Small Business Savvy: Securing the Lowest Credit Card Processing Rates

Understanding Credit Card Processing Costs for Small Businesses

Best credit card processing rates for small business typically range from 1.5% to 3.5% per transaction, plus a fixed fee of $0.10 to $0.30. Here's a quick comparison of top providers in 2025:

| Provider Type | In-Person Rate | Online Rate | Monthly Fee | Best For |

|---|---|---|---|---|

| Transparent Pricing Provider | Interchange + 0.40% + 8¢ | Interchange + 0.50% + 25¢ | $0 | Overall value & transparency |

| Simple Flat-Rate Provider | 2.6% + 10¢ | 2.9% + 30¢ | $0 | New & small businesses |

| Membership Model Provider | Interchange + 8¢ | Interchange + 15¢ | $99 | High-volume merchants |

| Online-Focused Provider | 2.7% + 5¢ | 2.9% + 30¢ | $0 | Online businesses |

| Non-Profit Specialist | Interchange + 0.15% + 8¢ | Interchange + 0.20% + 11¢ | $20 | Non-profits |

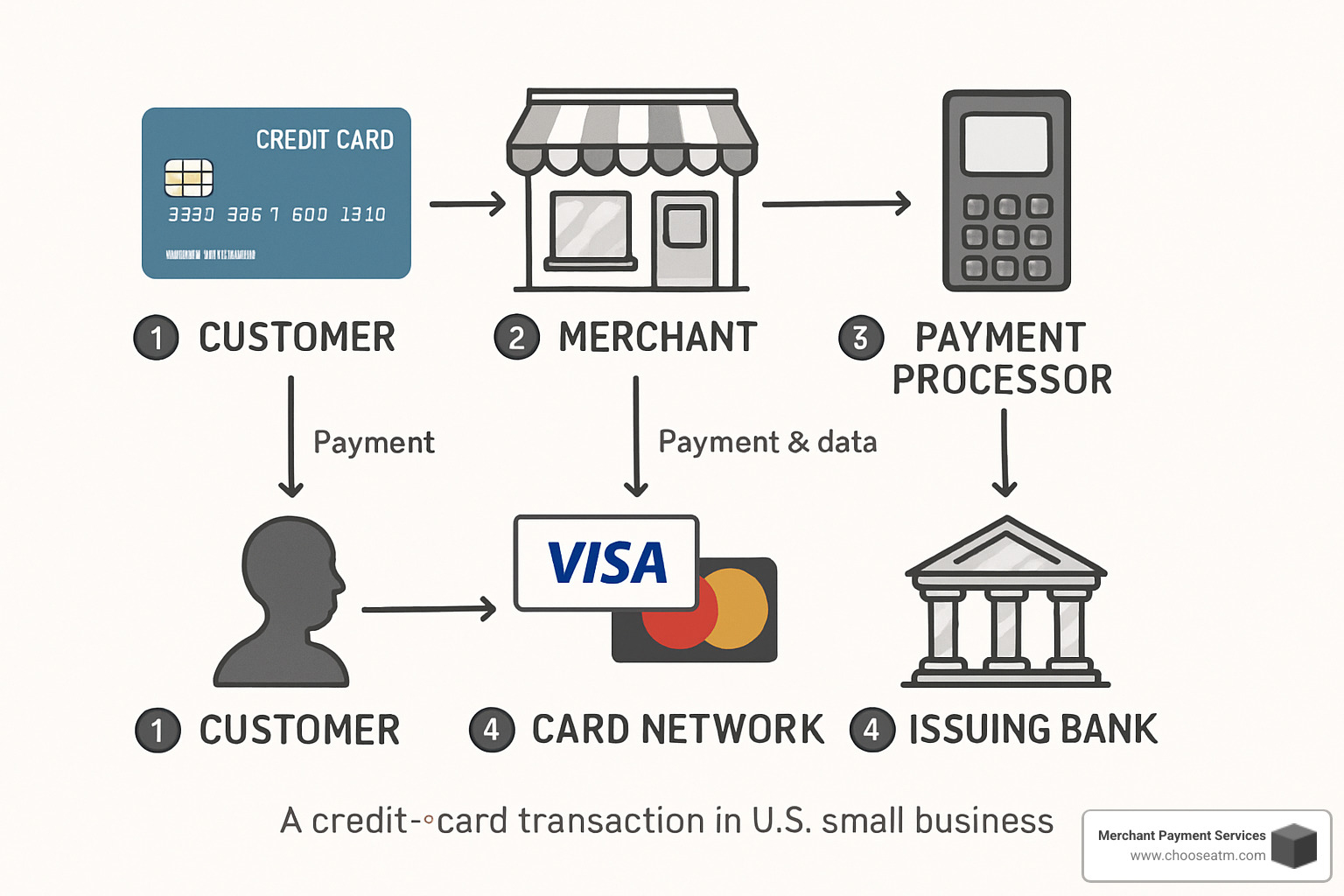

Every time a customer swipes, dips, or taps their card at your business, a complex chain of fees kicks into motion. For small business owners, these processing costs can significantly impact your bottom line, often ranking as your third or fourth largest expense after payroll, rent, and inventory.

