has passed. If you haven't updated these components yet, you're already behind the compliance curve.

Looking ahead to January 2025, all Encrypting PIN Pads must implement TR31 Phase 3 "Key Blocks" for secure cryptographic key management. This might sound technical, but it's essentially about better protecting the encryption keys that safeguard customer PINs.

Regular software updates aren't just good practice—they're essential for security and compatibility with payment networks as they improve their systems. One of our clients learned this lesson the hard way when their processor made a backend change that their outdated software couldn't handle.

Ongoing Testing & Recertification

Maintaining ATM EMV compliance is like caring for a car—regular check-ups prevent breakdowns. Here's your maintenance schedule:

Make quarterly reviews of available software updates part of your routine. When security patches become available, especially those affecting EMV functionality, implement them promptly. I always recommend testing updates on a single ATM before rolling them out across your entire fleet—this has saved our clients countless headaches!

Monthly transaction monitoring is crucial. Review your EMV logs to spot potential issues, watch for unusual fallback rates (when EMV cards default to magnetic stripe), and investigate declined transactions. One of our clients noticed a spike in fallbacks at a specific location and finded a damaged card reader before it could cause major problems.

Set aside time for annual compliance checks. Verify your EMV kernel certification status, confirm your PIN pad meets current PCI standards, and review your terminal configurations. Think of it as your yearly physical—preventative care that catches issues before they become serious.

Most payment networks require recertification when you change EMV kernel versions, modify terminal configurations significantly, support new card applications, or when your processor changes their backend systems. Keep detailed records of all compliance activities—you'll thank yourself when an auditor comes calling.

"We've learned that proactive compliance management is far less expensive than reactive fixes," shared one of our long-time clients. "Our quarterly compliance calendar has helped identify several issues before they impacted our liability protection."

Future Trends Shaping ATM EMV Compliance

The world of ATM security isn't standing still, and tomorrow's ATM EMV compliance standards will reflect emerging technologies. Here's what's coming down the pike:

Contactless ATM transactions are quickly gaining ground. Instead of inserting a chip card, customers simply tap their card or mobile device. This means adding NFC readers to your ATMs, supporting contactless EMV flows, and obtaining new certifications. We've already helped several clients make this transition, and their customers love the speed and convenience.

The days of relying solely on PINs for verification are numbered. Dynamic Cardholder Verification Methods are becoming more common, including fingerprint and facial recognition, mobile-based authentication, and one-time passcodes. One forward-thinking client recently implemented biometric verification at their high-traffic locations and saw a noticeable decrease in fraudulent attempts.

Data security continues to advance beyond basic EMV requirements. Point-to-point encryption, tokenization, improved key management, and real-time security monitoring are becoming standard practice rather than nice-to-have extras.

Perhaps most exciting is how AI and machine learning are revolutionizing fraud prevention. Real-time transaction scoring based on customer behavior patterns can spot potential fraud before it happens. One client told me, "Our new AI system flagged a series of unusual transactions that our old system would have missed completely. It likely saved us thousands in fraud losses."

ATMs are increasingly connected to broader mobile banking ecosystems, allowing for pre-staged withdrawals from mobile apps, cardless access, and personalized experiences. As one industry analyst put it: "The future of ATM security isn't just about the card-machine interaction anymore. It's about creating a secure ecosystem spanning physical and digital channels while maintaining a seamless customer experience."

At Merchant Payment Services, we're staying ahead of these trends to help our clients not just maintain compliance, but leverage new technologies to improve customer experience and security. After all, the ATM operators who accept these emerging technologies will not only stay compliant—they'll deliver better value to their customers.

Frequently Asked Questions about ATM EMV Compliance

What happens if I keep a mag-stripe-only ATM on the network?

The consequences of maintaining a magnetic-stripe-only ATM after the liability shift deadlines aren't pretty for your bottom line. Since October 2016 for MasterCard and October 2017 for Visa, any fraud that happens on your non-compliant ATM is now your financial burden to bear.

Think of it this way - you're essentially hanging a "fraud welcome" sign on your machine. One ATM operator shared their painful experience with me: "We thought our low-volume ATM wasn't worth upgrading. Three months and $4,000 in chargebacks later, we were scrambling to get EMV installed. Those two compromised cards taught us an expensive lesson."

