How Much Cash Fits in an ATM? The Surprising Truth

The Hidden World of ATM Cash Reserves

ATM cash capacity varies widely depending on the type of machine and location. Here's what you need to know:

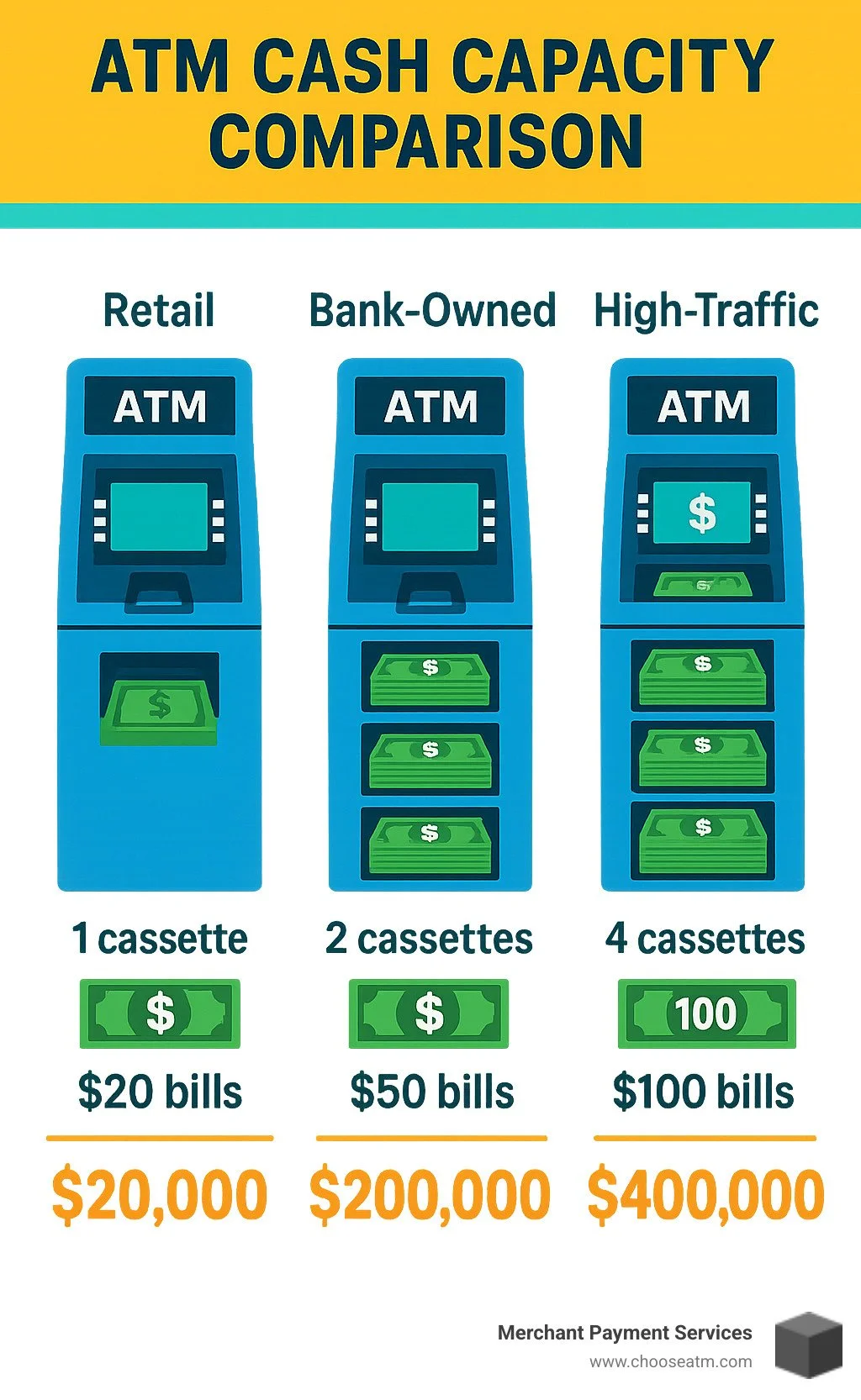

ATM Type Typical Cash Capacity Maximum Capacity Retail/Convenience Store $10,000-$20,000 $20,000-$50,000 Bank-owned $50,000-$200,000 Up to $200,000 High-traffic (casinos, airports) Up to $200,000 Up to $800,000*