Understanding how these fees work isn't just about saving money—it's about making informed decisions that align with your business model. Different pricing structures like flat-rate, interchange-plus, and subscription models each have their own advantages depending on your monthly volume and transaction types.

I'm Lydia Valberg, Co-Owner at Merchant Payment Services, and I've spent over a decade helping small businesses secure the best credit card processing rates for small business through our family-owned payment solutions company, continuing a 35-year tradition of transparent service.

Decoding Credit Card Processing Fees

Understanding what you're actually paying for is the first step toward securing better rates. Credit card processing fees aren't just one simple charge—they're more like layers of a cake, with different portions going to different players in the payment ecosystem.

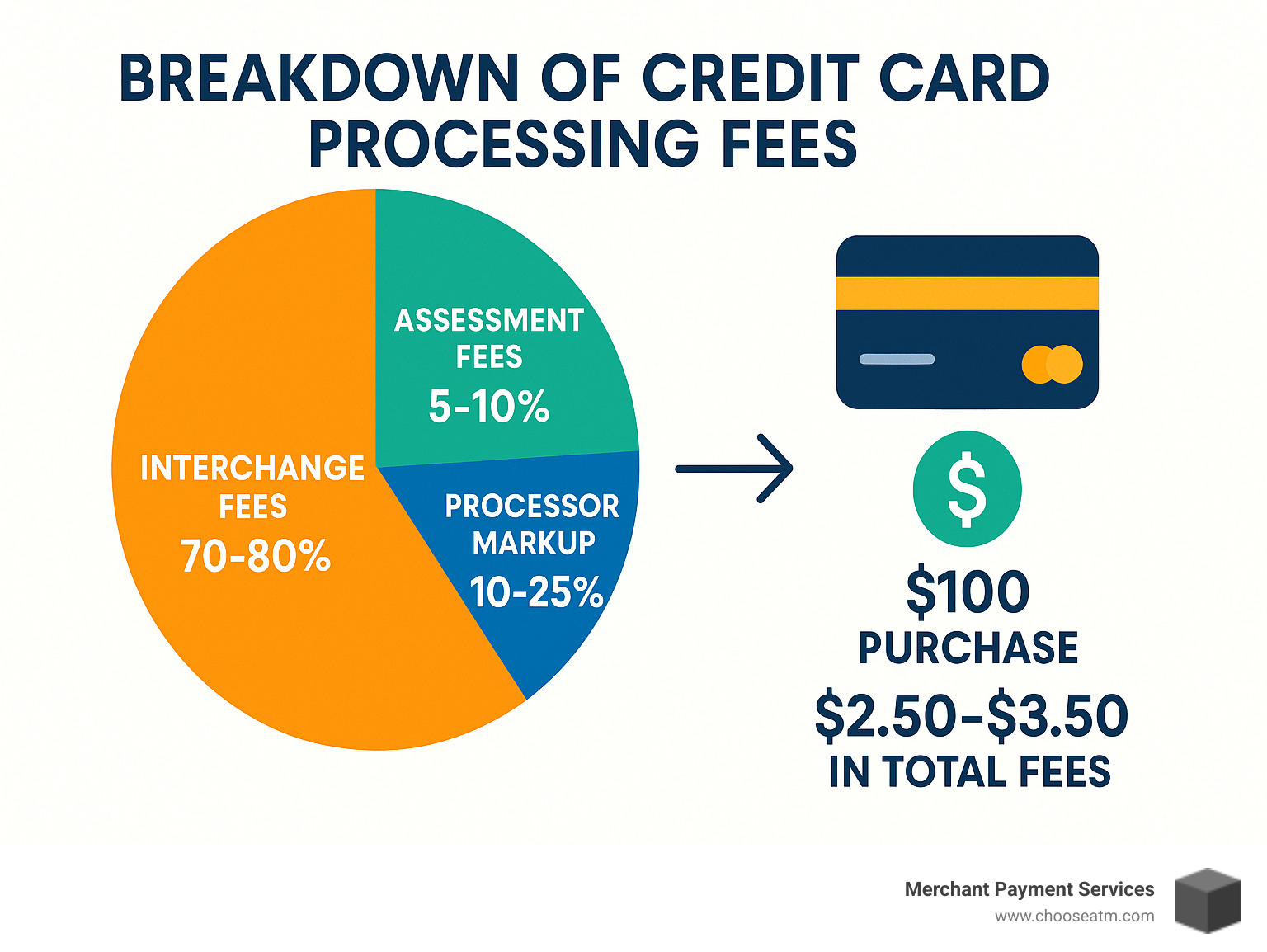

The Three Main Components of Processing Fees

Every time a customer swipes their card, your payment gets divided into three main chunks:

