Why Your ATM Isn't Dispensing Cash and How to Fix It Fast

When Your ATM Machine Stops Working: Quick Fixes

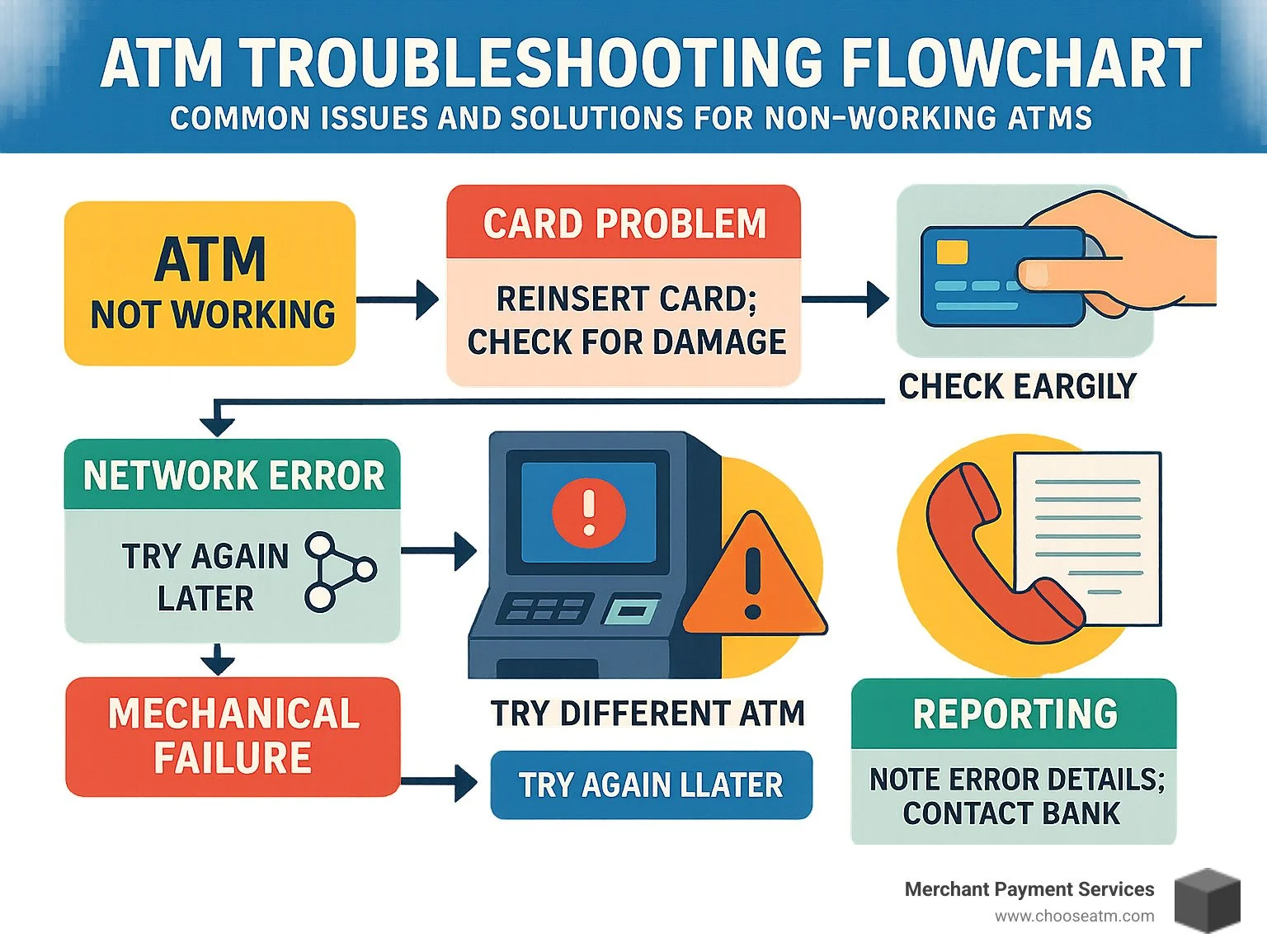

If your atm machine not working situation needs immediate attention, here's what to do:

Check your card - Ensure it's inserted correctly and not damaged

Verify your balance - You may have insufficient funds

Look for error messages - Note any codes for reporting

Try a smaller amount - The machine may have limited cash

Contact your bank - Call the number on your card or the ATM

Document everything - Take photos of error screens and receipts

It can be incredibly frustrating when you're in a rush and encounter an ATM that won't cooperate. Whether it's refusing to accept your card, not dispensing cash, or displaying cryptic error codes, an atm machine not working creates immediate stress and inconvenience. With over 10 billion ATM transactions occurring in the U.S. each year, most happen without incident—but when problems arise, knowing what to do can save you time and protect your finances.