*Theoretical maximum with four cassettes of $100 bills

Have you ever stood at an ATM and wondered exactly how much cash is inside that machine? Whether you're a business owner considering installing an ATM or simply a curious customer, understanding ATM cash capacity is both fascinating and practical.

Most retail ATMs that you see in convenience stores or gas stations typically hold between $10,000 and $20,000 in cash. These machines usually have a single cassette loaded with 1,000 $20 bills. Bank-owned ATMs, however, can hold significantly more—typically between $50,000 and $200,000—as they use multiple cassettes and are refilled more frequently.

The maximum capacity of an ATM depends on several factors:

Number of cassettes (1-4 typically)

Cassette capacity (1,000-2,200 notes each)

Bill denominations ($20, $50, or $100)

Location security and usage patterns

Business-owned ATMs in stores, bars, or restaurants are typically loaded with just $2,000 to $5,000 in $20 bills for daily operations—far below their technical capacity. This practical approach balances cash availability with security concerns and operational costs.

I'm Lydia Valberg, co-owner of Merchant Payment Services, and after helping hundreds of businesses optimize their ATM cash capacity over the past decade, I've learned that effective cash management is essential for maximizing both customer satisfaction and operational efficiency.

How Much Cash Is Inside? Typical & Maximum Limits

Ever wonder just how much money you're standing next to at the ATM? The answer might surprise you – there's often a big difference between what these machines could hold and what they actually contain.

Your average retail ATM in the US typically holds between $10,000 and $20,000 in cash. This makes perfect sense when you break it down: most retail ATMs use a single cash cassette that can hold about 1,000 bills. When loaded with $20 bills (the most common denomination), that gives you a neat $20,000 maximum capacity.

Bank-owned ATMs are a different story altogether. These financial workhorses typically hold between $50,000 and $200,000, using multiple cassettes and requiring more frequent refills due to their higher transaction volumes.

Then there are the high-rollers – ATMs in busy urban centers, airports, and casinos that might hold up to $200,000 in standard configurations. In extremely rare cases, when loaded with $100 bills in large-capacity cassettes, an ATM could theoretically hold up to $800,000. But you won't find many of these cash fortresses around, for obvious security and practical reasons!

Breaking Down Average ATM cash capacity

That ATM at your local gas station or convenience store is likely much more modest than you might think. Here's what's typically inside:

Most use just a single cassette system with a standard capacity of 1,000 notes. While they could hold up to $20,000 in $20 bills, the actual cash load is usually just $2,000 to $5,000.

"Why not fill it to the brim?" you might wonder. Well, at Merchant Payment Services, we've found that keeping just enough cash to meet daily or weekend demand is both safer and smarter. The average ATM withdrawal is only about $60, and most retail locations see between 4-13 transactions per day. So even a modest $2,000 cash load can easily handle several days of normal business.

It's like stocking your refrigerator – you don't need to fill it with a month's worth of groceries if you shop weekly, right?

The Extreme Scenario: Max ATM cash capacity with $100 bills

Now let's talk about those rare ATM beasts you might find in places like Las Vegas or JFK Airport. These high-traffic locations occasionally configure their ATMs for maximum capacity:

A fully-loaded machine might have four cassettes with 2,000 notes each, totaling 8,000 bills. If those were all $100 bills (which is rare), you'd be looking at an $800,000 potential capacity – nearly a million dollars inside a single machine!

But in our 35+ years at Merchant Payment Services, we've rarely seen ATMs loaded anywhere near this theoretical maximum. Even in busy casino environments, machines typically contain a mix of denominations and get refilled frequently rather than being stocked to capacity.

