Cutting Costs: No Monthly Fee Credit Card Processing for Small Businesses

Why Small Businesses Need No Monthly Fee Solutions

Credit card processing for small business no monthly fee options are becoming essential as traditional payment processors charge monthly fees ranging from $9.95 to $99 or more, eating into already tight profit margins. Many small businesses find they can eliminate these recurring charges entirely by shifting processing costs to customers or choosing flat-rate providers with zero monthly commitments.

Top No Monthly Fee Options:

- Surcharge Programs - Pass 100% of fees to credit card users (where legal)

- Cash Discount Programs - Offer lower prices for cash payments

- Flat-Rate Processors - Pay per transaction only with no monthly commitments

- Zero-Fee Processing - Customer pays service fee, merchant pays nothing

The math is simple: a business processing $10,000 monthly can save $120-$1,200 annually just by eliminating monthly fees. As one merchant noted, "Nobody can beat zero" when it comes to monthly charges.

However, there's a catch. True "free" processing doesn't exist - someone always pays the interchange fees that card networks require. The question becomes whether your business absorbs these costs or passes them along to customers.

I'm Lydia Valberg, Co-Owner of Merchant Payment Services, where I've spent over a decade helping small businesses steer credit card processing for small business no monthly fee solutions while maintaining customer satisfaction. My experience shows that the right no-fee strategy can boost your bottom line without driving customers away when implemented correctly.

Credit Card Processing for Small Business No Monthly Fee: How It Works

Let me break down how credit card processing for small business no monthly fee actually works behind the scenes. It's not magic - there's a simple system that makes it all possible.

Every time a customer swipes their card, three different parties get paid. First, there's the interchange fee - this goes straight to the bank that issued your customer's card. Think of it as a toll road fee that Visa and Mastercard set in stone. These fees typically run between 1.5% and 3.5% per transaction, and nobody can negotiate them away.

Next comes the processor markup - this is how your payment processor makes money. It's usually a small percentage (around 0.1% to 0.5%) on top of the interchange fee. Finally, there are those pesky monthly service fees that can range anywhere from zero to $199, depending on what bells and whistles your processor includes.

Here's the key insight: while interchange fees are set in stone, monthly fees are completely negotiable. You can eliminate them entirely through what we call "pass-through pricing" - essentially shifting those costs in creative ways.

The beauty of no-fee processing lies in understanding that someone always pays the interchange fees. The question isn't whether these fees exist (they do), but rather who's going to cover them. Smart business owners have figured out how to make this work without losing customers.

Scientific research on PCI compliance confirms that security requirements remain the same regardless of your fee structure, so you're not cutting corners on safety.

Is credit card processing for small business no monthly fee really free?

I'll give it to you straight - truly "free" credit card processing is like a unicorn. It sounds magical, but it doesn't exist in the real world.

When processors advertise zero-fee processing, they're using what I call "fee-shifting magic." Instead of your business eating the processing costs, your customers pick up the tab. It's perfectly legal and surprisingly common.

Fee-shifting works in several ways. The most popular is surcharging, where you add a small percentage (usually 2-4%) to credit card purchases. So that $100 sale becomes $102.90 for the customer, while you pocket the full $100. Some businesses prefer flat service fees instead of percentages, especially for smaller purchases.

Here's something that trips up many business owners: debit card rules are different. Federal law says you can't surcharge debit card transactions. This means you'll still pay processing fees when customers use their debit cards, though these fees are typically much lower - around 0.5% plus 22 cents.

The good news? Most customers don't mind paying a small surcharge when they understand it helps small businesses stay competitive.

Key steps to set up credit card processing for small business no monthly fee

Setting up your no-fee processing system is simpler than most people think. I've walked hundreds of businesses through this process, and it typically takes just a few days from start to finish.

Your first step is getting approved for a merchant account with a processor that specializes in zero-fee programs. The approval process is straightforward for most businesses - we're talking about a 95% approval rate for standard retail and service businesses.

Once approved, your payment terminals need special programming to automatically calculate surcharges. Modern terminals are smart enough to recognize whether a customer is using a credit card (which gets surcharged) or a debit card (which doesn't). The whole process happens in seconds.

