Secure Your ATM with These High-Quality Camera Options

Why ATM Machine Camera Security is Critical for Your Business

An atm machine camera is a specialized surveillance device designed to monitor ATM transactions, deter criminal activity, and provide evidence for fraud investigations. Here are the key types and purposes:

Main ATM Camera Types:

- Pinhole cameras - Hidden inside ATM housing for discreet monitoring

- Mini cube cameras - Compact visible deterrent with HD recording

- Wide Dynamic Range (WDR) cameras - Handle extreme lighting conditions

- Night vision cameras - Clear footage in low-light environments

Primary Functions:

- Document transactions and customer interactions

- Detect skimming devices and tampering attempts

- Provide evidence for dispute resolution

- Enable real-time security alerts

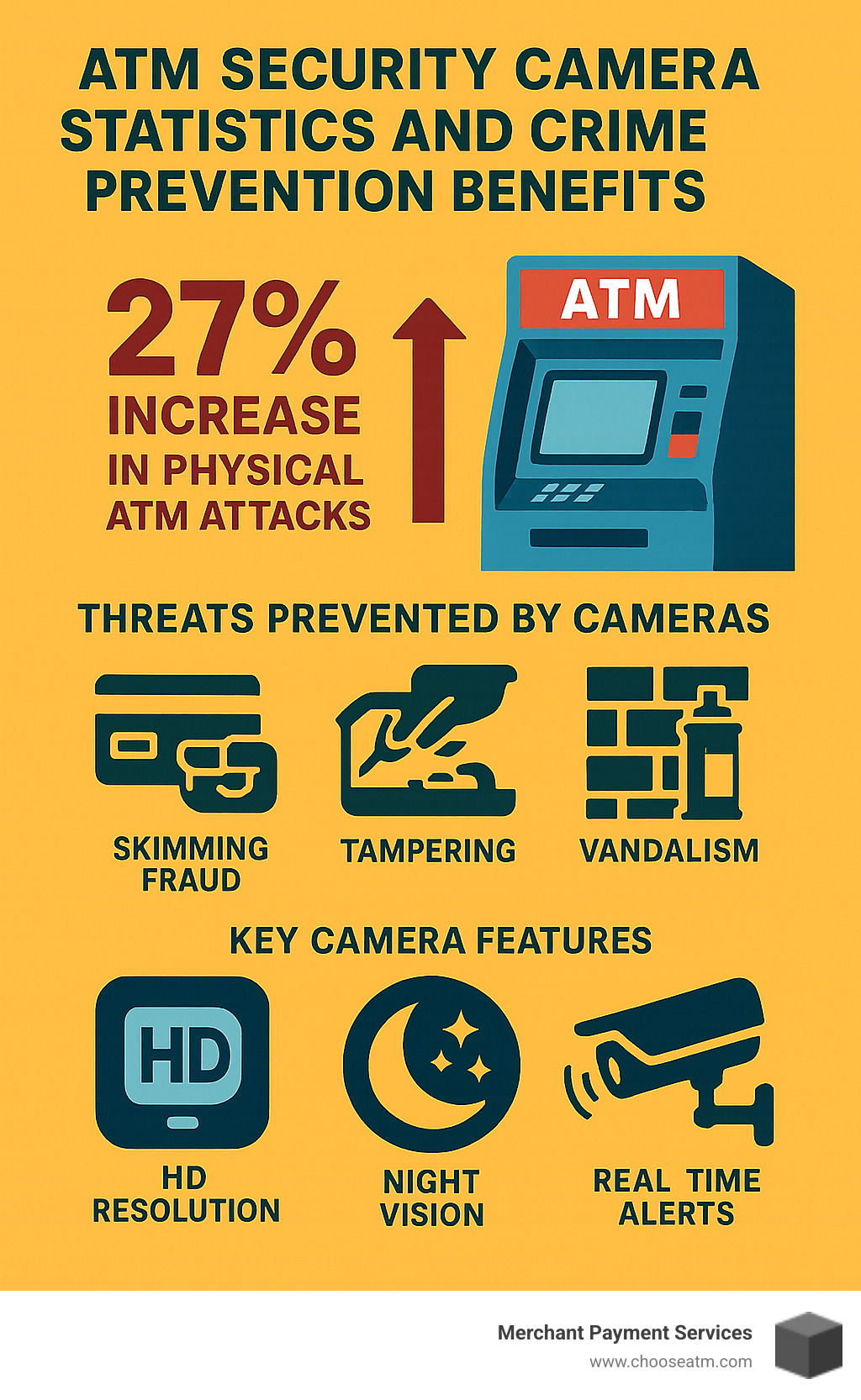

The numbers tell a stark story about ATM security threats. Physical attacks on ATM machines in Europe increased by 27% in 2018, jumping from 3,584 to 4,449 incidents, while stolen amounts rose 16% to €36 million. In the U.S., fraud incidents have doubled in the last year alone.

These statistics highlight why every ATM owner needs reliable camera protection. Whether you're running a convenience store, gas station, or retail location, your ATM represents both a revenue opportunity and a security liability.

Smart camera placement doesn't just capture crimes after they happen - it prevents them entirely. Visible cameras deter opportunistic thieves, while hidden pinhole systems catch sophisticated skimming operations that cost businesses thousands in chargebacks and reputation damage.

As Lydia Valberg from Merchant Payment Services, I've helped countless business owners secure their ATM investments with proper atm machine camera systems over my 35+ years in payment solutions. The right surveillance setup protects your customers, your cash, and your peace of mind while ensuring compliance with industry standards.

Why Read This Guide?

Every minute your ATM operates without proper camera protection, you're gambling with your business's reputation and bottom line. Video footage serves as your silent security guard, working 24/7 to document every transaction and interaction around your machine.

We've compiled this comprehensive guide to help you steer the complex world of ATM surveillance technology. You'll find which camera types work best for different environments, learn about cutting-edge features that transform basic recording into proactive crime prevention, and understand the installation requirements that ensure your system actually works when you need it most.

How an ATM Camera Safeguards Cash, Customers & Reputation

Think of your atm machine camera as the ultimate multitasker – it's simultaneously a crime prevention specialist, fraud investigator, and customer confidence booster all rolled into one compact device.