The reasons are practical: there are serious security concerns with storing that much cash, most customers don't want or need $100 bills, and there's a significant opportunity cost to having hundreds of thousands of dollars sitting idle inside a machine instead of earning interest somewhere else. Plus, the insurance requirements alone would give most business owners a headache!

For most businesses, the sweet spot for ATM cash capacity is finding that balance between having enough cash to serve your customers and not keeping more on hand than necessary. It's a balancing act we help our clients perfect every day.

Inside the Machine: Cash Cassettes & Denominations

The heart of an ATM's ATM cash capacity lies in its cassette system. These secure containers aren't just simple cash boxes—they're sophisticated tools designed to safely store and accurately dispense money to customers.

Most ATMs across America house between one and four cassettes, depending on the model and location needs. Each cassette typically holds a specific bill denomination, creating flexibility in how cash is dispensed. The most popular setup we see at Merchant Payment Services includes two cassettes of $20 bills paired with two cassettes of $50 bills. This combination gives customers a nice mix of bill options, whether they're grabbing a quick $40 or making a larger $300 withdrawal.

How Cash Cassettes Work & Common Capacities

Cash cassettes are marvels of practical engineering. When you press those buttons to request your cash, here's what happens behind that metal facade:

A spring-loaded pressure plate gently pushes bills forward toward the dispensing mechanism. Sophisticated note separators ensure only one bill moves forward at a time—no accidental double payments here! Throughout this process, built-in sensors vigilantly monitor for jams, verify bill thickness, and track how full the cassette remains. And naturally, the entire system is protected by robust locking mechanisms to keep unauthorized hands away.

Most standard cassettes hold between 1,000 and 2,200 notes, though we occasionally see high-capacity models that can store up to 4,000 bills each. The cassettes themselves are designed to be quickly swapped out during refills—a feature our service teams particularly appreciate during busy maintenance rounds.

From our experience helping hundreds of businesses optimize their ATMs, we've found that standard 1,000-note cassettes work perfectly for most retail locations. They're easier for staff to handle and require less capital tied up in cash reserves.

Denomination Strategy and ATM cash capacity Efficiency

Choosing the right mix of bills is both art and science when it comes to maximizing your ATM cash capacity. It's about finding that sweet spot between customer satisfaction and operational efficiency.

Most of our clients find success with $20 bills as their primary denomination, typically accounting for about 70-80% of all dispensed cash. These are the bills customers expect and prefer. We usually recommend including $50 bills as a secondary option for larger withdrawals, which helps reduce refill frequency. In certain locations like college campuses or budget-friendly shopping areas, we might suggest including $10 or even $5 bills to accommodate smaller transactions.

This balanced approach helps address several competing needs. Customers get the familiar bill sizes they're comfortable with. Business owners can optimize their total cash value per cassette. The ATM can offer flexible withdrawal amounts rather than just multiples of $20. And perhaps most importantly for busy merchants, higher denominations mean fewer refills and less time spent managing the machine.

I've personally worked with convenience store owners who switched from all-$20 configurations to a mixed denomination strategy and cut their refill frequency nearly in half. That's real time savings for busy entrepreneurs!

For more detailed guidance on loading procedures, you might want to check out our guide to ATM Cash Loading Procedures, which walks through the process step by step. And if you're looking to really fine-tune your approach, our team at Merchant Payment Services specializes in helping businesses find the perfect denomination mix based on their unique customer patterns and transaction volumes.

Keeping ATMs Stocked: Forecasting, Refills & Monitoring

Keeping the right ATM cash capacity is like making sure your refrigerator is properly stocked—you want enough to meet your needs without wasting space or resources. This delicate balancing act is something we've helped hundreds of businesses master over the years.

Scheduling Loads to Match ATM cash capacity Demand

Every ATM has its own personality when it comes to cash demand. Some machines in busy downtown areas might need daily attention, while that quiet machine in a small-town shop might only need a monthly visit.

What determines the perfect schedule? It's all about patterns:

Historical transaction data tells us what happened before, helping us predict what's coming next. We've seen ATMs that consistently run through $5,000 every weekend and others that barely move $1,000 in a month. This history is gold for planning.

