Peek-a-Boo! Finding the Cameras on ATM Machines

Why ATM Camera Placement Matters for Your Safety

Where are cameras on ATM machines is a crucial question for anyone using these cash dispensers. Here's what you need to know:

Primary Camera Locations:

- Front fascia - Usually above or beside the screen, capturing your face during transactions

- Internal pinhole cameras - Hidden inside the ATM housing, monitoring the card slot and keypad area

- Overhead positions - Mounted on ceilings or canopies in ATM vestibules

- Perimeter cameras - On surrounding walls or poles, covering the general area

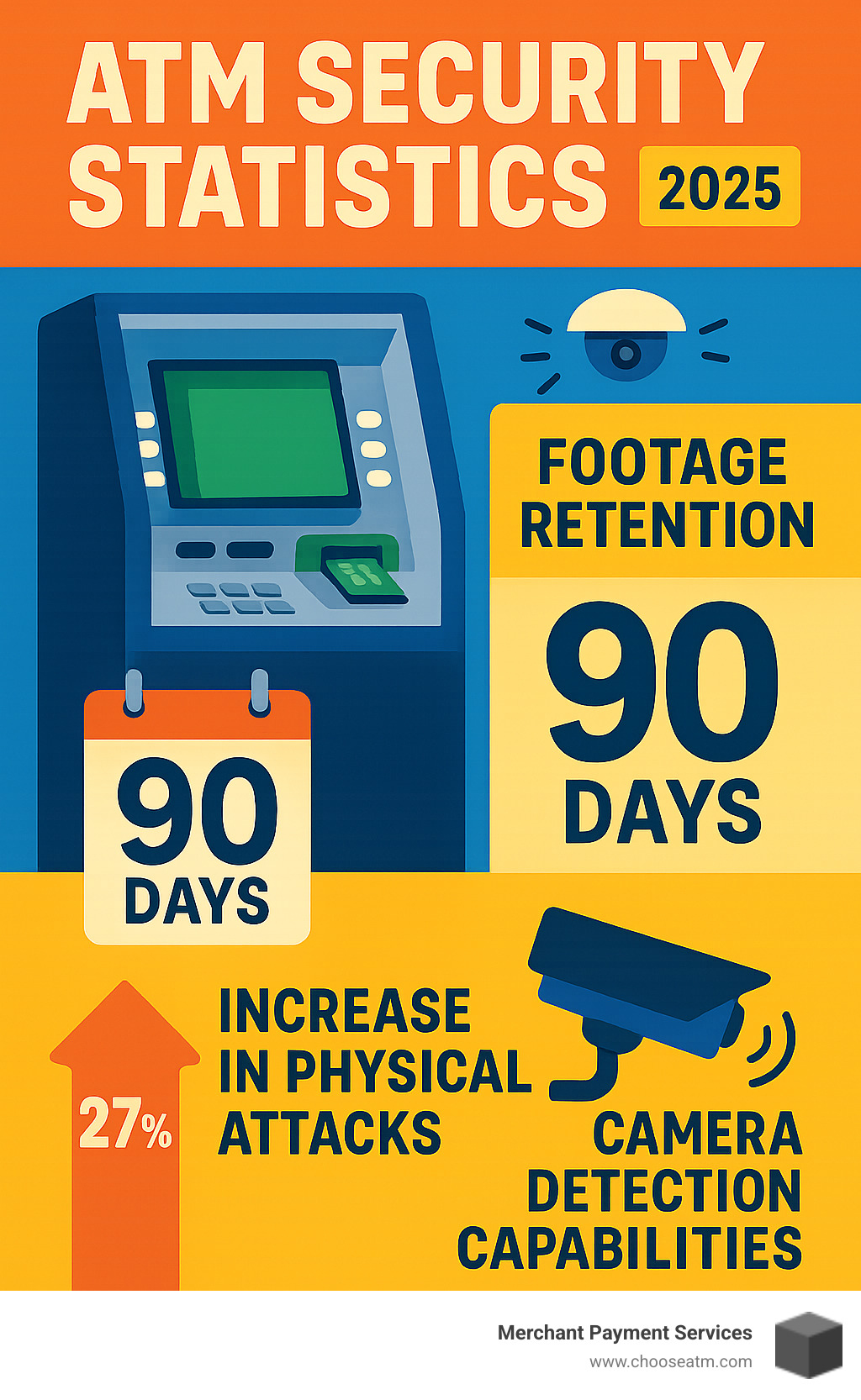

Most ATMs have at least one camera covering the area in front of the machine, and some ATMs have cameras installed inside them, though internal cameras are not very common at present. Banks typically store this surveillance footage for up to 90 days, and it's admissible in court as evidence.