ATM malfunctions can stem from various issues, ranging from simple card reader errors to complex network failures. The good news is that many common problems have straightforward solutions that don't require technical expertise. Others may need reporting to your bank or the ATM operator for proper resolution.

As Lydia Valberg, Co-Owner of Merchant Payment Services with over 35 years of family experience in the payment solutions industry, I've helped countless business owners troubleshoot atm machine not working scenarios and implement preventive measures to minimize downtime and customer frustration.

ATM Machine Not Working? 8 Quick Checks Customers Should Do On the Spot

When you find an atm machine not working, don't panic! Taking just a few minutes to try some simple troubleshooting can often get you your cash—or at least help you report the problem accurately. Before you walk away frustrated or reach for your phone, try these eight customer-friendly checks:

ATM Machine Not Working After Card Insert

We've all been there—you slide your card in and... nothing happens. If your card goes in but the ATM seems frozen:

First, check your card orientation. It sounds simple, but even regular ATM users occasionally insert cards upside down or backward. Most machines have a small diagram showing the correct position.

Watch those PIN attempts too! After three wrong tries, many ATMs will temporarily lock your card as a security measure. If you've been typing your PIN incorrectly, this might be why the machine is holding your card hostage.

Don't overlook screen prompts. Sometimes the ATM is working fine, but has confusing instructions. Take a moment to carefully read everything on screen—you might just need to press a specific button to move forward.

If you see numbers like "40047" or "D1500" pop up, you're looking at error codes. Jot these down! They're like secret decoder rings for technicians and bank representatives to identify exactly what's wrong.

"No one likes to see the dreaded 'Out of Order' sign on an ATM," our service team often says. "When customers need cash, they expect the ATM to work as needed."

Check the Cash Slot for Visible Jams

When an atm machine not working situation involves the cash dispenser, a quick visual inspection might reveal the problem:

Take a peek inside the cash slot (just looking—no poking around with fingers or objects) for any visible paper scraps or debris that might be blocking the mechanism. Sometimes the protective flap covering the dispenser gets stuck or damaged, preventing cash from coming out properly.

Listen closely for unusual grinding or humming sounds—these often indicate the dispenser is trying to work but something mechanical is stuck. If you spot any physical issues, resist the urge to play ATM repair technician! Simply report what you've observed to the ATM owner or your bank.

ATM Machine Not Working With Deposit

Depositing cash or checks when an atm machine not working properly can be especially nerve-wracking:

Your first move should be to cancel the transaction if possible—this prevents complications with your account. If you've already inserted cash or checks, grab your phone and take photos of any error message and the ATM location for documentation.

Smart tip: Count your deposit where the ATM's camera can see it. This creates a visual record of your transaction if there's a dispute later. And always, always request and keep your receipt, even if the transaction seems incomplete.

As one of our customers humorously put it: "It's one of life's major OMG moments when an ATM takes your cash or check and miscalculates or doesn't acknowledge your deposit." Staying calm helps you document everything properly.

Verify On-Screen Power or Network Alerts

Sometimes the issue isn't with your card or the machine itself, but with the broader system:

Watch for messages like "Connection Error," "Host Timeout," or "System Temporarily Unavailable" that indicate network problems. You might also see notices about the ATM rebooting or updating—just like your computer needs updates, so do ATMs!

Messages stating the ATM is "Temporarily Out of Service" usually mean there's a known issue already being addressed. Network connection problems rank among the most common ATM issues and typically require no action from you beyond finding another machine.

Try a Smaller Withdrawal Amount

If the ATM refuses to give you the cash you requested, it might not be broken—just limited:

Many ATMs have maximum single-transaction limits (typically around 40 bills at once). If you're requesting a large amount, try breaking it into smaller withdrawals. The machine might also have only certain denominations available—if it's out of $20 bills but has plenty of $10s, a smaller request might work.

Some ATMs impose daily withdrawal limits based on your account type or the ATM owner's policies. Our technicians often note, "A machine showing error code 20002 is usually indicating low cash or no cash conditions," which means smaller transactions might still work just fine.