Seasonal variations can throw a curveball into even the most predictable locations. That sleepy beach town ATM might suddenly need triple the cash during summer months. At Merchant Payment Services, we help our clients anticipate these seasonal swings before they happen.

Local events can create sudden cash demand spikes. When the state fair comes to town or a major concert is happening nearby, cash withdrawals can skyrocket overnight. We help our clients stay ahead of these local calendar highlights.

Day-of-week patterns are surprisingly consistent. Many ATMs see withdrawal spikes on Fridays as people prepare for weekend activities. Understanding these weekly rhythms helps us create refill schedules that make sense.

I remember one client whose convenience store ATM was constantly running dry on Saturdays. By analyzing the patterns and shifting their refill schedule from Monday to Friday morning, they never missed another weekend withdrawal opportunity.

Tech Innovations Improving ATM cash capacity Management

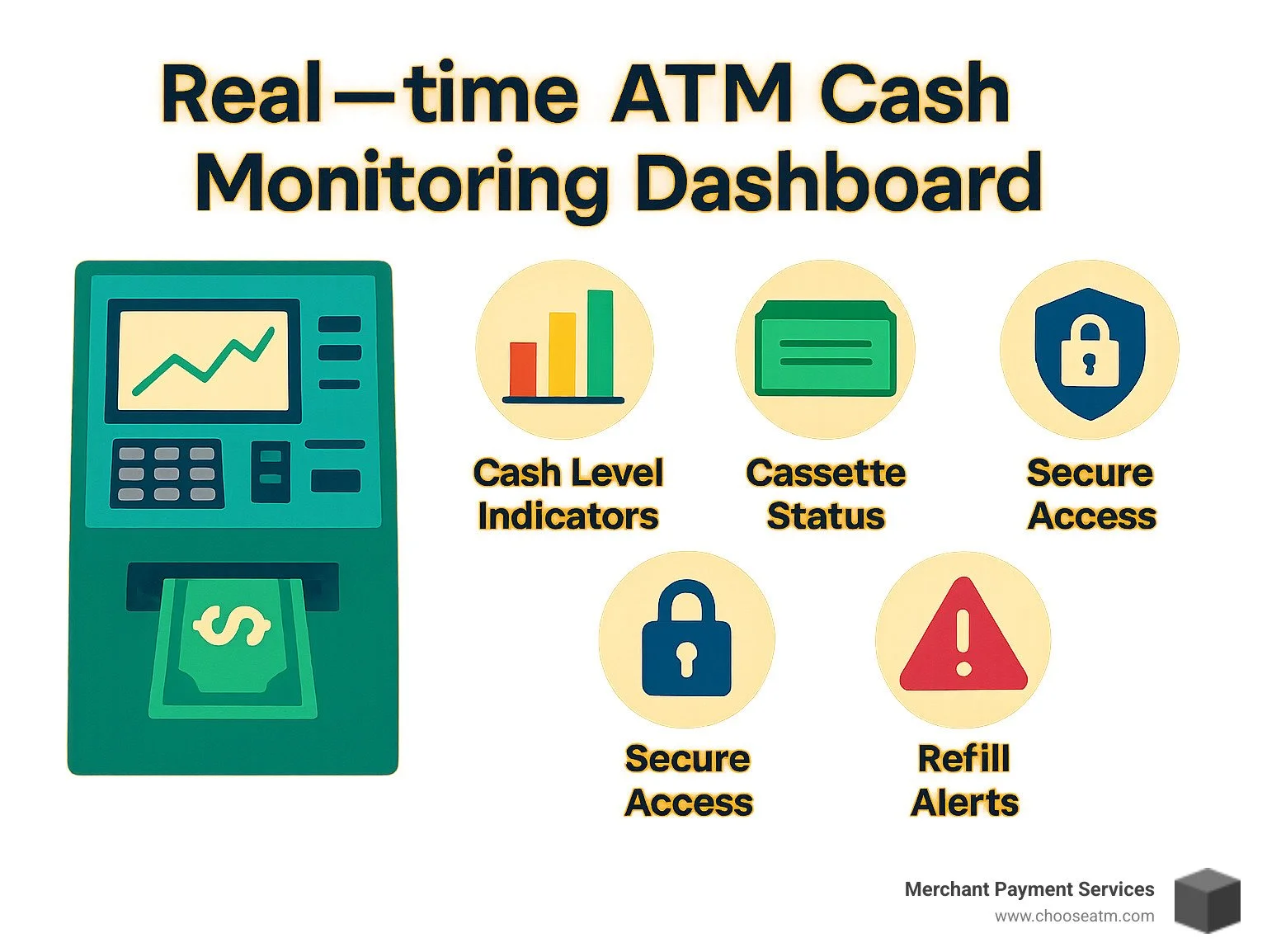

Gone are the days of "guess and check" ATM management. Today's technology gives us incredible visibility into cash levels and customer behavior:

Real-time monitoring systems have transformed how we manage ATMs. Rather than waiting for a customer complaint about an empty machine, our systems can alert you when cash levels hit predetermined thresholds. It's like having a 24/7 attendant watching your ATM.

Predictive analytics takes historical data and turns it into forecasts that are surprisingly accurate. Our ATM Cash Forecasting Tools can analyze years of transaction data alongside upcoming events to predict exactly how much cash you'll need next week or next month.

Automated cash optimization software doesn't just tell you when to refill—it tells you exactly how much cash to add and in which denominations. This precision helps minimize both the frequency of refills and the amount of idle cash sitting in machines.

Cloud-based dashboards give you the power to monitor your entire ATM network from your smartphone or computer. Our clients love being able to check cash levels while on vacation or receive automatic alerts when something needs attention. Our ATM Cash Management Software makes this process seamless.

According to recent research on refill frequency, optimizing your refill schedule can reduce cash management costs by up to 25% while improving customer satisfaction. That's a win-win that we love helping our clients achieve.

