ATM Skimming Cameras Explained (and How to Spot Them!)

The Hidden Threat at ATMs: Spotting Skimming Devices

ATM skimming cameras are small, hidden recording devices installed by criminals near ATM keypads to secretly capture your PIN while a separate skimming device reads your card data. These cameras are typically disguised to blend with the ATM's design and may be hidden in brochure holders, false panels, or light fixtures above the keypad.

Quick Guide to Spotting ATM Skimming Cameras:

- Look for unusual attachments above the keypad or on the ATM facade

- Check for tiny holes that could contain a pinhole camera lens

- Inspect brochure holders or promotional materials near the ATM

- Examine light fixtures for modifications or unusual appearance

- Always cover the keypad with your hand when entering your PIN

The FBI reports that skimming costs financial institutions and consumers more than $1 billion each year. In a single year, the U.S. Secret Service investigated skimming incidents accounting for over $115 million in losses and made more than 350 arrests related to these crimes.

ATM skimming is a sophisticated form of theft that combines physical devices with clever concealment. Criminals install card readers over legitimate card slots to capture your card data, while simultaneously using hidden cameras to record your PIN entry. Once they have both pieces of information, they can create counterfeit cards and drain your account.

Most concerning is how difficult these devices can be to detect. Many skimming cameras are professionally manufactured to match ATM colors and designs perfectly. They can be installed in seconds, often while distracting store clerks or other customers.

As Lydia Valberg, Co-Owner of Merchant Payment Services, I've spent years helping businesses protect their ATMs from skimming attacks, and have seen how ATM skimming camera technology has evolved from crude attachments to sophisticated, nearly invisible devices that threaten both consumers and businesses alike.

Why This Guide Matters

With over 35 years in the ATM management industry, we've witnessed the evolution of fraud techniques and the devastating impact they can have on both consumers and businesses. This guide isn't just about understanding a threat—it's about empowering you with practical knowledge to protect yourself and your customers.

For business owners with ATMs on their premises, skimming devices can damage customer trust and potentially expose you to liability issues. For consumers, falling victim to skimming can mean emptied accounts, hours spent disputing fraudulent charges, and the stress of having your financial security compromised.

By understanding how ATM skimming cameras work and implementing the detection techniques we'll share, you can significantly reduce your risk of becoming another statistic in this billion-dollar criminal industry.

What Is ATM Skimming & How It Works

Ever withdrawn cash and later found mysterious charges on your account? You might have been a victim of ATM skimming. Unlike straightforward theft, skimming is sneakier – criminals capture your card information while leaving the original in your wallet, meaning you might not realize anything's wrong until it's too late.

Think of skimming as a two-part heist that requires:

- Card data capture device - Usually a convincing overlay that sits on top of the real card reader or a paper-thin "deep-insert skimmer" hidden completely inside the card slot

- PIN capture method - Typically a hidden ATM skimming camera or sometimes a fake keypad overlay

Today's skimmers would impress even James Bond. Gone are the bulky, obvious devices of the past. Modern criminals use technology that's practically invisible to the untrained eye:

Deep-insert skimmers slip entirely inside the card slot – you can't see them at all. Overlay skimmers look remarkably like the real thing and attach with simple double-sided tape. The most advanced Bluetooth-enabled skimmers transmit your data wirelessly, so thieves never need to return to the scene of the crime.

The U.S. Secret Service has tracked increasingly organized skimming operations, with some criminal rings responsible for millions in fraud. Perhaps most troubling is the targeting of EBT cards since 2021. These benefits cards typically lack chip technology, making them particularly vulnerable to skimming attacks.

The financial impact is staggering – skimming operations cause approximately $115 million in yearly losses across the United States alone.

Step-By-Step Anatomy of a Skimming Attack

A skimming operation unfolds like a well-rehearsed play:

Act 1: Installation – Criminals install their devices in seconds, often working in teams. One person distracts the store clerk while another quickly attaches the skimmer and camera. They favor less-monitored locations like gas stations, convenience stores, or standalone outdoor ATMs.

Act 2: Data Collection – The devices silently capture information from unsuspecting customers. Modern skimmers can store hundreds or even thousands of card details before needing retrieval.