Signage rules are crucial and often overlooked. You'll need clear signs at your entrance and point of sale explaining your surcharge policy. The signs don't need to be huge, but they must be visible and easy to read. Most processors provide template signs that meet all legal requirements.

The technical setup typically happens within 24-48 hours of approval. Most modern terminals are plug-and-play, meaning they'll start working within minutes of being connected.

More info about Credit Card Processing Fee Breakdown

No Monthly Fee Models: Surcharge, Cash Discount & Flat-Rate

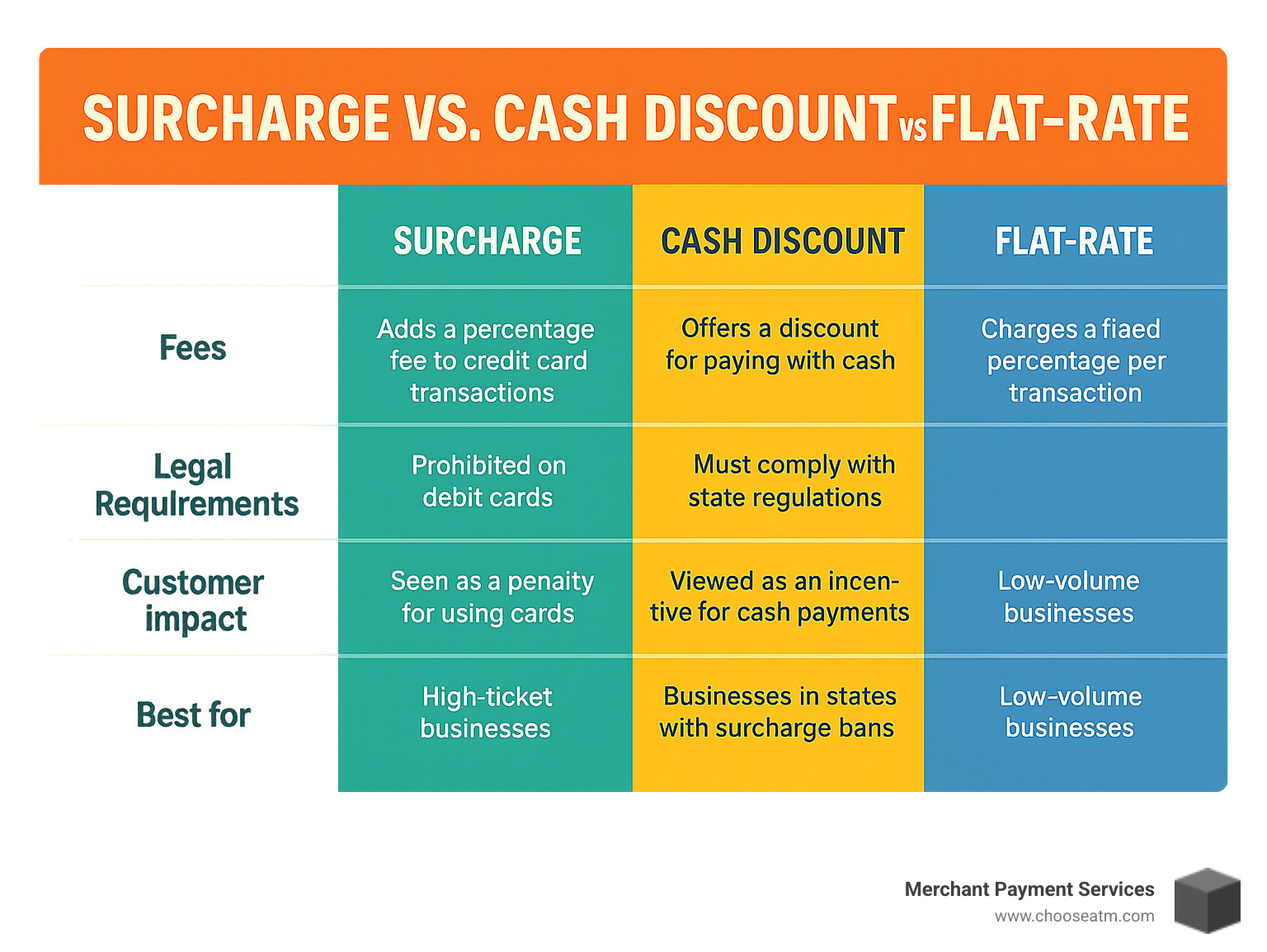

When you search for credit card processing for small business no monthly fee, you will almost always land on one of three approaches. All of them remove the monthly statement charge—but they do it in different ways, each with its own strengths.

