PCI Compliance for ATMs: Protecting Your Machines and Your Customers

Understanding ATM PCI Compliance: The 2025 Deadline

ATM PCI compliance refers to meeting the security standards established by the Payment Card Industry Security Standards Council (PCI SSC) for Automated Teller Machines. If you operate ATMs, here's what you need to know about the upcoming requirements:

What: New TR-31 key block encryption standard mandated for all ATMs

When: January 1, 2025 final compliance deadline

Who: Affects all ATM operators in the United States

Why: Improves PIN security and prevents data breaches

How: Requires hardware (EPP) upgrades and software/firmware updates

ATMs play a critical role in our financial ecosystem, providing convenient access to cash and banking services. But with this convenience comes responsibility. The PCI SSC has established strict security standards to protect cardholder data, and a major update is coming that affects every ATM operator in the country.

By January 1, 2025, all ATMs must implement the TR-31 key block standard to remain compliant and operational. This isn't just another regulatory hurdle – it's an essential security upgrade that protects your customers' sensitive financial information from increasingly sophisticated threats.

The challenge is significant: as of December 31, 2022, not a single ATM in the United States was fully compliant with the new standard, as the required software had not yet been released. ATMs manufactured after March 2021 likely have the proper Encrypting PIN Pad (EPP) hardware, but most machines manufactured before that date will require upgrades.

I'm Lydia Valberg, co-owner at Merchant Payment Services, where I've guided countless businesses through ATM PCI compliance upgrades over my family's 35+ years in the payment industry. My experience has shown that early planning prevents the costly scramble that occurs when deadlines approach.

The New TR-31 Key Block Mandate

Let's talk about the heart of these upcoming ATM PCI compliance changes – the TR-31 key block standard. If you're wondering what this technical-sounding term means for your ATM business, you're not alone!

TR-31 is essentially a more secure way to protect PIN data during transactions. Think of it as a digital lockbox defined by ANSI X9.24-1 that does something pretty clever: it wraps encryption keys together with rules about how they can be used. Unlike the older methods, which were like sending a key in an envelope, TR-31 is like sending a key in a tamper-proof box that only opens under specific conditions.

The deadline is clear and approaching fast: by January 1, 2025, all ATMs must implement TR-31 Phase 3 key blocks to process PIN transactions. This isn't one of those "nice-to-have" upgrades – it's mandatory. According to the latest research on key blocks, processors will be required to enforce this standard, which means non-compliant ATMs simply won't work after the deadline.

Why TR-31 Is Replacing Legacy Keys

There's a good reason the industry is making this switch. TR-31 key blocks offer significant security improvements that protect both you and your customers:

Stronger cryptography means the encryption is much harder to crack, even with advanced hacking tools. With dual-control protection, no single person can access sensitive keys, reducing insider threats. The split-knowledge approach ensures that cryptographic keys are divided between multiple authorized people – like requiring two keys to launch a missile.

I often explain it to our clients this way: "TR-31 does for ATM security what deadbolts did for door locks – it's a fundamental upgrade that addresses weaknesses in the system we've relied on for years."

Which ATMs Are Affected?

If you own or operate ATMs, this affects you – full stop. But how much work your machines need depends on their age and model.

For retail ATMs manufactured before March 2021, you're likely looking at both hardware and software upgrades. This includes many popular non-WinCE models like early Hyosung 1800 and 2700 series, older Genmega G1900s, and Triton RL series machines.

Financial institution ATMs face similar requirements, though they often have different hardware configurations and deployment timelines.

The good news? Newer ATMs (especially WinCE-based models) manufactured after 2021 might only need software or firmware updates. But don't assume – we've seen plenty of newer machines that still require hardware upgrades.

At Merchant Payment Services, we've helped hundreds of businesses identify exactly what their ATMs need based on model numbers and EPP (Encrypting PIN Pad) versions. Our experience shows that about 70% of ATMs currently in service will need some level of upgrade before 2025.

The clock is ticking, but with proper planning, meeting the TR-31 mandate doesn't have to be stressful. The sooner you assess your fleet, the more options you'll have – and the less likely you'll face last-minute scrambling as the deadline approaches.