These aren't your grandfather's security cameras that just sit there recording everything. Today's systems are smart enough to detect suspicious activity and alert you instantly. When someone tries to tamper with your ATM, you'll know about it within seconds, not days later when you're reviewing footage.

The real magic happens when cameras work together with other security features. If someone blocks the camera lens – a classic move by skimmers – the system can automatically shut down the ATM. No footage means no transactions, which stops fraud attempts dead in their tracks.

Here's how different camera responses counter common ATM threats:

| Threat Type | Camera Response | Prevention Method |

|---|---|---|

| Card Skimming | Motion detection + close-up recording | Captures device installation attempts |

| Shoulder Surfing | Wide-angle coverage + face detection | Documents suspicious loitering behavior |

| Physical Tampering | Vibration sensors + instant alerts | Triggers immediate security response |

| Cash Theft | Transaction sync + HD recording | Links video to exact dispense amounts |

| Vandalism | Night vision + perimeter monitoring | Deters property damage attempts |

Your customers notice security measures, even if they don't say anything. A visible camera system tells them you take their safety seriously, which builds trust and encourages repeat visits to your location.

From Skimming to Vandalism—Cameras Make the Difference

Card skimming has become the silent threat that keeps ATM owners up at night. These devices look innocent enough – criminals can build them for around $200 and they'll run for two full days on a single battery charge. The scary part? They're getting harder to spot.

We've seen cases where fraudsters hid modified digital cameras in fake ceiling tiles just to record PIN numbers. They're not just targeting your ATM anymore either. Those card readers that control access to ATM vestibules? They're prime targets because most accept any card with a magnetic stripe.

Shoulder surfing might sound old-school, but it's still incredibly effective. Criminals position themselves to watch customers enter their PINs, sometimes even using small mirrors or smartphone cameras. Advanced camera systems with face detection can spot when multiple people are hanging around during a single transaction – a major red flag.

The physical attacks are where things get really serious. While we don't see the explosion attacks that have plagued European ATMs, tampering and vandalism attempts are real concerns here in the U.S. High-quality surveillance doesn't just help catch the criminals afterward – the visible deterrent effect prevents many attacks from happening in the first place.