Act 3: Data Retrieval – Criminals either physically collect their devices or, with fancier equipment, download your data remotely via Bluetooth or cellular connections.

Act 4: Card Cloning – Using stolen data, they create counterfeit cards with inexpensive magnetic stripe writers – technology that's unfortunately easy to purchase online.

Act 5: The Cash-Out – Armed with working clones and PINs, criminals withdraw money directly from victims' accounts. For EBT cards, these withdrawals typically happen between midnight and 6 a.m. when benefits are first deposited.

What makes skimming particularly effective is its stealth. A single compromised ATM in a busy location might capture dozens of cards daily, and many victims don't realize anything's wrong until they check their account balance and find it mysteriously empty.

At Merchant Payment Services, we've seen how devastating these attacks can be for both consumers and businesses. That's why understanding how skimmers work is your first line of defense against becoming another statistic.

Anatomy of an ATM Skimming Camera

The ATM skimming camera might be the most clever piece of a skimmer's toolkit. While the card skimmer steals your card information, it's the hidden camera that captures your PIN—completing the puzzle criminals need to access your hard-earned money.

Today's ATM skimming cameras are incredibly tiny, often no bigger than a pinhead. These miniature marvels can be tucked away almost anywhere with a view of the keypad:

That innocent-looking brochure holder? Perfect hiding spot. The decorative panel that seems like part of the ATM? Could contain a camera. Even light fixtures, speaker grills, and believe it or not, fake security camera housings can conceal these tiny spies.

What makes these devices particularly sneaky is how well they blend in. Criminals carefully color-match them to the ATM's design and use removable adhesive for quick installation and removal. Some advanced models use wide-angle lenses to capture the entire keypad from odd angles, making them even harder to spot during your quick transaction.

These cameras are also surprisingly efficient. Running on small batteries, some can record continuously for up to two days, while others use motion sensors to activate only when someone approaches—conserving power for longer operations.

Drive-up ATMs create a perfect storm for ATM skimming camera success. When you're sitting in your car, it's awkward to lean forward and cover the PIN pad properly, making these locations particularly attractive to criminals looking for easy PIN captures.

| PIN Capture Method | How It Works | Detection Difficulty | Prevalence |

|---|---|---|---|

| Pinhole Camera | Tiny camera records PIN entry | High - Often nearly invisible | Very Common |

| Bar-Style Camera | Elongated camera housing above screen | Medium - Looks like ATM component | Common |

| Fake Keypad Overlay | Records keystrokes directly | Low - Changes feel of keypad | Less Common |

| Thermal Camera | Detects heat signatures left on keypad | Very High - No visible components | Rare |

ATM Skimming Camera Hot-Spots

Criminals are strategic about where they place their ATM skimming cameras. Knowing their favorite hiding spots can help you spot them before becoming a victim.

The area directly above the keypad is prime real estate for hidden cameras. Those thin bar-style cameras blend seamlessly with many ATM designs, making them hard to notice during a quick transaction. Speaker grills are another favorite—their small holes provide perfect concealment while still allowing the camera to see your fingers pressing those PIN buttons.

Light bars that illuminate the keypad or screen can be swapped out with counterfeit versions hiding cameras inside. And those helpful brochure holders? Security experts consistently warn that they're frequently used to hide cameras, with some criminals even adding fake holders to ATMs that never had them before.

For ATMs in those secure vestibules requiring card access, criminals get creative by placing skimmers on the door card reader instead of the ATM itself, with a camera positioned inside to capture your PIN once you enter.

Perhaps most disturbing is when criminals create complete facade overlays containing both skimming components and cameras in a single unit, designed to look identical to the ATM's original face. Some have even been known to place fake covers over the ATM's legitimate security camera, with their own hidden camera pointed at the keypad.

How Criminals Use Footage & Data

Once criminals have both your card data and PIN, they're ready to empty your account. Here's their typical playbook:

With inexpensive magnetic stripe writers (available online for less than $100), they transfer your stolen data onto blank cards, creating functional copies of your card. For EBT cards especially, they know exactly when benefits become available and strike quickly—often between midnight and 6 a.m. when you're sound asleep.