Collect Any Receipt or On-Screen Reference Number

If things go sideways, documentation becomes your best friend:

Always tap "Yes" if asked about a receipt, even for failed transactions. Make note of any transaction ID or reference number displayed on screen—these are golden for resolving disputes later. If possible, snap a photo of the error screen with your phone and record the exact time and date.

Banking regulations are on your side: "Banks are required by federal law (Regulation E) to investigate ATM errors," but your claim stands much stronger with proper documentation in hand.

Listen for Unusual Beeps or Whirs

An ATM's soundtrack can actually tell you a lot about what's wrong:

Repeated beeping often signals a sensor error or card reader issue. If you hear grinding or cycling sounds from the cash dispenser, it might be trying to give you money but encountering a mechanical problem. Complete silence after inserting your card? That could indicate a power or software issue.

Our service technicians can often diagnose problems just by hearing customers describe these sounds over the phone—they're like ATM whisperers!

Move to a Nearby In-Network ATM

When all else fails, know when to cut your losses:

Use your banking app's ATM locator feature to find the nearest working machine in your network. Consider alternatives like getting cash back at a grocery store checkout—often free when making a purchase. Many banking apps now offer cardless ATM access through mobile codes or NFC technology, which might work even if your physical card is giving you trouble.

With 63% of customer transactions now happening after banking hours, having backup plans for accessing your funds is more important than ever.

Decoding ATM Error Codes & What They Mean

Ever stared at an ATM screen displaying a mysterious code like "40047" and wondered what alien language you're reading? You're not alone! Those cryptic numbers and letters actually tell a specific story about why your atm machine not working situation is happening. Let's decode this secret language together:

Error Code Meaning Quick Fix 40047 Dispenser Error Machine needs service; try another ATM 20013 No Receipt Paper Transaction may still work; ask for digital receipt D1500 Connection Error Network issue; try again in a few minutes F000F Incorrect/Empty TID Machine needs reprogramming by operator 20002 Low Cash or No Cash Try a smaller amount or another ATM

How to Locate and Read the Code

When your friendly neighborhood ATM turns not-so-friendly, finding the error code is your first detective work. Most machines display these codes in a corner of the screen—usually tucked away like they're slightly embarrassed about the whole situation. Sometimes the code hides within the error message text itself, like "Error 40047: Unable to dispense cash."

Even if the screen goes blank, don't lose hope! Many ATMs will still print a receipt with the error code, even when the transaction fails. This little slip of paper becomes your golden ticket when reporting the problem.

"Think of error codes as the ATM's way of telling you exactly where it hurts," explains our maintenance team. "It's like when your car's check engine light comes on—specific codes point to specific problems."

Fast Fixes for the 5 Most Common Messages

When you see 40047 – Dispenser Error, the ATM is essentially saying, "I can't get the cash out!" This usually means bills are jammed in the dispenser or the sensors are dirty. As a customer, your best move is to find another ATM and report the issue. ATM owners can often fix this by carefully clearing the jam or cleaning the sensors with compressed air.

Seeing 20013 – No Receipt Paper? Good news—the ATM can still handle your transaction! It's just run out of paper to print your receipt. You can proceed with your transaction, but be sure to request an email receipt if that's an option, or take a photo of the confirmation screen.

The dreaded D1500 – Connection Error is like when your internet drops during a video call. The ATM has lost its connection to the banking network. This is typically temporary—like a digital hiccup. Give it a few minutes and try again, or move on to another ATM if you're in a hurry.

If you spot F000F – Incorrect/Empty TID, the ATM has an identity crisis! Its Terminal ID (the unique identifier that tells the network which ATM is which) is missing or incorrect. Unfortunately, this requires the ATM operator to update the machine's programming—nothing you can fix on the spot.

And finally, 20002 – Low Cash or No Cash is pretty straightforward—the ATM is running on empty. You might have success trying a smaller withdrawal amount (the machine might have just a few bills left), but your best bet is finding another ATM.

"For ATM owners, these codes are like a diagnosis from a doctor," our service team often tells clients. "Instead of calling a technician right away, check your manual for these common codes. Most have simple fixes you can handle yourself in minutes." For more detailed information about common ATM problems, check out our More info about ATM Machine Problems guide or consult the Operator Menu Guide for your specific machine.