The stakes are higher than you might think. According to the European Safe Transaction Association, physical attacks on ATM machines increased by 27% in 2018, with stolen amounts rising by 16%. These cameras serve as your first line of defense against crime and fraud.

Understanding camera placement helps you stay safe and spot potential tampering. Criminal skimmers often disguise hidden cameras as legitimate ATM security features, making them harder to detect without knowing what to look for.

As Lydia Valberg, Co-Owner of Merchant Payment Services with over 35 years of family business experience in payment solutions, I've seen how proper camera placement protects both businesses and customers when considering where are cameras on ATM machines. My expertise in ATM services has shown me that educated users are safer users, which is why understanding these security features matters so much.

Why You Should Care

Your security awareness directly impacts your personal safety at ATMs. With incidents of ATM crime and fraud doubling in the last year, understanding camera placement isn't just helpful—it's essential. When you know where legitimate cameras are positioned, you can better identify suspicious additions that might be skimming devices or hidden cameras placed by criminals.

These cameras protect you in multiple ways. They deter potential criminals who know they're being watched, provide evidence if crimes do occur, and help banks investigate disputes or fraudulent transactions. Most importantly, they create a safer environment that gives you confidence to access your money when you need it.

Why ATMs Have Cameras & What Types Do They Use

Think of ATM cameras as your silent guardians. They're there for two main reasons: deterrence and evidence gathering. When potential criminals see those cameras, they often think twice about their plans. And if something does happen, the footage becomes crucial evidence for law enforcement investigations.

Modern ATM cameras are pretty impressive pieces of technology. You'll find pinhole lenses that monitor discreetly, dome cameras that cover wide areas, and infrared night vision capabilities that keep watch even in complete darkness. Most systems now capture HD resolution footage—some advanced models offer crystal-clear 2.1MP/1080p at 30fps, making facial recognition remarkably accurate.

These cameras also come equipped with tamper sensors that immediately alert security teams when someone tries to mess with the surveillance system. It's like having a security guard that never sleeps and never misses a detail. For more detailed information about ATM Security Camera systems, you can explore the various options available.

Legitimate Camera Types

Board cameras are the workhorses of ATM surveillance. These compact units fit perfectly into the machine's housing and capture clear images of users during transactions. They're positioned to get good facial shots while still respecting your personal space during banking.

Covert pinhole cameras represent the cutting edge of ATM security technology. These clever devices capture exceptionally clear video through an invisible pinhole lens with up to 106.6° horizontal field of view. They install completely hidden inside the ATM without shifting over time, making them perfect for close-range facial capture.

Here's the key difference you need to know: legitimate cameras blend seamlessly into the ATM's original design. Criminal devices, on the other hand, often look like aftermarket additions with mismatched colors, adhesive residue, or loose fittings. Where are cameras on ATM machines becomes an important question when you're trying to spot the difference between authentic security features and fraudulent add-ons.

Smart Features Modern ATMs Offer

Today's ATMs are getting smarter by the day. Face detection technology can actually prevent cash from dispensing if no person is detected in front of the machine—pretty clever protection against automated fraud attempts.

Transaction-video synchronization links every withdrawal or deposit to its corresponding footage. This means banks can search for specific transactions by card number or date, and the system automatically pulls up the relevant video evidence. It's like having a perfectly organized filing system that never loses a document.

Real-time alerts might be the most exciting advancement in ATM security. These systems detect suspicious behavior like loitering, multiple failed PIN attempts, or physical tampering, then immediately notify security personnel or law enforcement. Some advanced systems can even trigger automatic door locks, police alerts, and terminal shutdowns when they detect unauthorized impacts.