ATM PCI Compliance Requirements & Deadlines

The TR-31 key block mandate isn't just another checkbox—it's a critical piece of the broader ATM PCI compliance puzzle. Let's break down what this means for your ATM operations in practical terms.

Think of ATM PCI compliance as a comprehensive security framework with several interconnected parts:

PCI DSS v4.0: The foundation of payment security standards that governs how your ATMs handle sensitive cardholder data.

PCI PTS v5+: Specific requirements for PIN Transaction Security that focus on the physical and logical security of your ATM keypads.

Encrypting PIN Pad (EPP) requirements: The specialized hardware that captures and encrypts customer PINs—the front line of defense against data theft.

Software and firmware requirements: The "brains" of your ATM that must implement proper security controls and encryption protocols.

TR-31 key block implementation: The sophisticated encryption method that protects PIN data throughout its journey.

What Does ATM PCI Compliance Mean for Your Fleet?

When we work with ATM operators at Merchant Payment Services, we often find they're overwhelmed by compliance requirements. Let's simplify what this means for your business.

Start by taking stock of what you have. Document your ATM models, serial numbers, and EPP versions. This inventory becomes your compliance roadmap. Pay special attention to those keypad serial numbers—they're the key to determining whether you need hardware replacements or just software updates.

Next, verify your EPP compliance status by checking for version labels on the back of keypads (usually above the serial number). This small step can save you thousands in unnecessary hardware costs.

Your software audit should identify operating system versions and application releases. Many non-compliant ATMs are running perfectly good hardware that simply needs updated software.

Don't overlook your encryption protocols. Are you running modern TLS versions? What key management approaches are you using? These technical details matter tremendously for compliance.

Keep your compliance documentation organized and accessible. When auditors or processors ask questions, having records of previous upgrades and certifications at your fingertips can make all the difference.

Finally, establish clear communication with your ATM manufacturers or service providers. They should be able to confirm exactly what upgrades your specific machines need.

For more comprehensive guidance, check out our More info about ATM Compliance Regulations resource center.