Interchange Fees make up the lion's share (70-80%) of what you pay. These go straight to the customer's bank (like Chase or Bank of America) and are unfortunately non-negotiable. They typically range from 1.15% + $0.05 to 2.50% + $0.10 per transaction, depending on factors like card type and processing method.

Assessment Fees take a smaller bite (5-10%) and flow directly to card networks like Visa and Mastercard. Think of these as the "highway tolls" of the payment world—usually around 0.13% to 0.15% of your monthly volume plus a small per-transaction fee.

Processor Markup is where the real negotiating happens. This 10-25% portion is what your processor charges for their services, and it's the only truly flexible part of your processing costs. This can range from as little as 0.10% + $0.05 to 1% or more, depending on your processor and your bargaining power.

At Merchant Payment Services, we help businesses focus on trimming this processor markup—because trying to negotiate the other components is like arguing with gravity!

What Determines a Fee?

Your business's unique profile heavily influences the best credit card processing rates for small business you can secure:

Business Type matters enormously. Running a bookstore? You'll likely pay less than someone selling nutritional supplements online, simply because some industries have higher chargeback risks than others.

Monthly Volume gives you negotiating muscle. Businesses processing over $50,000 monthly often qualify for significantly better rates than those handling under $10,000. It's like buying in bulk—the more you process, the better your rates can be.

Average Ticket Size affects your optimal pricing structure. If you're selling $5 coffee drinks all day, you need different pricing than someone selling $1,000 furniture pieces. Very small or very large transactions often require specialized pricing approaches.

Card-Present vs. Card-Not-Present transactions have different risk profiles. When a customer hands you their physical card in your store, you'll pay less (typically 1.5-2.5%) than for online or phone orders (usually 2.5-3.5%) because the fraud risk is lower.

Card Type introduces another variable. That premium rewards card offering airline miles? It costs more to process than a basic debit card. American Express transactions typically run 0.3-0.5% higher than Visa or Mastercard.

Average Cost Benchmarks

To know if you're getting a fair shake, here are the benchmarks we use at Merchant Payment Services:

Most businesses pay between 1.5% and 3.5% of each transaction's total, plus a fixed fee of $0.10 to $0.30 per swipe, regardless of amount. For simple flat-rate pricing, in-person transactions average around 2.6%, while online payments hover near 2.9%.

Most processors deposit your hard-earned money within 1-2 business days after the transaction settles, though some offer next-day or even same-day funding (often for an additional fee).

The best credit card processing rates for small business aren't one-size-fits-all. What works beautifully for a busy restaurant might be terrible for a low-volume jewelry store. That's why we take the time to understand your specific business before recommending a solution.

Looking to dig deeper into reducing your processing fees? Check out our guide on Credit Card Fee Reduction or explore the latest research on average processing fees to stay informed.