You can learn more about How Video Surveillance Helps protect ATM users and operators through these sophisticated monitoring systems.

Where Are Cameras on ATM Machines?

Where are cameras on ATM machines isn't a one-size-fits-all answer, but there are some spots you can count on finding them. Think of ATM cameras like a security team with different jobs—each one watches a specific area to keep you safe.

The fascia lens is your most common encounter. This camera lives right in the front of the ATM, usually tucked into a recessed bezel above or beside the screen. It's designed to get a clear shot of your face during transactions, which helps banks verify legitimate users and catch the bad guys.

Many ATMs also use overhead mounting systems, especially in those glass vestibules outside banks. These ceiling cameras act like security guards with a bird's-eye view, watching the entire ATM area from above. If you're using a drive-thru ATM, you'll often see cameras mounted on drive-thru poles positioned to capture both your vehicle and your face.

Don't forget about the surrounding wall cameras either. These extend the security bubble beyond just the ATM itself, keeping an eye on who's coming and going in the area.

Primary Camera Positions: "Smile for the Fascia Lens"

The front fascia camera is your main photo op when using an ATM. This little guy is specifically positioned for facial capture, angled just right to get a clear shot of your face without blocking your view of the screen or keypad.

Where are cameras on ATM machines becomes pretty obvious with this front-facing position. You'll typically find it in a small housing above the screen, sometimes so seamlessly integrated that you might not notice it at first glance. This smart positioning gives the camera the perfect PIN-pad field of view while respecting your privacy by focusing on your face rather than your hands.

Some newer ATMs even show you what the camera sees on the transaction screen. It's like a friendly reminder that you're being filmed, which also serves as a warning to anyone thinking about causing trouble.

Peripheral Cameras Guard the Perimeter

Beyond that main facial camera, ATMs often have a supporting cast of peripheral cameras, each with their own specialty. Card slot cameras keep a close watch on the insertion point where criminals love to attach skimming devices. These cameras are positioned to spot any foreign objects or fake overlays that might be trying to steal your card data.

Cash dispenser cameras focus on the money slot, capturing images of bills being dispensed and withdrawn. This positioning helps resolve those "Hey, where's my twenty?" disputes and provides evidence if someone tries to mess with the cash mechanism.

Area surveillance cameras take the wide view, monitoring the general vicinity around the ATM. These cameras often use wide-angle lenses that can photograph activity up to 50 feet from the machine, giving context to any incidents that might occur. They're like the neighborhood watch of the ATM world.

Placement Variations: Indoor vs. Outdoor vs. Drive-Thru ATMs

The location of your ATM dramatically affects where are cameras on ATM machines and how they're protected. Think of it like choosing the right outfit for different weather—each environment demands specific camera features and mounting strategies.

Environmental lighting creates the biggest challenge for ATM cameras. Indoor machines enjoy consistent fluorescent or LED lighting, while outdoor ATMs battle everything from blazing noon sun to pitch-black midnight conditions. This means outdoor cameras need IR illuminators and specialized sensors that indoor units can skip.

Vandal-resistant housings become absolutely critical once you move outside. Indoor cameras can use sleek, lightweight designs, but outdoor installations need armor-like protection against weather, vandalism, and determined criminals with crowbars.

Wide-angle lenses help capture more area with fewer cameras, especially important for outdoor installations where every additional camera mount increases costs and complexity. Weatherproof enclosures must seal out moisture while preventing the condensation that can fog up a lens at the worst possible moment.

Indoor & In-Branch Machines

Indoor ATMs live in a protected world with lower crime risk thanks to controlled access and staff nearby. This safer environment opens up more creative camera placement options, including ceiling domes that provide bird's-eye coverage without screaming "you're being watched."

Branch ATMs often tap into the bank's existing security network, creating layers of protection that extend far beyond the machine itself. The combination of ATM-specific cameras with general branch surveillance means every angle gets covered, from the moment someone walks through the door.

Controlled lighting makes indoor cameras perform beautifully. No harsh shadows from overhead sun, no glare bouncing off car windshields—just consistent, even illumination that produces clear facial images every time.

