Is Your ATM Card Reader Safe? Learn How to Detect Skimming Devices

The Silent Threat at Every ATM

ATM card readers are the mechanisms that process your debit or credit card at automated teller machines. While most are legitimate and secure, criminals increasingly install counterfeit readers to steal your information.

How to Identify Legitimate vs. Fraudulent ATM Card Readers:

Appearance: Legitimate readers have uniform coloring and fit seamlessly with the ATM

Movement: Real readers are firmly attached - if it jiggles or moves, don't use it

Surface: Authentic readers have no adhesive residue or unusual attachments

Technology: Modern ATMs use EMV chip readers which are more secure than magstripe-only readers

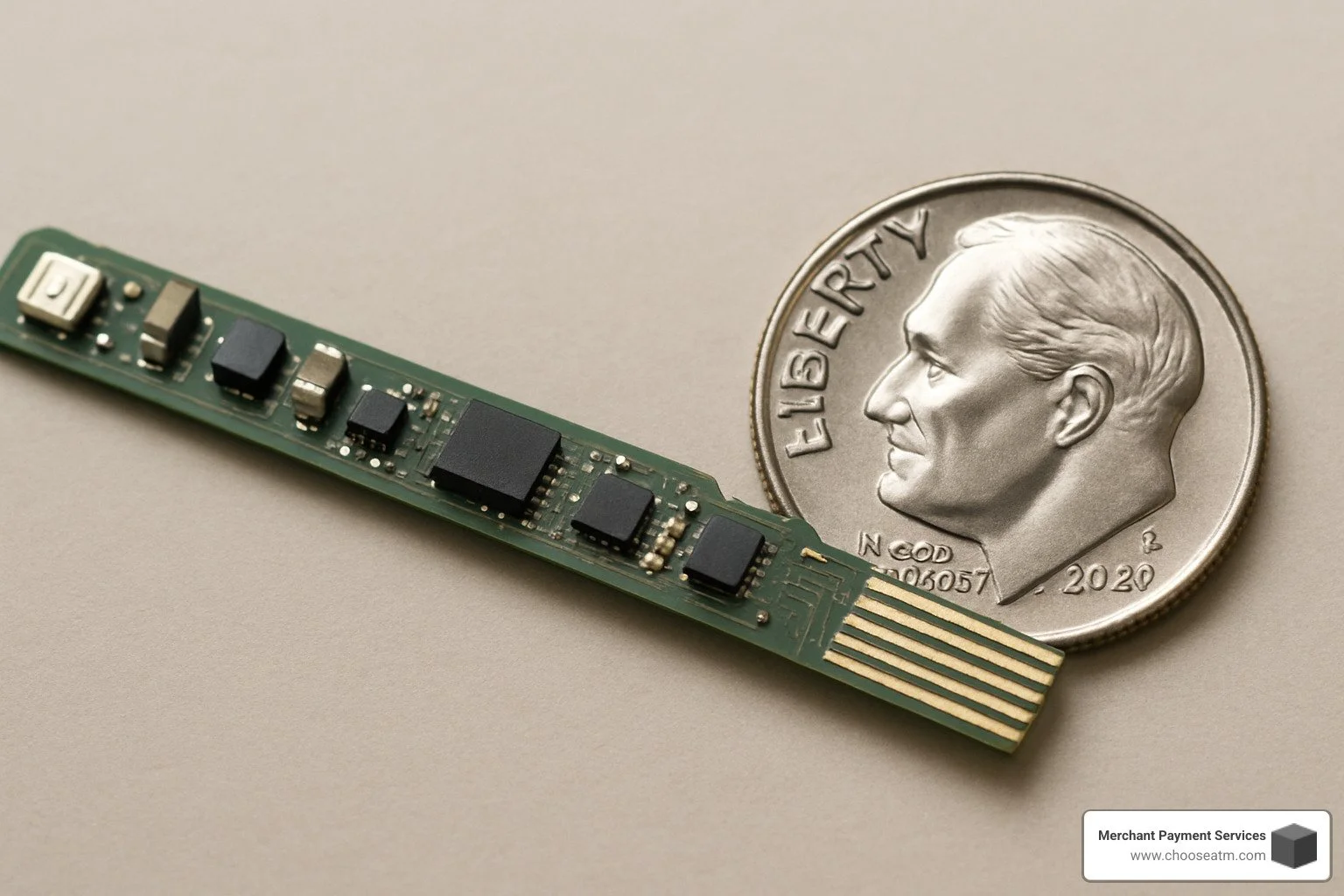

The threat of ATM skimming is growing across the United States. According to industry data, billions of dollars are lost annually due to this type of fraud. What's particularly concerning is the evolution of skimming technology – modern "deep insert" skimmers can be as thin as 0.68 millimeters (about half the height of a U.S. dime), making them nearly impossible to detect visually.