- Surcharge programs – Add a small fee (typically 2–4%) only to credit card transactions. You keep 100% of the sale price; the cardholder covers the processing cost. Best for higher-ticket sales where a few extra dollars won’t scare customers away.

- Cash-discount programs – List a "regular" price and automatically discount it for cash or debit. Customers feel rewarded rather than penalized, and the model is legal in every U.S. state.

- Flat-rate processors – Skip monthly fees and pay one predictable rate per swipe, like 2.6% + 10¢. Ideal for newer or lower-volume businesses that value simplicity over squeezing every last basis point.

Credit card processing for small business no monthly fee options compared

Legal limits matter. Most states let you surcharge up to 4%, but Colorado caps it at 2%, and Connecticut and Massachusetts ban surcharging altogether. A federal rule also bars surcharging debit cards, so your terminal must recognize card type automatically.

Pros and cons of each no-fee model

- Surcharge: Maximum savings, straightforward setup, but some customers dislike extra fees and you still pay on debit sales.

- Cash discount: Works nationwide, includes debit, and feels positive to shoppers. Downsides are re-pricing your items and training staff to explain the program.

- Flat rate: Fast, familiar, and transparent for customers. You remove only the monthly fee—high volume can cost more long-term compared with interchange-plus pricing.

Pick the model that balances compliance, customer perception, and your average ticket size. Many merchants even start with flat-rate, then graduate to a surcharge or cash-discount setup once they know their volumes.

Cost-Benefit Analysis & Hidden Fees

When you're exploring credit card processing for small business no monthly fee options, the monthly savings are just the tip of the iceberg. Smart business owners dig deeper to understand the complete cost picture before making the switch.

Let's be honest - nothing in business is ever completely "free," and payment processing is no exception. While you might eliminate that pesky monthly fee, other costs can sneak up on you if you're not prepared.

Hardware costs often catch business owners off guard. Those sleek new terminals don't magically appear - they typically run between $299 and $799. The good news? Many no-fee processors throw in free equipment to sweeten the deal. Others offer lease options that spread the cost over time.

Chargeback fees stick around regardless of your fee structure. Every time a customer disputes a charge, you're looking at $15 to $25 in fees, win or lose. High-risk businesses face these more often, making fee-shifting models even more appealing despite potential customer pushback.

PCI compliance isn't optional, and neither are the fees for failing it. Skip your security audits, and you'll face $25 to $100 monthly penalties. Scientific research on PCI compliance shows that maintaining security standards protects both you and your customers.

Dispute and retrieval fees add another $10 to $15 each time card networks need to investigate a transaction. These administrative costs exist whether you're paying monthly fees or not.

More info about How to Reduce Credit Card Processing Fees

Credit card processing for small business no monthly fee versus low-fee plans

Here's where the math gets interesting. Break-even analysis reveals when no-fee processing truly makes sense for your specific situation.

Consider a small café processing $5,000 monthly. Traditional processing might cost 3% plus a $30 monthly fee, totaling $180. With no-fee processing, that entire $180 gets passed to customers instead of coming from your pocket. That's $2,160 in annual savings.

Scale that up to a service business processing $50,000 monthly. Traditional costs hit $1,599 monthly (including a typical $99 monthly fee for higher-volume accounts). Shifting those costs to customers saves nearly $20,000 annually.

Average ticket size plays a huge role in customer acceptance. A 4% surcharge on a $5 coffee adds just 20 cents - most customers won't blink. But that same percentage on a $1,000 service contract adds $40, which might spark some serious sticker shock.

High-risk businesses often find no-fee processing especially attractive. These industries typically face monthly fees ranging from $100 to $300, plus higher per-transaction costs. When you're already dealing with liftd processing expenses, shifting those costs to customers becomes much more appealing.