Linking Video to Transactions for Fast Dispute Resolution

Here's where modern atm machine camera systems really shine. Instead of spending hours hunting through footage, you can pinpoint exactly what happened during any transaction in under two minutes.

When Mrs. Johnson calls claiming your ATM ate her card without dispensing cash, you don't need to panic. Just pull up her transaction time, and the synchronized video shows you everything – card insertion, PIN entry, cash dispensing, and her walking away with the money.

This time-stamp synchronization has revolutionized dispute resolution. Credit card companies used to side with customers by default because businesses couldn't provide solid evidence. Now you have frame-by-frame proof of exactly what transpired during each transaction.

The financial impact is huge. A single fraudulent chargeback can cost you hundreds of dollars in fees, plus the disputed amount. With synchronized video evidence, you can successfully contest these claims and protect your bottom line.

Banks using centralized video management report cutting investigation times from days to minutes. Instead of manually scrubbing through hours of footage, you can search by card number, transaction amount, or specific time windows to find exactly what you need.

For more detailed information about how these systems function, check out our comprehensive guide on How Do ATM Security Cameras Work?.

Choosing the Right ATM Machine Camera Type & Features

The atm machine camera market offers numerous options, each designed for specific security challenges and installation environments. Understanding these differences helps you select the system that best protects your particular ATM setup.

Choosing the Right ATM Machine Camera Type

Pinhole Cameras represent the gold standard for discrete ATM monitoring. These ultra-compact devices capture exceptionally clear video at 2.1MP/1080p resolution at real-time 30fps, even when installed in the cramped confines inside an ATM housing. Their tiny form factor makes them virtually invisible to customers and criminals alike.

The horizontal field of view reaches up to 106.6 degrees, ensuring comprehensive coverage of the transaction area without requiring multiple camera installations. Professional-grade pinhole systems offer both concealed and visible mounting brackets, allowing you to choose between stealth monitoring and visible deterrence based on your security strategy.

Mini Cube Cameras provide a middle ground between discrete monitoring and visible deterrence. These compact units typically offer 5MP resolution with H.265 video compression, reducing bandwidth and storage requirements by 25-50% compared to older H.264 systems. Power over Ethernet (PoE) capability simplifies installation by delivering both data and power through a single cable.

Most mini cube systems include motion detection with email alerts and mobile app support for remote viewing. The visible design serves as a deterrent while maintaining a professional appearance that doesn't intimidate legitimate customers.