Why this matters to your business: If you operate an ATM, compromised card readers can damage customer trust, create liability issues, and ultimately reduce the revenue your machine generates.

I'm Lydia Valberg, co-owner of Merchant Payment Services, and I've spent over 15 years helping business owners protect their ATM card readers from increasingly sophisticated fraud attempts while maximizing their surcharge revenue.

How an ATM Card Reader Works

Understanding how legitimate ATM card readers function is your first line of defense against fraud. Here at Merchant Payment Services, we've had our hands inside thousands of ATMs across America, and I'm happy to share what we've learned along the way.

When you slide your card into an ATM, there's actually quite a bit happening in that small slot:

The card either sits partially in the machine (what we call a "dip reader") or gets gently pulled all the way inside (a "motorized reader"). Your card's information is then captured through one or more methods - the traditional magnetic stripe, the more secure EMV chip, or increasingly, through contactless NFC technology if you're just tapping your card.

Once your information is read, it's immediately encrypted before being sent through processing networks for authentication. Only after your card is verified can you proceed with your transaction.

"I always tell our clients that card insertion is the most vulnerable moment in any ATM transaction," our lead technician often says. "That split second is when the bad guys try to steal your data before it reaches the secure system."

Components Inside an ATM Card Reader

Pop open a legitimate ATM card reader (something only technicians like us should do!), and you'll find an impressive array of technology:

The card transport mechanism works like a miniature conveyor belt, carefully guiding your card in and out of motorized readers. Magnetic read heads - tiny sensors that look like small metal blocks - capture the data encoded on your card's stripe. For chip cards, gold-plated contacts physically connect with the EMV chip when your card settles into position.

Modern readers also contain anti-skimming sensors designed to detect unauthorized devices and metal shielding that protects against electromagnetic interference that could compromise your data.

There's a significant security difference between dip readers (where part of your card remains visible) and motorized readers (which pull your card completely inside). While motorized readers generally offer better protection against external skimming devices, they can be vulnerable to internal tampering if an ATM isn't regularly inspected and maintained.

The Primary Keyword: ATM Card Reader Technology in 2024

Today's ATM card readers represent a fascinating mix of old and new technologies. Here's what's happening in our industry right now:

Despite the newer chip technology, magnetic stripes aren't going anywhere soon. Most payment cards issued to Americans still store data on these stripes in what security experts call "plain text" - creating an ongoing vulnerability even on cards with chips.

EMV chip technology has been a game-changer. Unlike magstripes, these chips generate a unique transaction code every time you use your card, making it significantly harder for criminals to clone. Modern ATM card readers are designed to prioritize chip reading whenever possible.

Contactless ATM withdrawals are gaining serious traction across the country. These transactions use the same tap-to-pay NFC technology you might use at retail stores, but with additional security steps before dispensing cash.

All new ATM card readers must meet Payment Card Industry (PCI) standards, which include rigorous physical and digital security requirements to protect your information at every step of the transaction.

At Merchant Payment Services, we're committed to staying ahead of these technology trends. Every ATM we install meets or exceeds these standards, giving both our business clients and their customers peace of mind with every transaction. After all, we've been doing this for 35 years - we've seen it all, and we know what works.

Skimming Threats Targeting Your ATM Card Reader

The cat-and-mouse game between security experts and fraudsters has created a world of increasingly clever skimming attacks. Whether you operate ATMs or just use them, understanding these threats could save you from becoming the next victim.

Deep-Insert Devices: The 0.68 mm Menace

The most worrying development keeping me up at night is the "deep insert" skimmer. These ultra-thin devices slip entirely inside the card slot where no one can see them – they're practically invisible to the naked eye.

What makes these devices so dangerous? For starters, they're incredibly thin – about 0.68 millimeters (roughly half the height of a dime). That's so slim they fit inside the card slot without disrupting normal operation. Unlike older skimmers that attach to the outside, these hide completely within the machine.

"Once inside, they silently capture magnetic stripe data in plain text from every card that enters," explains our head of security at Merchant Payment Services. "Some models can store hundreds of card details before the criminal returns to retrieve the device."