At Merchant Payment Services, we've spent over 35 years refining our approach to ATM cash capacity management. We've learned that the perfect balance isn't just about having enough cash—it's about having the right amount of cash at the right time, minimizing costs while maximizing availability for your customers.

Security & Operational Considerations for High-Traffic Sites

Managing ATM cash capacity in high-traffic locations comes with a unique set of challenges. When your ATM needs to serve hundreds of customers daily, you need the right balance of cash availability and security measures.

Protecting Large ATM cash capacity Reserves

I've seen how proper security measures make all the difference when dealing with large cash reserves. Think about it - an ATM in a busy casino or airport might hold $100,000 or more. That kind of money needs serious protection!

Modern high-capacity ATMs feature impressive security systems that would make a bank vault proud. They're built with vault-grade safes that can resist drilling and tampering attempts. The electronic locks often include time-delay features, meaning even authorized personnel can't instantly access the cash.

"We always recommend dual-control access for our high-traffic clients," says our security team at Merchant Payment Services. "Having two people required to access the machine dramatically reduces internal theft risk."

Beyond the physical machine, comprehensive surveillance is crucial. Most high-traffic sites maintain 24/7 camera coverage of both the ATM and surrounding area. Some advanced models even include ink-dye packs that can render stolen cash useless if triggered during a theft attempt.

The human element matters just as much as the technology. For our clients with high-capacity ATMs, we help implement:

Background checks for all personnel with ATM access

Randomized refill schedules to avoid predictable patterns

Armored transport services for safe cash delivery

Comprehensive insurance coverage custom to their specific cash levels

Cost–Benefit of Larger Loads

"Is it better to load up my ATM with a week's worth of cash, or refill it more frequently?" This is one of the most common questions I hear from business owners.

The answer isn't always straightforward. Larger cash loads mean fewer refills, which saves on labor costs and service fees. However, every dollar sitting in your ATM is money that isn't working for your business elsewhere.