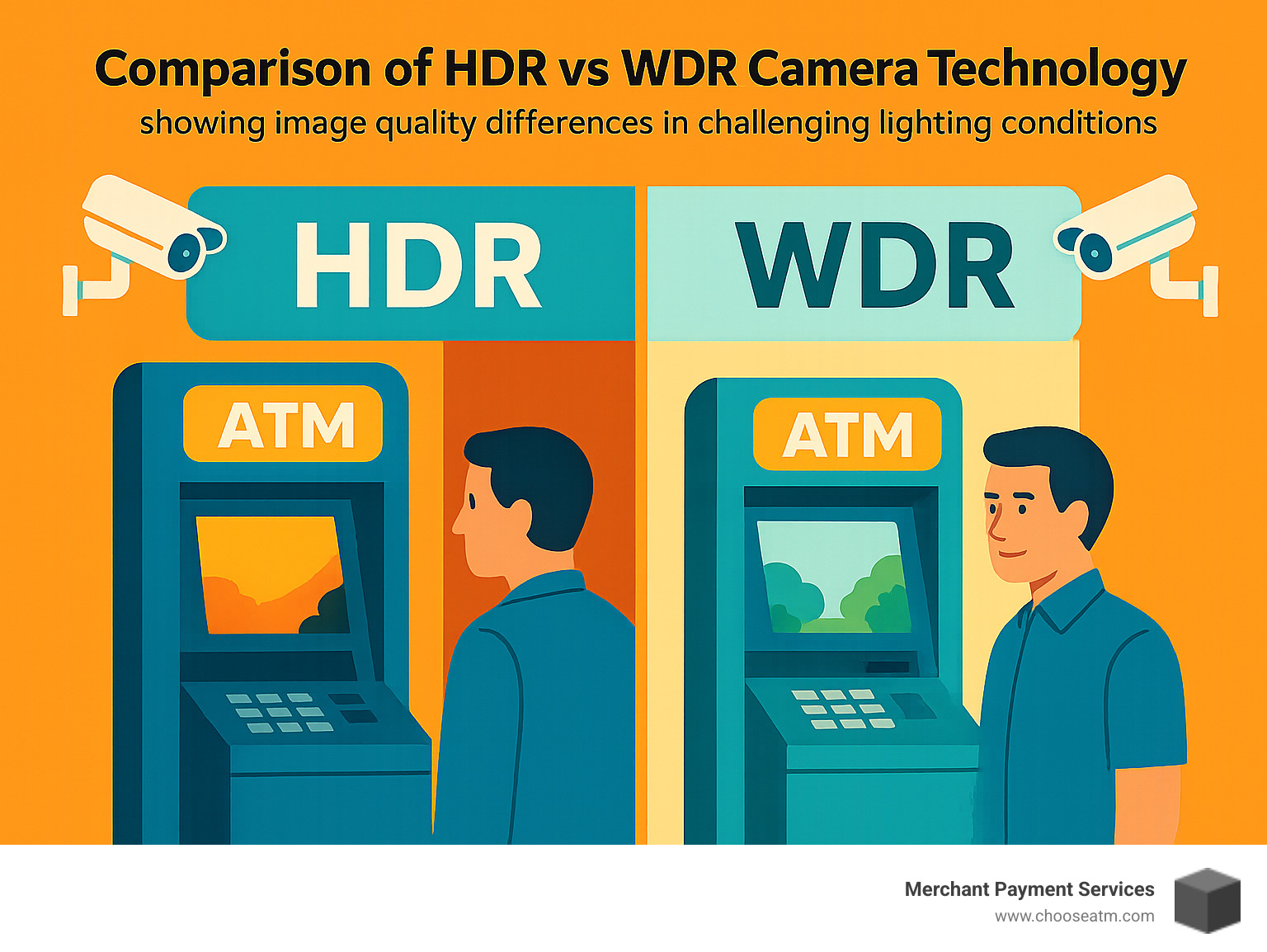

Wide Dynamic Range (WDR) Cameras excel in challenging lighting conditions common around ATMs. These systems can handle extreme contrasts between bright outdoor sunlight and dark ATM vestibules, ensuring clear footage regardless of time of day or weather conditions.

Professional WDR systems achieve up to 130dB of dynamic range with minimum illumination ratings as low as 0.03 Lux. This means they capture usable footage even in near-complete darkness, crucial for 24-hour ATM locations.

Advanced Tech That Turns an ATM Machine Camera into a Crime-Fighting Tool

Modern atm machine camera systems incorporate sophisticated analytics that transform passive recording into active crime prevention. Face recognition technology can prevent cash dispensing when no face is detected, stopping certain automated fraud attempts before they succeed.

Edge video analytics enable cameras to detect tampering, vandalism, loitering, and shoulder surfing in real-time. When suspicious behavior is identified, the system can automatically trigger audio warnings, send mobile notifications to security personnel, or even lock down the ATM to prevent further criminal activity.

HD resolution has become the baseline for professional ATM surveillance, but newer systems push even further. Some cameras capture up to 48MP panoramic video at 30fps, providing incredible detail for facial identification and evidence gathering.

Dual-streaming capability allows systems to simultaneously record high-resolution footage for evidence while streaming lower-resolution video for real-time monitoring. This approach optimizes network bandwidth while ensuring you never sacrifice recording quality when it matters most.

Smart 3D Digital Noise Reduction (DNR) technology reduces visual noise in low-light conditions without introducing processing lag. This ensures clear, usable footage even during overnight hours when many ATM crimes occur.

Feature-by-Feature Comparison

When evaluating camera options, several technical specifications directly impact your system's effectiveness:

Lens Angle: Wide-angle lenses (100+ degrees) capture more of the surrounding area but may sacrifice detail in the center of the frame. Narrower lenses (70-90 degrees) provide better facial detail but require more precise positioning.

Frame Rate: Real-time 30fps recording ensures smooth video that captures fast movements like card skimming device installation. Lower frame rates (15fps or less) may miss crucial details during rapid criminal activities.