The real danger comes when criminals pair this card data with your PIN (often captured with hidden cameras). With both pieces of information, they can create clone cards and empty accounts at other ATMs. It's a one-two punch that's hard to defend against.

Surface Overlays & Keypad Covers

While deep-insert skimmers are frightening, don't forget about the more traditional external devices that remain common across America.

Card reader overlays still work well for criminals. These fake card slots fit over the legitimate reader and are designed to blend in. They're bulkier than deep-insert skimmers, but most people never notice the difference. Watch for slightly bulkier appearance, different coloration, adhesive residue, or a loose fit when gently tugged.

Fake PIN pads often work alongside card skimmers. These overlays sit atop the real keypad, recording every PIN entered. I've seen some that are remarkably convincing – the only giveaway might be a slightly thicker or spongier feel when pressing the keys.

Hidden cameras complete the arsenal. These tiny devices can be tucked into brochure holders, disguised as security mirrors, or hidden in other creative spots with a view of the keypad. They silently record PIN entries to pair with stolen card data.

Contactless Relay & "Shimmer" Attacks on Chip Readers

As ATM card reader technology evolves to be more secure, so do the criminals' methods of attack.

Shimmers are the next generation of skimming. These wafer-thin devices slide between your card's chip and the reader contacts. While they can intercept data during EMV chip transactions, the unique cryptogram generated for each transaction still makes outright cloning difficult – but not impossible for sophisticated fraudsters.

Contactless relay attacks represent the newest frontier. As tap-to-pay ATM transactions become more common across the US, criminals are developing ways to capture and relay NFC transaction data wirelessly. While still relatively uncommon at ATMs, we're seeing early cases that suggest this threat is growing.

"The technology arms race never stops," says our lead technician at Merchant Payment Services. "That's why we're constantly updating our security recommendations and equipment for all the ATMs we manage."

For more detailed information on various skimming methods and how they work, check out our guides on ATM Skimming and How Credit Card Skimmers Work.

How to Detect and Avoid Skimming Devices

Let's talk about protecting yourself at the ATM - something I take pretty seriously after seeing how clever these skimmers have become. Different card technologies offer varying levels of protection, so here's what you need to know:

Magnetic stripe cards are unfortunately the most vulnerable - these old-school strips store your data in a way that's relatively easy to steal. When using these cards, always check for overlay devices and give that card reader a gentle wiggle.

EMV chip cards offer better protection with their encrypted transactions. Still, watch for any unusual resistance when inserting your card - that could signal a "shimmer" hiding inside.

Contactless cards are generally the safest option, though not foolproof. When tapping, verify the contactless symbol looks legitimate and keep your card within sight throughout the transaction.

No matter which type of card you use, always cover your PIN when entering it. This simple habit defeats most skimming attempts, since criminals typically need both your card data and PIN to commit fraud.

The Primary Keyword in Action: ATM Card Reader Inspection Checklist

Before you insert your card at any ATM, take a moment to become your own security expert. Here's how to inspect an ATM card reader properly:

Give the card slot a gentle tug - legitimate readers won't budge at all. If it moves or feels loose, walk away immediately. Next, look at how the reader fits with the rest of the machine. Does the color match? Is the material the same? Fraudsters often can't perfectly match the original design.

Check for any sticky residue or tape marks around the card slot - these are telltale signs of tampering. When you press the keypad buttons, they should feel crisp and responsive. If they feel mushy or unusually thick, someone might have installed an overlay to capture your PIN.

"You'd be surprised how many skimming attempts could be foiled with a simple 10-second inspection," our lead technician often tells customers. "Most people are in such a rush they don't take that time."

Tech Tools for Consumers & Operators

Technology is giving us new weapons in the fight against skimmers. If you're particularly security-conscious, consider these options:

The Hunter Cat detector is a clever card-shaped device that counts magnetic read heads inside a card slot. Since legitimate ATM card readers have a specific number of read heads, any extras likely indicate a skimmer.

Some smartphone apps can detect Bluetooth signals that many modern skimmers use to transmit stolen data. A sudden appearance of an unnamed Bluetooth device near an ATM is a major red flag.

For our business clients who operate ATMs, we recommend advanced AI detection systems that can identify unusual patterns indicating tampering. These systems provide an extra layer of protection beyond regular physical inspections.

Location & Lighting Matter

Where you choose to use an ATM makes a huge difference in your security. The safest ATMs are typically found in bank branch lobbies with good surveillance, 24-hour store vestibules with regular foot traffic, or well-lit indoor locations with security personnel nearby.