Stand-Alone & Outdoor Kiosks

Outdoor ATMs face Mother Nature's full fury, requiring specialized protection that indoor units never need. Rain hoods shield camera lenses from downpours while maintaining crystal-clear visibility—think of them as tiny umbrellas that never fold up.

IR illuminators become essential partners for night operations, flooding the area with invisible infrared light that turns darkness into daylight for camera sensors. These systems ensure 24/7 surveillance capability whether it's high noon or midnight.

Weatherproof enclosures protect delicate electronics from temperature swings that could fry circuits or freeze mechanisms. These housings must meet strict waterproof ratings while allowing clear video capture—a balancing act between protection and performance.

Drive-Thru Installations

Drive-thru ATMs present unique puzzles because of vehicle height differences. A camera positioned perfectly for a Honda Civic might completely miss the driver of a lifted pickup truck. Boom-arm mounts solve this by allowing cameras to extend and adjust for optimal positioning regardless of vehicle size.

Liftd viewpoints help overcome visual obstacles created by car roofs and tinted windows. These installations often use multiple cameras working together—one at vehicle level for close-up shots, another liftd for wide-area coverage.

The combination of different camera angles makes drive-thru ATMs increasingly difficult for criminals to outsmart, despite their often isolated locations. It's like having security guards positioned at multiple heights, each watching different aspects of every transaction.

Spotting Trouble: Hidden Cameras, Skimmers & Tampering Signs

Here's the uncomfortable truth: criminals are getting really good at disguising their devices. Pinhole spy cameras used by fraudsters often look nearly identical to legitimate ATM components, making them incredibly difficult to spot unless you know what to look for.

Overlay skimmers represent one of the most common threats you'll encounter. These devices fit right over the real card reader and PIN pad, capturing your data as you conduct what feels like a normal transaction. The scary part? They often include tiny cameras positioned to record your PIN entry, giving criminals everything they need to empty your account.

When criminals install these devices, they leave behind telltale signs. Adhesive residue around components is a dead giveaway—legitimate ATM parts don't need extra glue to stay in place. Loose bezels that wiggle when touched indicate something's been added or modified. Mismatched colors between different parts of the ATM often reveal where criminals couldn't perfectly match the original factory finish.

Understanding where are cameras on ATM machines legitimately belong helps you spot the ones that shouldn't be there. Criminal cameras need clear sightlines to your PIN pad and card, so they're often positioned in obvious spots that criminals hope you'll assume are normal security features.

The good news? Most criminal devices create blind spots in legitimate security coverage, and banks are increasingly using ATM skimming camera detection systems to spot these intrusions. Some financial institutions are even testing ATM skimmer detectors that can identify when an extra device is scanning your card information.

Quick DIY Inspection Checklist

Before inserting your card, spend thirty seconds doing a quick inspection. The wiggle test should be your first move—gently pull on the card reader and PIN pad to check for loose or removable parts. Legitimate components are built to withstand thousands of transactions and shouldn't budge at all.

Look for mismatched colors between different sections of the ATM. Criminals often struggle to perfectly match the original color scheme, leaving subtle differences that alert users can spot. Pay special attention to areas around the card slot and PIN pad where overlay devices are commonly placed.

Check for unusual lens holes or openings that seem out of place. Hidden cameras need a clear view of your PIN entry, so criminals must create openings that may not match the ATM's original design. These holes are often perfectly round and suspiciously positioned near the keypad area.

What to Do If You Suspect Tampering

If something doesn't look right, trust your instincts and walk away. Don't use the ATM under any circumstances—it's better to find another machine than risk having your account compromised.

Report to the bank immediately, even if you're not completely sure about what you've found. Most banks have 24/7 customer service lines specifically for security concerns, and they'd rather investigate a false alarm than deal with customer fraud later.

Call police if you find obvious skimming devices or tampering evidence. These findies represent active crime scenes that require professional investigation. Don't try to remove devices yourself—you could compromise evidence or accidentally trigger defensive mechanisms that criminals sometimes build into their equipment.

Most importantly, avoid re-entering your PIN if your card gets stuck or if someone nearby suggests you try your transaction again. This is a classic tactic used by criminals to capture your PIN after they've already copied your card data through a skimmer.