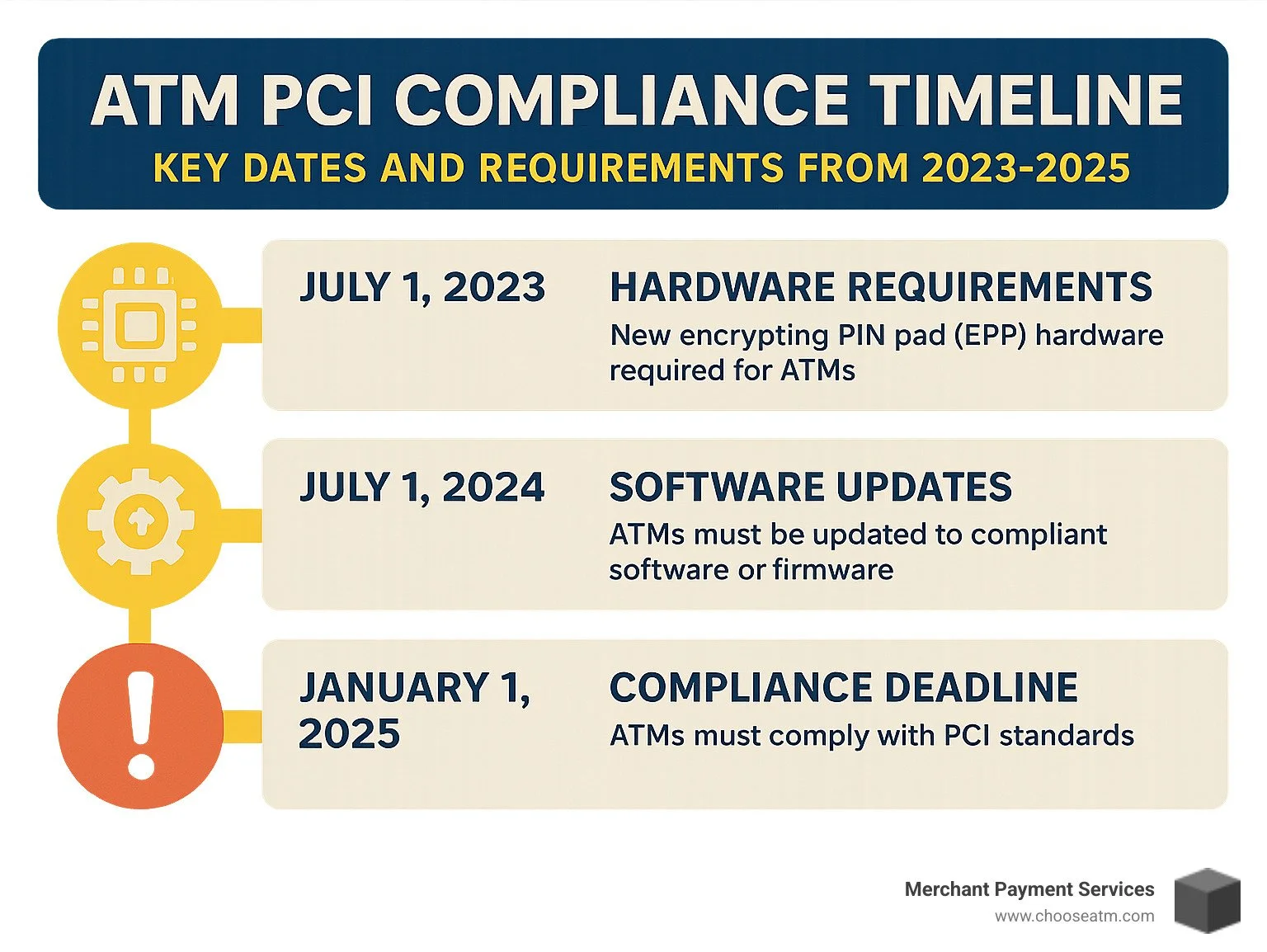

ATM PCI Compliance Deadlines You Can't Miss

The road to TR-31 compliance follows a carefully structured timeline with several make-or-break deadlines:

June 30, 2023 marked the initial phase, requiring acquirers and processors to support TR-31 key blocks on their end. This behind-the-scenes work laid the foundation for ATM-level changes.

By December 31, 2023, the focus shifted to hardware readiness, with requirements for TR-31 capable equipment deployment.

June 30, 2024 represents a critical milestone for software and firmware readiness. If your ATMs haven't received the necessary software updates by this date, you're falling behind the curve.

December 31, 2024 is the final hardware compliance deadline—every ATM in your fleet must have TR-31 capable EPPs physically installed by this date. Waiting until the last minute creates unnecessary risk due to potential parts shortages and technician availability.

Finally, January 1, 2025 marks full enforcement. After this date, non-compliant ATMs may face transaction processing disruptions.

While some processors might offer grace periods after the deadline, banking your business continuity on such extensions is extremely risky. As Visa's security bulletin clearly states, "acquirers and their agents must migrate to the use of key blocks as soon as possible."

The timeline we're working with today actually represents an extension from earlier deadlines. COVID-19 forced the PCI SSC to delay implementation, giving ATM operators valuable extra time to prepare. But the January 2025 deadline is now firmly established, as confirmed by scientific research on deadline impact.

At Merchant Payment Services, we've seen the consequences of last-minute compliance scrambles. The businesses that start their upgrade process early consistently avoid the premium costs and operational disruptions that come with deadline-driven upgrades.

Upgrade Roadmap, Risks & Outsourcing Solutions

The January 2025 deadline might seem far away, but when it comes to ATM PCI compliance, time flies faster than cash through a counting machine. At Merchant Payment Services, we've guided countless businesses through compliance upgrades, and we've learned that a clear roadmap isn't just helpful—it's essential for your sanity and your bottom line.

Think of your upgrade journey like planning a cross-country road trip. You wouldn't start driving without knowing your route, checking your vehicle, and booking places to stay. Similarly, your TR-31 compliance journey needs thoughtful planning. We recommend starting with a complete fleet inventory now, making honest decisions about which machines to upgrade versus replace, and creating a realistic budget that accounts for both parts and labor.