Be extra cautious with isolated outdoor kiosks, poorly lit areas, or locations with minimal foot traffic. Criminals need privacy and time to install their devices, so busy, well-monitored locations naturally deter them.

"I always tell our clients that good lighting isn't just about convenience - it's one of the most effective security measures you can have," says our installation specialist. "Skimmer installers hate being in the spotlight, literally and figuratively."

At Merchant Payment Services, we carefully evaluate location security before installing any ATM, ensuring your transactions remain as safe as possible while maximizing convenience for your customers.

Maintenance & Security Best Practices for Operators

For businesses operating ATMs, regular maintenance isn't just about keeping things running—it's a crucial part of your security strategy. At Merchant Payment Services, we've seen how simple maintenance routines can make a world of difference in protecting your ATM card readers.

Regular Cleaning and Inspection

Think of your card reader like your teeth—regular cleaning prevents bigger problems down the road. Those specialized cleaning cards might look simple, but they're actually quite clever little tools. They gently sweep through the card path, removing dirt, debris, and anything that shouldn't be there (like parts of skimming devices).

How often should you clean? It really depends on how busy your ATM gets. For those machines that see lines of customers daily, weekly cleaning makes sense. Medium-traffic spots can get by with bi-weekly attention, while quieter locations need at least monthly care.

The best part? A box of 50 cleaning cards runs about $20—probably the most affordable security measure you'll ever invest in! As my grandfather used to say, "An ounce of prevention is worth a pound of cure," and that's especially true with ATM card readers.

Firmware and Software Updates

Your ATM's brain needs regular check-ups too. Those firmware updates might seem like a hassle, but they're actually digital armor for your machine.

"Out-of-date firmware is like leaving your front door wide open," our lead technician often tells clients. "It's practically an engraved invitation for sophisticated attackers."

Make friends with your ATM provider and set up a regular schedule for updates. Just be careful to verify that updates come from legitimate sources—criminals are clever that way. And keep good records of every update you apply; those logs will be golden if you ever need to track down when a change happened.

EMV Upgrades and Contactless Retrofits

Still running a magnetic-stripe-only ATM? I hate to be the bearer of bad news, but it's time for an upgrade. EMV-capable ATM card readers aren't just more secure—they also shift liability away from you when fraud occurs.

Already have EMV? Nice work! Now might be the time to consider adding contactless capability. Those tap-to-withdraw retrofit kits are becoming more affordable, and customers increasingly expect that convenience. At Merchant Payment Services, we can help figure out the most budget-friendly upgrade path for your specific machine model.

Physical Hardening Measures

Sometimes the old ways are still the best ways. Physical security measures create tangible barriers that frustrate would-be thieves:

Anti-skimming enclosures make it nearly impossible to attach fake overlays to your ATM card reader. Tamper-evident seals immediately show if someone's been tampering with your machine. Card reader guards are like little protective shields that still allow customers to insert their cards normally.

The smartest approach combines these physical protections with electronic monitoring—belt and suspenders, as my father would say.

Regulatory & Certification Essentials

I won't sugarcoat it—the regulatory landscape for ATM operators can feel like navigating a maze. But understanding these requirements is essential:

The EMV Liability Shift has been in effect since October 2015, meaning if you haven't upgraded to chip-reading technology, you might be on the hook for fraudulent transactions that chip technology would have prevented.

PCI PTS Compliance sets security standards for PIN-capturing devices—absolutely crucial for maintaining network certification.

The Americans with Disabilities Act includes specific requirements for card readers, covering everything from height to orientation to tactile indicators. This isn't just about avoiding fines—it's about making your ATM accessible to all your customers.

Keep detailed Audit Logs of all maintenance, inspections, and security incidents. These records aren't just paperwork—they're your protection if questions ever arise.

At Merchant Payment Services, we've spent 35 years helping business owners steer these complex requirements while keeping their ATMs profitable. After all, secure machines inspire customer confidence, and confident customers use ATMs more frequently—it's as simple as that.

Frequently Asked Questions about ATM Card Reader Safety

Why do U.S. cards still have magnetic stripes?

Ever wondered why your credit card still has that black stripe when chip technology is supposedly more secure? You're not alone! Despite their security vulnerabilities, magnetic stripes aren't disappearing from U.S. payment cards just yet, and there are good reasons for this.

Most importantly, we still have tons of ATM card readers and payment terminals across America that rely on magnetic stripe technology. Think about small businesses, older ATMs, and certain industries that haven't updated their equipment. Your card needs that stripe to work in these places.