Let's break down the real costs of maintaining larger cash reserves:

Cash holding costs hit your bottom line in ways you might not immediately notice. That $50,000 sitting in your ATM could be earning interest or funding other business operations. Over time, this opportunity cost adds up significantly.

Insurance premiums typically increase with the amount of cash you keep on hand. While basic coverage might be affordable for a $10,000 load, the premium jumps considerably when you're insuring $100,000 or more.

Security infrastructure requirements scale with your cash holdings. Higher capacity often necessitates upgraded security systems, which means both upfront investment and ongoing maintenance costs.

In my 15+ years helping businesses optimize their ATM operations at Merchant Payment Services, I've found that most retail locations do best with moderate cash loads sufficient for 3-5 days of transactions. This sweet spot minimizes both risk exposure and opportunity costs while maintaining excellent customer service.

For high-traffic locations like casinos or tourist destinations, we often recommend more frequent refills rather than maxing out the machine's capacity. Yes, you'll pay for more service visits, but the reduced risk and improved cash flow management typically more than make up the difference.

The goal isn't just keeping your ATM from running empty – it's maximizing the return on every dollar in your business, whether that dollar is in your ATM or working elsewhere for you.

Customer Perspective: Withdrawal Limits & Tips

Ever wondered why you can't just empty that ATM of all its cash? From a customer's perspective, ATM cash capacity matters less than the daily withdrawal limits set by your bank. These limits are the real ceiling on how much cash you can access, regardless of how much money is actually inside the machine.

What To Do When ATM cash capacity Meets Customer Needs

Most of us have experienced that moment when we need more cash than our ATM card will allow. Standard daily withdrawal limits vary quite a bit depending on where you bank:

Bank of America typically caps daily ATM withdrawals at $1,000, while Chase Bank offers a wider range from $500 up to $3,000 depending on your account type. Wells Fargo customers usually work with limits between $300 and $1,500, and most credit unions set their limits somewhere in the $500 to $1,000 range.

These limits aren't arbitrary—they protect both you and your bank from fraud or theft. But when you need more cash for a major purchase or special event, these limits can feel frustratingly low.

If you find yourself needing more cash than your daily limit allows, here are some practical solutions:

Call your bank a few days ahead to request a temporary limit increase. Many banks are happy to accommodate these requests for legitimate needs. You can also withdraw your maximum amount over several consecutive days if you have time to plan ahead.

For immediate needs, visiting a bank branch with proper ID often allows for larger withdrawals than ATMs permit. Some customers maintain accounts at multiple banks precisely for this reason—you can withdraw up to the limit from each bank's ATMs on the same day.

The good news is that many banks now let you temporarily adjust your own withdrawal limits through their mobile apps or online banking portals. Just sign in to adjust limits with many major banks, making it easier to access larger amounts when needed.

Safe Withdrawal Practices at Any ATM cash capacity

Whether you're taking out $40 or $400, safety should always be your priority when using ATMs.

Always choose ATMs in well-lit, visible locations where others are present. Before approaching, take a moment to scan the area and make sure nothing seems suspicious. When entering your PIN, use your body or hand to shield the keypad—a simple move that prevents "shoulder surfing" by potential thieves.

Whenever possible, visit ATMs during daylight hours, especially for larger withdrawals. Have your card ready before approaching the machine to minimize your time at the ATM. One common mistake is counting cash while standing at the machine—instead, put your money away immediately and wait until you're in your car or another secure location to count it.

Always keep your receipt until you've verified the transaction in your account. This small habit can save huge headaches if there's ever a discrepancy.

At Merchant Payment Services, we help business owners place their ATMs in locations that balance convenience with customer safety. After 35 years in the business, we've learned that the most successful ATM placements are those where customers feel secure making withdrawals at any time of day. Safe customers are repeat customers, which means more surcharge revenue for your business.

Frequently Asked Questions about ATM Cash Capacity

How much cash does an average U.S. ATM hold?

Curious about what's really inside that ATM you just used? The average retail ATM you'll encounter at your local convenience store typically holds between $10,000 and $20,000. This amount comes from the standard cassette that holds about 1,000 bills—usually $20s.