Storage Requirements: HD recording generates substantial data volumes. H.265 compression significantly reduces storage needs compared to older codecs, but you'll still need adequate hard drive capacity or cloud storage for your retention requirements.

Power Requirements: PoE systems simplify installation but require compatible network switches. Traditional 12VDC systems offer more flexibility but need separate power runs to each camera location.

Weather Resistance: Outdoor cameras need appropriate IP ratings for your local climate. Indoor installations have fewer environmental concerns but still require protection from tampering and vandalism.

Installation, Placement & Compliance Best Practices

Getting your atm machine camera system installed correctly makes the difference between real security and false confidence. I've watched too many business owners spend good money on quality cameras, only to have them fail when it matters most because of poor installation choices.

The truth is, even the best camera becomes useless if it's pointing at the wrong angle or mounted where vibrations slowly shift its view over time. Let's walk through the essential steps that ensure your surveillance system actually protects your investment.

Step-by-Step Mounting Checklist

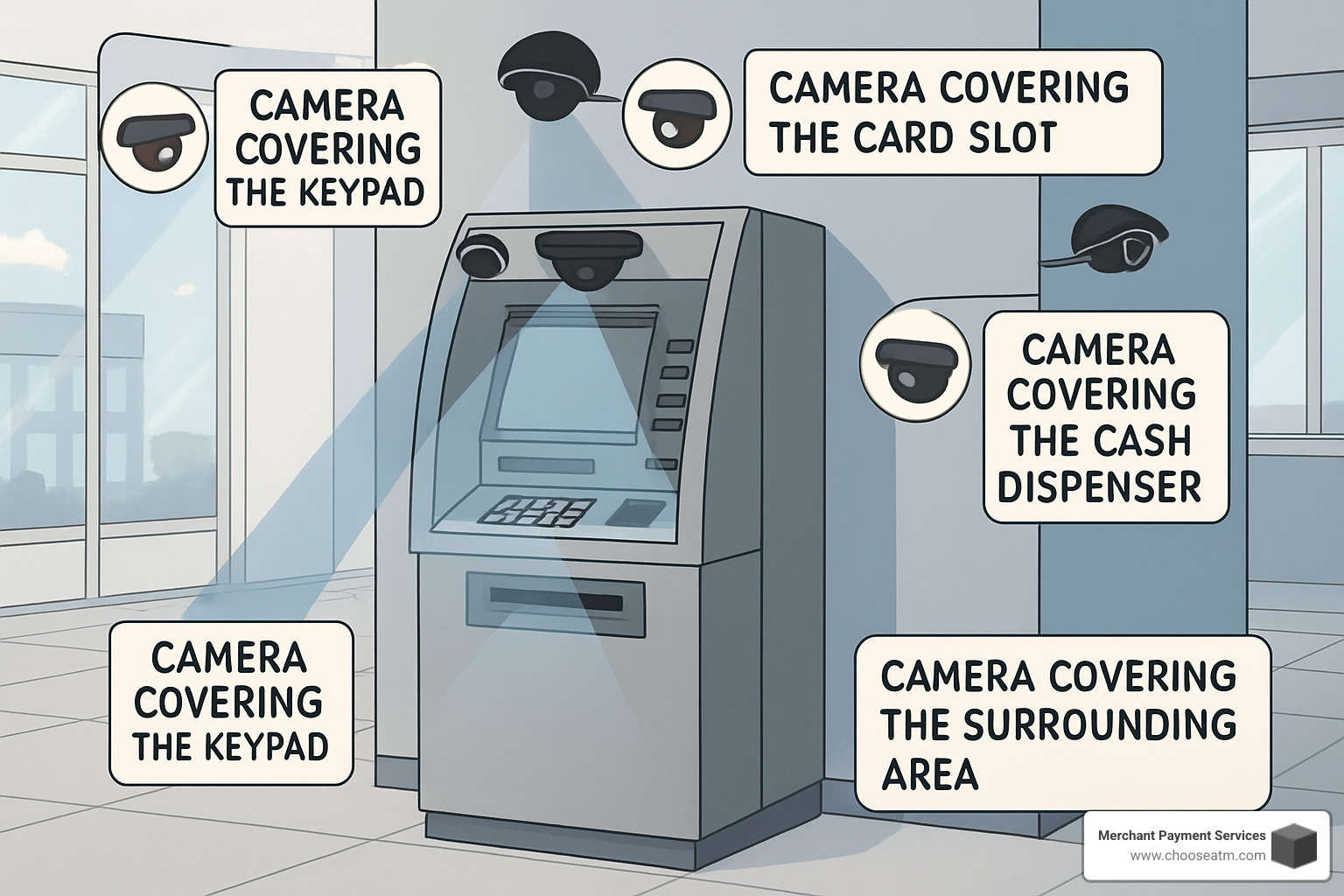

Interior placement gives you the clearest view of what really matters - the actual transaction. Mount your primary camera inside the ATM housing where it captures card insertion, PIN entry, and cash dispensing without weather interference or tampering attempts.

The trick is positioning the camera to avoid screen glare while maintaining perfect sight lines to the customer area. You want crystal-clear documentation without making legitimate customers feel uncomfortable or invaded.

Bracket alignment seems simple until you realize that generic mounting hardware often fails over time. The cash dispenser mechanism creates constant vibration that gradually shifts poorly secured cameras. Use manufacturer-specific brackets designed for your exact ATM model, and you'll avoid the frustration of finding your camera has been recording the ceiling for weeks.

Professional installations always include vibration control materials and proper cable management. Loose connections are the most common reason surveillance systems fail right when you need them most. Secure every cable and protect connection points from mechanical stress.

Exterior coverage extends your security perimeter beyond the immediate ATM area. Position additional cameras to capture approach paths, parking areas, and license plates. Many incidents begin long before the criminal reaches your machine, and that context often proves crucial for law enforcement.

Make sure exterior cameras handle overnight conditions well. ATM crimes frequently happen during dark hours when ambient lighting is minimal, so night vision capabilities aren't optional - they're essential.