More sophisticated operations may sell your data on dark web marketplaces rather than risking ATM withdrawals themselves. To avoid triggering fraud alerts, they'll often make several smaller withdrawals instead of emptying accounts all at once. They might even test your card with a small purchase or balance check before attempting larger withdrawals.

The ATM skimming camera footage is typically timestamped and synchronized with the card data, allowing criminals to match PINs with the corresponding cards. Some advanced operations use automated software to pair this data, enabling them to process hundreds of compromised cards efficiently.

At Merchant Payment Services, we've seen these techniques evolve over our 35 years in the industry. That's why we're committed to helping business owners understand and combat these threats to protect both their ATMs and their customers.

How to Detect and Avoid ATM Skimming Cameras

Let's face it – most of us don't give ATMs a second thought when we need cash. But taking just a few extra seconds before you insert your card could save you from becoming the next victim of skimming fraud.

I've seen hundreds of compromised machines over my years in the industry, and the sad truth is that ATM skimming cameras are getting harder to spot. They're smaller, more cleverly disguised, and often perfectly matched to the machine's color scheme.

When you approach any ATM, look for these telltale warning signs:

The most effective check is what we in the industry call the "wiggle test." Before inserting your card, gently tug on the card reader. A legitimate card slot should feel solid and firmly attached. If anything wiggles, feels loose, or seems off – walk away and report it immediately. Criminals often use temporary adhesives that can loosen over time.

Always shield your PIN entry with your other hand, purse, or wallet – even if you don't see anything suspicious. This simple habit defeats most ATM skimming cameras regardless of where they're hidden. You'd be surprised how many people skip this basic precaution!

Location matters too. Choose ATMs in well-lit, high-traffic areas whenever possible. Machines inside bank lobbies or secured vestibules with surveillance cameras are significantly less likely to be compromised than gas station or convenience store ATMs where criminals have more privacy to install devices.

When you have the option, tap-to-pay or contactless ATM transactions provide an extra layer of security. These methods use sophisticated tokenization technology that doesn't expose your actual card data during the transaction – making them virtually immune to traditional skimming attacks.

For more information on reporting suspected fraud, the Federal Trade Commission offers excellent resources at their Fraud Reporting site.

10-Second Inspection Checklist

You don't need a magnifying glass or special training to protect yourself. This quick 10-second routine can help you spot most skimming attempts:

First, take a visual scan (3 seconds) – look for anything unusual around the card reader and above the keypad. Pay attention to mismatched colors, unusual seams, or suspicious attachments.

Next, do a quick tactile check (3 seconds) – gently tug the card reader and press around the edges of the keypad. Legitimate components should feel solid and firmly attached.

Then, try a light test (2 seconds) – use your phone's flashlight to illuminate the card slot and keypad at an angle. This simple trick can reveal hidden cameras or the edges of overlay devices that might otherwise blend in perfectly.

Finally, if possible, do a quick comparison (2 seconds) – if there are multiple ATMs available, compare them. Criminals rarely tamper with all machines in the same location.

This quick routine becomes second nature with practice and could save you from the headache of dealing with a drained bank account. For more detailed information about ATM skimming, visit our ATM Skimming blog post.

Advanced Tools & Technologies

The battle against skimming has entered the high-tech arena, with new tools emerging to help consumers and businesses fight back:

Several smartphone apps now claim to detect Bluetooth signals from wireless skimmers. While results vary, these apps can sometimes identify suspicious Bluetooth transmitters near ATMs that might indicate the presence of a remote skimming operation.

Newer ATMs increasingly incorporate "jitter" technology – a clever defense that moves your card in an unpredictable pattern during insertion. This makes it nearly impossible for skimming devices to accurately read the magnetic stripe.

The most advanced machines now include Internet of Things (IoT) sensors that can detect tampering or unauthorized attachments and immediately alert the operator. At Merchant Payment Services, our premium ATM solutions include built-in anti-skimming features that can detect and prevent many common skimming attacks. Learn more about our ATM Security Solutions.