Best Credit Card Processing Rates for Small Business: 2025 Snapshot

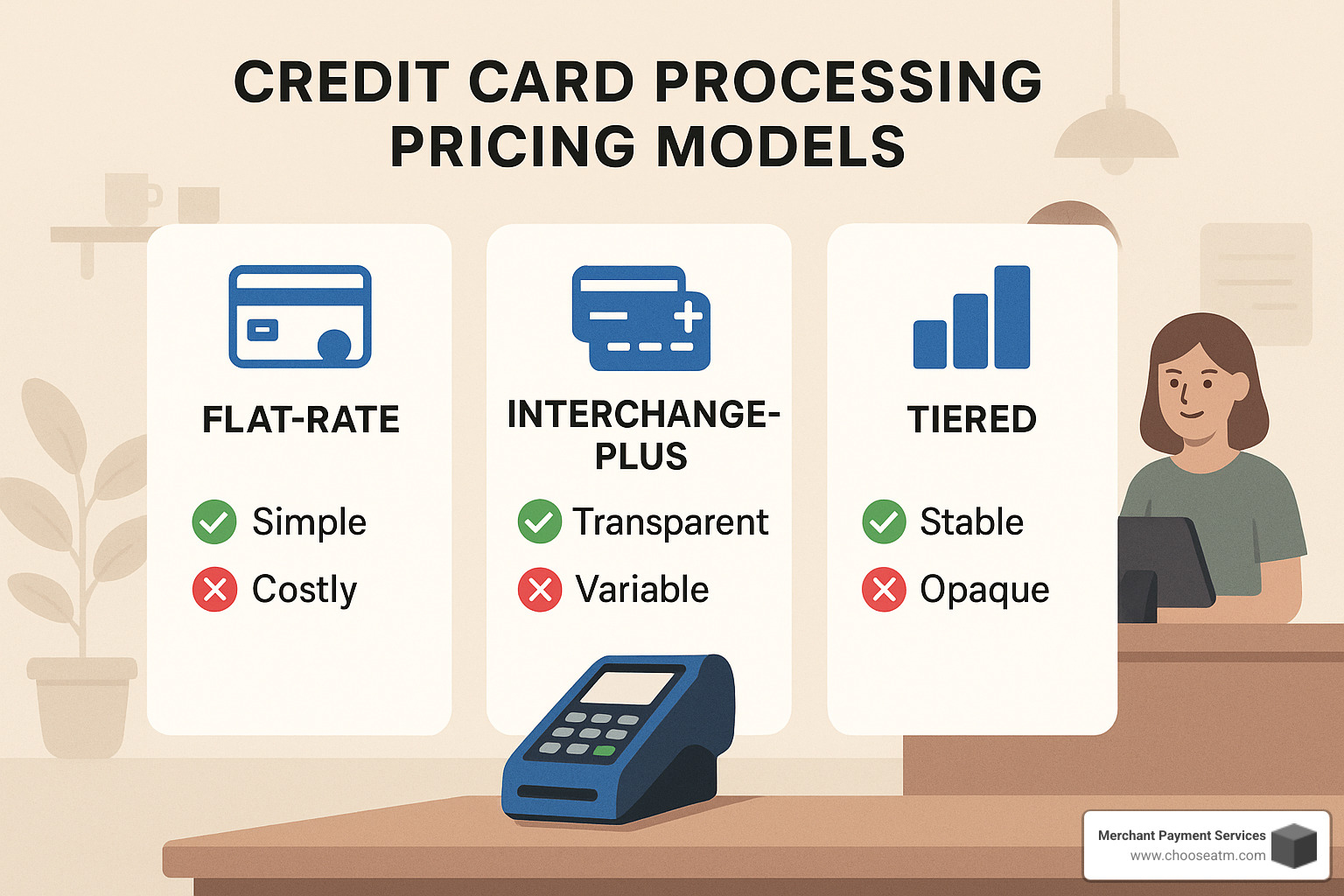

When it comes to processing options, understanding the different pricing models is like learning the rules of a game before playing. Each model has its sweet spot where it shines brightest for certain types of businesses.

Pricing Model Comparison

| Pricing Model | How It Works | Typical Range | Best For | Drawbacks |

|---|---|---|---|---|

| Flat-Rate | One consistent rate for all transactions | 2.6-2.9% + $0.10-$0.30 | New businesses, low volume (<$10K/mo) | More expensive at higher volumes |

| Interchange-Plus | Interchange + transparent markup | IC + 0.15-0.50% + $0.05-$0.25 | Established businesses ($10K-$50K/mo) | Statements more complex |

| Membership | Monthly fee + per-transaction fee | $50-$199/mo + IC + $0.05-$0.15 | High-volume merchants (>$50K/mo) | Requires higher volume to offset monthly fee |

| Zero-Fee | Customer pays the processing fee | 0% for merchant, 3-4% surcharge for customer | Businesses with price-sensitive margins | Potential customer pushback |

Flat-Rate Plans vs the Best Credit Card Processing Rates for Small Business

Think of flat-rate pricing as the "easy button" of credit card processing. You'll pay the same percentage and fixed fee whether your customer hands you a basic debit card or a premium rewards card.

Flat-rate pricing shines in its simplicity. Your monthly statements won't give you a headache – just one clean line item that's easy to budget for. There's typically no monthly minimum to worry about, making it perfect for businesses that might process very little (or nothing at all) during slow months.

This model works beautifully for newcomers just dipping their toes into card acceptance. If you're processing less than $10,000 monthly or have a seasonal business, the predictability often outweighs the slightly higher rates. It's like paying a bit extra for peace of mind – no surprises when that customer pulls out their fancy airline miles card.

Interchange-Plus: Often the Best Credit Card Processing Rates for Small Business

Once your business finds its rhythm, interchange-plus pricing (also called cost-plus) typically offers the best credit card processing rates for small business with established volume. Think of it as "wholesale plus markup" pricing.