Compliance & Customer Experience

Navigating the legal landscape while keeping customers happy is where many businesses stumble with credit card processing for small business no monthly fee programs. The truth is, compliance isn't optional - but it doesn't have to be overwhelming either.

The regulatory maze starts with understanding that state surcharge laws vary dramatically across the country. Connecticut and Massachusetts have completely banned surcharging, making cash discount programs your only option there. Colorado allows surcharges but caps them at 2% instead of the typical 4% maximum. Most other states permit surcharging but require specific disclosure language and signage.

Federal disclosure rules under the Truth in Lending Act add another layer of requirements. You'll need clear signage at entry points and payment areas, plus separate line items on receipts showing exactly what customers paid in surcharges. Card networks also require 30-day advance notice before you can start any surcharge program.

Here's where many businesses get tripped up: the debit card ban enforced by the Federal Reserve. Accidentally charging a surcharge on a debit transaction can result in hefty fines and program termination. Your terminal programming must automatically detect card types and only apply surcharges to credit cards.

Scientific research on surcharge legality shows that compliance requirements continue expanding as states examine consumer protection implications more closely.

Best practices to keep customers happy while shifting fees

The secret to successful fee-shifting isn't just compliance - it's making customers feel respected throughout the process. Transparent receipt practices form the foundation of trust. Show surcharges as separate line items with clear language like "Credit Card Service Fee" rather than burying costs in confusing totals.

Your staff training matters enormously here. When customers ask questions (and they will), employees should explain that the program prevents price increases for cash customers rather than focusing on the fee itself. It's a subtle but powerful difference in messaging.

Alternative payment options give customers control over their experience. Prominently display cash discount amounts so people can see their savings. For larger purchases, consider accepting ACH transfers which typically cost only 0.5% plus $0.25.

Loyalty program incentives can actually turn fee-shifting into a competitive advantage. Use the money you save on processing costs to fund better customer service or rewards programs that exceed surcharge amounts.

Hardware & POS requirements for no-fee processing

Your equipment needs to handle the technical complexity of fee-shifting automatically. EMV terminal capabilities aren't just nice-to-have features - they're essential for compliance and security. Your terminal must process chip cards to avoid liability shifts, support contactless payments like Apple Pay, and automatically calculate surcharges based on card type.

Most importantly, your system needs to print receipts with proper disclosure language without any manual intervention from staff. The last thing you want is to rely on busy employees to remember compliance requirements during rush periods.

Mobile readers work well for businesses needing portability, but make sure they have sufficient battery life for full business days and reliable cellular or WiFi connectivity.

For phone and mail orders, you'll need virtual terminal capabilities with web-based processing interfaces. These systems should integrate with your existing accounting software and provide multi-user access with proper permission controls.

The good news? Most modern terminals handle these requirements seamlessly once properly programmed. The key is working with a provider who understands both the technical and compliance aspects of no-fee processing.

Strategies to Reduce Fees Beyond Monthly Charges

Getting rid of monthly fees is just the beginning. Smart businesses know that credit card processing for small business no monthly fee solutions work best when combined with other cost-cutting strategies that tackle every angle of payment processing.

ACH payments offer your biggest opportunity for dramatic savings. Instead of paying 2-3% on credit cards, ACH transactions typically cost just 0.5% plus 25 cents, with most providers capping fees at $6 no matter how large the transaction. That means a $2,000 payment costs the same $6 whether it's processed through ACH or would have cost you $60 in credit card fees.

The challenge is getting customers to use ACH. Many businesses succeed by offering small discounts for bank transfers, especially on larger purchases. A contractor might offer 1% off invoices paid by ACH - the customer saves money, and the business still comes out way ahead.

Minimum purchase requirements help offset the fixed costs that hit small transactions hardest. Federal law allows you to set minimums up to $10 for credit cards (though not for debit cards). A coffee shop paying 30 cents plus 2.9% on a $3 latte is losing over 12% to processing fees, but that same fee structure on a $10 minimum becomes much more manageable.

Rate negotiation remains possible even with no-fee processors. Once you've demonstrated consistent volume for six months or more, most providers will consider volume discounts or reduced equipment costs.