Extra Protection Tips

Beyond physically inspecting ATMs, here are some additional layers of protection I recommend to all our clients:

Enable transaction alerts on your accounts. Most banks now offer text or email notifications for ATM withdrawals and transactions above a certain amount. This allows you to immediately identify unauthorized activity before criminals can drain your account.

Don't wait for your monthly statement – review your accounts weekly online to catch suspicious transactions early. The sooner you spot fraud, the easier it is to resolve.

For those particularly concerned about fraud, consider credit freezes to prevent criminals from opening new accounts using stolen information. This extra step can provide peace of mind beyond just ATM security.

Whenever possible, use mobile wallet solutions like Apple Pay or Google Pay that use sophisticated tokenization rather than exposing your actual card data. These technologies are significantly more resistant to traditional skimming attacks.

Finally, consider ways to limit your ATM use altogether. Getting cash back during retail purchases or using your bank's official branch locations can reduce your exposure to potentially compromised machines.

What to Do If You Suspect a Skimmer or Become a Victim

So you've spotted something fishy at the ATM—maybe a loose card reader or an odd-looking attachment near the keypad. First things first: trust your gut.

If you suspect you've encountered an atm skimming camera or device, immediately cancel your transaction and step away from the machine. Your quick thinking could save not just your account, but potentially dozens of others too.

Instead of removing the device (tempting as it may be), take clear photos of it from multiple angles. This documentation will be invaluable to both the ATM owner and law enforcement. Just be careful not to touch the device—it's evidence that could help catch the criminals.

Next, alert the ATM owner right away. If it's at a bank after hours, most have 24/7 customer service lines posted right on the ATM. For machines at convenience stores or gas stations, notify the manager on duty. They'll typically have protocols in place for handling potential skimming incidents.

If you think your card information has already been compromised, time is of the essence. Contact your bank immediately—most have dedicated fraud departments that can freeze your account and issue a new card with a new PIN. While you're on the phone, ask about their specific procedures for handling fraud claims.

While waiting for your new card, monitor your accounts daily for suspicious activity. Many banking apps now offer instant transaction notifications, which can alert you to fraud in real-time.

Filing a police report might seem like overkill, but it creates an official record that can strengthen your fraud claim with your bank. Plus, local law enforcement can alert other agencies about skimming activity in your area.

Take a few minutes to submit an online report to the Internet Crime Complaint Center (IC3) as well. They coordinate with law enforcement nationwide to track and combat financial crimes like ATM skimming.

If you're especially concerned about identity theft, consider placing a fraud alert on your credit reports. This extra step helps prevent criminals from opening new accounts using your stolen information.

Reporting & Legal Protections

The good news? You have strong legal protections when it comes to fraudulent transactions. But these protections depend on how quickly you report the problem.

For debit cards, the Electronic Funds Transfer Act (EFTA) creates a tiered system of liability:

- Report before unauthorized charges occur: $0 liability

- Report within 2 business days: Maximum $50 liability

- Report within 60 calendar days of your statement: Maximum $500 liability

- Report after 60 days: Potentially unlimited liability (this is why quick reporting is crucial!)

Credit cards offer even stronger protection under the Truth in Lending Act, capping your liability at $50 regardless of timing. Even better, most major credit card issuers now offer zero-liability policies that eliminate even this modest risk.

When disputing fraudulent transactions, start with a phone call but always follow up in writing. Document everything—keep copies of all correspondence, note the names and employee IDs of representatives you speak with, and track the promised resolution timeline.

Your bank is legally required to investigate and resolve fraud claims within specific timeframes: typically 10 business days for debit cards (though they may extend this to 45 days in complex cases) and within two billing cycles for credit cards.

At Merchant Payment Services, we've helped countless business owners implement stronger ATM security measures after skimming incidents. Our experience has shown that the faster you act, the better your chances of full recovery and preventing future attacks.

Industry Response & Future Trends

The battle against ATM skimming feels a bit like a technological arms race—as criminals develop more sophisticated techniques, the financial industry continuously evolves its defenses. It's fascinating to see how this cat-and-mouse game plays out in real time.

Today's ATMs are getting smarter about protecting your money. Modern machines now include physical countermeasures like card slot jammers that physically block skimming devices from being installed. Many ATMs also feature specialized sensors that can detect when something foreign has been attached to the card reader—kind of like an immune system for the machine.