How to Report a Failed ATM Transaction and Protect Your Rights

When you've encountered an atm machine not working and it's affected your account, knowing how to properly report the issue is crucial for getting your money back quickly. Let's face it - there's nothing quite like the sinking feeling of watching an ATM eat your card or debit your account without dispensing cash!

Information to Gather Before You Call

Before reaching for the phone to call your bank, take a deep breath and collect your evidence. This isn't just about complaining – it's about building a case that gets results.

First, note the date and time when the transaction went sideways. The exact location of the ATM matters too – jot down the address, store name, or bank branch. Your bank will need to know the transaction amount you attempted to withdraw or deposit.

Did the screen flash any error codes or messages? These are like diagnostic gold for resolving your issue faster. If possible, snap photos of any error screens or the ATM itself. And always grab that receipt, even if it just shows an error – it's physical proof of your attempted transaction.

"Staying calm helps you communicate the problem more effectively," our customer service team often reminds clients. "The more information you can provide, the faster your issue can be resolved."

Filing a Regulation E Dispute Step-by-Step

Here's where knowing your rights really pays off. Under federal Regulation E (Electronic Fund Transfer Act), you have specific protections when an ATM transaction goes haywire.

Report promptly – while technically you have up to 60 days from your statement date, don't wait! The sooner you report, the fresher the evidence and the quicker your resolution.

Start with a phone call to your bank's customer service number (it's right on your card). Be polite but persistent in explaining what happened. Many issues get resolved right on this first call. Your bank may ask you to follow up with a written report – if so, do it immediately.

Expect a clear timeline for resolution. By law, your bank must investigate within 10 business days of your report. Can't complete it that quickly? They must issue a provisional credit to your account while continuing their investigation (which can take up to 45 days).

Keep detailed documentation of everything. Note who you spoke with, when, and what they promised. Save copies of all correspondence. This paper trail becomes invaluable if things get complicated.

According to federal regulations, "Banks are required by federal law (Regulation E) to investigate electronic fund transfer errors," which means you're not left fighting this battle alone.

Escalation Paths If the Bank Delays

Sometimes even with the best preparation, you might hit roadblocks. If your bank seems to be dragging their feet, it's time to escalate.

First, ask to speak with a manager or supervisor. Higher-level staff often have more authority to resolve issues on the spot. Be courteous but firm about your rights under Regulation E.

If that doesn't work, the Consumer Financial Protection Bureau (CFPB) has your back. File a complaint through their website, and they'll forward it to your financial institution, which typically must respond within 15 days.

A formal written follow-up can also work wonders. Send a certified letter to your bank's customer service department detailing the issue and your previous attempts to resolve it. This creates an official record they can't ignore.

Sometimes, nothing beats face-to-face interaction. Visiting a branch in person often yields faster results than endless phone calls. Bring all your documentation with you.

"If the bank can't resolve the error within 10 business days, it must issue you a provisional credit under Regulation E." This ensures you're not left cash-strapped while they sort things out.

For more information about common banking issues, check out our guide on Bank Machines Not Working: Common Issues and Solutions or review your rights under § 1005.11 consumer protections.

First-Line Troubleshooting for Owners: Get Your ATM Back Online Fast

For ATM owners and operators, downtime means lost revenue and frustrated customers. When your atm machine not working situation affects your business, quick action can make all the difference between a minor hiccup and a major headache.

Power, Network, and Software Resets

The simplest fixes often solve the most common problems. Before calling in the professionals, try these basic troubleshooting steps:

Start with a good old-fashioned power cycle. Just like your home router, ATMs sometimes just need a fresh start. Turn off the machine completely, count to 30 (no cheating!), and power it back up. You'd be surprised how many mysterious glitches disappear after this simple reset.

Next, check your connection. Is your internet working? For ATMs using dedicated phone lines, make sure there's a dial tone. If your machine uses 4G LTE technology, check the signal strength on the router – sometimes just repositioning the antenna can work wonders.

Software updates matter too. Just like your smartphone, ATMs run better with the latest firmware. Check if there's a pending update from your manufacturer that might resolve your issue. Our technicians often joke that "turning it off and on again" solves about half of all tech problems – and they're not wrong!

Clearing Dispenser and Printer Jams Safely

Physical jams are the nemesis of ATM operators everywhere, but handling them properly is crucial.