Secure Storage & Remote Access

Here's something that might surprise you: criminals often know exactly how to destroy local video storage during physical attacks. If your footage only exists inside the ATM, you could lose all evidence precisely when you need it most.

Centralized server storage protects your video data even if attackers damage or steal the entire machine. Quality network connections enable real-time backup of critical footage to secure off-site locations, ensuring evidence survives any local incident.

Encryption and strict access controls prevent unauthorized viewing of customer transactions. Only designated personnel should access surveillance footage, and every viewing session should be logged for compliance auditing.

Set up automatic data retention policies that balance legal requirements with storage costs. Some states mandate specific retention periods, while others leave the decision to business owners. Know your local regulations and configure your system accordingly.

The sophistication of modern skimming operations became clear through documented cases like those detailed in Having a Ball with ATM Skimmers. These devices can operate undetected for days or weeks, making historical video review absolutely crucial for identifying when and how attacks occurred.

Integrating Cameras with Alarms & Monitoring Software

Your atm machine camera system becomes exponentially more powerful when integrated with alarm sensors and monitoring software. Physical contact sensors detect tampering attempts instantly, triggering immediate video recording and alert notifications before criminals can complete their work.

Face detection technology adds an intelligent layer of protection by disabling cash dispensing when no legitimate customer is present. This feature proves especially valuable during overnight hours when automated fraud attempts are more likely to go unnoticed.

Mobile notification systems ensure security alerts reach you immediately, regardless of time or location. Configure escalating alerts that contact multiple people if initial notifications aren't acknowledged within reasonable timeframes. The faster you respond to incidents, the better your chances of preventing or minimizing losses.

Some advanced systems include two-way audio capabilities, allowing you to communicate directly with individuals at your ATM location. This feature can deter criminal activity while providing helpful customer assistance when technical issues arise.

For comprehensive guidance on implementing these integrated security measures, check out our detailed resource on ATM Camera Security.

Frequently Asked Questions about ATM Machine Cameras

How long is video from an ATM camera kept?

Most businesses keep their atm machine camera footage for 30-90 days, though there's no one-size-fits-all answer. The right retention period depends on your storage capacity, local regulations, and how you use the video data.