One of the most promising developments is the use of artificial intelligence in ATM security. These systems analyze camera footage in real-time, spotting suspicious behavior or unauthorized device installations before they can do harm. Imagine having a vigilant security guard watching every ATM transaction—that's essentially what this technology provides.

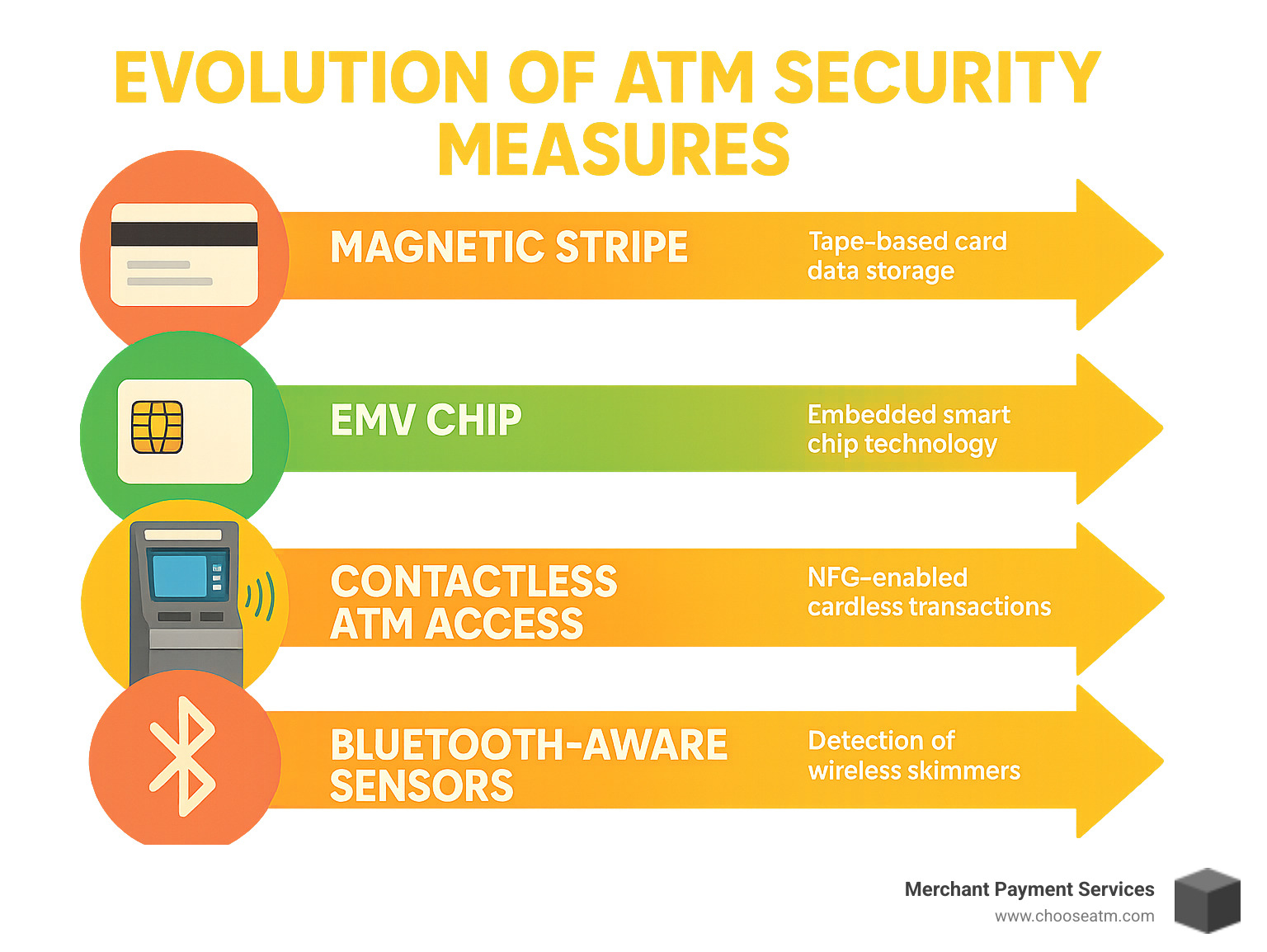

The shift from magnetic stripe to EMV chip technology has been a game-changer, making traditional card cloning significantly more difficult. Though criminals haven't given up—they've responded with "shimming" attacks that target chip cards in new ways. It's a reminder that security is never a "set it and forget it" proposition.