For dispenser jams, access the cash area according to your specific model's instructions – every ATM is a bit different. When you're inside, gently remove any visibly jammed bills. A can of compressed air is your best friend here – use it to blow away dust from those sensitive sensors. While you're in there, double-check that your cash is properly aligned in the cassettes. As our maintenance team loves to point out, "Proper bill loading can reduce jams by up to 90%" – those few extra seconds spent neatly arranging bills will save you hours of headaches later.

Printer jams need a gentle touch too. Open the printer compartment and carefully remove any stuck paper. Here's a pro tip: use a business card or similar non-metal tool to clear jams. Metal objects can scratch or damage the delicate components inside. Make sure your receipt paper is loaded correctly – the thermal side needs to face the right direction or you'll end up with blank receipts. Before closing everything up, double-check that all components are properly seated.

When to Call Second-Line Maintenance

While you can handle many issues yourself, some problems require professional expertise. Know when it's time to call in the cavalry.

If you've tried basic troubleshooting and the same error keeps coming back, it's time for professional help. Similarly, if you notice any signs of tampering or security concerns, don't investigate further – call the experts immediately. Component failures that require replacement parts, calibration issues with readers or dispensers, and software errors that lock you out of your operator menu are all clear signals that you need second-line maintenance.

As our experienced technicians often observe, "It isn't very common for new ATM machines to malfunction, but anything can happen at any time." That's why having a relationship with a qualified service provider is essential – they can often diagnose issues remotely before sending someone onsite, saving you time and money.

At Merchant Payment Services, we understand that every minute of downtime costs you money and customer goodwill. That's why we provide round-the-clock support for ATM owners, with friendly technicians who speak plain English, not tech jargon. Many problems can be solved with a quick phone call, and when they can't, we'll get someone to your location fast.

For more detailed information about keeping your ATM running smoothly, check out our comprehensive guide to ATM Maintenance Services.

Preventing the Next Outage: Maintenance, Upgrades & Future Tech

The best way to handle an atm machine not working situation is to prevent it from happening in the first place. Modern technology and proactive maintenance can dramatically reduce ATM downtime.

Scheduling Preventive Maintenance

Think of your ATM like your car – regular check-ups prevent breakdowns. Monthly maintenance makes a world of difference in keeping your machine humming along. Taking just 15 minutes each month to clean card readers with approved cleaning cards can prevent those frustrating "card not reading" errors that drive customers away.

Quarterly care goes deeper – this is when you should update software and security patches to protect against the latest threats. It's also the perfect time for a thorough cleaning of all components. As one of our technicians likes to say, "Dust is the silent killer of ATM components."

Once a year, schedule a complete hardware diagnostic check. This is your chance to replace parts showing signs of wear before they fail during a busy weekend. Our data shows that ATMs with regular annual maintenance experience 78% fewer emergency service calls.

"ATM owners would be wise to conduct regular servicing and maintenance," our technical team advises. "Preventive maintenance costs far less than emergency repairs and lost business due to downtime."