Banks and credit unions often hold onto footage much longer—sometimes several months or even years. They've learned that sophisticated fraud schemes don't always surface immediately. Criminals might collect card data over weeks before actually using it, making those older recordings surprisingly valuable for investigations.

Here's something many ATM owners don't realize: skimming operations can go undetected for extended periods. By the time customers start reporting fraudulent charges, the actual data theft might have happened weeks earlier. If you've already deleted that footage, you've lost crucial evidence that could have protected you from chargebacks.

Storage costs have dropped significantly with modern digital systems, making longer retention periods more affordable than ever. Many businesses find that keeping footage for 60-90 days strikes the right balance between useful evidence preservation and reasonable storage expenses.

Do all ATMs in the U.S. legally require cameras?

There's no federal law requiring cameras on every ATM across the United States, but don't let that fool you into thinking they're optional. Many states and local jurisdictions have their own specific requirements, especially for machines in certain locations or operating during overnight hours.

Even where cameras aren't legally mandated, they're practically essential for most ATM operations. Credit card processors and insurance companies frequently require surveillance systems as part of their fraud protection and liability coverage. Without proper camera documentation, you might find yourself without coverage when you need it most.

The liability protection alone makes cameras worth every penny. When customers dispute transactions or claim they didn't receive cash, video evidence is often the only thing standing between you and expensive chargeback fees. Without that footage, you're essentially taking the customer's word against your machine's transaction log.

Some jurisdictions also require specific camera capabilities, like minimum resolution standards or particular viewing angles. Check with your local authorities and insurance provider to understand exactly what's required in your area.

What if criminals install their own hidden cameras?

This is one of those scenarios that keeps ATM owners up at night, and for good reason. Criminals do install their own cameras—usually small, battery-powered devices positioned to record customers entering their PINs. These cameras often look like tiny pinhole devices or can be disguised as part of the ATM's existing hardware.

The good news is that your legitimate atm machine camera system can actually help detect these criminal additions. Most illegal cameras operate on batteries that last only 24-48 hours, giving criminals a narrow window to collect data before the devices die.

Regular physical inspections of your ATM area become crucial here. Look for anything that seems out of place—new attachments, unusual objects near the keypad, or modifications to the machine's appearance. Your security footage can help identify when these changes occurred by showing individuals spending excessive time around the ATM without completing transactions.

Criminals have gotten creative with placement too. Some target the vestibule door readers that control access to ATM areas, installing skimmers on entry doors while hiding cameras in ceiling panels or other concealed spots. This is why comprehensive surveillance coverage that monitors the entire ATM environment, not just the machine itself, proves so valuable.

The best defense combines regular physical inspections with quality surveillance footage that captures anyone tampering with or installing equipment around your ATM. If something looks suspicious in your daily checks, you can review the video to see exactly when and how it appeared.

Conclusion

Your ATM doesn't have to be a sitting duck for criminals. The sobering reality is that ATM-related crimes keep climbing, and hoping your machine won't be next isn't a business strategy—it's wishful thinking.

Here's the good news: the right atm machine camera system flips the script entirely. Instead of operating a vulnerable target, you'll have a protected revenue generator that keeps customers coming back because they feel safe using it.

Whether you go with sneaky pinhole cameras that criminals never see coming, visible systems that make troublemakers think twice, or a full-coverage setup that monitors everything, success comes down to matching your security tech to your real-world challenges.

After 35+ years helping business owners like you, I've learned that ATM ownership should boost your profits, not keep you up at night worrying about security problems. At Merchant Payment Services, we've seen what works and what doesn't when it comes to protecting your investment.

We make ATM ownership simple because that's what you need—more cash flow and sales without the headaches. Our partnerships with top ATM manufacturers mean you get security solutions built specifically for your type of business and customers.

Don't wait until something bad happens to find your current setup isn't cutting it. The best time to upgrade your security was yesterday. The second-best time is right now.

Your customers trust you to keep them safe when they're getting their money. That trust translates into repeat visits, positive word-of-mouth, and the kind of reputation that sets your business apart from places that cut corners on security.

The bottom line? Professional security measures protect everyone while showing your community that you run a business they can count on.

Ready to learn more about the latest surveillance technology and industry best practices? Check out our comprehensive resource for More info about ATM cameras to stay ahead of emerging threats and opportunities.