Contactless ATM access represents another leap forward. Many newer machines support transactions using NFC technology, which means you don't even need to insert your card. No card insertion means no opportunity for traditional skimming—pretty clever, right?

Some cutting-edge ATMs can now even detect unauthorized Bluetooth signals nearby, potentially revealing the presence of wireless skimming devices. It's like giving the ATM a sixth sense for criminal activity.

Law enforcement hasn't been sitting idle either. The U.S. Secret Service leads many investigations into organized skimming operations, resulting in hundreds of arrests annually. The coordination between financial institutions, ATM manufacturers, and law enforcement has created a powerful network sharing information about new skimming techniques almost as soon as they appear.

At Merchant Payment Services, we pride ourselves on staying at the cutting edge of these security developments. Our ATM solutions incorporate the latest anti-skimming technologies because we believe prevention is always better than dealing with fraud after it happens. Learn more about our approach to ATM Network Security if you're curious about the details.

Emerging Threats & Countermeasures

As traditional skimming becomes harder due to improved security, criminals are getting more creative—and sometimes more technical—with their approaches.

Shimming has emerged as a particularly sneaky threat. Unlike bulky skimmers that attach to the outside of card readers, "shims" are ultra-thin devices (about the thickness of a piece of paper) inserted directly into the card slot. At just 0.1-0.2mm thick, they're practically invisible to the naked eye and can read chip card data as it's being processed.

Malware jackpotting takes a completely different approach. Rather than physically skimming cards, criminals install malicious software on ATMs that can force them to dispense cash on command—like hitting a jackpot on a slot machine, hence the name.

Deep-insert skimmers represent yet another evolution. These devices sit entirely within the card reader, making them undetectable through visual inspection alone. You could stare at that card slot all day and never spot the danger lurking inside.

Fortunately, the industry isn't standing still. Predictive analytics now uses machine learning to identify unusual patterns in ATM usage that might indicate fraud, often before customers even realize they've been victimized. Think of it as an early warning system that can spot the subtle signals of fraud amid the noise of normal transactions.

Smart-ATM IoT integration represents another innovative defense. Internet of Things sensors monitor ATM integrity in real-time, detecting subtle changes in weight, temperature, or vibration that might indicate tampering. It's like giving the ATM a nervous system that can feel when something's not right.

Perhaps most exciting is the rise of biometric authentication. Some ATMs now incorporate fingerprint or facial recognition, reducing reliance on PINs that can be captured by hidden atm skimming cameras. Your unique biological features become your password—something that's much harder for criminals to steal or duplicate.

The future of ATM security looks promising, with technology increasingly tilting the advantage toward legitimate users and away from criminals. At Merchant Payment Services, we're committed to bringing these advanced security features to businesses of all sizes, making ATM management both safer and simpler.

Frequently Asked Questions about ATM Skimming Cameras

How common are ATM skimming cameras in the U.S.?

If you've ever wondered whether ATM skimming is a rare crime or something to genuinely worry about, the numbers tell a sobering story. The FBI estimates that skimming costs financial institutions and consumers more than $1 billion annually in the United States alone. That's not pocket change.

In just one year, the U.S. Secret Service investigated cases accounting for over $115 million in losses and made more than 350 arrests related to skimming operations. Unfortunately, these numbers continue to grow as technology becomes more accessible to criminals.

Some ATM locations are particularly risky. Gas station ATMs tend to be prime targets because they often have minimal supervision. Tourist area ATMs are frequently targeted because visitors may be less familiar with what a normal ATM should look like. Standalone ATMs with minimal surveillance give criminals the time they need to install devices without being noticed. And drive-up ATMs are especially vulnerable because users typically can't easily shield their PIN entry from overhead cameras.