The truth is, we're already seeing signs of what's coming: as more operators wake up to these requirements, parts are becoming scarcer and technician calendars are filling up. Those who waited until the last minute on previous upgrades like EMV ended up paying premium prices—sometimes 15-20% higher—and faced frustrating delays. One of our banking clients learned this lesson the hard way, losing about $45,000 in surcharge revenue during a six-week wait for technicians during the EMV crunch.

Step-by-Step Upgrade Process

When it's time to actually perform the upgrade, here's what happens at each ATM:

First, we conduct a site survey to verify exactly what you're working with—the ATM model, current EPP version, and any site-specific installation needs. Next comes ordering the proper EPP that's certified for TR-31 compliance. While waiting for hardware delivery, we prepare the software components needed for your specific machine.

The hands-on work begins with the physical installation of the new EPP, typically taking 1-2 hours per machine. Once installed, we load the TR-31 compatible software and firmware, followed by the critical key injection process that securely loads encryption keys in the new format. Before we consider the job complete, we run certification testing to verify everything works properly, document the upgrade for your compliance records, and finally return the ATM to service—now fully TR-31 compliant.

What makes this process tricky isn't any single step—it's coordinating all these elements across multiple machines, often in different locations, while minimizing downtime. It's like conducting an orchestra where every instrument needs to play perfectly.

Financial, Operational & Reputational Risks of Delay

Procrastination might work for some things in life, but ATM PCI compliance isn't one of them. The risks of waiting touch every aspect of your business:

From a financial perspective, non-compliant ATMs face transaction rejection after the deadline—an immediate revenue flatline. You'll also face higher upgrade costs as demand surges, potential fines for non-compliance, increased liability for data breaches, and even higher insurance premiums.

Operationally, you could experience extended ATM downtime when technicians become impossible to book, parts become unavailable, and coordination becomes a nightmare. We've seen businesses struggle to explain to customers why their ATMs aren't working, which leads to the next risk category.

Your reputation takes a hit when customers encounter non-functional ATMs or, worse, when their data is compromised. In today's connected world, one negative experience can spread quickly, creating a perception that you don't take security seriously. Meanwhile, your competitors with fully compliant machines continue serving customers without interruption.

Why Outsourcing Can Simplify Compliance

Let's face it—most businesses didn't get into ATM ownership because they love keeping up with encryption standards and security protocols. You're focused on your core business, whether that's running a convenience store, managing a hotel, or operating a financial institution.

This is where outsourcing to specialists like us at Merchant Payment Services makes sense. We eat, sleep, and breathe ATM PCI compliance so you don't have to. When you partner with us, you gain immediate access to expertise that would take years to develop in-house. We transform unpredictable upgrade expenses into predictable monthly costs that you can budget for.

We also serve as your single point of contact for coordinating hardware vendors, software providers, and service technicians—no more playing phone tag between multiple companies. The administrative burden of maintaining compliance documentation and certifications shifts to our shoulders, letting you focus on what you do best.

Perhaps most importantly, outsourcing helps future-proof your ATM operations. In the past decade alone, we've steerd major upgrades approximately every two years—EMV, ADA requirements, multiple PCI DSS versions, and Windows OS updates. This pace isn't slowing down, and having a dedicated partner monitoring the horizon for you means no more compliance surprises.

The TR-31 mandate is just the latest chapter in the ongoing story of ATM security. By taking proactive steps now and considering the benefits of outsourced management, you can ensure your ATMs remain secure, compliant, and profitable well beyond the 2025 deadline. After all, the best compliance strategy isn't just about meeting today's standards—it's about being prepared for tomorrow's as well.

Looking for more ways to protect your ATM investment? Check out our comprehensive guide to ATM Security Solutions and learn how to safeguard your machines from both physical and digital threats.

Frequently Asked Questions about ATM PCI Compliance

Will non-compliant ATMs shut off on January 1, 2025?

While your ATMs won't dramatically power down at midnight on January 1st, the practical reality isn't much different. Think of it as a gradual shutdown rather than flipping a switch.

Most processors will begin rejecting transactions from non-compliant machines, effectively rendering them useless for their primary purpose. Yes, some processors might offer a temporary grace period – but I've seen this scenario play out before with other compliance deadlines, and these grace periods are typically shorter than expected and not guaranteed.