With interchange-plus, your statements show exactly what's happening behind the scenes – the actual interchange rate (which varies by card type) plus your processor's fixed markup. This transparency means you automatically pay less when customers use lower-cost cards like debit.

The beauty of this model becomes apparent once you're processing over $10,000 monthly. You'll see real savings compared to flat-rate, especially if many of your customers use debit cards. For businesses that frequently process corporate cards, you can even optimize for Level 2/3 data to significantly reduce costs on these typically expensive transactions.

While the statements are more detailed (some might say "complex"), the savings are worth the extra line items for growing businesses.

Membership & Surcharge Models

For businesses with healthy processing volumes, membership models flip the traditional pricing structure on its head.

With a membership model, you'll pay a monthly subscription fee ($50-$199) in exchange for direct access to wholesale interchange rates. Instead of a percentage markup on each transaction, you pay only a small fixed fee per swipe (often just 5-15¢) plus the direct interchange cost. This approach can deliver serious savings once your volume is high enough to offset the monthly fee.

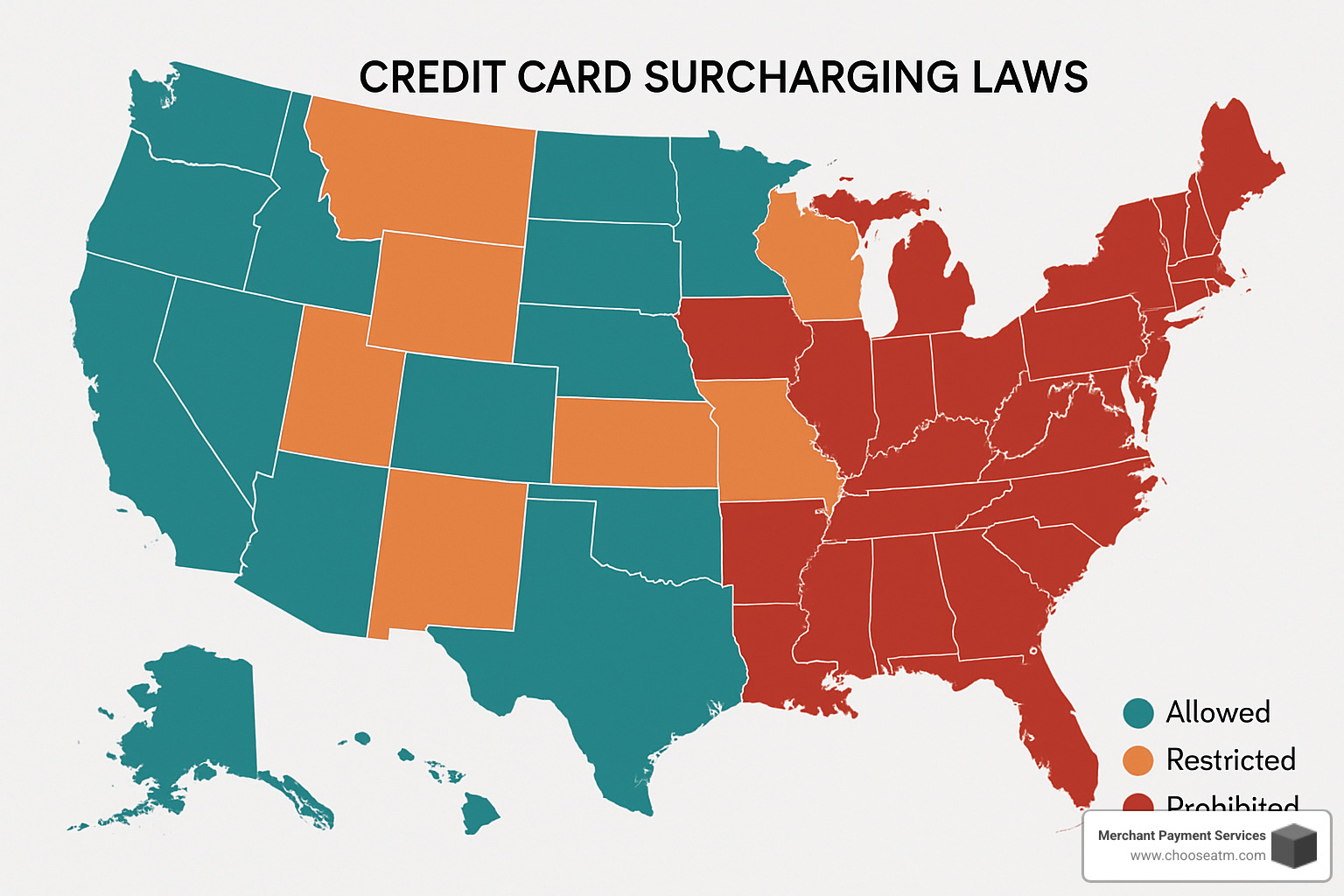

The zero-fee (or surcharging) model takes an entirely different approach – passing the processing costs to customers who choose to pay with credit. Typically implemented as a 3-4% surcharge on credit transactions, this model allows customers to avoid the fee by using debit, cash, or ACH transfers instead.