While major cities do see more skimming activity due to higher population density and more ATMs, don't assume rural areas are safe. In fact, criminals sometimes specifically target less-monitored rural locations precisely because they expect users and business owners to have their guard down.

Are chip or contactless cards immune to skimming cameras?

While chip (EMV) technology has significantly improved card security, it doesn't make you completely immune to skimming attacks. It's important to understand the protection levels of different payment methods.

Chip cards offer strong protection against data cloning, but there's a catch. Most chip cards still have a magnetic stripe for backward compatibility. If you insert your card fully into a compromised ATM, a skimmer can still read this magnetic stripe data. And regardless of how secure your card is, an ATM skimming camera can still capture your PIN as you type it.

Contactless cards provide better protection since they never physically enter a potentially compromised card reader. However, they're not perfect either. In theory, specialized RFID skimming devices could capture data from contactless cards at very close range, though this is rare in actual skimming operations. And again, if you need to enter a PIN, a hidden camera could still record it.

For the strongest protection, consider using mobile wallets like Apple Pay or Google Pay. These methods use tokenization—creating a unique one-time code for each transaction rather than transmitting your actual card data. This makes any captured information essentially useless for creating cloned cards.

Can I rely on bank-installed security cameras to protect me?

While those security cameras mounted in and around ATMs do serve a purpose, they shouldn't be your only line of defense against skimming.

Bank security cameras have several limitations when it comes to preventing skimming attacks. First, they're typically positioned to capture the overall ATM area rather than detailed close-ups of the card reader or keypad where skimmers and cameras are installed. This means a small device might not be visible in the footage.

Most ATM security footage isn't actively monitored in real-time. By the time someone reviews the footage, a skimming device might have been collecting card data for hours or even days. Sophisticated criminals sometimes even temporarily block or tamper with security cameras before installing their devices.

Camera coverage also varies widely depending on the ATM location. Those inside bank branches typically have better surveillance than standalone ATMs in convenience stores or gas stations.

The most effective protection comes from combining the bank's security measures with your own vigilance. Even if you see security cameras watching over an ATM, always take those few seconds to inspect the machine before using it, and always cover your PIN entry with your hand.

At Merchant Payment Services, we understand these security concerns and offer ATM solutions with improved security features to help protect both businesses and their customers from these increasingly sophisticated threats.

Conclusion

The hidden world of ATM skimming cameras represents a genuine threat that continues to evolve alongside our financial technology. Throughout this guide, we've uncovered how these nearly invisible devices work together with card skimmers to capture both your card data and PIN—essentially handing criminals the keys to your financial kingdom.

But here's the encouraging news: you don't need to be a security expert to protect yourself. By incorporating a few simple habits into your ATM routine, you can dramatically reduce your risk. Taking just 10 seconds to inspect an ATM before use and always shielding your PIN entry with your hand creates a powerful defense against most skimming attempts.

For business owners with ATMs on your premises, the stakes are even higher. Your customers trust you with their financial security every time they use your ATM. That's where partnering with an experienced provider like Merchant Payment Services makes all the difference. With our 35+ years in the industry, we've developed ATM solutions with sophisticated anti-skimming technologies and continuous monitoring that protect both your business reputation and your customers' accounts.

The most important lessons to take away from this guide are refreshingly simple: inspect before you insert, cover your PIN without exception, choose well-lit and monitored ATMs when possible, and consider contactless options when available. If you spot something suspicious, don't keep it to yourself—report it immediately to help protect others.

Staying vigilant doesn't mean living in fear. It simply means developing awareness and healthy habits that become second nature over time. By checking ATMs before use and regularly monitoring your accounts, you're taking control of your financial security in a world where ATM skimming cameras continue to pose a threat.

The financial industry continues to develop more sophisticated protections, but your awareness remains the first and most effective line of defense. We're proud to be part of that protection, offering ATM solutions that incorporate the latest security features while simplifying management for business owners.

For more information about how we can help protect your business and customers with our comprehensive ATM management solutions, visit Merchant Payment Services. Let us help you turn your ATM from a potential vulnerability into a secure, profitable asset for your business.