Chargeback prevention deserves serious attention because these fees stick around regardless of your processing model. Every chargeback costs $15-25 in fees, plus the lost merchandise and time spent fighting the dispute. Simple steps like using address verification, requiring CVV codes, and keeping detailed transaction records can cut chargeback rates dramatically.

More info about Eliminate Credit Card Processing Fees

Building a long-term fee-reduction plan

The most successful businesses treat fee reduction as an ongoing process, not a one-time setup. Regular data review means actually reading those monthly processing statements instead of just filing them away. Look for gradual rate increases, new fees that weren't in your original contract, or changes in your transaction mix that might qualify you for better pricing.

Processor audits should happen annually, just like reviewing your insurance policies. The payment processing industry moves fast, with new competitors and pricing models appearing regularly. What was a great deal two years ago might be average today.

Interchange optimization gets technical, but the savings can be substantial for B2B companies. If you're processing business credit cards, submitting additional data like tax amounts and customer codes can qualify you for lower interchange rates. This Level II and Level III processing can save 0.5-1% per transaction.

The biggest mistake businesses make is thinking about processing fees as fixed costs. They're not. With the right combination of no-fee processing, alternative payment methods, and ongoing optimization, many businesses cut their total payment processing costs by 60-80% compared to traditional merchant accounts.

Frequently Asked Questions about No Monthly Fee Credit Card Processing

Below are the questions we hear most often about credit card processing for small business no monthly fee programs—along with quick, practical answers.

Do debit card transactions qualify for no-fee programs?

Federal law says you cannot add a surcharge to debit cards. However, debit can still fit inside a cash-discount model because the discount is applied to cash, not a fee added to the card. Either way, debit is cheaper by design—usually about 0.5% + 22¢—so the cost bite is smaller than credit interchange.

Is surcharging legal in every U.S. state?

No. Connecticut and Massachusetts prohibit surcharging, while Colorado allows it but limits the fee to 2%. Most other states allow up to 4% as long as you follow disclosure rules and notify the card brands 30 days in advance. Laws do change, so double-check current regulations or ask your processor before launching a program.

What signage is required at checkout?

You must disclose surcharges in three places:

- At every public entrance—a small sign or decal is fine.

- At the point of sale—near the terminal or cash register.

- On the receipt—as a separate line item such as "Credit Card Service Fee."

For phone orders, staff should give a quick verbal notice. Most processors supply compliant templates so you’re not guessing at the wording.

Clear communication keeps you legal and minimizes customer pushback—two things every small business owner can appreciate.

Conclusion

The journey to credit card processing for small business no monthly fee doesn't have to be complicated, but it does require the right partner and approach. After helping hundreds of small businesses over our 35+ years in the payment industry, I've seen how eliminating monthly fees can transform a business's bottom line.

The math speaks for itself - saving $120 to $1,200 annually just by removing monthly fees gives you breathing room to invest in growth, better inventory, or simply keep more of what you earn. When you add fee-shifting programs on top of that, the savings can reach thousands of dollars yearly.

But here's what I've learned matters most: success isn't just about the lowest fees. It's about finding a solution that fits your customers, follows the law, and actually works day-to-day. A surcharge program that drives away half your customers isn't a win, no matter how much you save on paper.

That's where our experience at Merchant Payment Services makes the difference. We don't just hand you a card reader and wish you luck. We help you steer state regulations, choose the right fee model for your business type, and implement everything properly so you stay compliant from day one.

What really sets us apart is our comprehensive approach to payment optimization. While other companies focus solely on credit card processing, we look at the bigger picture. Our strategic ATM placement services can generate additional surcharge revenue that offsets any remaining processing costs, creating multiple income streams from your payment infrastructure.

The best part? We make ATM ownership simple. No complicated contracts, no surprise fees, no wondering if you're getting a fair deal. Just straightforward solutions that put more money in your pocket while giving your customers the payment options they want.

Ready to stop paying monthly processing fees? The first step is understanding exactly what you're paying now and which no-fee model makes sense for your business. With proper setup and customer communication, you can slash processing expenses without losing a single sale.