Bank ATMs are a different story altogether. These machines are workhorses, typically stocked with $50,000 to $200,000 because they handle many more transactions and get refilled more regularly.

That said, what's interesting is that most business-owned ATMs—like the one at your favorite coffee shop or gas station—aren't actually loaded to capacity. They might only contain $2,000 to $5,000 on a typical day. This practical approach helps business owners manage their cash flow more effectively while still meeting customer needs.

Why don't banks fill machines to maximum ATM cash capacity?

It might seem logical to fill ATMs to their maximum capacity, but there's actually some smart thinking behind keeping them at less than full capacity.

First and foremost, security concerns top the list—more cash means a bigger target for potential theft. There's also the matter of financial efficiency—every dollar sitting in an ATM is money that isn't working elsewhere in the financial system.

Banks and ATM operators also face insurance limitations that often cap how much cash can be in a machine at once. Plus, when you look at actual customer demand, most ATMs simply don't need to be filled to the brim to satisfy daily withdrawal needs.

Perhaps most practically, with regular refill schedules already in place, maintaining maximum capacity just doesn't make operational sense. Instead, operators use smart forecasting tools to load just enough cash to meet expected demand until the next scheduled refill—it's all about finding that sweet spot of efficiency.

How often are ATMs in busy city centers refilled?

The busy ATMs in Times Square or downtown Chicago naturally need refilling more often than the one at a quiet suburban strip mall. The refill frequency really depends on how many people are making withdrawals, but here's what we typically see:

ATMs in super-busy spots like major transit hubs or tourist attractions often need daily cash replenishment. Those in regular high-traffic urban centers might get refilled 2-3 times weekly, while standard retail locations usually manage fine with weekly refills. The quieter, low-volume locations might only need fresh cash every other week or once a month.

What's changed the game is technology. Today's ATM cash capacity management is incredibly sophisticated, with real-time monitoring systems that alert operators when cash levels drop below certain thresholds. This means refills can be scheduled based on actual usage patterns rather than rigid timetables.

At Merchant Payment Services, we've helped countless businesses implement these smart monitoring solutions. Our systems can even detect unusual withdrawal patterns—like during a local festival or holiday shopping rush—and trigger emergency refills when needed. This ensures your ATM never displays that dreaded "Temporarily Out of Service" message when customers need cash the most.

Conclusion

Understanding ATM cash capacity isn't just about numbers—it's about finding the sweet spot between customer service and smart business operations. While today's ATMs could theoretically hold up to $800,000 in their most extreme configurations, the reality is much more down-to-earth. Most retail ATMs contain a modest $10,000 to $20,000, while bank-owned machines typically hold between $50,000 and $200,000.

Success in managing your ATM cash isn't about maxing out capacity—it's about balance. Think of it as a four-part harmony:

First, you need enough cash to meet your customers' needs when they need it. Nothing frustrates customers more than an "out of service" sign when they're looking to make a withdrawal.

Second, you want to minimize security risks. Cash sitting in a machine is cash at risk, so finding that "just right" amount matters for your peace of mind.

Third, smart refill scheduling keeps your operations running smoothly without unnecessary costs or disruptions.

Finally, choosing the right mix of bill denominations gives your customers flexibility while maximizing how much value each cassette can hold.

At Merchant Payment Services, we've spent over 35 years helping business owners steer these considerations. We've seen how the right ATM cash capacity strategy can transform a machine from a simple convenience into a valuable asset that both serves customers and generates revenue.

Whether you're just dipping your toes into ATM ownership or looking to fine-tune your existing operations, understanding cash capacity fundamentals makes all the difference. With the right approach, technology, and support team behind you, your ATM can become one of your business's most reliable performers.

Ready to make your ATM work harder for your business? Our team at Merchant Payment Services is here to help you implement effective cash management solutions custom to your specific needs. We're committed to taking the complexity out of ATM ownership while helping you maximize returns on your investment.

For more information about how we can help streamline your ATM operations, contact our team of experts today. After all, your success is our success.