At Merchant Payment Services, we've helped countless small businesses implement compliant surcharging programs that effectively eliminate processing costs while keeping customers happy. Our Zero Processing Fee Credit Card solutions ensure you stay within the legal guidelines (which vary by state) while protecting your profit margins.

Hidden Fees & Contract Traps to Avoid

Let's be honest – getting the best credit card processing rates for small business isn't just about that eye-catching percentage rate you see in advertisements. It's about understanding the full picture, including those sneaky fees that can turn a seemingly great deal into a costly mistake.

Common Hidden Fees to Watch For

Ever opened your processing statement and wondered, "What on earth is THAT charge for?" You're not alone. As a small business owner, you need to watch for these common gotchas:

Monthly and annual fees can range from $10-$99 monthly or $99-$199 annually – that's money that could be staying in your pocket! Those innocent-looking statement fees ($5-$15 monthly) for paper statements add up over time too.

PCI compliance fees are particularly frustrating. You might be charged $20-$99 monthly if you don't complete those security questionnaires (which many processors don't clearly explain how to do). Then there are batch fees ($0.10-$0.50 per daily closing), gateway fees for online payments ($10-$25 monthly), and the dreaded chargeback fees ($15-$50 per disputed transaction).

Perhaps the most painful are early termination fees ($300-$1,000) and those terrible terminal lease arrangements. I've seen small businesses pay $30-$60 monthly for years on equipment that's worth only $200-$600 to purchase outright!

Red Flags in Processing Agreements

When you're reviewing that processing agreement (and yes, you should read every word), keep your eyes peeled for these red flags:

Those sneaky auto-renewal clauses can lock you into another 1-3 year term if you don't cancel within a specific window, often just 30-90 days before expiration. Miss that window, and you're stuck for another full term.

Watch out for liquidated damages language. Instead of a straightforward early termination fee, some processors calculate what you would have paid in fees for the remaining contract months and charge you that entire amount! I've seen businesses hit with thousands in fees when they thought they'd only pay a few hundred.

Equipment leases are almost always a bad deal. That $300 terminal can end up costing over $2,000 through a non-cancelable 48-month lease. Even worse, these leases often continue even if you cancel the processing service!

Be wary of rate increase provisions that allow the processor to hike your rates with minimal notice. And if you see terms like "qualified," "mid-qualified," and "non-qualified" rates, run! This tiered pricing model lets processors decide which of your transactions fall into which categories – and guess which category most end up in? The expensive ones.

At Merchant Payment Services, we believe processing shouldn't be a minefield. That's why our agreements have zero hidden fees, no long-term contracts, and absolutely no early termination penalties. We provide a detailed Credit Card Processing Fee Breakdown so you'll always know exactly what you're paying for – no surprises, no gotchas, just transparent service.

The best credit card processing rates for small business aren't just about the percentage – they're about the total cost of ownership and partnership. Don't let the fine print eat away at your hard-earned profits.

Proven Strategies to Lower Your Rate

Now that you understand how processing fees work and what to avoid, let's explore actionable strategies to secure the best credit card processing rates for small business needs.

Step-by-Step Rate Negotiation

Walking into a rate negotiation unprepared is like going grocery shopping hungry—you'll likely end up with more than you bargained for. I've helped hundreds of merchants negotiate better rates, and it all starts with homework.

First, gather your statements from the past three months. These documents tell the real story of your processing history—your typical monthly volume, average ticket size, and current fee structure. This information is your strongest bargaining chip.

When you're ready to talk rates, specifically request interchange-plus pricing. Don't settle for tiered or flat-rate models that hide the true cost breakdown. A good processor won't hesitate to offer this transparent option.

If your business processes over $10,000 monthly, don't be shy about it—leverage your volume in negotiations. Processors compete fiercely for higher-volume merchants, and knowing your worth gives you an edge.

Smart negotiators know the power of options. Take time to collect competitive quotes from two or three processors. These written offers aren't just alternatives—they're negotiation tools with your preferred provider.