If you used the ATM before finding the tampering, contact your bank immediately to report potential fraud and start monitoring your account for unauthorized transactions. Quick action can often prevent criminals from successfully using your stolen information.

Frequently Asked Questions about ATM Cameras

When it comes to ATM security, customers naturally have questions about how surveillance works and what it means for their privacy. Understanding these details helps you use ATMs more confidently while staying alert to potential security threats.

How long is footage stored?

Most banks across the United States follow a 90-day average retention period for ATM surveillance footage. This timeframe isn't arbitrary—it's carefully calculated to give customers enough time to notice fraudulent transactions on their statements while keeping storage costs manageable for financial institutions.

The 90-day window works well because most people check their accounts monthly, and credit card companies typically allow 60 days for fraud reporting. This gives everyone involved plenty of time to identify problems and request video evidence.

Legal retention requirements vary by state, but most banks exceed the minimum standards. Some high-traffic locations or ATMs with frequent security incidents might store footage for several months or even longer, especially if they have advanced storage systems that can handle the extra data.

Who can view the video?

Access to ATM camera footage is surprisingly restricted, even though it might seem like your video should be available to you. Banks can review footage for legitimate business purposes like investigating fraud claims, resolving transaction disputes, or monitoring security incidents at their machines.

Law enforcement can obtain footage through proper legal channels, typically requiring subpoenas or court orders except in genuine emergency situations. This legal protection ensures that surveillance footage isn't misused or accessed without proper justification.

Here's something that surprises many people: banks generally cannot release footage directly to customers, even if you appear in the video. This restriction exists because of subpoena requirements and privacy regulations that protect all customers who might appear in the footage, not just the person making the request.

Can cameras see my PIN?

This is probably the most important question for your personal security. Legitimate cameras are positioned specifically to avoid capturing PIN entry. Banks design their surveillance systems to focus on facial recognition and general transaction monitoring rather than spying on your keypad activity.

The angle and positioning of authentic ATM cameras make it nearly impossible to see the numbers you're pressing. Camera manufacturers and banks work together to ensure legitimate cams cannot compromise your PIN privacy while still providing effective security coverage.

However, hidden cameras placed by criminals tell a completely different story. These devices are specifically designed to capture PIN entry, often disguised as privacy covers, fake card readers, or other seemingly legitimate ATM components. Criminal cameras are positioned with direct views of the keypad because stealing your PIN is their primary goal.

The best protection remains simple: always cover your keypad with your hand, wallet, or purse when entering your PIN. This technique defeats both any legitimate cameras that might have partial keypad visibility and criminal devices specifically placed to steal your PIN. It's such a simple habit that can save you from significant financial headaches.

Conclusion

Understanding where are cameras on ATM machines is like having a security roadmap in your back pocket. You now know that the primary fascia camera above the screen is watching for your safety, while peripheral cameras guard the perimeter like silent sentinels. This knowledge transforms you from a passive user into an informed protector of your own financial security.

The real power comes from spotting the difference between legitimate security features and criminal additions. Authentic cameras blend seamlessly into the ATM's design—they're part of the machine's DNA. Criminal devices stick out like a sore thumb once you know what to look for, with their mismatched colors, loose fittings, and obvious aftermarket installation signs.

These cameras aren't just passive recording devices anymore. Modern ATM surveillance systems are smart guardians that can detect tampering, sound alarms, and even lock down the machine when threats are detected. They're working 24/7 to create a protective bubble around your transactions, whether you're making a quick withdrawal at 2 PM or 2 AM.

Think of it this way: every time you see that little camera lens, you're looking at a piece of technology that's specifically designed to have your back. It's there to make criminals think twice, gather evidence if something goes wrong, and give you the confidence to access your money when you need it.

At Merchant Payment Services, we've spent over 35 years perfecting ATM security because we believe your peace of mind is priceless. Our expertise in ATM management has shown us that the best security system is one that works invisibly in the background while keeping you fully informed about how it protects you.

Whether you're a business owner considering your first ATM installation or someone who just wants to feel safer during transactions, knowledge is your best defense. Those cameras are your allies, not your enemies—they're proof that someone cares about keeping your money and your personal information secure.

Stay curious, stay cautious, and remember that every glance at a camera position is a small investment in your own financial safety.