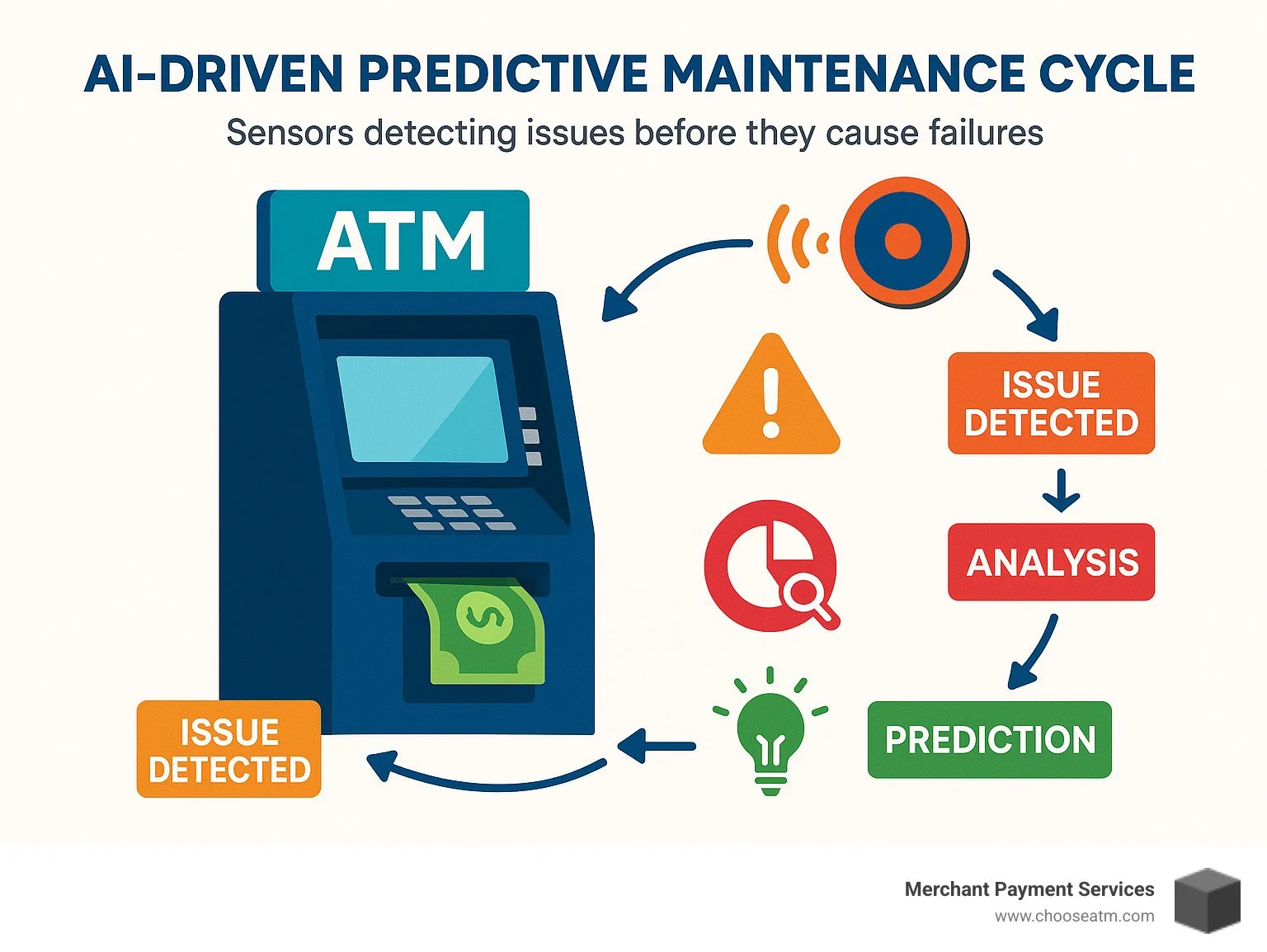

Leveraging AI & IoT for Live Alerts

Remember when ATMs were just "dumb" cash dispensers? Those days are gone. Today's smart ATMs can practically tell you when they're feeling under the weather before they get sick.

IoT sensors now detect early warning signs of trouble – like when a dispenser motor starts making slightly more noise than usual or when temperature patterns change. These subtle shifts, invisible to human operators, can signal an impending failure days or even weeks before it happens.

AI-powered analytics take this to another level by learning your business patterns. If your ATM typically needs a cash refill every Friday but a local festival is coming to town, the system can alert you to load extra cash before the weekend rush hits.

With cloud-based monitoring platforms, you can keep tabs on your entire ATM fleet from your smartphone while sipping coffee at your kitchen table. When something needs attention, you'll know instantly rather than finding out from an angry customer.

"Financial institutions can no longer afford to wait for problems—they must anticipate them," notes our implementation team. At Merchant Payment Services, we help businesses integrate these technologies to maximize ATM uptime while minimizing those middle-of-the-night service calls.

Security Upgrades That Double as Uptime Boosters

Here's a pleasant surprise: many security improvements also make your ATM more reliable. EMV chip card readers aren't just more secure than old magnetic stripe readers – they're also more dependable, with fewer moving parts to break down.

Anti-skimming devices protect your customers from fraud while simultaneously preventing the physical tampering that often leads to machine failures. It's a classic two-birds-with-one-stone situation.

High-visibility CCTV cameras deter vandalism that can put machines out of commission. Even better, they provide clear evidence if tampering does occur, making it easier to recover costs for repairs.

Contactless readers are becoming increasingly popular, and for good reason. They reduce wear and tear on physical components while speeding up transactions. Customers love the convenience, and you'll love the reduced maintenance headaches.

"Real-time monitoring is a game-changer in ATM security and uptime," our security specialists emphasize. By implementing these dual-purpose upgrades, ATM owners can simultaneously improve security and reliability while positioning their business for the future of banking technology.