Already comfortable with your current processor but found better rates elsewhere? Ask them to match or beat the competitor's offer. Many will happily adjust their rates rather than lose your business to a competitor.

The processing industry runs on verbal promises, but memories can be conveniently short. Always get guarantees in writing in your merchant agreement. If it's not documented, it doesn't exist.

Finally, take aim at those pesky extra charges. Negotiate away junk fees like statement fees, PCI fees, annual fees, and monthly minimums. These are often the first concessions processors will make to win or keep your business.

Technology & Security Upgrades

The equipment and security protocols you use directly impact your processing rates, often in ways merchants don't realize.

EMV chip readers aren't just about security—they're about savings. Using these modern terminals reduces your fraud liability and can qualify your transactions for lower interchange rates. The initial investment typically pays for itself within months.

For online or phone orders, implementing Address Verification (AVS) and CVV verification adds a layer of security that can reduce your interchange rates by 0.10-0.30%. These simple verification steps signal to card issuers that you're taking fraud prevention seriously.

Behind the scenes, tokenization and encryption technologies protect sensitive cardholder data throughout the transaction process. Beyond the obvious security benefits, these technologies can qualify you for better rates while reducing the scope of your PCI compliance requirements.

E-commerce businesses should consider implementing 3-D Secure (3DS) authentication for online transactions. This extra verification step shifts liability away from your business and can reduce interchange rates substantially. According to Federal Reserve data, businesses using these comprehensive security measures typically see their overall processing costs drop by 0.15-0.25%.

Additional Cost-Saving Strategies

The savvy merchant knows that the path to the best credit card processing rates for small business extends beyond negotiation and technology.

Encouraging debit card usage can make a meaningful difference to your bottom line. Debit cards typically carry lower interchange rates than credit cards, especially when processed with a PIN. Something as simple as training staff to ask "Debit or credit?" or displaying signage can steer customers toward this cost-saving option.

It might seem minor, but batching daily matters. Settling your transactions every day ensures you qualify for the lowest possible interchange rates. Transactions that settle beyond 24 hours often bump into higher rate categories.

For businesses that accept corporate cards, implementing Level 2/3 data is like finding money in your couch cushions. By providing additional transaction data (like tax amounts, customer codes, or product descriptions), you can reduce interchange rates on business cards by an impressive 0.50-1.00%.

High-ticket or recurring billing businesses should explore ACH payments as an alternative to card processing. With costs typically ranging from just 0.5-1% (versus 2.5-3.5% for credit cards), the savings can be substantial for larger transactions.

Finally, a solid chargeback prevention strategy protects more than your merchandise—it protects your processing rates. Clear return policies, descriptive billing descriptors, and responsive customer service all help minimize costly disputes that can lead to higher processing rates over time.

At Merchant Payment Services, we've spent over three decades helping businesses like yours implement these Credit Card Fee Reduction strategies. We don't believe in one-size-fits-all solutions—our consultants analyze your specific processing patterns to identify immediate savings opportunities custom to your business model. Want to learn more about How to Reduce Credit Card Processing Fees? We've got you covered with detailed guides and personalized support.

Frequently Asked Questions about Credit Card Processing Rates

What is the typical processing fee range for small businesses?

If you're a small business owner, you're probably wondering what you should expect to pay. The best credit card processing rates for small business typically fall between 1.5% and 3.5% per transaction, plus that small fixed fee of $0.10 to $0.30 that gets tacked onto every sale.

Your specific rate isn't random, though. It's like a custom suit custom to your business's measurements. If you're in a higher-risk industry, process less than $10,000 monthly, or accept lots of rewards cards, you'll likely land on the higher end of that range. Meanwhile, businesses processing over $50,000 monthly often enjoy rates closer to that sweet 1.5% mark.

I've worked with local coffee shops processing just $8,000 monthly who initially paid 3.2%, and after optimization, we got them down to 2.7%—a meaningful difference when margins are tight!

How do in-person, online, and keyed-in transactions affect rates?

Not all transactions are created equal when it comes to processing rates. Think of it like insurance—the higher the risk, the higher the premium.

When a customer hands you their physical card for an in-person transaction, that's your lowest-risk scenario, typically costing between 1.5-2.6% plus a small fixed fee. Your customer is physically present, their card is right there, and the chance of fraud is relatively low.

Online transactions bump up to about 2.5-2.9% plus a fixed fee because there's more risk involved. You can't see the customer or their card, so the card networks charge more.

The most expensive option? Manually keyed-in transactions at 2.75-3.5% plus a fixed fee. When you're punching those numbers in by hand, there's no chip reader or signature to verify—making this the highest-risk transaction type.