The stripe also serves as a helpful backup. We've all experienced that moment when a chip reader fails, and the cashier says, "Let's try swiping instead." Without the magnetic stripe, you'd be stuck with no way to pay.

When traveling internationally, that magnetic stripe can be a lifesaver too. Many regions around the world still primarily use this older technology.

The good news? The industry is gradually moving forward. Mastercard has already announced plans to begin phasing out magnetic stripes in 2024, with complete elimination targeted by 2033. Other card networks will likely follow a similar timeline, so eventually, this technology will become a relic of the past.

What should I do if I spot a suspected skimmer?

Finding what looks like a skimming device on an ATM card reader can be alarming, but knowing exactly what to do can help catch criminals and protect others.

First and most importantly, don't use the ATM or insert your card. That magnetic stripe contains your financial information, and you don't want to hand it over to fraudsters.

While you might be tempted to pull off the suspicious device, don't remove it yourself. Law enforcement needs this evidence intact to investigate properly and potentially catch the criminals.

Instead, notify the ATM owner immediately. If you're at a bank branch, alert a staff member. For standalone ATMs, call the customer service number displayed on the machine (this is why we at Merchant Payment Services always ensure our contact information is clearly visible on our ATMs).

Make sure to contact local law enforcement to report what you've found. They may want to inspect the device or take it into evidence.

"The most important thing is not to try removing the device yourself," advises our security specialist. "This could damage evidence that law enforcement needs to catch the criminals."

If you've recently used the compromised ATM, monitor your accounts closely for any unauthorized transactions and consider notifying your bank of potential fraud.

How often should an ATM card reader be cleaned or serviced?

Just like your car needs regular oil changes, your ATM card reader needs consistent maintenance to stay in top working condition – both for functionality and security.

Professional servicing schedules should be based on how busy your machine is:

For those busy locations with over 100 transactions daily, monthly professional service keeps everything running smoothly. Medium-traffic spots (30-100 daily transactions) do well with quarterly check-ups, while quieter locations with fewer than 30 daily transactions can typically manage with semi-annual professional service.

Between these professional visits, it's smart for operators to perform weekly visual inspections. Look for anything unusual around the card slot, check that nothing wiggles or seems loose, and make sure the machine appears untampered.

Using cleaning cards is another simple maintenance step that makes a big difference. These specialized cards remove dirt, debris, and potential foreign objects from the card path – think of it as flossing for your ATM! They're inexpensive (about $20 for a box of 50) and can prevent both mechanical failures and security issues.

At Merchant Payment Services, we've found that customized maintenance plans based on your specific ATM usage patterns work best. After 35 years in the business, we've learned that proper maintenance not only prevents problems but also extends the life of your investment.

Conclusion: Protecting Your Business and Customers

After 35 years helping businesses manage their ATMs, we've seen ATM card reader technology evolve from simple magnetic stripe readers to sophisticated multi-function devices. We've also watched criminals develop increasingly clever ways to compromise these machines.

But here's the good news: with the right approach, you can keep your ATM secure and your customers protected.

When your ATM's card reader gets compromised, you lose more than just money. You lose something even more valuable – your customers' trust. And in the ATM business, trust directly affects your bottom line. People who feel safe using your machine will return again and again, boosting your surcharge revenue month after month.

At Merchant Payment Services, we've developed a straightforward approach that works:

First, we implement proactive security measures using the latest anti-skimming technology. These physical and electronic safeguards make your machine a much harder target for criminals.

Second, we establish regular maintenance schedules. This isn't just about keeping your machine running smoothly – it's about spotting the early warning signs of tampering before they lead to fraud.

Third, we help educate both your staff and customers. When everyone knows what to look for, you create a human security network that criminals can't easily defeat.

Finally, we set up rapid response protocols so that if something suspicious does occur, you can address it immediately – protecting both your customers and your reputation.

Every transaction at your ATM represents someone's hard-earned money. When you protect their financial security, you're not just being a good business owner – you're being a good neighbor.

We're passionate about helping businesses like yours maximize ATM revenue while maintaining rock-solid security standards. Our end-to-end ATM programs include everything you need: regular maintenance, security updates, and 24/7 support to keep your ATM card readers safe, even as threats continue to evolve.

Want to learn more about securing your ATM or exploring our comprehensive management solutions? Reach out to us at Merchant Payment Services today. We'd love to show you how simple and profitable a well-managed ATM program can be.

After all, your customers' security and your business reputation are too important to leave to chance.