Beyond the immediate financial hit from chargebacks, your processor might flag your ATM as high-risk, potentially leading to increased fees or surcharges. Some processors have even begun implementing policies requiring ATM EMV compliance for all machines on their network - meaning your non-compliant ATM might eventually be unable to process transactions at all.

The question isn't really if you'll face fraud losses, but when and how much they'll cost you.

How can I tell if my ATM reader and PIN pad are EMV-ready?

Determining if your ATM is ready for the EMV world requires checking both hardware components and software compatibility. Let's break it down into manageable parts.

For your card reader, start by looking for physical clues. EMV-capable readers typically have a slot with a chip symbol and are designed to hold the card during the transaction. Motorized readers will pull the card in completely, while dip readers have a deeper insertion point than traditional magnetic readers.

Not sure what you're looking at? Contact your ATM manufacturer or seller to verify the model specifications. Most ATMs manufactured after 2014 either came with EMV readers or had them pre-installed but not enabled in software.

For your PIN pad, you'll need to verify the model number against the PCI PTS list of approved devices. Ensure it supports Triple DES encryption at minimum and check if it supports the TR31 key block format that will be required by 2025.

Don't forget software compatibility! Your current ATM software version must support EMV processing. Contact your manufacturer to verify compatibility and determine if updates are needed.

As one seasoned ATM technician told me, "Don't assume your ATM is EMV-ready just because it's relatively new. I've seen plenty of machines shipped with disabled EMV readers or just empty mounting brackets where readers should go. Nothing beats a physical inspection by someone who knows what to look for."

Does EMV compliance also cover contactless and mobile wallets?

The short answer is no - standard ATM EMV compliance primarily addresses contact chip cards, not contactless payments or mobile wallets. But with contactless becoming increasingly popular (especially since the pandemic), this is something you'll want to understand.

Contactless EMV transactions and mobile wallets (like Apple Pay and Google Pay) require additional hardware - specifically an NFC reader - beyond basic EMV compliance. They also need separate certification and specific software capabilities to process these transactions.

The good news is that contactless transactions follow similar security principles as contact EMV, with the same core benefit of generating unique transaction cryptograms for each payment. The liability shift rules generally apply similarly to contactless EMV transactions as well.

If you're planning an EMV upgrade now, it's worth considering whether to implement contactless capability at the same time. As one ATM network operator shared with me, "We've seen customer demand for contactless ATM access skyrocket recently. While it requires additional investment beyond basic EMV compliance, doing both upgrades simultaneously is more cost-effective than separate projects, and the improved customer experience typically drives higher transaction volume."

Think of contactless capability as future-proofing your ATM investment. While not strictly required for basic ATM EMV compliance, it's quickly becoming an expected feature that can help keep your machines relevant and attractive to users.

Conclusion

Achieving and maintaining ATM EMV compliance isn't just a checkbox on a to-do list—it's essential protection for your business in today's payment landscape. The shift from magnetic stripe to EMV chip technology represents one of the most significant security advancements we've seen, with real-world results in slashing counterfeit fraud.

Throughout this guide, we've walked through everything you need for proper EMV compliance: upgrading your hardware with new card readers and PIN pads, updating software to handle chip transactions, configuring your machines correctly, completing certification with payment networks, and staying on top of evolving standards.

Yes, the upfront costs might make you wince a little. But here's the good news—most ATM operators recoup their investment within 12-18 months through avoided fraud losses and smoother operations. Think of it as insurance that actually pays you back!

At Merchant Payment Services, we've been in the trenches with hundreds of businesses just like yours over our 35+ years in the industry. We know exactly what it takes to get your ATMs compliant without unnecessary headaches. We can:

Take a close look at your current ATM fleet to see what's possible

Map out the most cost-effective path to compliance

Handle all the technical stuff—installation, configuration, you name it

Steer the certification maze with your processor

Keep you compliant for the long haul with ongoing support

But we don't stop at just keeping you out of trouble. Our team helps maximize your ATM profitability through smart surcharge strategies, strategic placement decisions, and regular performance check-ups. We make sure your ATMs aren't just secure—they're profit centers for your business.

The ATM world keeps evolving, with contactless transactions, mobile wallets, and even biometric authentication on the horizon. By building a solid EMV foundation now, you'll be ready to accept these new technologies as they become mainstream.

Don't wait for a fraud nightmare to hit your bottom line. Reach out to Merchant Payment Services today about your ATM EMV compliance needs. Let's protect and improve your ATM business together—because compliance doesn't have to be complicated when you have the right partner.