For more detailed guidance on keeping your ATM running smoothly, check out our comprehensive ATM Troubleshooting Guide.

Frequently Asked Questions about ATM Failures

We've all been there – standing at an ATM, transaction incomplete, wondering what just happened and what to do next. Here are the answers to the most common questions we hear from both customers and ATM owners.

Why Was My Account Debited But I Got No Cash?

This might be the most heart-stopping moment at an ATM – seeing your account balance drop but walking away empty-handed due to a mechanical hiccup.

When this happens, take a deep breath. Your money isn't gone forever. Banks have procedures for these exact situations, and federal regulations protect you. Start by documenting everything – note the time and location, snap photos of any error messages, and keep your transaction receipt if one printed.

Contact your bank right away and clearly explain: "The atm machine not working took my money but gave me no cash." They'll place what's called a "debit hold" on the transaction during their investigation.

"It can be truly nerve-wracking when an ATM doesn't give you your money but still charges your account," acknowledges our customer service team. "But remember, Regulation E is your financial safety net in these situations."

How Long Until I Get My Money Back?

The good news is that federal banking regulations create a clear timeline for resolving these issues:

Your bank must complete their investigation within 10 business days of your report. If they need more time, they must provide you with "provisional credit" – essentially returning the money to your account temporarily while they continue investigating.

This investigation can take up to 45 days to fully complete, but you'll have access to your funds during this time (minus a potential $50 hold that some banks may apply). Once they finish investigating, they must either make the provisional credit permanent within one business day or explain their findings within three business days if they've determined no error occurred.

"The banking system has built-in consumer protections for electronic transfer errors," our team explains. "The key is reporting the problem promptly and keeping documentation of everything."

Can I Avoid Fees If I Must Use Another ATM?

When your regular atm machine not working forces you to find an alternative, you can often avoid those pesky out-of-network fees with a bit of strategy.

Your bank's mobile app is your best friend in these situations – most have ATM locator features that show you the nearest in-network machines where you can withdraw cash without fees. Many people don't realize that getting cash back during a purchase at grocery stores or pharmacies is essentially a fee-free ATM alternative.

Some banks even offer monthly ATM fee reimbursements as part of their account benefits. Check if yours does – you might be able to use any ATM and get those surcharges refunded up to a certain dollar amount each month.

The banking world is also increasingly moving toward cardless ATM access through mobile apps. These systems let you generate a temporary code or use your phone's NFC capability to access select ATMs without your physical card, potentially expanding your fee-free options.

At Merchant Payment Services, we help business owners place ATMs in locations that create win-win situations – convenient access for customers while generating surcharge revenue for the business. It's part of our commitment to making ATM management as smooth and profitable as possible for our clients.

Conclusion

When an atm machine not working situation strikes, it doesn't have to ruin your day. Whether you're a frustrated customer staring at an error message or a business owner watching potential revenue walk away, the steps we've covered can turn a moment of panic into a quick resolution.

At Merchant Payment Services, we believe ATM ownership shouldn't be complicated. Our decades of family experience in the payments industry has taught us that preventive care is always better than emergency repairs. The reality is that even the most reliable machines occasionally hiccup – but with proper maintenance, quick reporting, and secure technology, these moments can be rare and brief.

For customers, you have strong protections under federal banking regulations. That provisional credit requirement means you won't be left cashless while your bank investigates an error. Document everything, stay calm, and know your rights – your money is protected.

For business owners, your ATM is more than a convenience – it's a revenue generator and customer service tool. When you partner with experts who understand both the mechanical and customer service aspects of ATM management, you're investing in reliability. Our clients tell us that the peace of mind from knowing their machines are monitored, maintained, and quickly serviced is just as valuable as the surcharge revenue.

The banking world continues to evolve with contactless options, biometric security, and AI-driven maintenance, but the core need remains the same: people need reliable access to their money when and where they want it. By implementing the preventive measures we've discussed and having a plan for when issues arise, you're ensuring that an atm machine not working becomes a rare exception rather than a recurring headache.

We've been helping businesses steer the ATM landscape for over 35 years, and one thing remains constant – people appreciate businesses that make their lives easier. A well-maintained ATM does exactly that, while generating additional revenue and bringing customers through your door.

Ready to make ATM ownership truly effortless? Learn more about our ATM solutions and find why so many businesses trust Merchant Payment Services to keep the cash flowing – for their customers and their bottom line.