One of our restaurant clients saved nearly $200 monthly just by switching from keying in phone orders to using a proper virtual terminal with address verification!

Can a small business switch processors without downtime?

Absolutely! With some careful planning, you can change processors as seamlessly as changing lanes on a highway. The key is to never cut off your old service before your new one is up and running smoothly.

Here's how we handle transitions for our clients at Merchant Payment Services:

- We set up and thoroughly test your new processing system first

- We schedule the switch during your slowest business period (maybe that's Monday mornings or mid-week afternoons)

- We make sure all equipment is programmed and ready before your go-live date

- We train your team on any new procedures or equipment

- We keep your old processor active for an extra week to catch any lingering authorizations

I remember helping a boutique clothing store switch processors right before their busy season. By overlapping services for a week, we ensured they didn't miss a single sale during the transition—and they started saving about $350 monthly with their new rates!

Are zero-fee processing programs legal?

Yes, those "zero-fee" or "cash discount" programs you've heard about are indeed legal in most of the United States—47 states and D.C. to be precise. Only Connecticut, Massachusetts, and Puerto Rico currently prohibit these practices.

However, staying on the right side of the law requires following some specific rules:

You must register with card networks before implementing your program. Your surcharge can't be a profit center—it can only cover your actual processing costs. You need clear signage informing customers about the surcharge before they make their purchase. The surcharge must appear separately on receipts. And importantly, you cannot surcharge debit card transactions, even when they're processed as credit.

Our How to Reduce Credit Card Processing Fees guide walks you through implementing these programs properly.

How do ATM solutions complement credit card processing strategies?

For physical businesses, having an ATM on-site is like having a processing-fee reduction machine. It's one of my favorite strategies to recommend because it creates a win-win situation.

When you have an ATM in your shop, you're essentially giving customers an alternative payment method. This reduces your credit card volume as more customers pay with cash, immediately lowering your monthly processing costs. Plus, the ATM generates surcharge revenue that can offset the processing fees you do incur.

What many business owners don't realize is that customers typically spend 20-25% of their ATM withdrawals right there in your store. One of our convenience store clients installed an ATM and saw their cash sales increase by 15% in the first month alone!

At Merchant Payment Services, we specialize in crafting a balanced payment acceptance strategy that combines the best credit card processing rates for small business with smart ATM solutions. The result? Maximized cash flow and minimized fees—exactly what every small business needs to thrive.

Conclusion

Navigating payment processing can feel overwhelming, but finding the best credit card processing rates for small business doesn't have to be a headache. After walking through the complexities of fee structures and pricing models, you're now equipped to make choices that could save your business thousands of dollars annually.

Think about this: the typical small business pays between 1.5% and 3.5% on every transaction. For a business processing $20,000 monthly, that's anywhere from $300 to $700 leaving your bank account. But with the right approach, you can push those costs toward the lower end of that spectrum—or even eliminate them entirely.

Here's what really matters for your bottom line:

First, take a good look at your monthly processing volume before deciding on a pricing model. If you're processing over $10,000 monthly, interchange-plus pricing typically offers the most transparency and value. For lower volumes, a simple flat-rate model might serve you better until you grow.

Don't be shy about negotiating! Those pesky statement fees, PCI compliance charges, and monthly minimums? They're often negotiable and can be eliminated entirely with the right conversation. Processors want your business—use that leverage.

Security upgrades aren't just about protection—they directly impact your rates. Implementing EMV chip readers, address verification, and other security measures can qualify you for lower interchange rates while protecting your business from costly fraud.

For businesses with tight margins, compliant surcharging programs offer a legitimate way to pass processing costs to customers who choose to pay with credit. Our team at Merchant Payment Services can help you implement these programs within legal guidelines, ensuring you maintain both compliance and customer satisfaction.

Many of our clients have found that complementary solutions like in-store ATMs create a powerful strategy—reducing credit card volume while generating surcharge revenue that offsets remaining processing costs. It's about creating a holistic payment acceptance approach that works for both your business and your customers.

At Merchant Payment Services, we've spent over three decades helping small businesses just like yours steer the payment landscape. Our family-owned company combines straightforward processing solutions with ATM management expertise to improve your overall cash flow and reduce the total cost of payment acceptance.

Whether you're just starting to accept cards or looking to optimize your current setup, our team of payment experts is ready to provide a personalized analysis of your specific business needs. Visit our home page to find how we can help your business thrive without being weighed down by excessive processing fees.

Finding the right payment processing solution isn't about chasing the lowest advertised rate—it's about finding the lowest total cost of acceptance that fits your unique business model. With the right partner, you can turn payment processing from a necessary expense into a strategic advantage.