The transition typically unfolds in three phases:

First, you'll see warning messages while transactions still process. Next, certain transaction types (usually higher-risk ones) will be declined. Finally, all transactions will be rejected from non-TR-31 compliant machines.

The bottom line? Your ATM might physically power on, but without the ability to process transactions, it might as well be unplugged. Planning ahead prevents this outcome entirely.

Can every ATM be upgraded, or will some need replacement?

This is one of the most common questions we hear at Merchant Payment Services, and unfortunately, not every ATM can make the jump to TR-31 compliance. Your upgrade options depend on several key factors:

Operating system compatibility makes a huge difference – most WinCE-based ATMs can be upgraded relatively easily, while many older non-WinCE systems simply can't handle the new requirements.

Hardware architecture matters too. Some older machines physically can't accommodate the new EPP hardware needed for compliance.

Manufacturer support is crucial – if your ATM model has reached end-of-life status, replacement parts and software updates may no longer exist.

From our extensive experience upgrading ATM fleets, about 70% of machines can be fully upgraded with both hardware and software updates. Another 20% can receive software updates but need hardware replacement. The remaining 10% simply cannot be upgraded and require complete replacement.

Not sure where your ATMs fall? We offer free assessments to determine your specific situation.

How much does a typical TR-31 upgrade cost?

The upgrade cost varies widely based on your specific situation, but I can give you a realistic picture of what to expect.

For hardware, an EPP replacement typically runs between $400-$800 per unit, with potential additional components adding $100-$300 more. On the software side, expect to spend $150-$300 for firmware updates and $200-$500 for application software per machine.

Labor costs add another layer: $200-$400 per unit for installation and configuration, plus $100-$200 for testing and certification. These figures can fluctuate based on your ATM model, age, quantity of machines, and location.

For perspective, upgrading a fleet of 10 ATMs typically costs between $8,500 and $22,000 total. That's a significant investment, but ATM PCI compliance isn't optional if you want your machines to keep processing transactions.

The good news? At Merchant Payment Services, we've created flexible financing options specifically for these upgrades, including lease arrangements that build in future compliance updates. This approach helps smooth out these costs over time rather than requiring a large upfront expenditure.

One last tip from my years in this industry: early adopters almost always save money. As the deadline approaches, both parts and qualified technicians become scarce, driving up costs significantly. I've seen last-minute upgrades cost 25-30% more than those planned well in advance.

Conclusion

The journey to ATM PCI compliance isn't just about meeting regulatory requirements—it's about protecting what matters most: your business reputation and your customers' financial security. As January 1, 2025 approaches, the TR-31 key block mandate represents a critical turning point in ATM security that requires your attention now, not later.

Throughout my years helping businesses steer ATM compliance changes, I've seen how proper planning makes all the difference. Those who prepare early breathe easy when deadlines arrive, while those who wait face unnecessary stress, higher costs, and potential revenue loss.

Early action truly pays off. Not only will you avoid the inevitable supply shortages and price increases as the deadline approaches, but you'll also gain peace of mind knowing your ATMs will continue operating without interruption. Most ATMs manufactured before March 2021 will need both hardware and software upgrades—identifying these machines now gives you time to budget appropriately.

For some of you, this compliance journey may reveal that certain older ATMs simply cannot be upgraded. This isn't bad news if finded early—it's valuable information that allows for strategic replacement planning rather than emergency purchases when transactions start failing.

Many of our clients have found that outsourcing their ATM management simplifies not just this compliance upgrade, but all future regulatory changes as well. When you partner with experts who handle these transitions every day, you transform unpredictable compliance costs into manageable, predictable operating expenses.

At Merchant Payment Services, we've guided businesses through every major ATM compliance change for over three decades. Our turnkey solutions include proactive compliance management that keeps your machines secure and operational regardless of what regulatory changes come next. We handle the technical details so you can focus on what you do best—running your business.

Don't let the 2025 TR-31 mandate become a last-minute emergency. Contact us today for a complimentary ATM compliance assessment and personalized upgrade roadmap. With our expertise and your proactive planning, meeting this mandate can become a smooth process that strengthens your security posture for years to come.

Remember: when it comes to ATM PCI compliance, the right time to act is now. Your business, your machines, and most importantly, your customers are counting on it.